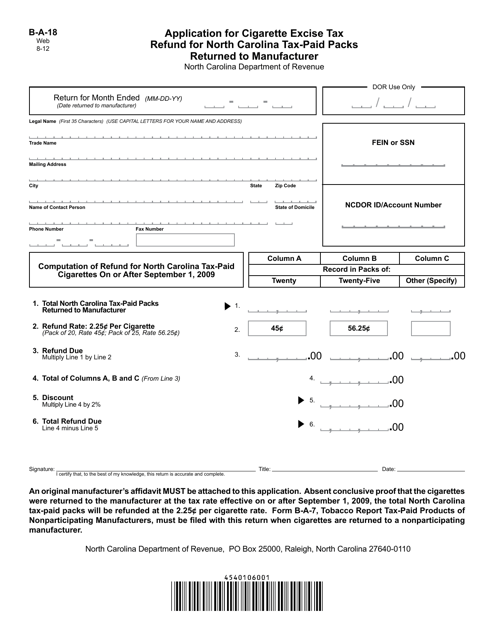

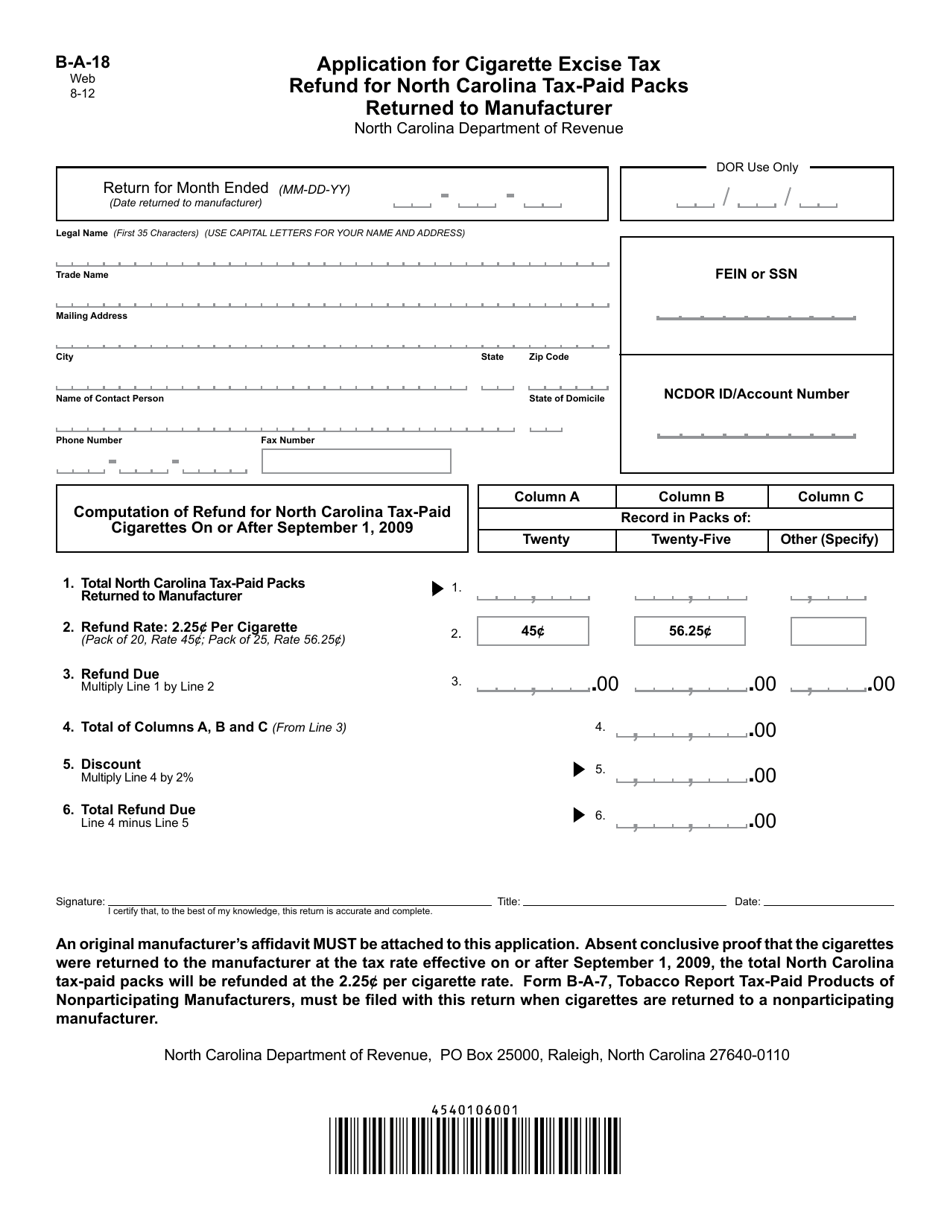

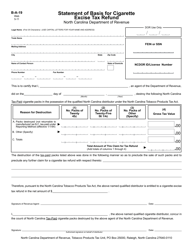

Form B-A-18 Application for Cigarette Excise Tax Refund for North Carolina Tax-Paid Packs Returned to Manufacturer - North Carolina

What Is Form B-A-18?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form B-A-18?

A: Form B-A-18 is an application for a cigarette excise tax refund for North Carolina tax-paid packs returned to the manufacturer.

Q: What does Form B-A-18 apply to?

A: Form B-A-18 applies to cigarette packs that were purchased in North Carolina and returned to the manufacturer.

Q: What is the purpose of Form B-A-18?

A: The purpose of Form B-A-18 is to apply for a refund of the excise tax paid on North Carolina tax-paid cigarette packs that are returned to the manufacturer.

Q: Who is eligible to submit Form B-A-18?

A: Anyone who has purchased North Carolina tax-paid cigarette packs and returned them to the manufacturer may be eligible to submit Form B-A-18.

Q: Are there any requirements for submitting Form B-A-18?

A: Yes, the cigarette packs must have been purchased in North Carolina and returned to the manufacturer within specified time limits in order to be eligible for the excise tax refund.

Q: Is there a deadline for submitting Form B-A-18?

A: Yes, Form B-A-18 must be submitted within one year from the date the cigarette packs were returned to the manufacturer in order to be eligible for the excise tax refund.

Q: How long does it take to receive a refund after submitting Form B-A-18?

A: The processing time for Form B-A-18 refund applications may vary. It is recommended to contact the North Carolina Department of Revenue for more information on the refund timeline.

Q: Are there any fees associated with submitting Form B-A-18?

A: There are no fees associated with submitting Form B-A-18. However, you may be required to provide documentation supporting your refund claim.

Form Details:

- Released on August 1, 2012;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form B-A-18 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.