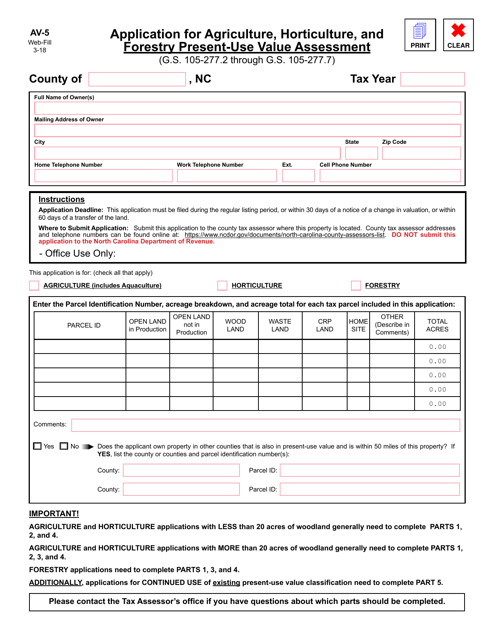

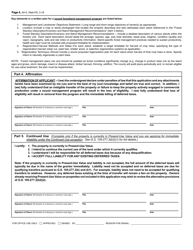

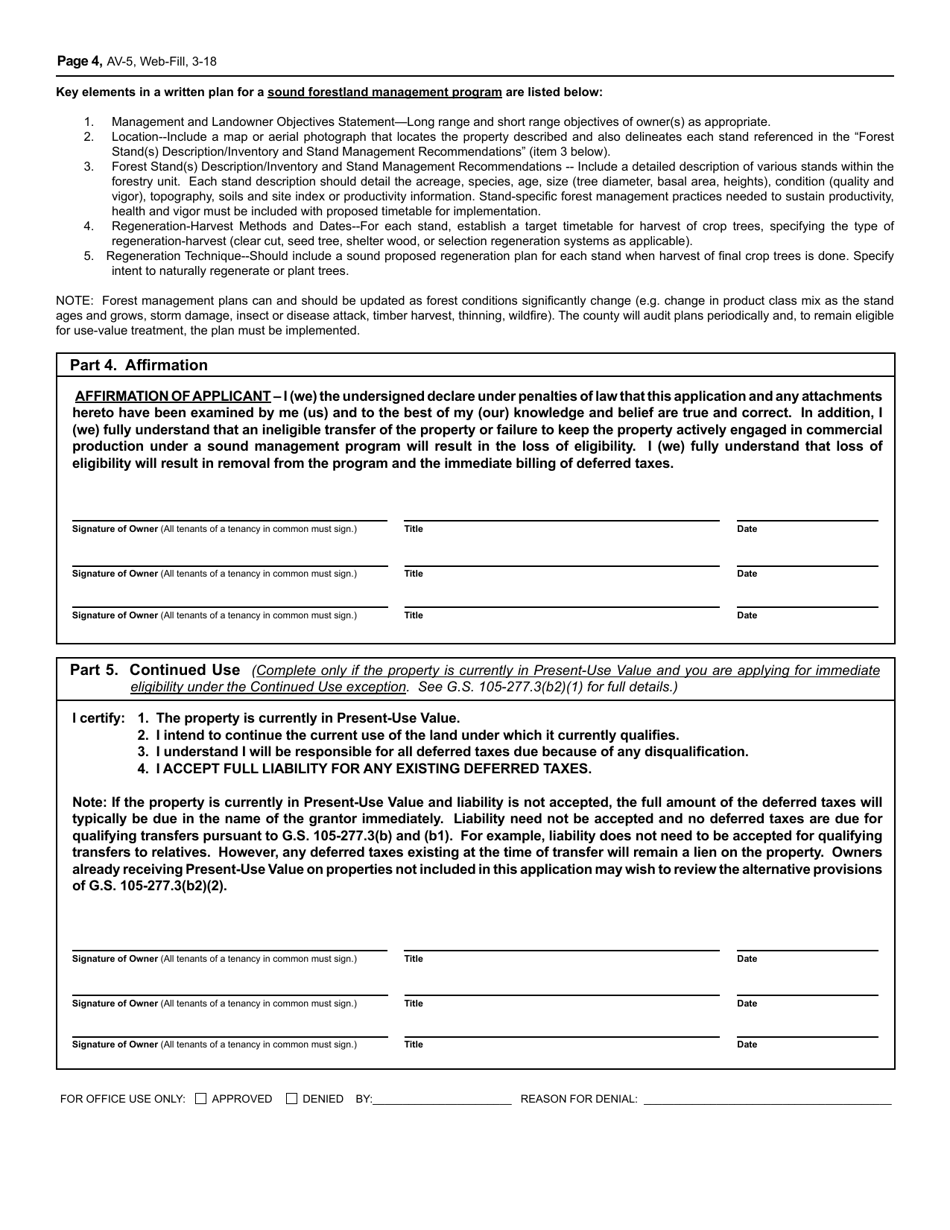

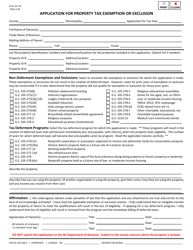

Form AV-5 Application for Agriculture, Horticulture, and Forestry Present-Use Value Assessment - North Carolina

What Is Form AV-5?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AV-5?

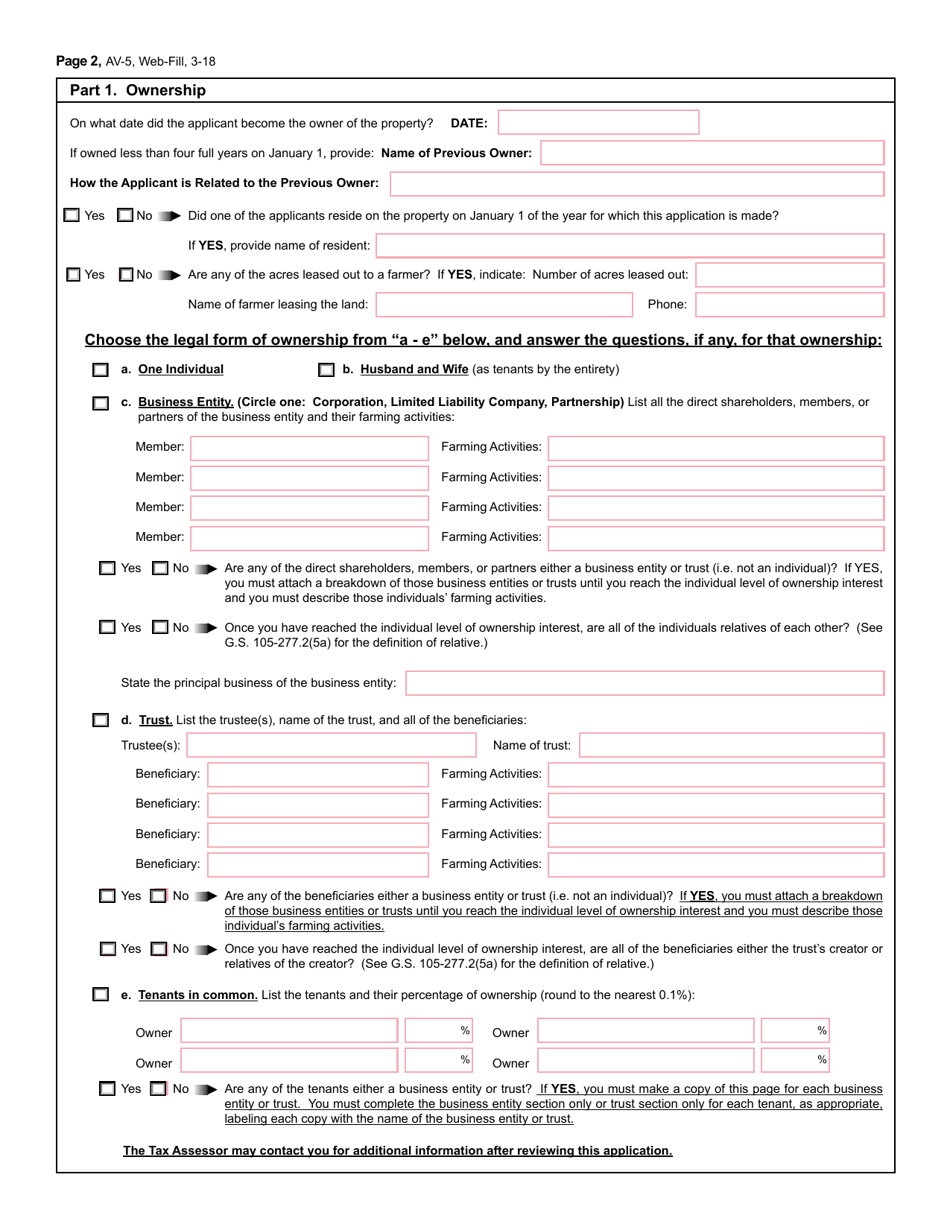

A: Form AV-5 is an application used in North Carolina for the present-use value assessment of agricultural, horticultural, and forestry properties.

Q: Who needs to fill out Form AV-5?

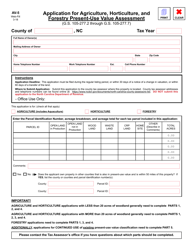

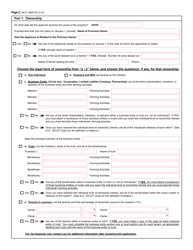

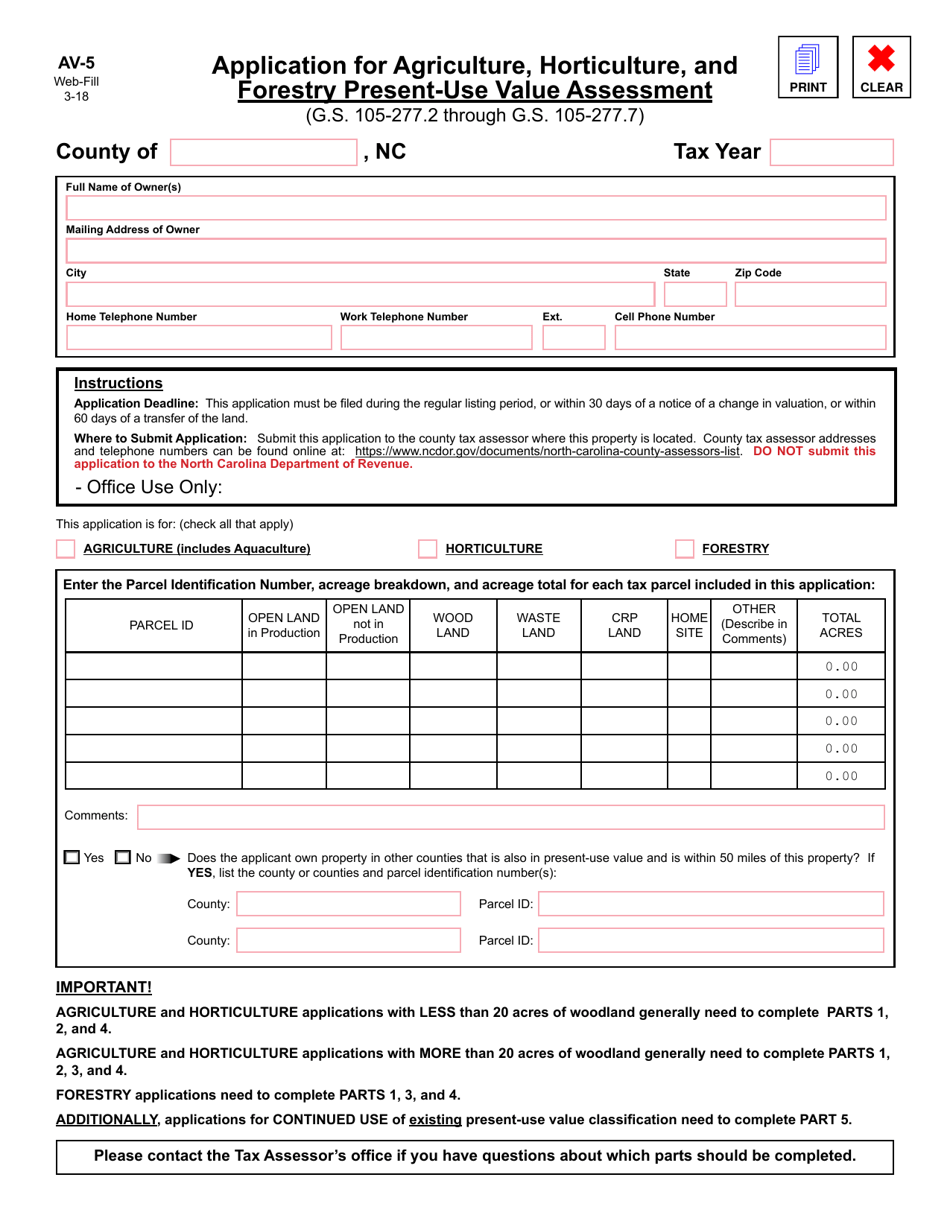

A: Property owners who have agricultural, horticultural, or forestry properties and want to qualify for the present-use value assessment program in North Carolina need to fill out Form AV-5.

Q: What is the purpose of Form AV-5?

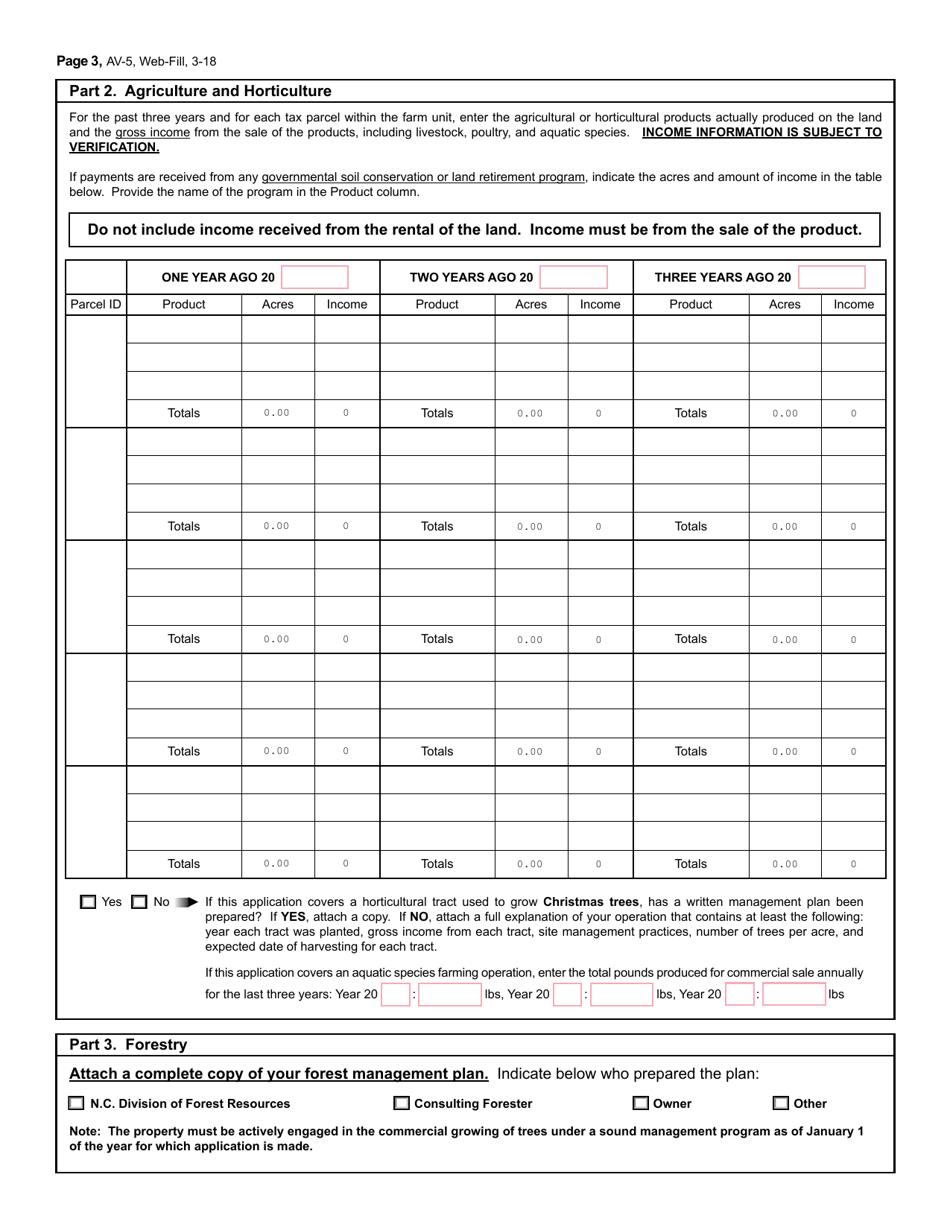

A: The purpose of Form AV-5 is to determine the eligibility of agricultural, horticultural, and forestry properties for the present-use value assessment, which can result in lower property taxes.

Q: When is the deadline to submit Form AV-5?

A: The deadline to submit Form AV-5 is typically January 31st of each year. However, it's best to check with your local tax assessor's office for any specific deadlines or requirements.

Q: What supporting documents are required with Form AV-5?

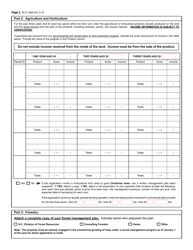

A: Supporting documents, such as maps, deeds, income and expense statements, and timber management plans, may be required depending on the type of property being assessed. Please refer to the instructions provided with Form AV-5 for a complete list of required documents.

Q: What are the benefits of the present-use value assessment program?

A: The present-use value assessment program can result in significantly lower property taxes for qualifying agricultural, horticultural, and forestry properties in North Carolina.

Q: How often do I need to fill out Form AV-5?

A: In most cases, Form AV-5 needs to be filled out and submitted annually to maintain eligibility for the present-use value assessment program. However, it's important to check with your local tax assessor's office for any specific requirements or updates.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AV-5 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.