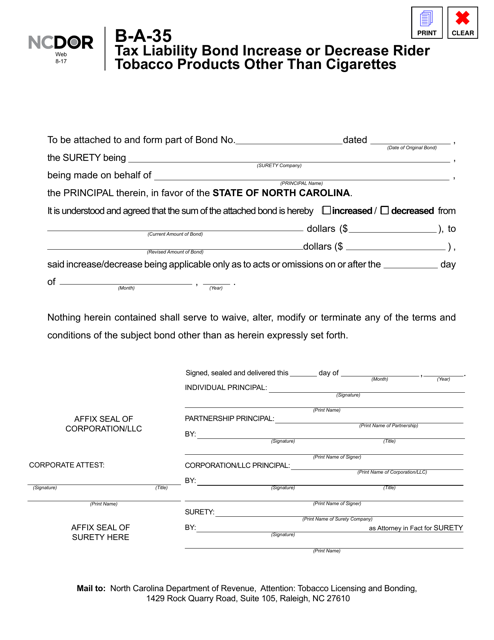

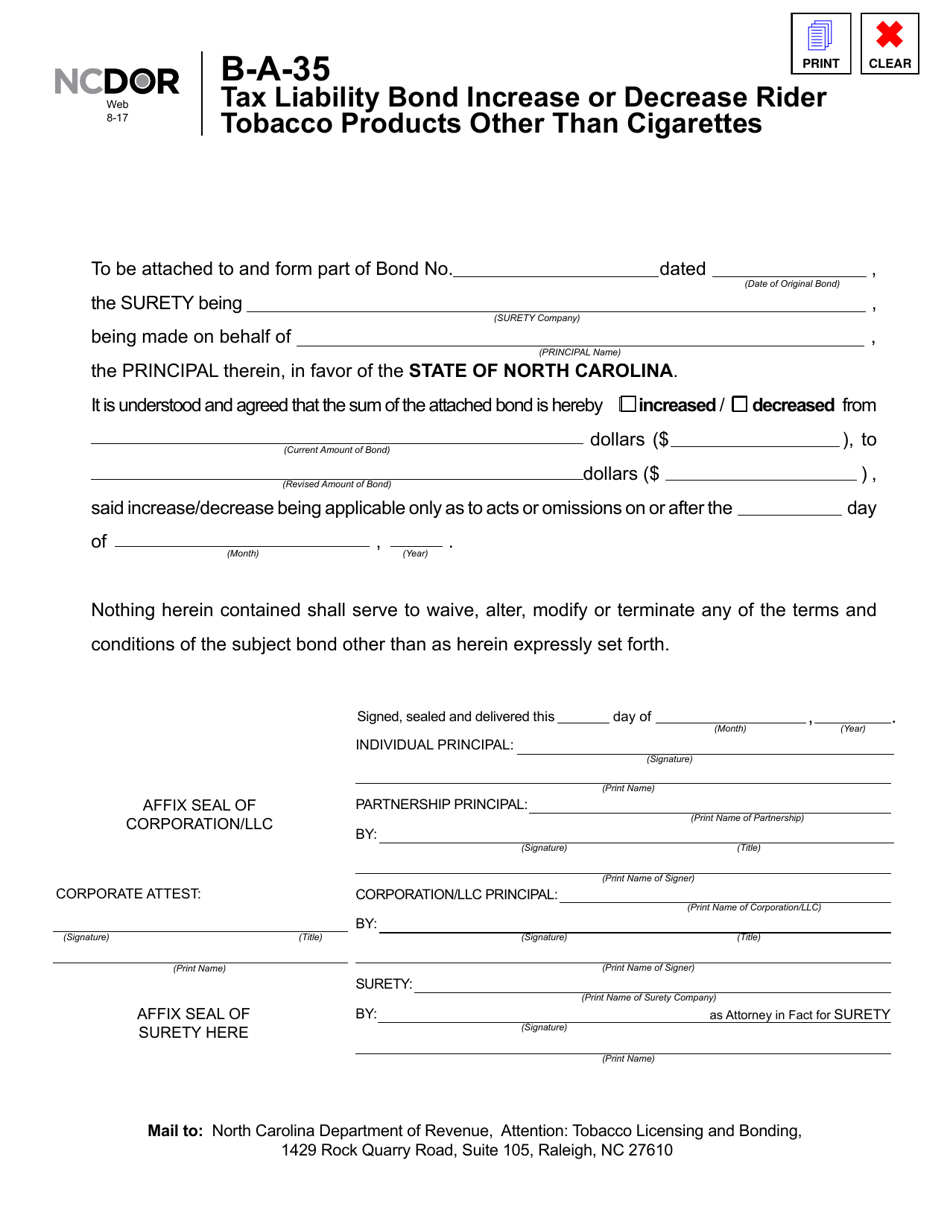

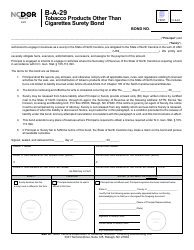

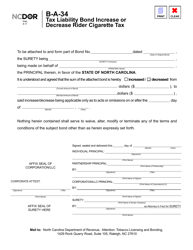

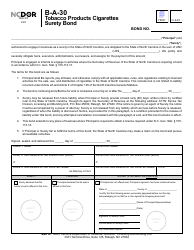

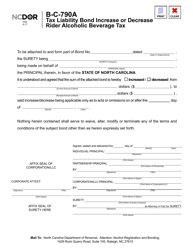

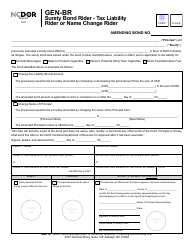

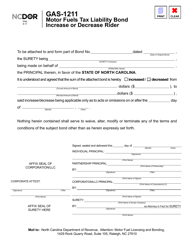

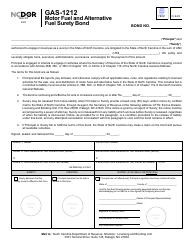

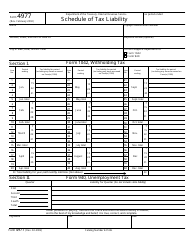

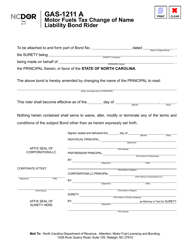

Form B-A-35 Tax Liability Bond Increase or Decrease Rider Tobacco Products Other Than Cigarettes - North Carolina

What Is Form B-A-35?

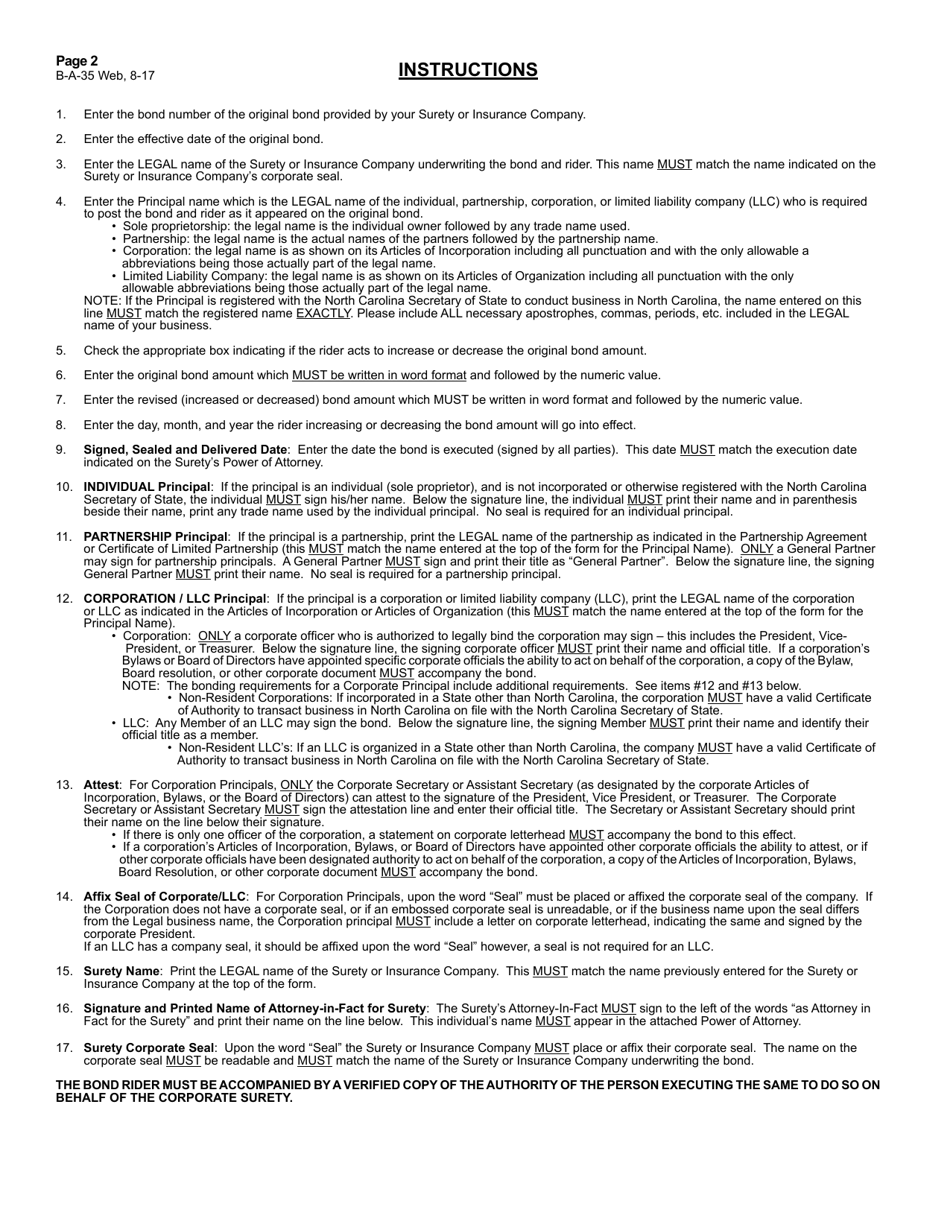

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form B-A-35 Tax Liability Bond Increase or Decrease Rider?

A: Form B-A-35 is a document that allows taxpayers in North Carolina to increase or decrease the amount of their tax liability bond for tobacco productsother than cigarettes.

Q: What is a tax liability bond?

A: A tax liability bond is a financial guarantee that ensures payment of taxes owed to the state.

Q: Who needs to use a Form B-A-35 Tax Liability Bond Increase or Decrease Rider?

A: Taxpayers in North Carolina who sell tobacco products other than cigarettes and have a tax liability bond are required to use this form to adjust the bond amount.

Q: Why would someone need to increase or decrease their tax liability bond?

A: The bond amount may need to be adjusted if the taxpayer's sales of tobacco products other than cigarettes change, resulting in a higher or lower tax liability.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B-A-35 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.