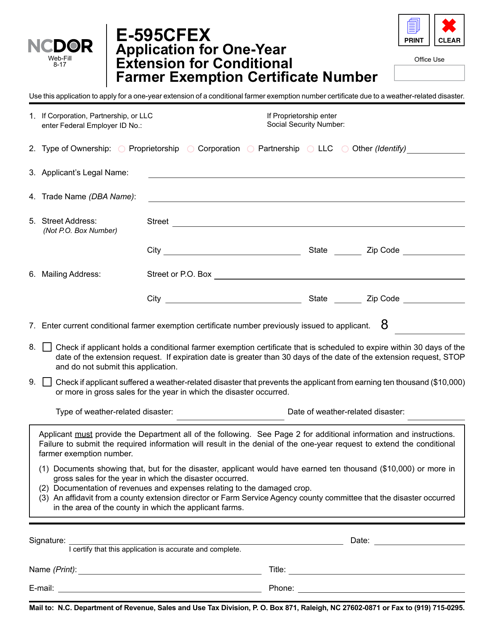

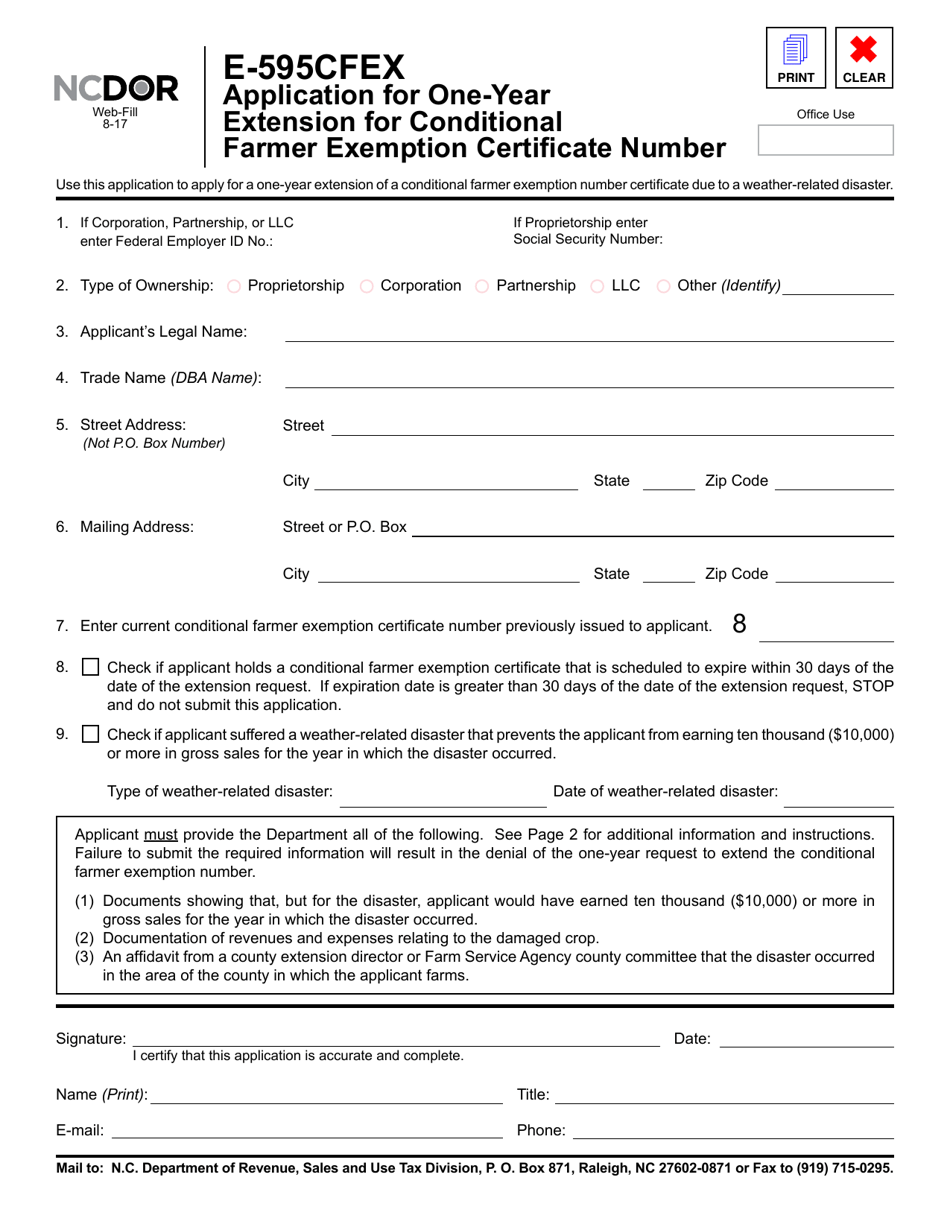

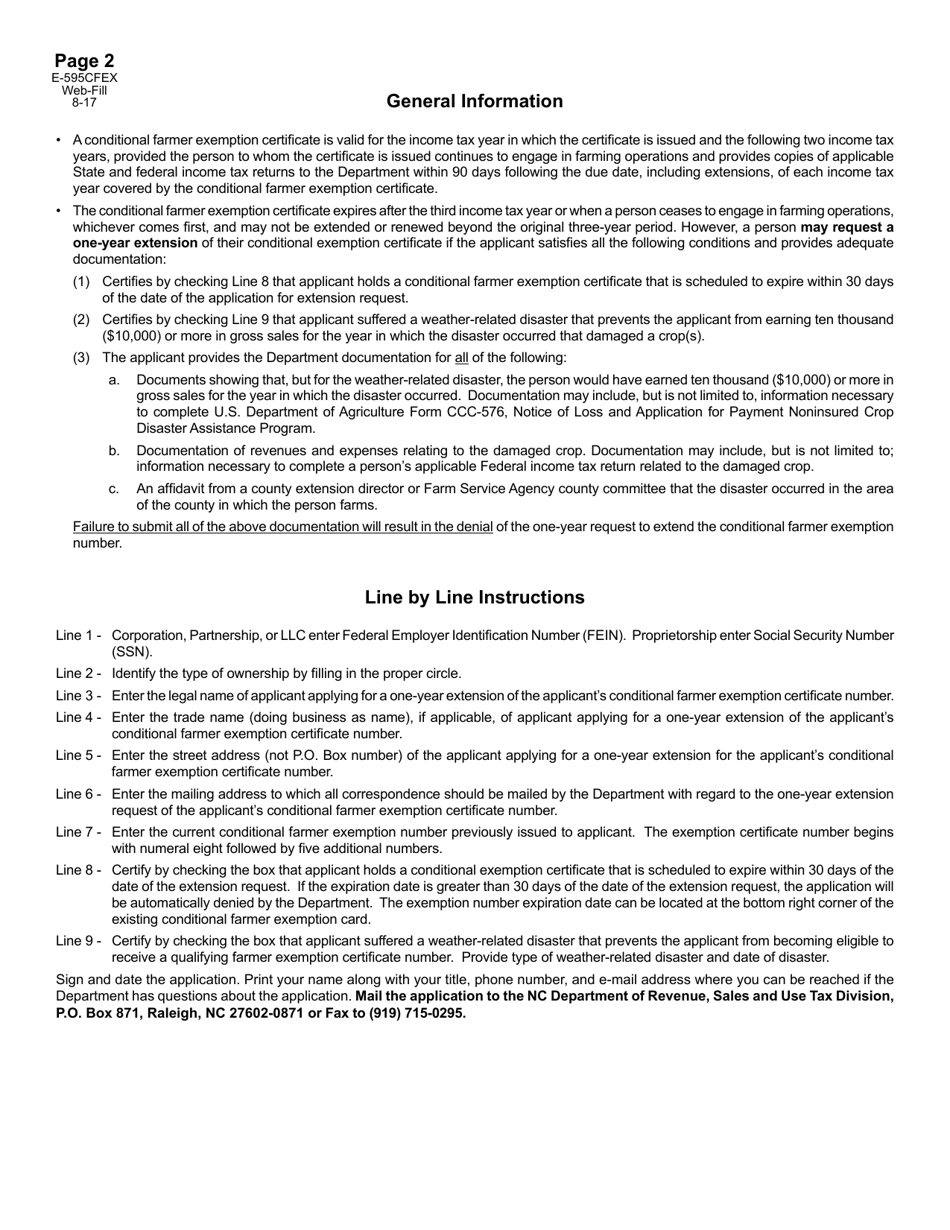

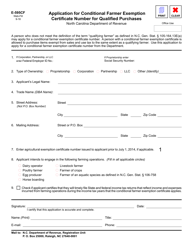

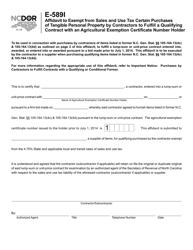

Form E-595CFEX Application for One-Year Extension for Conditional Farmer Exemption Certificate Number - North Carolina

What Is Form E-595CFEX?

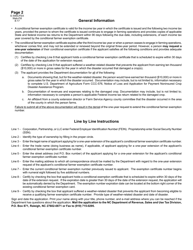

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-595CFEX?

A: Form E-595CFEX is an application for a one-year extension for a Conditional Farmer Exemption Certificate Number.

Q: What is a Conditional Farmer Exemption Certificate Number?

A: A Conditional Farmer Exemption Certificate Number is a certificate that allows farmers in North Carolina to claim certain exemptions from sales and use tax.

Q: Who can use Form E-595CFEX?

A: Form E-595CFEX is used by farmers in North Carolina who have a Conditional Farmer Exemption Certificate Number and need to apply for a one-year extension.

Q: What is the purpose of the one-year extension?

A: The one-year extension allows farmers to continue claiming exemptions from sales and use tax for an additional year.

Q: Are there any fees associated with applying for the one-year extension?

A: No, there are no fees associated with applying for the one-year extension.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E-595CFEX by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.