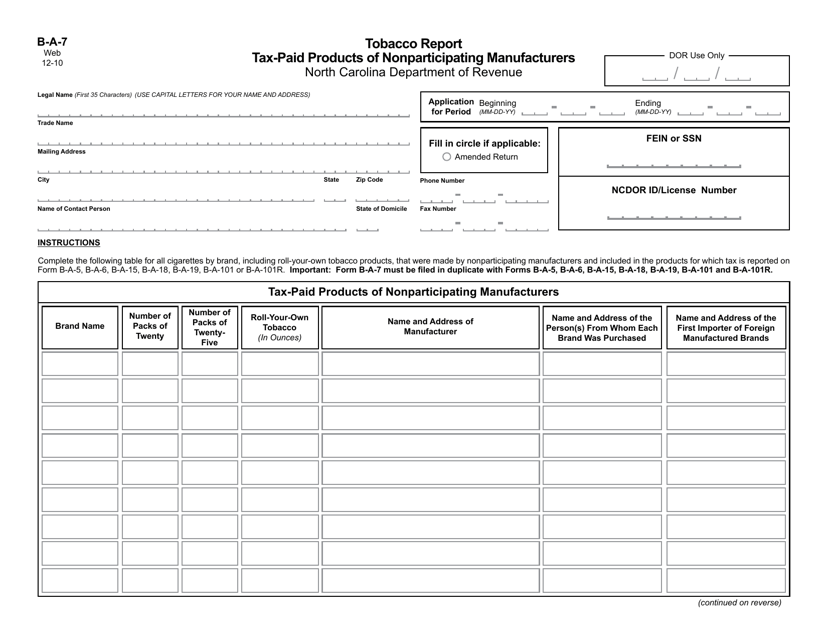

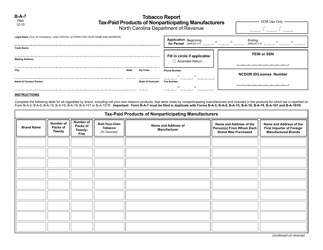

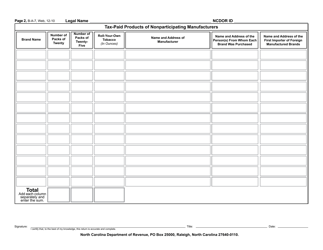

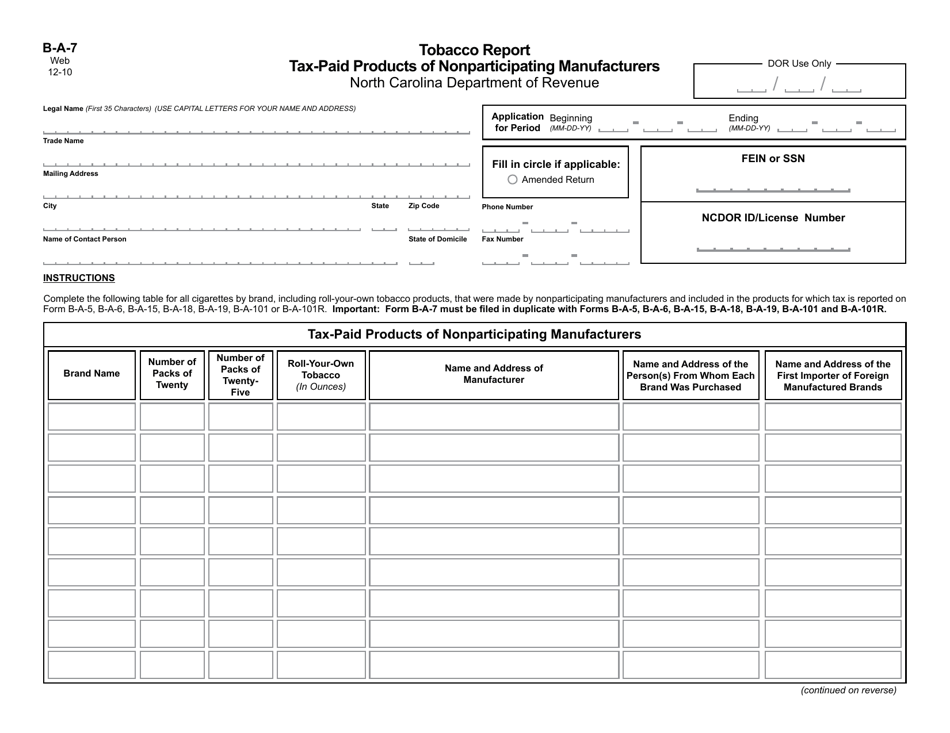

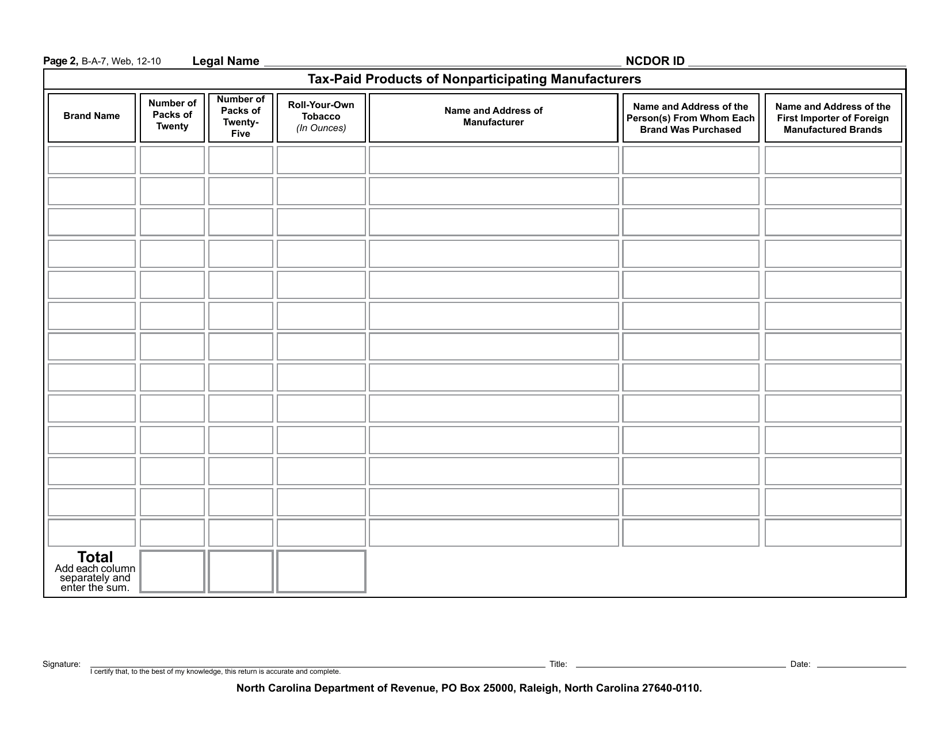

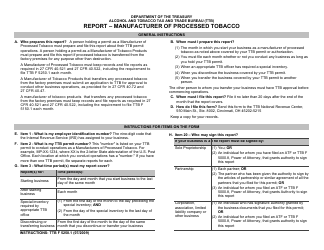

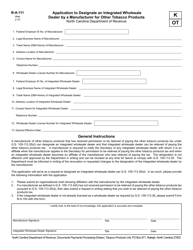

Form B-A-7 Tobacco Report - Tax-Paid Products of Nonparticipating Manufacturers - North Carolina

What Is Form B-A-7?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form B-A-7?

A: Form B-A-7 is a report for tax-paid products of nonparticipating manufacturers.

Q: What is the purpose of Form B-A-7?

A: The purpose of Form B-A-7 is to track and report tax-paid tobacco products from manufacturers that are not participating in certain tobacco settlement agreements.

Q: Who needs to file Form B-A-7?

A: Anyone who sells tax-paid tobacco products in North Carolina from nonparticipating manufacturers needs to file Form B-A-7.

Q: How often do you need to file Form B-A-7?

A: Form B-A-7 needs to be filed monthly.

Q: What information is required in Form B-A-7?

A: Form B-A-7 requires information such as the name and address of the nonparticipating manufacturer, the quantity and value of the tax-paid tobacco products sold, and other related details.

Q: Is there a deadline for filing Form B-A-7?

A: Yes, Form B-A-7 must be filed by the 20th day of the month following the reporting month.

Q: Are there any penalties for not filing Form B-A-7?

A: Yes, failure to file Form B-A-7 or filing it late can result in penalties and interest.

Q: Do I need to keep records of the tax-paid tobacco products sold?

A: Yes, you must keep records of the tax-paid tobacco products sold for a minimum of three years from the date of sale.

Form Details:

- Released on December 1, 2010;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form B-A-7 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.