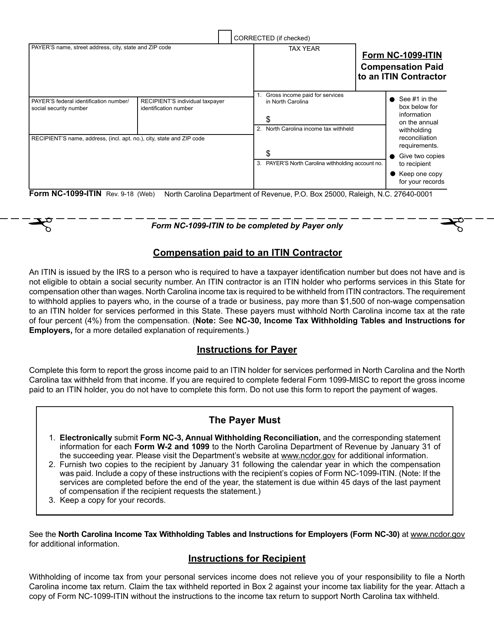

Form NC-1099-ITIN Compensation Paid to an Itin Contractor - North Carolina

What Is Form NC-1099-ITIN?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form NC-1099-ITIN?

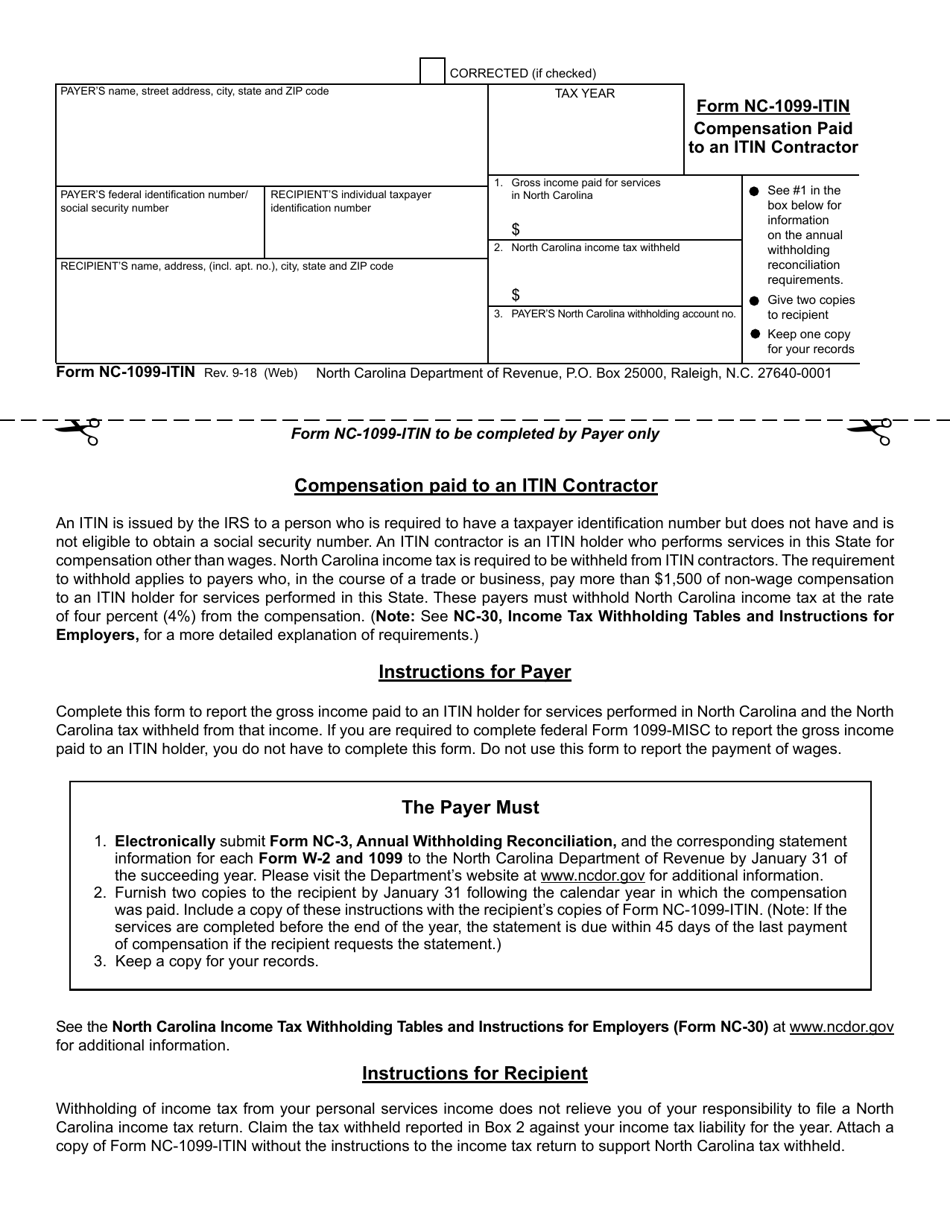

A: Form NC-1099-ITIN is a tax form used in North Carolina to report compensation paid to an ITIN contractor.

Q: What is an ITIN contractor?

A: An ITIN contractor is an independent contractor who has an Individual Taxpayer Identification Number (ITIN) instead of a Social Security Number (SSN).

Q: Who needs to file form NC-1099-ITIN?

A: If you paid more than $600 in compensation to an ITIN contractor in North Carolina, you need to file form NC-1099-ITIN.

Q: What information is required to complete form NC-1099-ITIN?

A: You will need the contractor's name, address, ITIN, the total amount of compensation paid, and the date the payment was made.

Q: When is the deadline to file form NC-1099-ITIN?

A: The deadline to file form NC-1099-ITIN is January 31st of the following year.

Q: What should I do with form NC-1099-ITIN after filing?

A: You should provide copies of form NC-1099-ITIN to the ITIN contractor and keep a copy for your records.

Q: Are there any penalties for not filing form NC-1099-ITIN?

A: Yes, there can be penalties for not filing form NC-1099-ITIN, including potential fines and interest on unpaid taxes.

Q: Can I e-file form NC-1099-ITIN?

A: No, form NC-1099-ITIN cannot be e-filed. It must be mailed to the North Carolina Department of Revenue.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC-1099-ITIN by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.