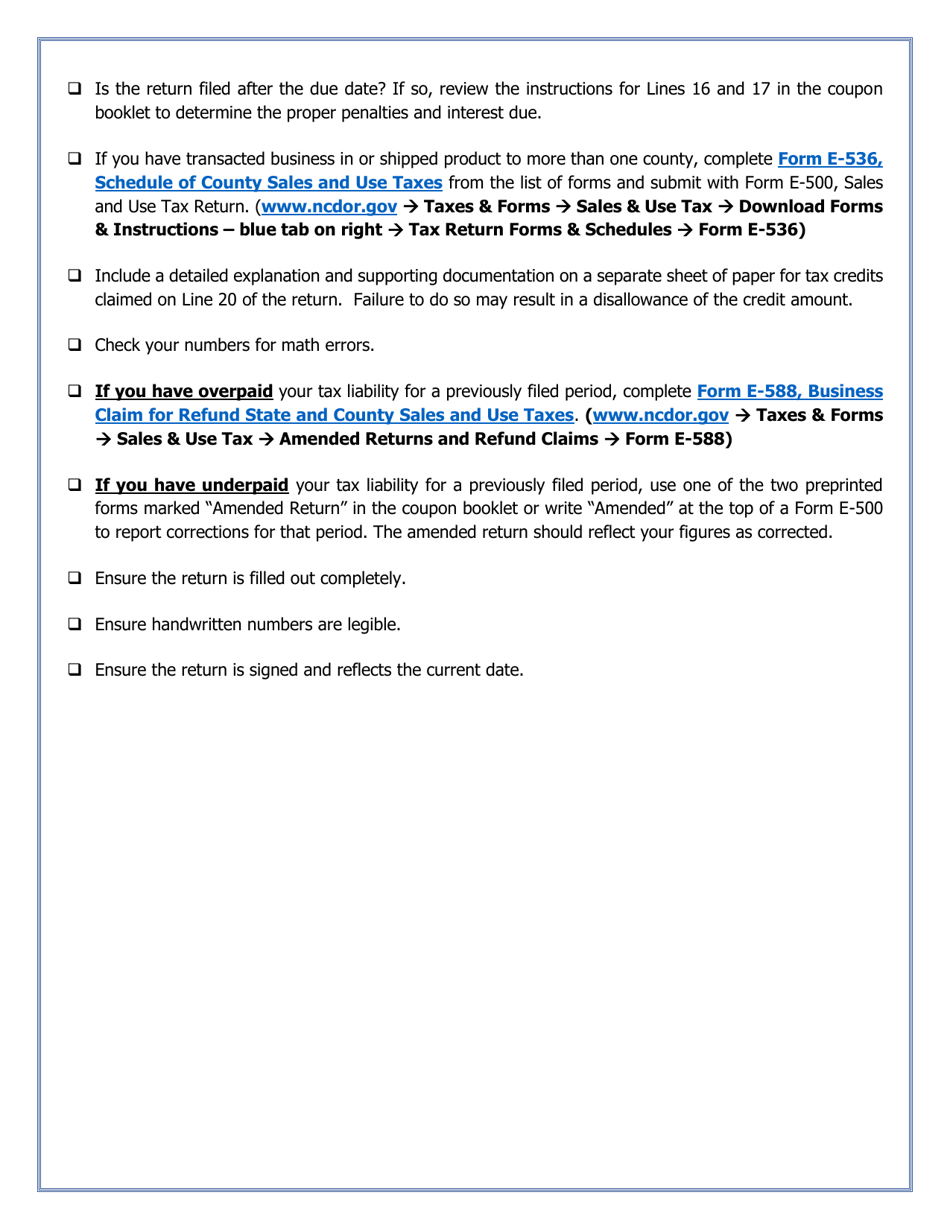

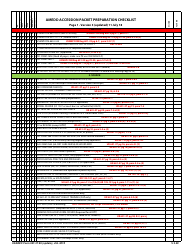

Form E-500 Preparation Checklist - North Carolina

What Is Form E-500?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

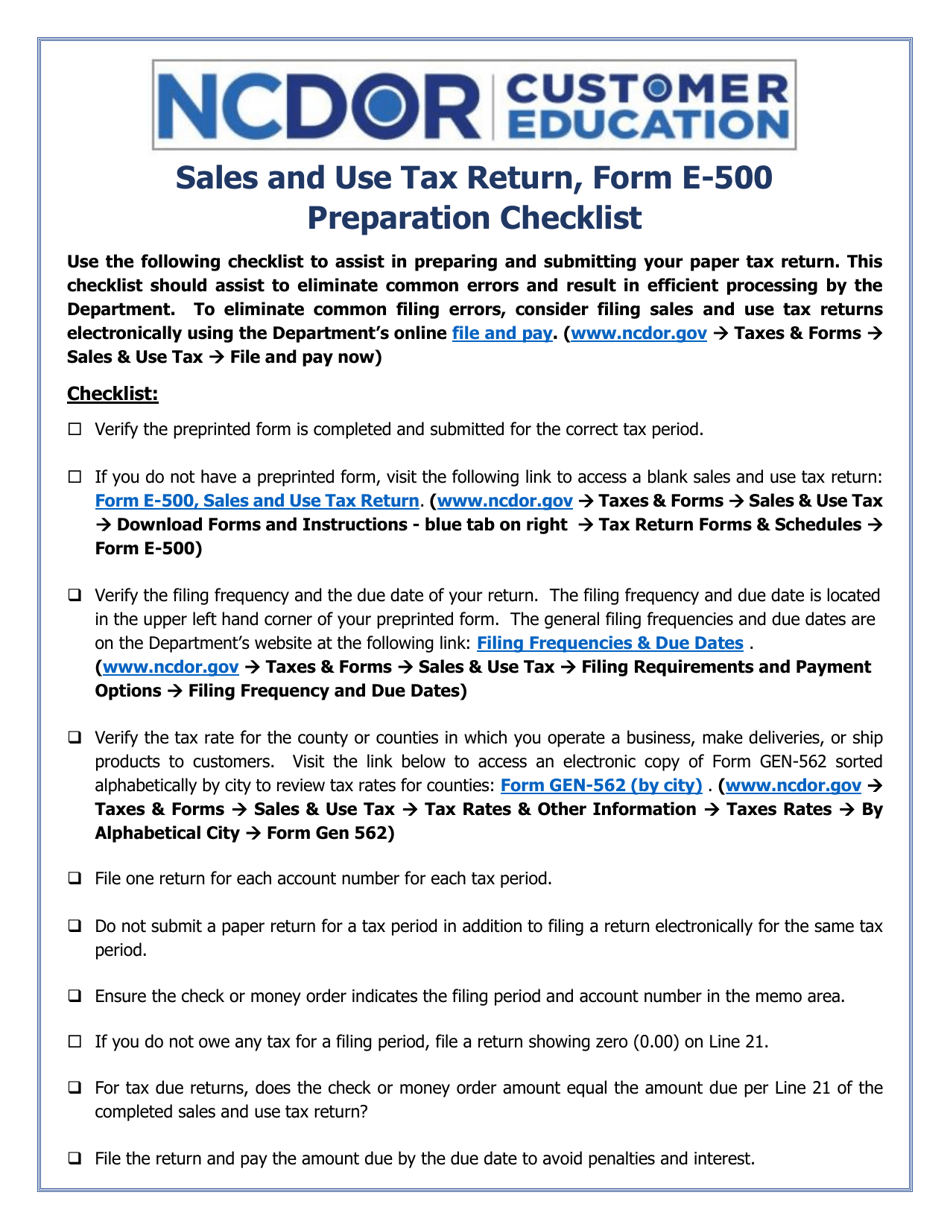

Q: What is Form E-500?

A: Form E-500 is a tax form used in North Carolina.

Q: What is the purpose of Form E-500?

A: Form E-500 is used to report and pay sales and use tax in North Carolina.

Q: Who needs to file Form E-500?

A: Businesses operating in North Carolina that are required to collect and remit sales tax must file Form E-500.

Q: What information is required to complete Form E-500?

A: You will need to provide information about your business, such as the name and address, as well as details about your sales and use tax liability.

Q: When is Form E-500 due?

A: Form E-500 must be filed and the tax payment must be made by the 20th of the month following the end of the reporting period.

Q: Are there any penalties for late filing of Form E-500?

A: Yes, there are penalties for late filing and late payment of sales and use tax in North Carolina.

Form Details:

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form E-500 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.