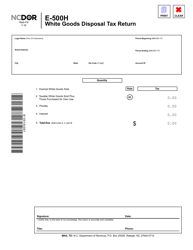

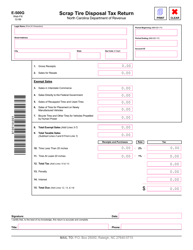

Form E-585H Claim for Refund of White Goods Disposal Tax - North Carolina

What Is Form E-585H?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

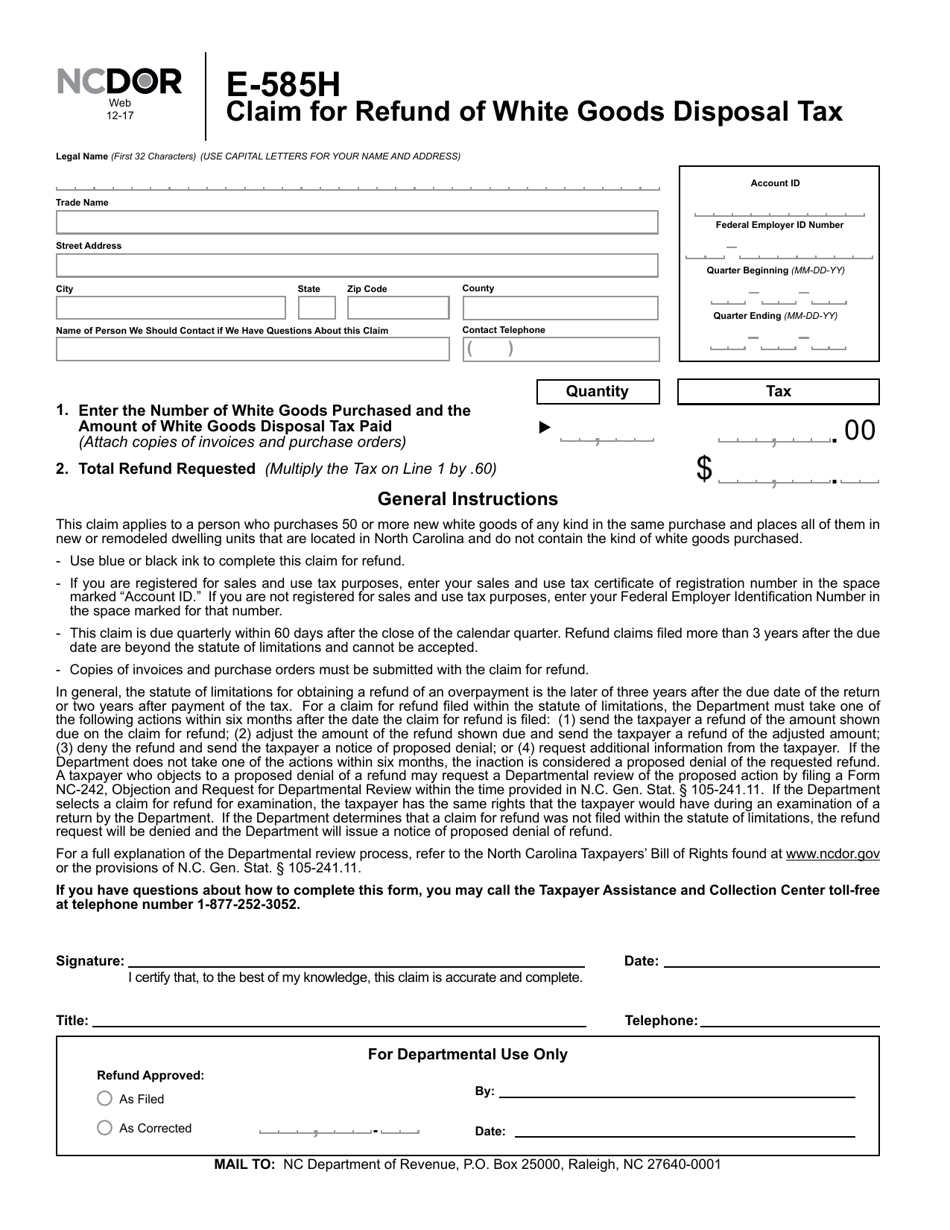

Q: What is Form E-585H?

A: Form E-585H is a document used to claim a refund of the White Goods Disposal Tax in North Carolina.

Q: What is the White Goods Disposal Tax?

A: The White Goods Disposal Tax is a tax imposed on the disposal of certain appliances, such as refrigerators and air conditioners, in North Carolina.

Q: Who can use Form E-585H?

A: Any individual or business who has paid the White Goods Disposal Tax in North Carolina may use Form E-585H to claim a refund.

Q: What information is required on Form E-585H?

A: Form E-585H requires information such as the name and address of the claimant, the date of purchase, and proof of payment of the White Goods Disposal Tax.

Q: How do I submit Form E-585H?

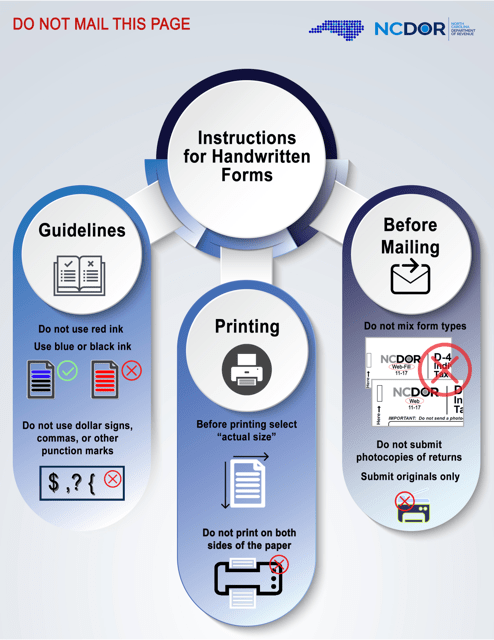

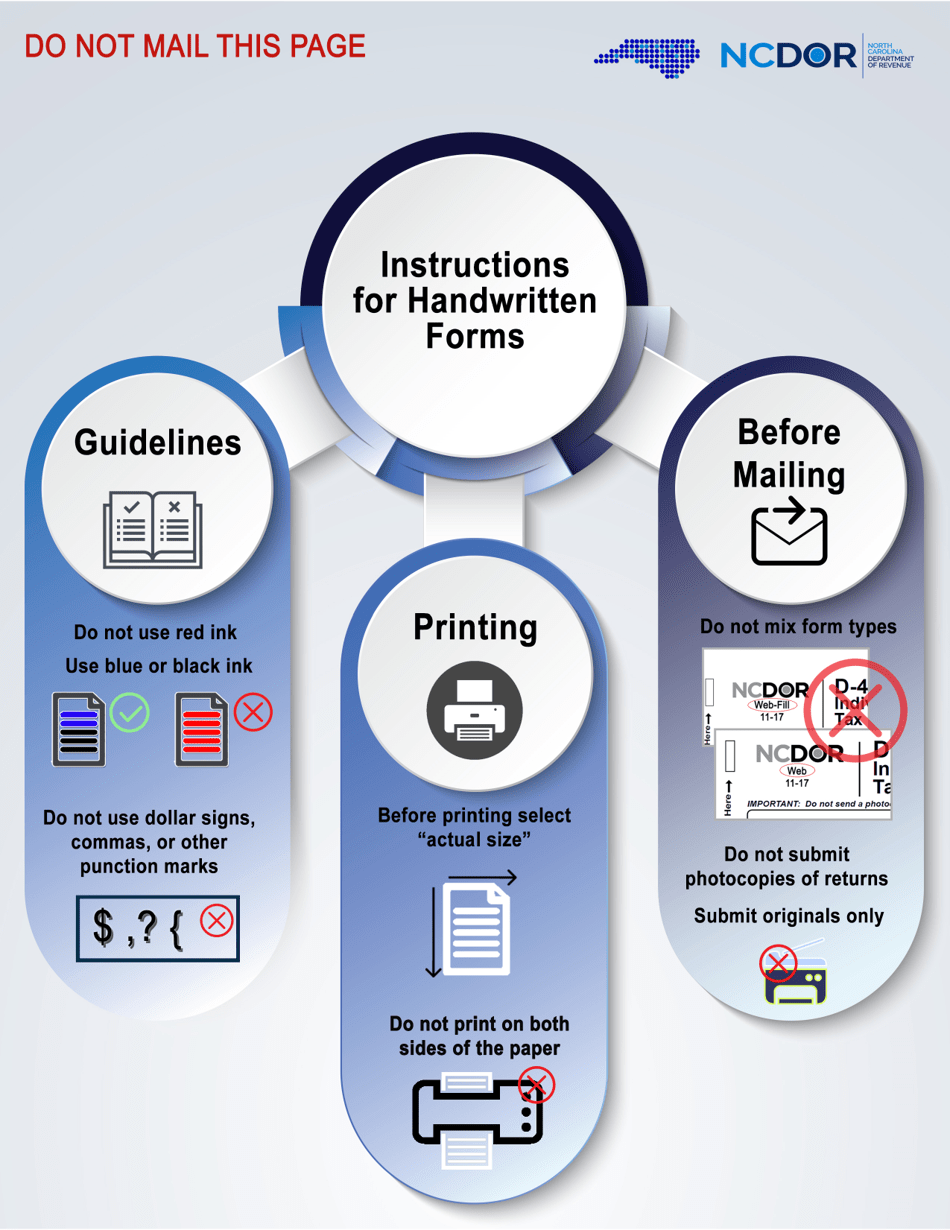

A: Form E-585H can be submitted by mail to the North Carolina Department of Revenue, along with any required supporting documentation.

Q: Is there a deadline for filing Form E-585H?

A: Yes, Form E-585H must be filed within three years from the date the tax was paid or the appliance was disposed of, whichever is later.

Q: What is the refund amount for Form E-585H?

A: The refund amount for Form E-585H is equal to the amount of White Goods Disposal Tax paid on the appliance.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form E-585H by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.