This version of the form is not currently in use and is provided for reference only. Download this version of

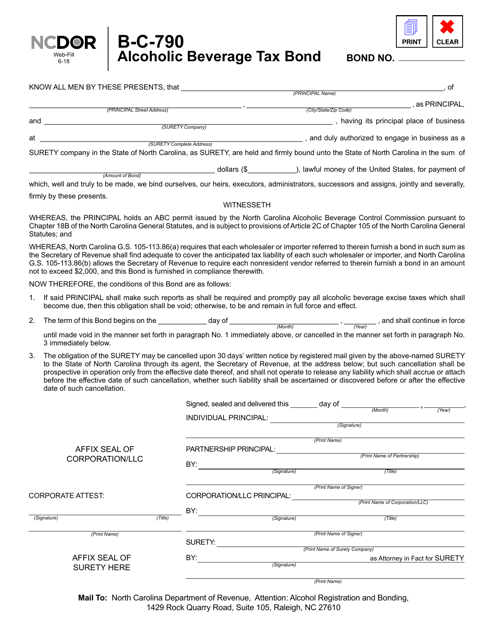

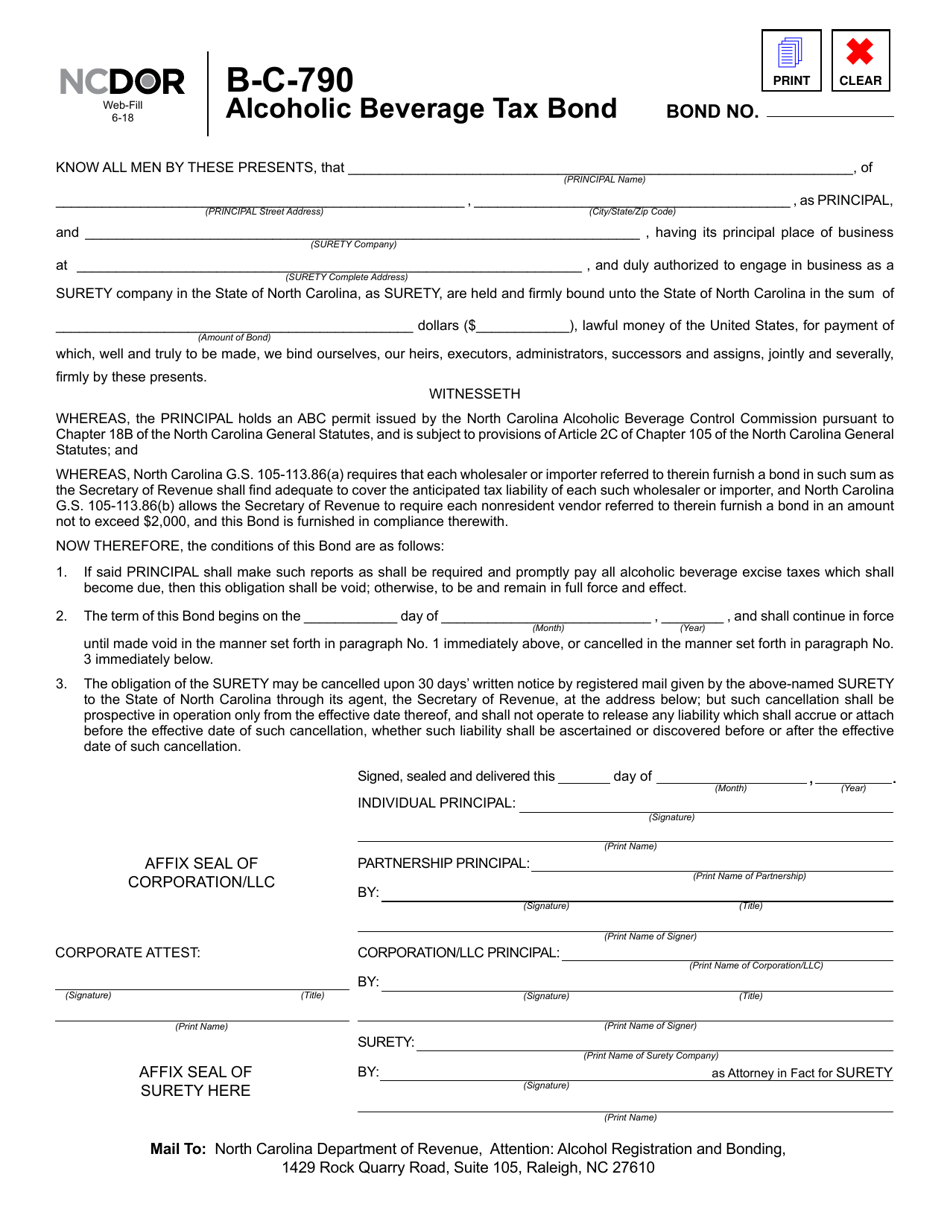

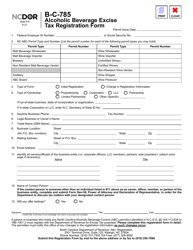

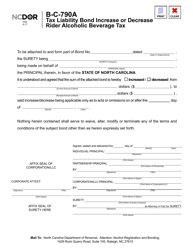

Form B-C-790

for the current year.

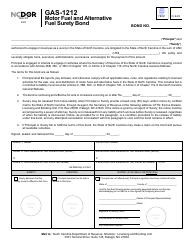

Form B-C-790 Alcoholic Beverage Tax Bond - North Carolina

What Is Form B-C-790?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form B-C-790?

A: Form B-C-790 is the Alcoholic Beverage Tax Bond specifically for the state of North Carolina.

Q: What is the purpose of Form B-C-790?

A: The purpose of Form B-C-790 is to provide a bond as a guarantee that the alcoholic beverage taxes owed to the state of North Carolina will be paid.

Q: Who needs to file Form B-C-790?

A: Any person or business in North Carolina engaged in the sale or distribution of alcoholic beverages that is required to pay alcoholic beverage taxes is required to file Form B-C-790.

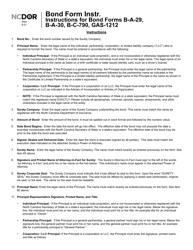

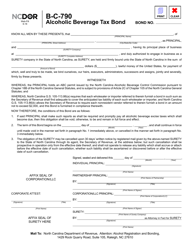

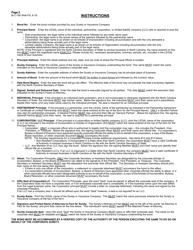

Q: What information is required on Form B-C-790?

A: Form B-C-790 requires information such as the name and address of the bonded principal, the amount of the bond, and the signatures of the principal and the surety.

Q: What happens after I submit Form B-C-790?

A: After submitting Form B-C-790, the bond will be reviewed and approved by the North Carolina Department of Revenue. The bond will then serve as a guarantee for the payment of alcoholic beverage taxes.

Q: Is there a fee to file Form B-C-790?

A: Yes, there is a fee associated with filing Form B-C-790. The fee amount can be found on the form or by contacting the North Carolina Department of Revenue.

Q: How often do I need to file Form B-C-790?

A: Form B-C-790 must be filed when initially applying for an alcoholic beverage license in North Carolina, and then renewed annually as long as the license is active.

Q: What happens if I don't file Form B-C-790?

A: Failure to file Form B-C-790 can result in penalties, fines, and the suspension or revocation of your alcoholic beverage license in North Carolina.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B-C-790 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.