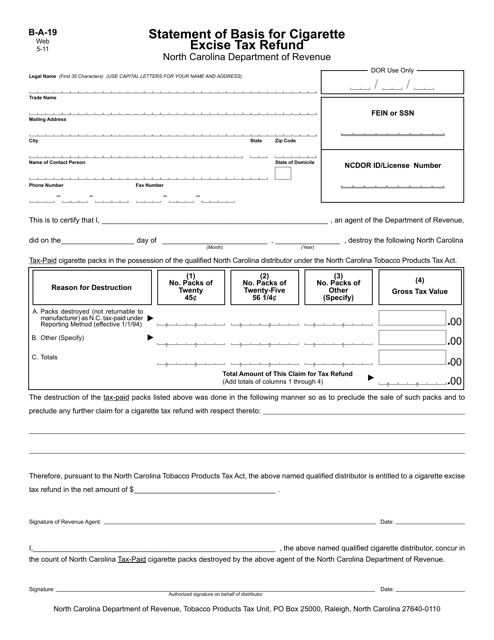

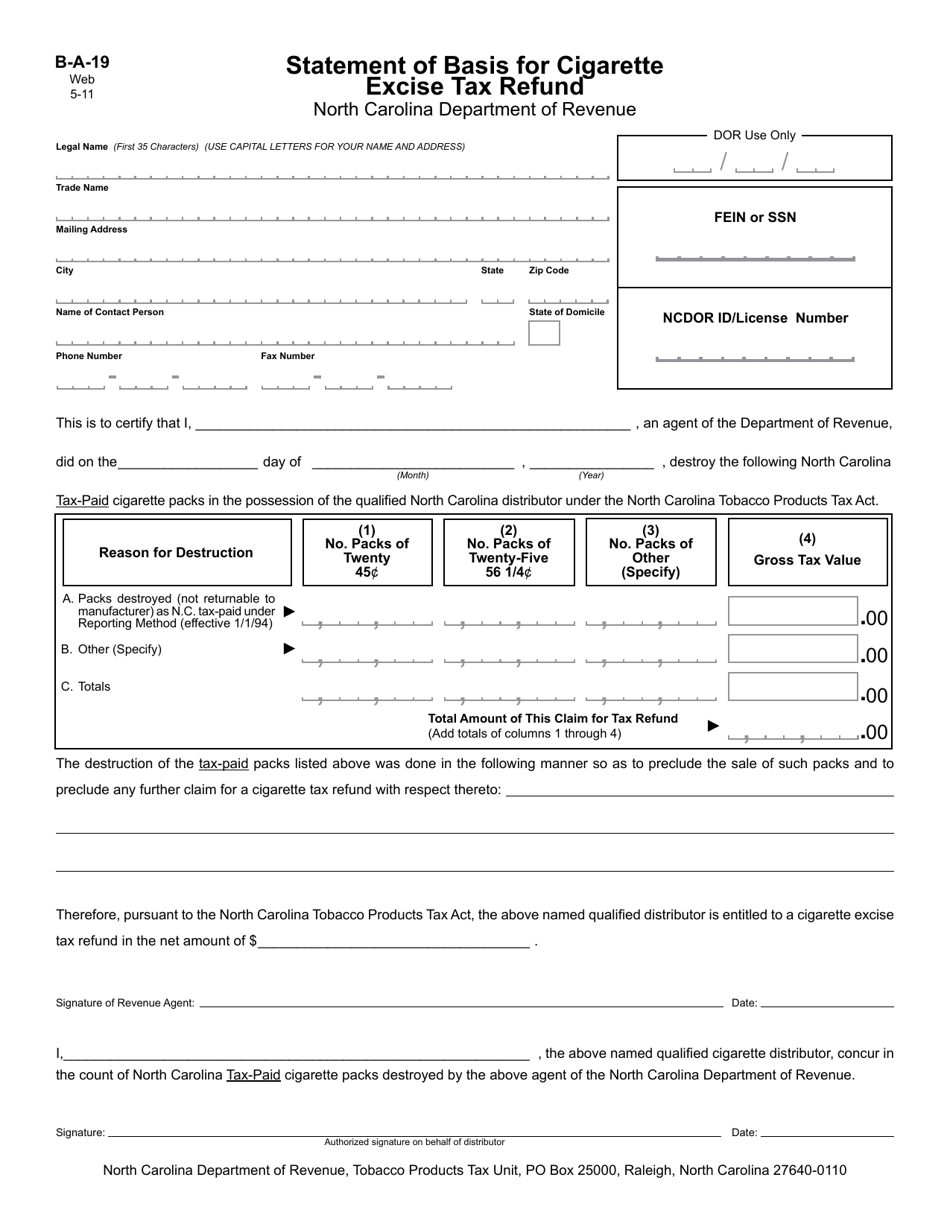

Form B-A-19 Statement of Basis for Cigarette Excise Tax Refund - North Carolina

What Is Form B-A-19?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form B-A-19?

A: Form B-A-19 is a Statement of Basis for Cigarette Excise Tax Refund specific to North Carolina.

Q: Who can use Form B-A-19?

A: Form B-A-19 is used by individuals and businesses seeking a refund of cigarette excise taxes in North Carolina.

Q: What is the purpose of Form B-A-19?

A: Form B-A-19 is used to provide a statement explaining the basis for claiming a refund of cigarette excise taxes.

Q: What information is required on Form B-A-19?

A: Form B-A-19 requires detailed information about the cigarettes for which a refund is being claimed, including the purchase date, quantity, and supporting documentation.

Q: Is there a deadline for submitting Form B-A-19?

A: Yes, Form B-A-19 must be filed within three years from the date the tax was paid or within three years from the date the tax return was due, whichever is later.

Q: Is there a fee for filing Form B-A-19?

A: No, there is no fee for filing Form B-A-19.

Q: How long does it take to process a refund claim on Form B-A-19?

A: The processing time for a refund claim on Form B-A-19 varies, but it typically takes several weeks to several months.

Q: Are there any specific eligibility criteria for claiming a refund on Form B-A-19?

A: Yes, the eligibility criteria for claiming a refund on Form B-A-19 include meeting the requirements set by the North Carolina Department of Revenue and providing supporting documentation.

Form Details:

- Released on May 1, 2011;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form B-A-19 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.