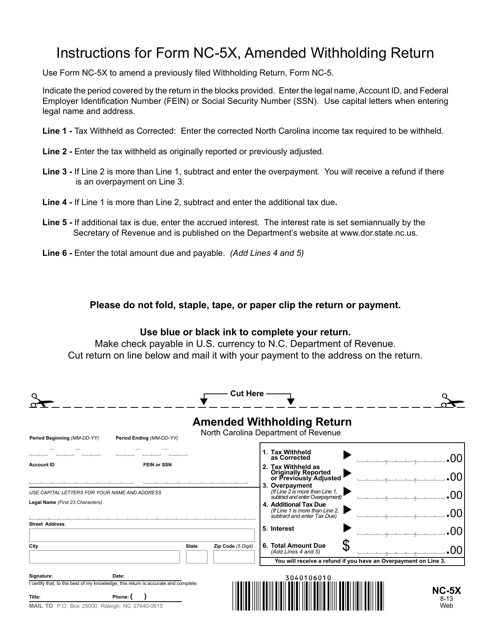

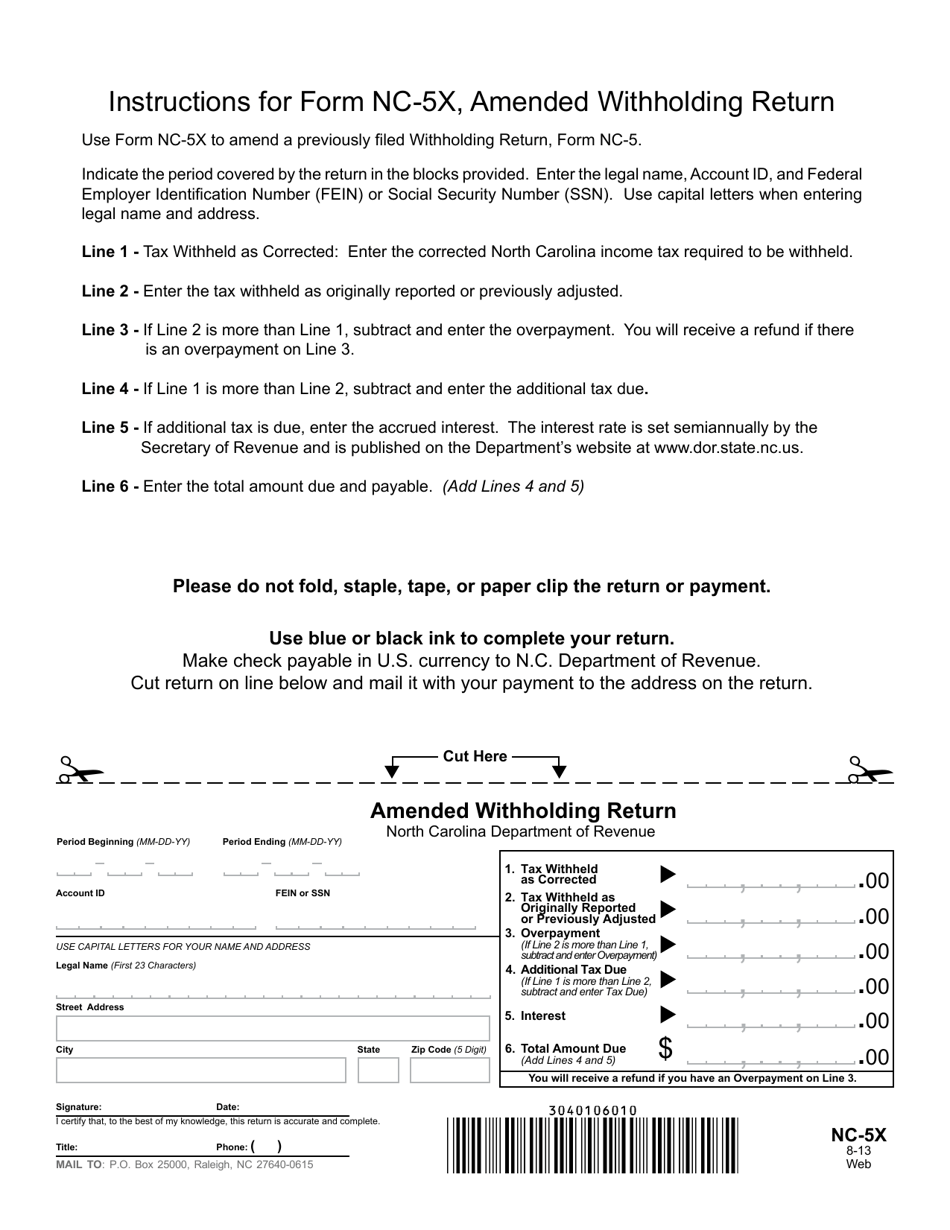

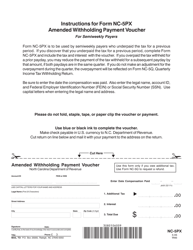

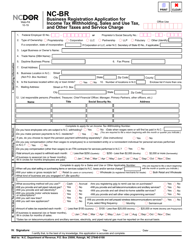

Form NC-5X Amended Withholding Return - North Carolina

What Is Form NC-5X?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form NC-5X?

A: The Form NC-5X is the Amended Withholding Return used by employers in North Carolina to correct any errors or changes in previously filed withholding returns (Form NC-5).

Q: When should I use the Form NC-5X?

A: You should use the Form NC-5X when you need to make changes or corrections to a previously filed withholding return (Form NC-5) for North Carolina.

Q: What information do I need to complete the Form NC-5X?

A: To complete the Form NC-5X, you will need information from your original Form NC-5, such as the withholding totals, employee information, and any changes or corrections you need to make.

Q: Do I need to attach any supporting documentation to the Form NC-5X?

A: Yes, you may need to attach supporting documentation, such as corrected W-2 forms, to the Form NC-5X to support the changes or corrections you are making.

Q: Are there any penalties for filing an incorrect or incomplete Form NC-5X?

A: Yes, there may be penalties for filing an incorrect or incomplete Form NC-5X. It is important to carefully review the instructions and double-check all information before filing.

Form Details:

- Released on August 1, 2013;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC-5X by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.