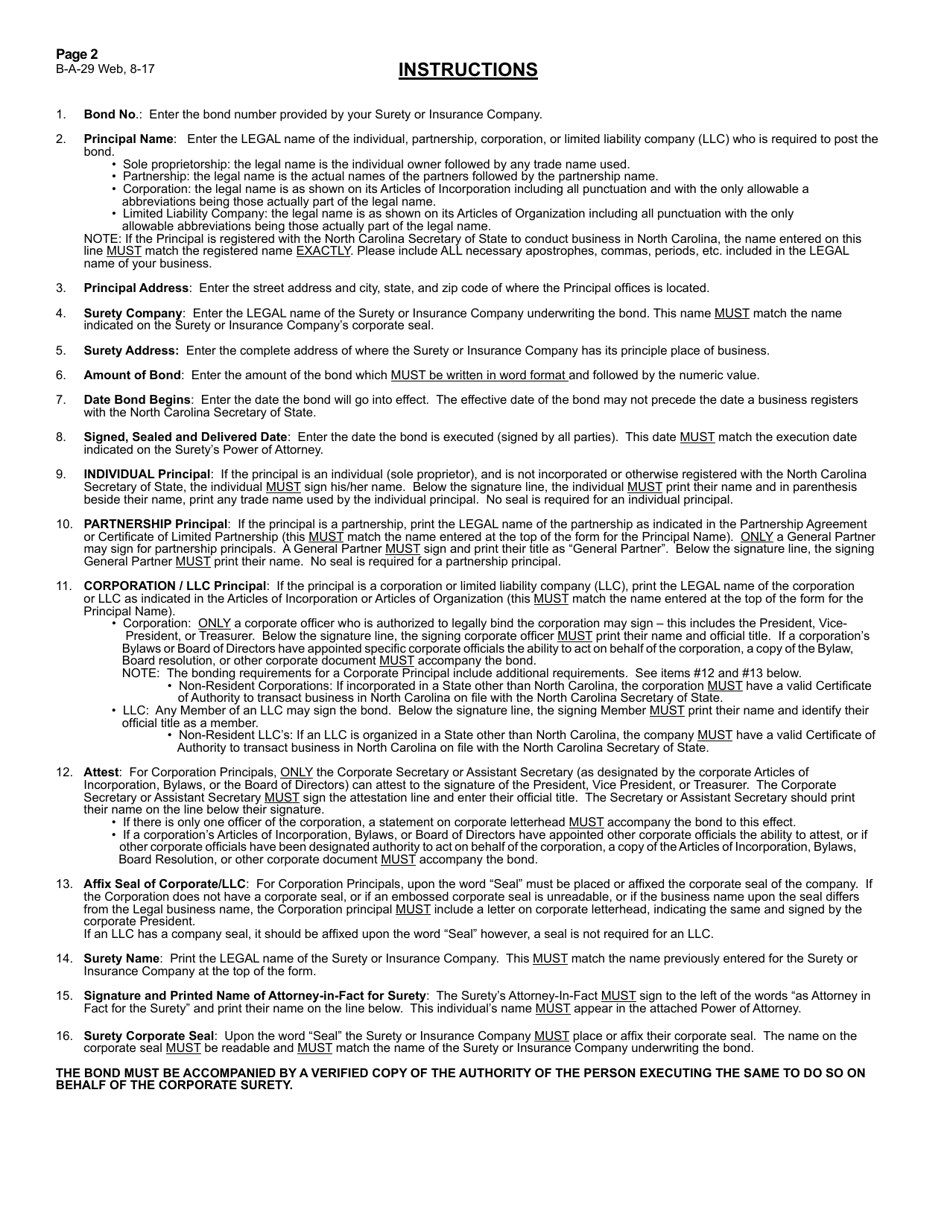

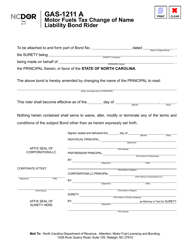

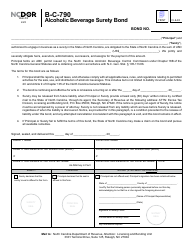

This version of the form is not currently in use and is provided for reference only. Download this version of

Form B-A-29

for the current year.

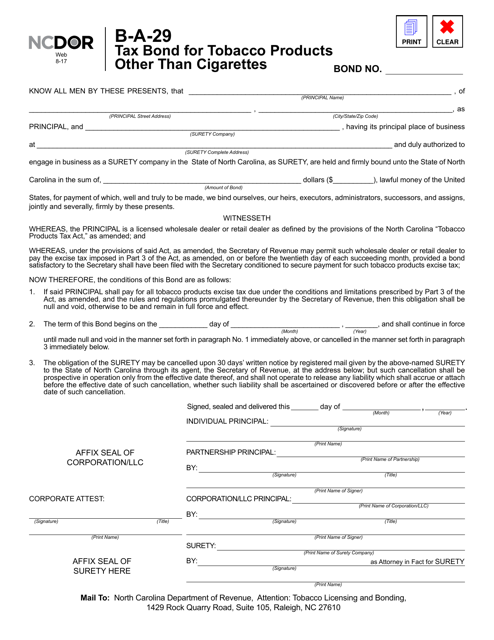

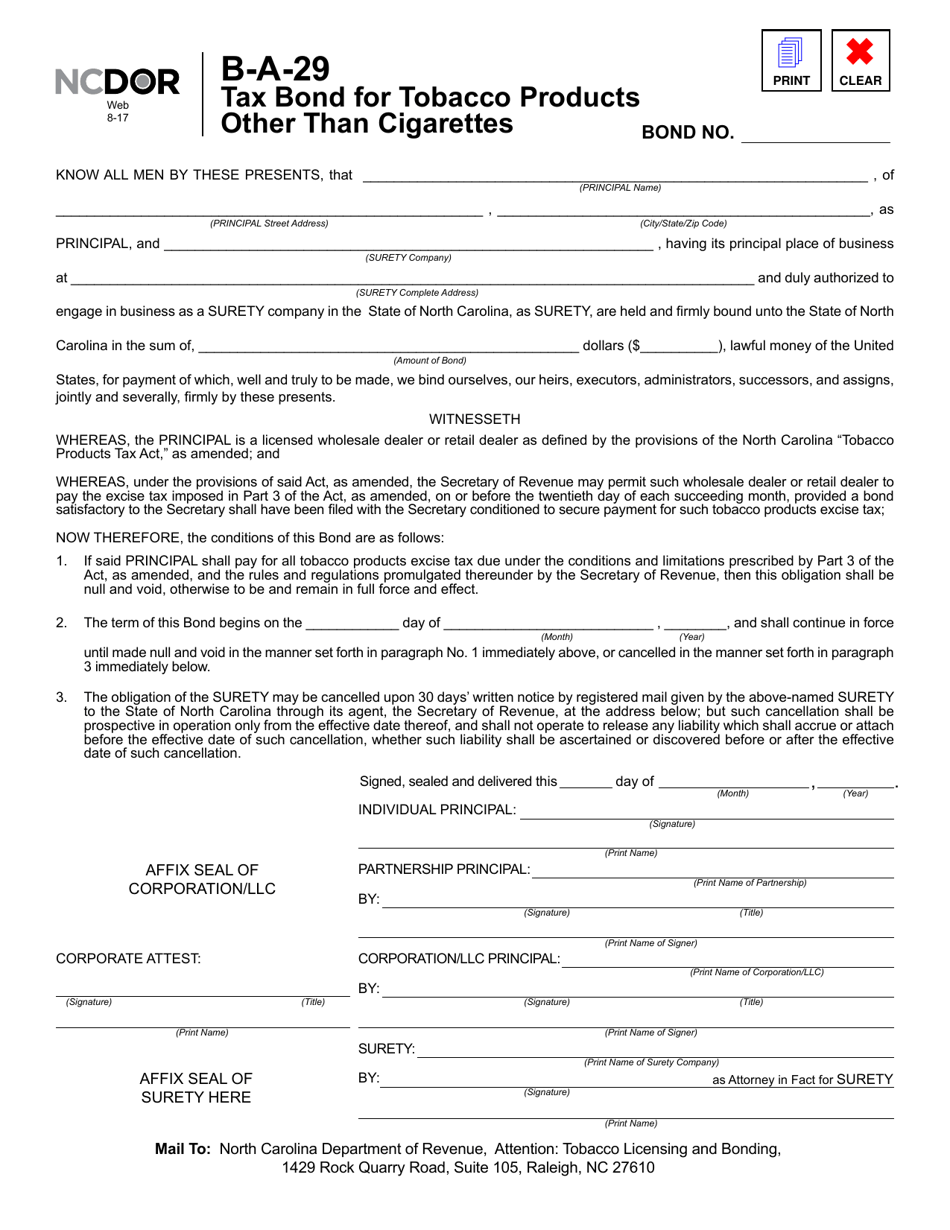

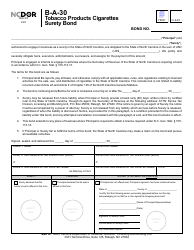

Form B-A-29 Tax Bond for Tobacco Products Other Than Cigarettes - North Carolina

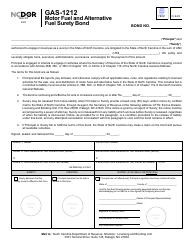

What Is Form B-A-29?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form B-A-29?

A: Form B-A-29 is a tax bond for tobacco productsother than cigarettes in North Carolina.

Q: Who needs to file Form B-A-29?

A: Any individual or business that engages in the sale or distribution of tobacco products other than cigarettes in North Carolina may need to file Form B-A-29.

Q: Why do I need to file Form B-A-29?

A: Filing Form B-A-29 is required by the North Carolina Department of Revenue as a security requirement to ensure the payment of taxes on tobacco products other than cigarettes.

Q: When is Form B-A-29 due?

A: The due date for filing Form B-A-29 varies depending on the specific circumstances. It is best to check with the North Carolina Department of Revenue or refer to the instructions on the form.

Q: Are there any penalties for not filing Form B-A-29?

A: Failure to file Form B-A-29 or comply with the tax bond requirements may result in penalties and interest charges imposed by the North Carolina Department of Revenue.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B-A-29 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.