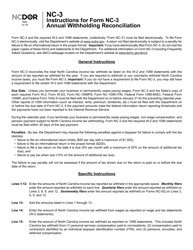

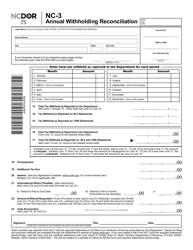

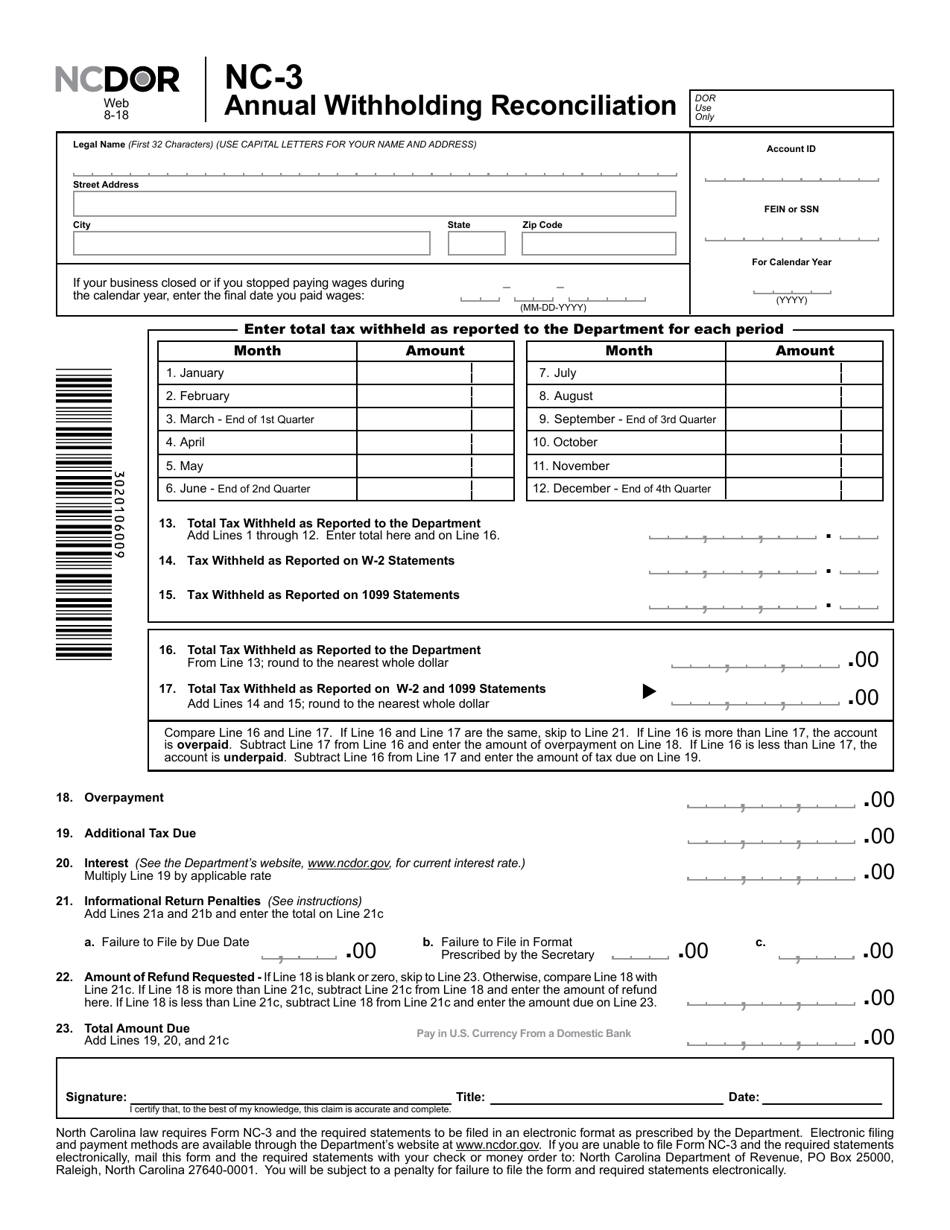

Form NC-3 Annual Withholding Reconciliation - North Carolina

What Is Form NC-3?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form NC-3?

A: Form NC-3 is the Annual Withholding Reconciliation form used in North Carolina.

Q: Who needs to file Form NC-3?

A: Employers in North Carolina must file Form NC-3.

Q: What is the purpose of Form NC-3?

A: Form NC-3 is used to reconcile the withholding taxes that employers have withheld from employees' wages.

Q: When is Form NC-3 due?

A: Form NC-3 is due by January 31st of the following year.

Q: Are there any penalties for not filing Form NC-3?

A: Yes, there are penalties for not filing Form NC-3 or for filing it late.

Q: Are there any supporting documents required to be filed with Form NC-3?

A: Yes, employers must include copies of the W-2 forms with Form NC-3.

Q: Can Form NC-3 be filed electronically?

A: Yes, employers have the option to file Form NC-3 electronically.

Q: Is Form NC-3 applicable for both resident and nonresident employees?

A: Yes, Form NC-3 is applicable for both resident and nonresident employees in North Carolina.

Form Details:

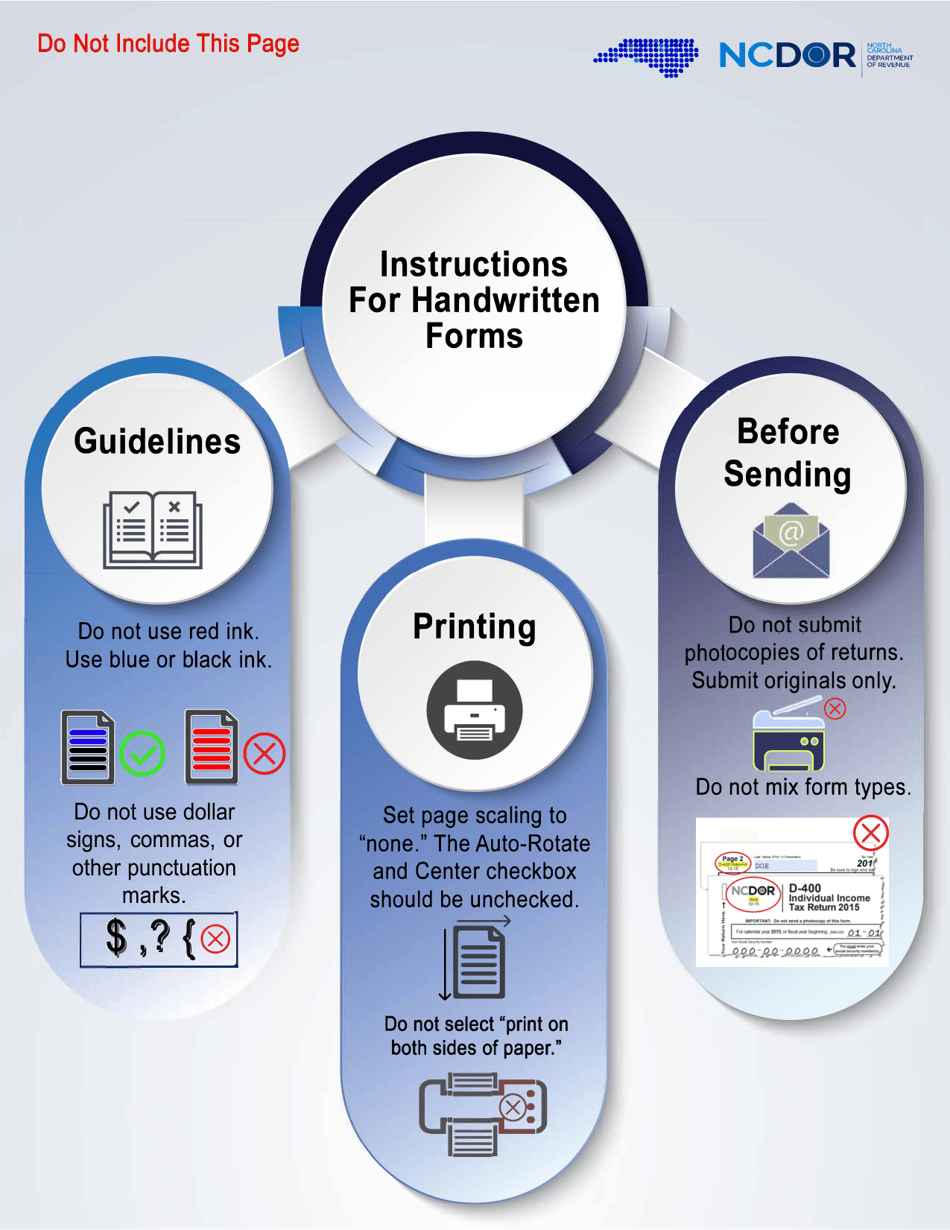

- Released on August 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC-3 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.