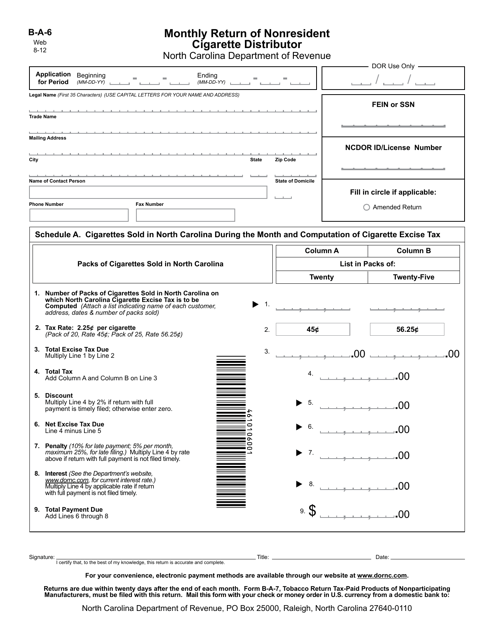

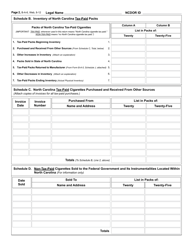

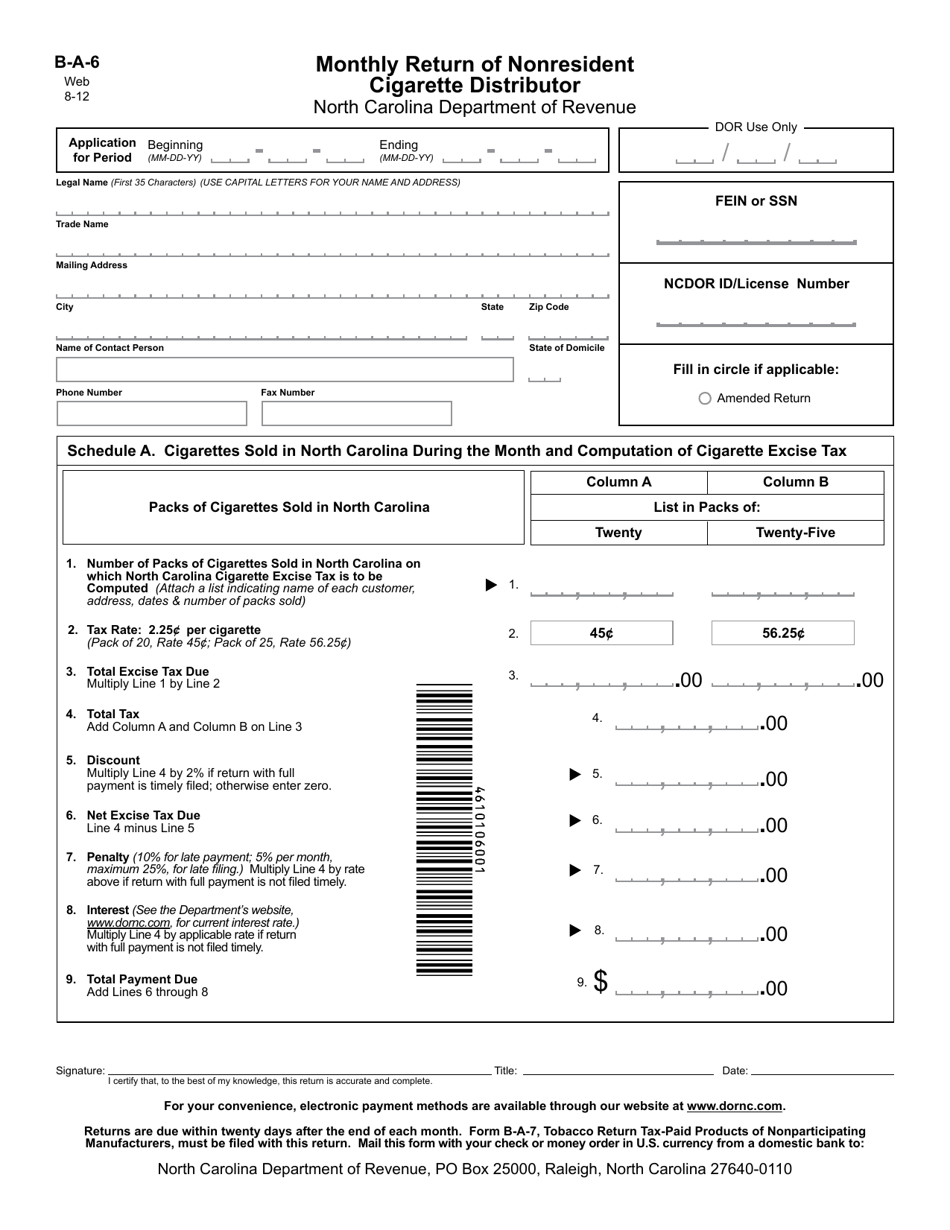

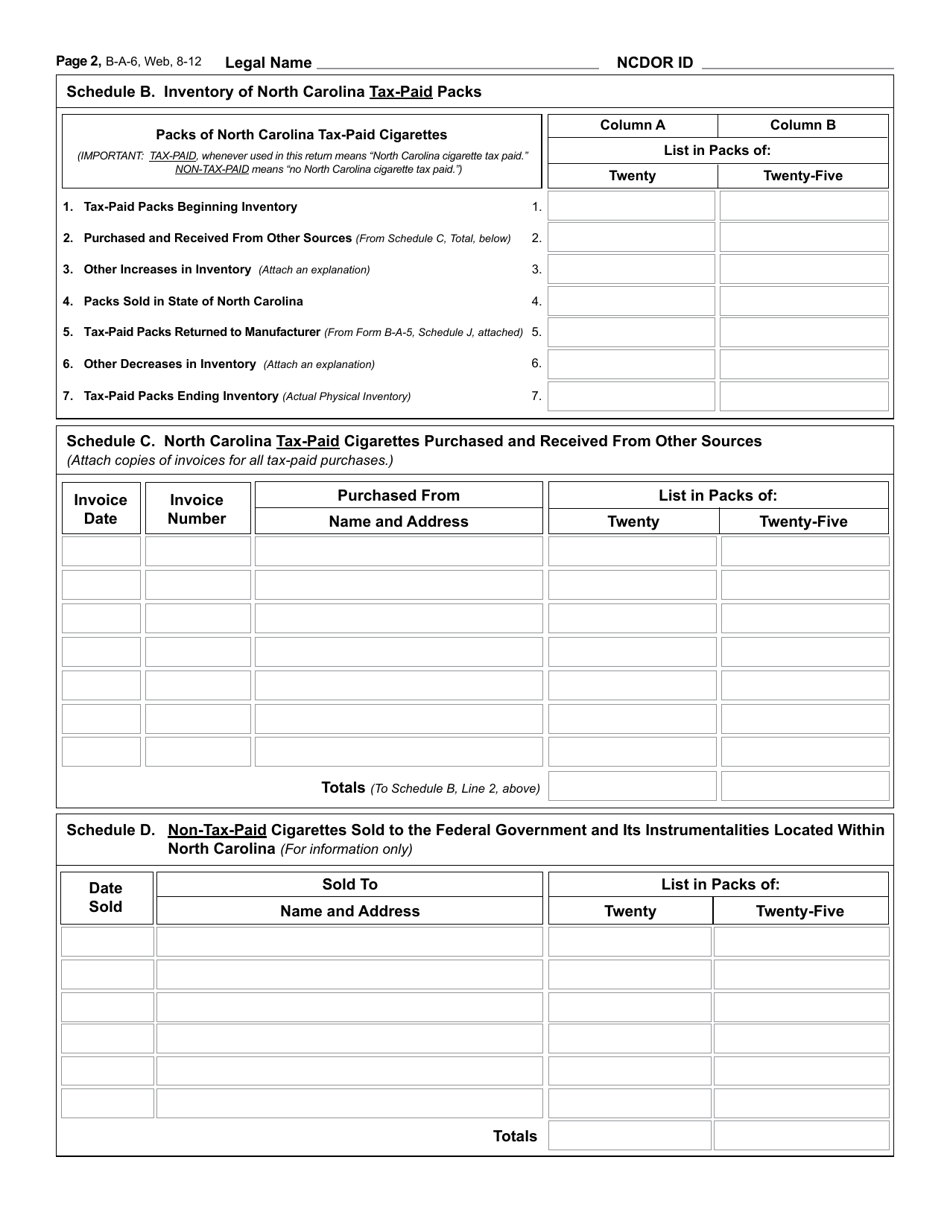

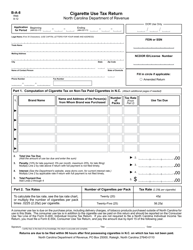

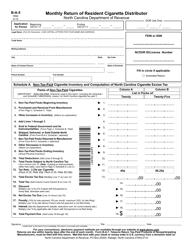

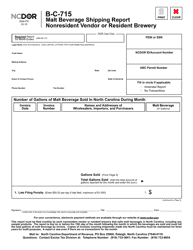

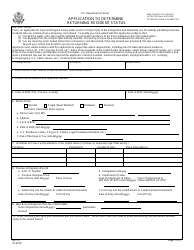

Form B-A-6 Monthly Return of Nonresident Cigarette Distributor - North Carolina

What Is Form B-A-6?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form B-A-6?

A: Form B-A-6 is a Monthly Return of Nonresident Cigarette Distributor, used in North Carolina.

Q: Who needs to file Form B-A-6?

A: Nonresident cigarette distributors operating in North Carolina need to file Form B-A-6.

Q: What is the purpose of Form B-A-6?

A: Form B-A-6 is used to report the sales and distribution of cigarettes by nonresident distributors in North Carolina.

Q: How often do I need to file Form B-A-6?

A: Form B-A-6 must be filed on a monthly basis.

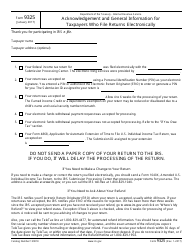

Q: What information is required on Form B-A-6?

A: Form B-A-6 requires details such as the distributor's name, address, sales information, and tax liability.

Q: When is the deadline to file Form B-A-6?

A: Form B-A-6 must be filed by the 20th day of the month following the reporting period.

Q: Are there any penalties for not filing Form B-A-6?

A: Yes, failure to file Form B-A-6 or filing it late can result in penalties and interest.

Q: Can I request an extension to file Form B-A-6?

A: Yes, requests for extension to file Form B-A-6 can be made to the North Carolina Department of Revenue.

Q: What should I do if I have questions about Form B-A-6?

A: For any questions or assistance regarding Form B-A-6, you can contact the North Carolina Department of Revenue directly.

Form Details:

- Released on August 1, 2012;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form B-A-6 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.