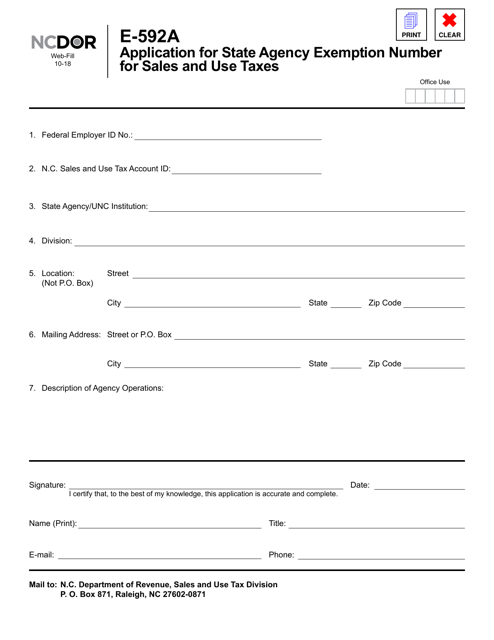

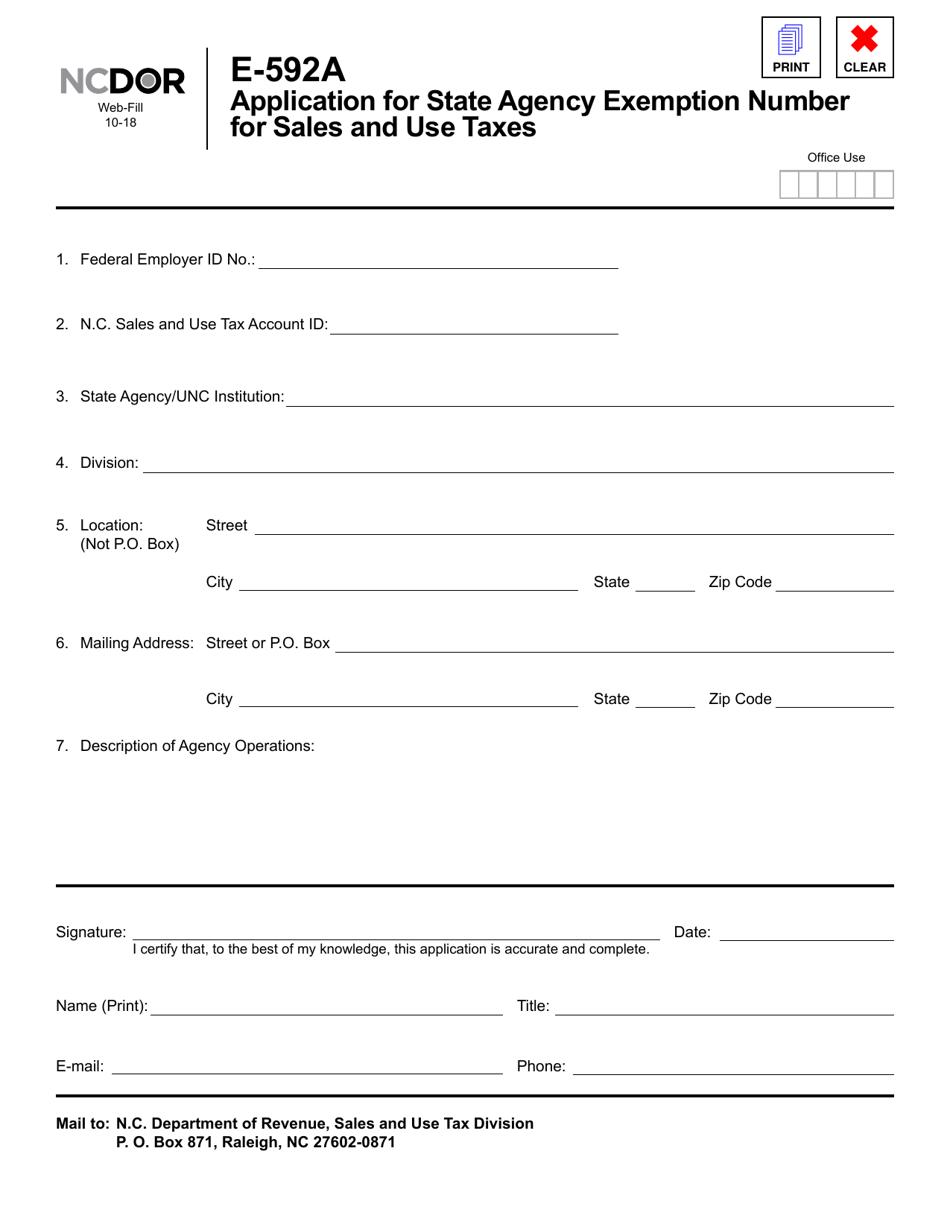

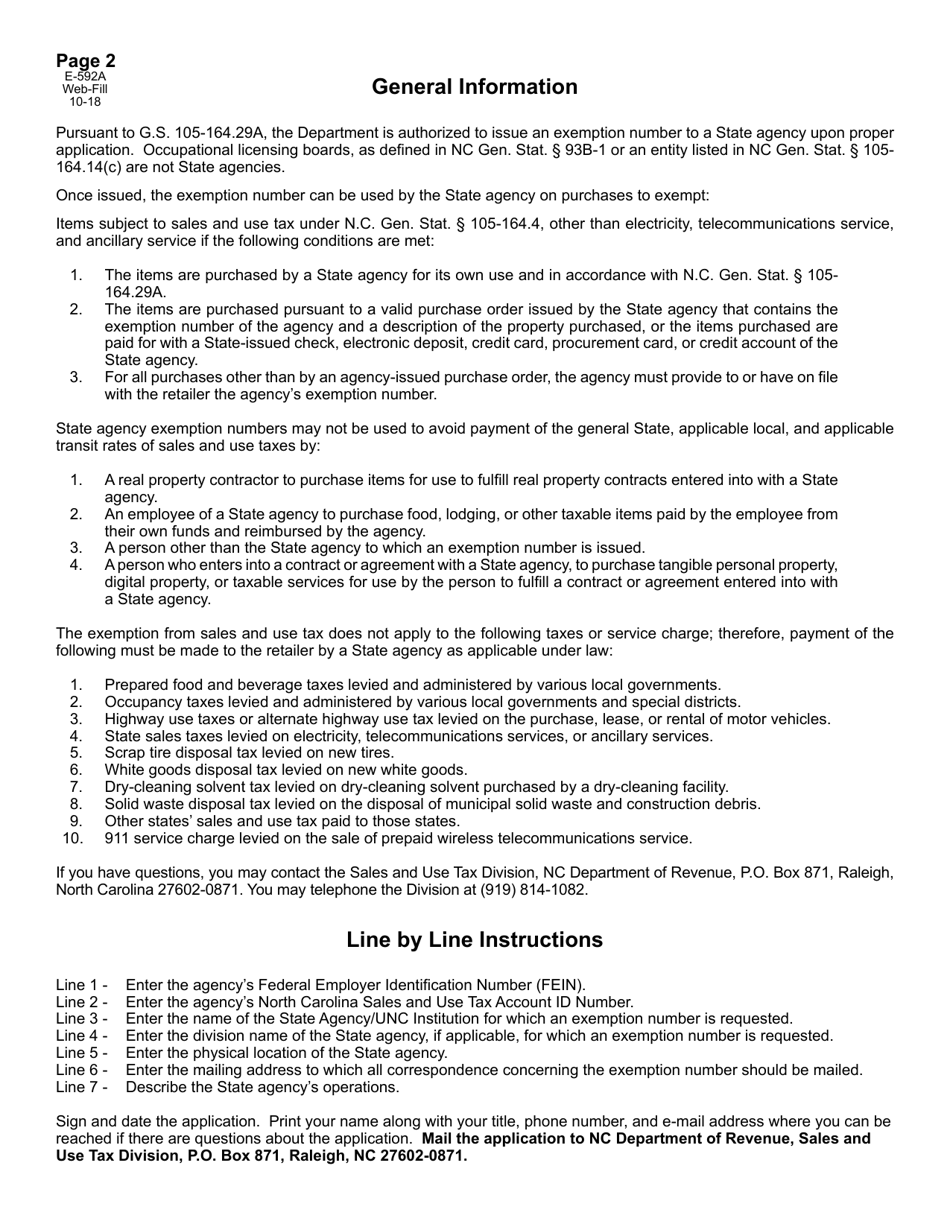

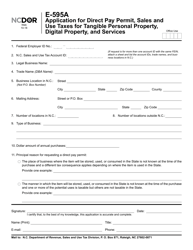

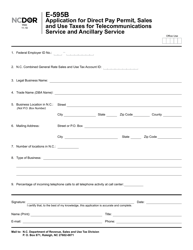

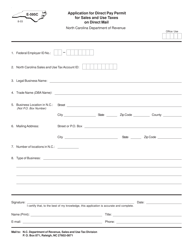

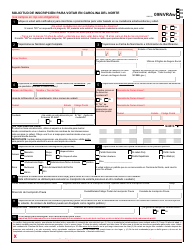

Form E-592A Application for State Agency Exemption Number for Sales and Use Taxes - North Carolina

What Is Form E-592A?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-592A?

A: Form E-592A is an application for the State Agency Exemption Number for Sales and Use Taxes in North Carolina.

Q: What is the purpose of Form E-592A?

A: The purpose of Form E-592A is to apply for a State Agency Exemption Number for Sales and Use Taxes in North Carolina.

Q: Who needs to use Form E-592A?

A: Form E-592A is used by state agencies in North Carolina to apply for an exemption number for sales and use taxes.

Q: What is the exemption number for sales and use taxes?

A: The exemption number for sales and use taxes is a unique identifier given to state agencies that exempts them from paying sales and use taxes on certain purchases.

Q: Are there any fees to submit Form E-592A?

A: No, there are no fees to submit Form E-592A.

Q: When should Form E-592A be filed?

A: Form E-592A should be filed before making any purchases that are eligible for the exemption from sales and use taxes.

Q: How long does it take to process Form E-592A?

A: The processing time for Form E-592A can vary, but it is typically processed within a few weeks.

Q: Is the State Agency Exemption Number permanent?

A: Yes, once a state agency is assigned an exemption number, it is permanent and does not need to be renewed.

Q: Can a state agency transfer the exemption number to another entity?

A: No, the exemption number is specific to the state agency and cannot be transferred to another entity.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E-592A by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.