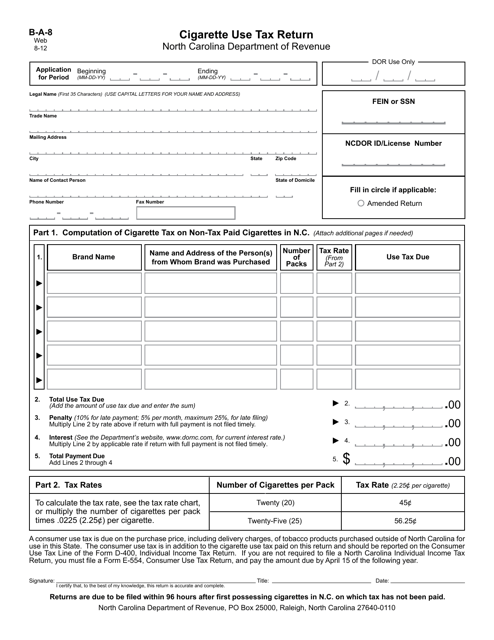

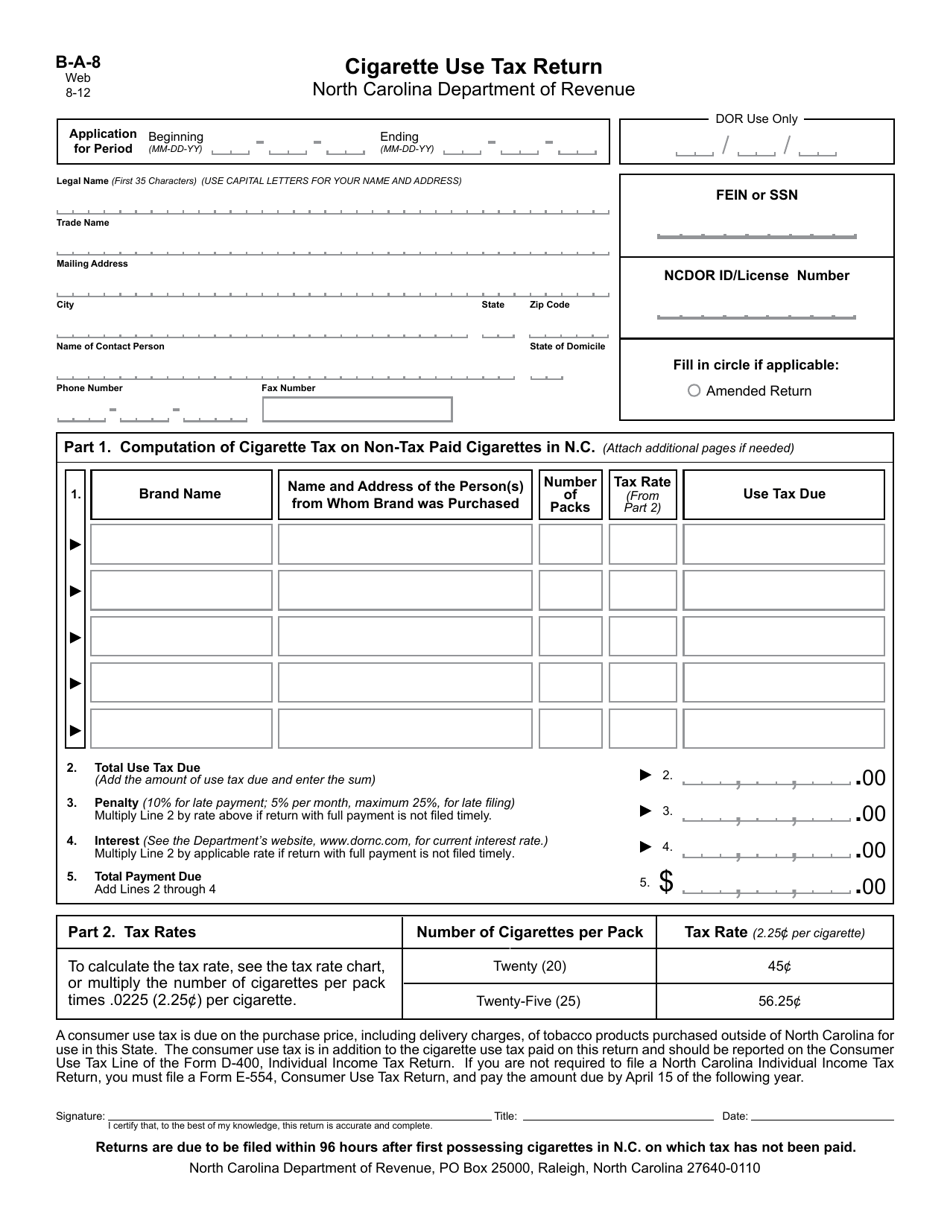

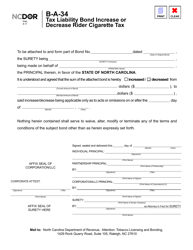

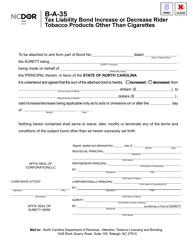

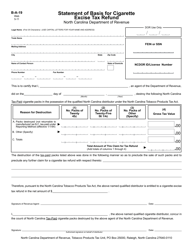

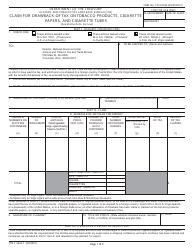

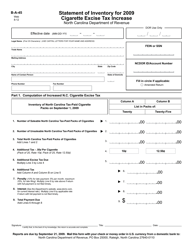

Form B-A-8 Cigarette Use Tax Return - North Carolina

What Is Form B-A-8?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form B-A-8?

A: Form B-A-8 is the Cigarette Use Tax Return in North Carolina.

Q: Who needs to file Form B-A-8?

A: Any person or entity who purchases or receives untaxed cigarettes in North Carolina needs to file Form B-A-8.

Q: What is the Cigarette Use Tax?

A: The Cigarette Use Tax is a tax on cigarettes that were obtained without paying the appropriate North Carolina tax.

Q: When is Form B-A-8 due?

A: Form B-A-8 is due on the 20th day of the month following the month in which the untaxed cigarettes were obtained.

Q: What are the penalties for not filing Form B-A-8?

A: Penalties for not filing Form B-A-8 include monetary penalties and possible criminal charges.

Form Details:

- Released on August 1, 2012;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form B-A-8 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.