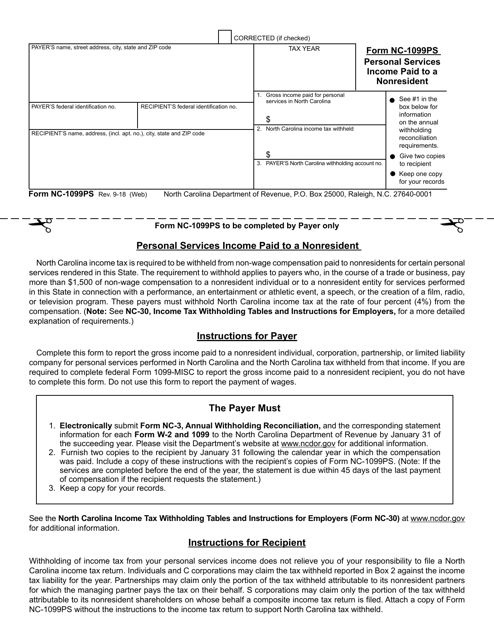

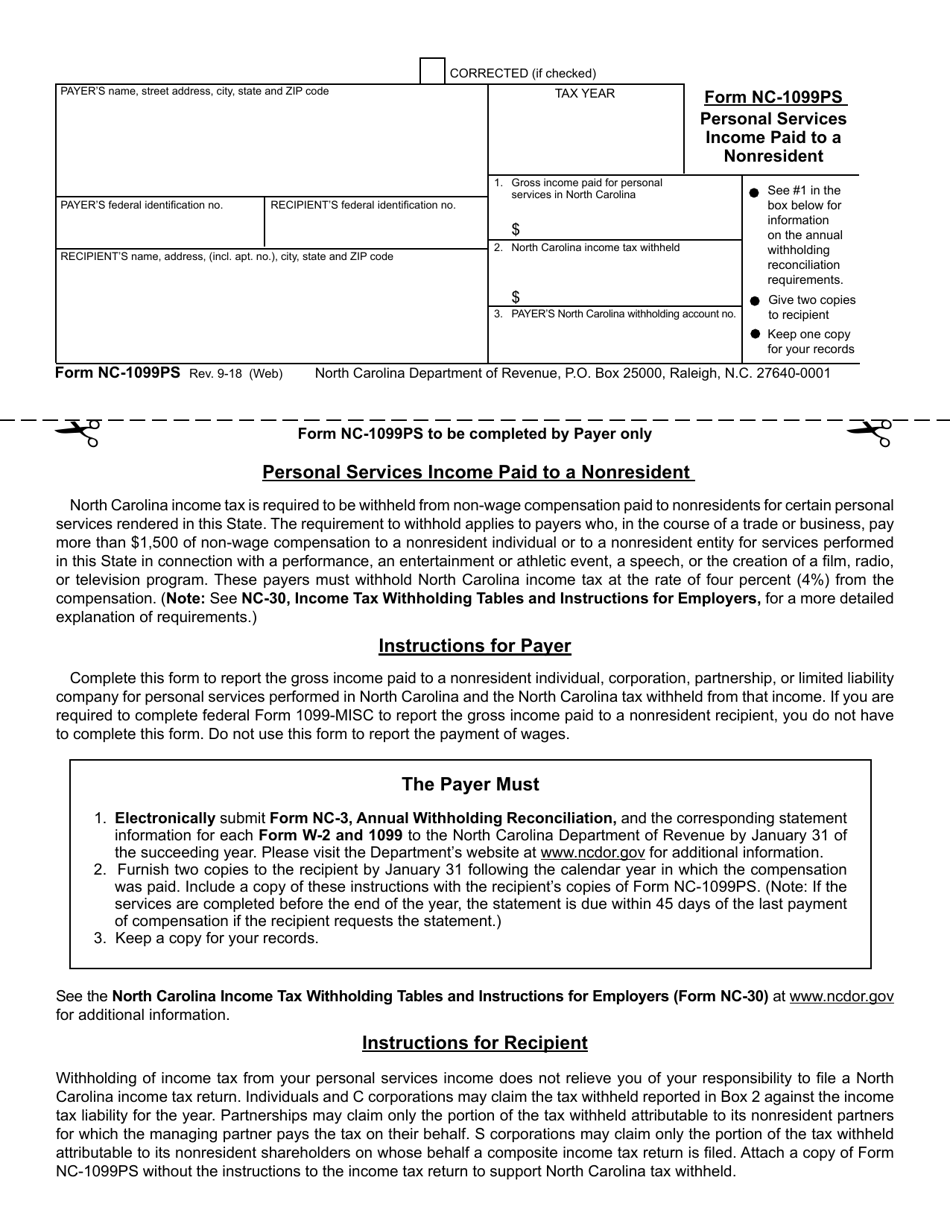

Form NC-1099PS Personal Services Income Paid to a Nonresident - North Carolina

What Is Form NC-1099PS?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NC-1099PS?

A: Form NC-1099PS is a form used to report personal services income paid to a nonresident in the state of North Carolina.

Q: Who needs to file Form NC-1099PS?

A: Anyone who paid personal services income to a nonresident in North Carolina needs to file Form NC-1099PS.

Q: What is considered personal services income?

A: Personal services income refers to payments made for services performed by an individual, such as fees, commissions, and other forms of compensation.

Q: What information is required on Form NC-1099PS?

A: Form NC-1099PS requires the nonresident's name, address, federal identification number, and the amount of personal services income paid.

Q: When is the deadline for filing Form NC-1099PS?

A: Form NC-1099PS must be filed by January 31st of each year.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC-1099PS by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.