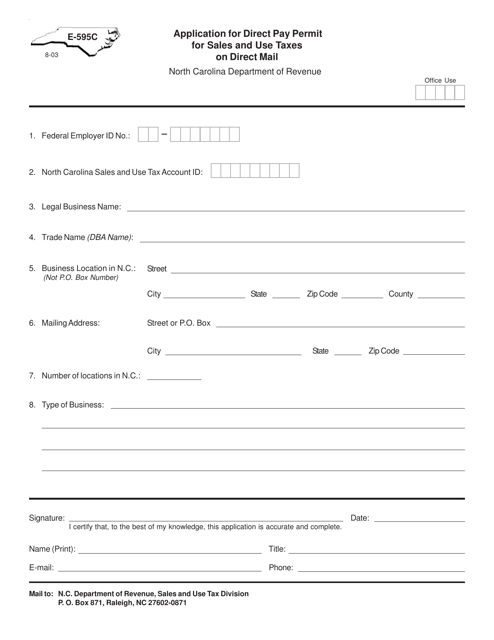

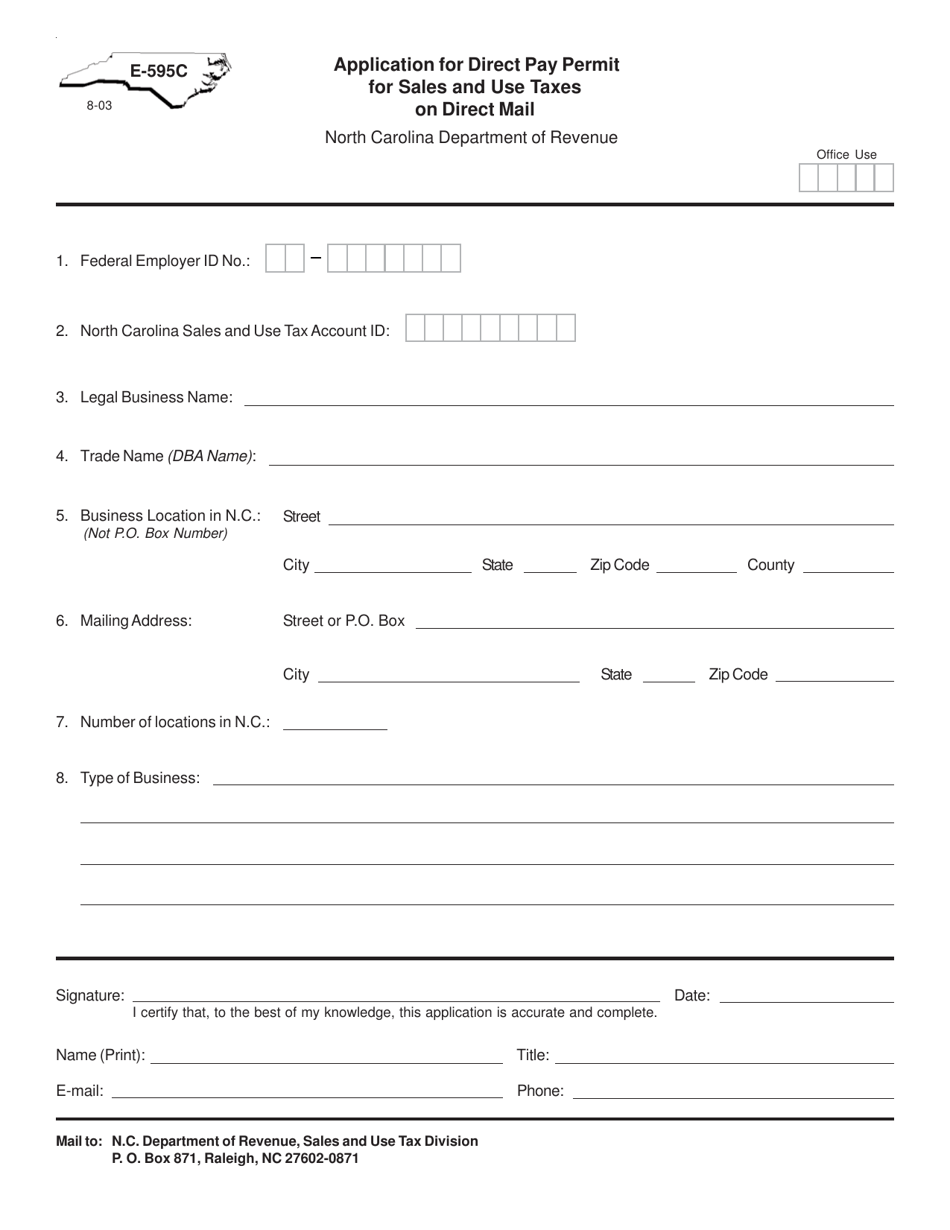

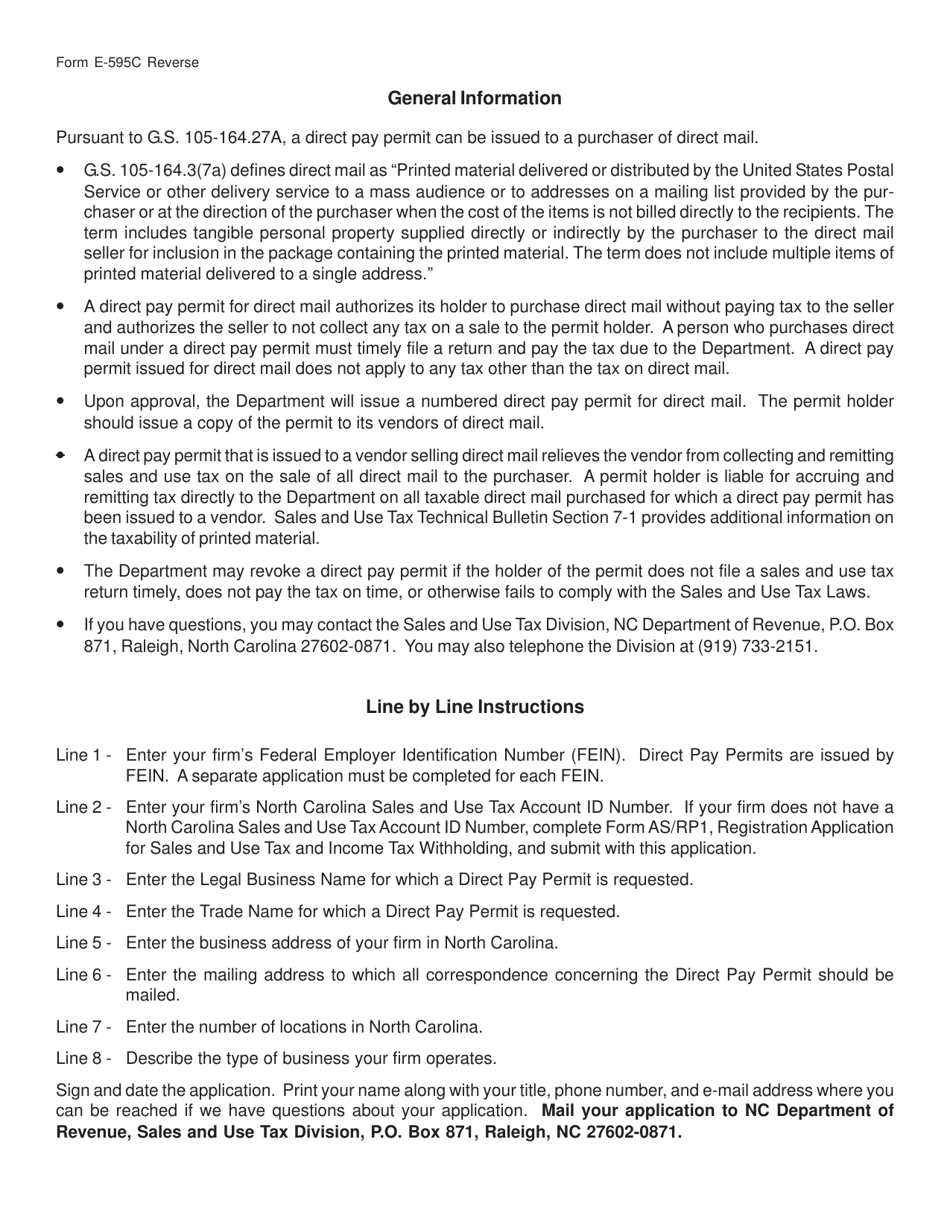

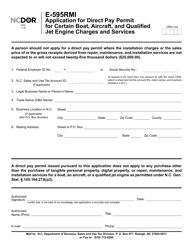

Form E-595C Application for Direct Pay Permit for Sales and Use Taxes on Direct Mail - North Carolina

What Is Form E-595C?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-595C?

A: Form E-595C is an application for a Direct Pay Permit for Sales and Use Taxes on Direct Mail in North Carolina.

Q: What is a Direct Pay Permit?

A: A Direct Pay Permit allows businesses to pay sales and use taxes directly to the state, rather than to vendors.

Q: What is Direct Mail?

A: Direct Mail refers to advertising materials, such as brochures or catalogs, that are mailed to potential customers.

Q: Why would a business need a Direct Pay Permit for Sales and Use Taxes on Direct Mail?

A: Businesses that engage in direct mail advertising in North Carolina may need a Direct Pay Permit to pay sales and use taxes directly.

Q: How can I apply for a Direct Pay Permit using Form E-595C?

A: You can apply for a Direct Pay Permit by completing Form E-595C and submitting it to the North Carolina Department of Revenue.

Q: Are there any fees associated with applying for a Direct Pay Permit?

A: No, there are no fees associated with applying for a Direct Pay Permit.

Q: Is the Direct Pay Permit valid for a specific period of time?

A: Yes, the Direct Pay Permit is valid for a period of three years.

Q: Can I use the Direct Pay Permit for all types of purchases?

A: No, the Direct Pay Permit can only be used for the purchase of direct mail items.

Form Details:

- Released on August 1, 2003;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form E-595C by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.