This version of the form is not currently in use and is provided for reference only. Download this version of

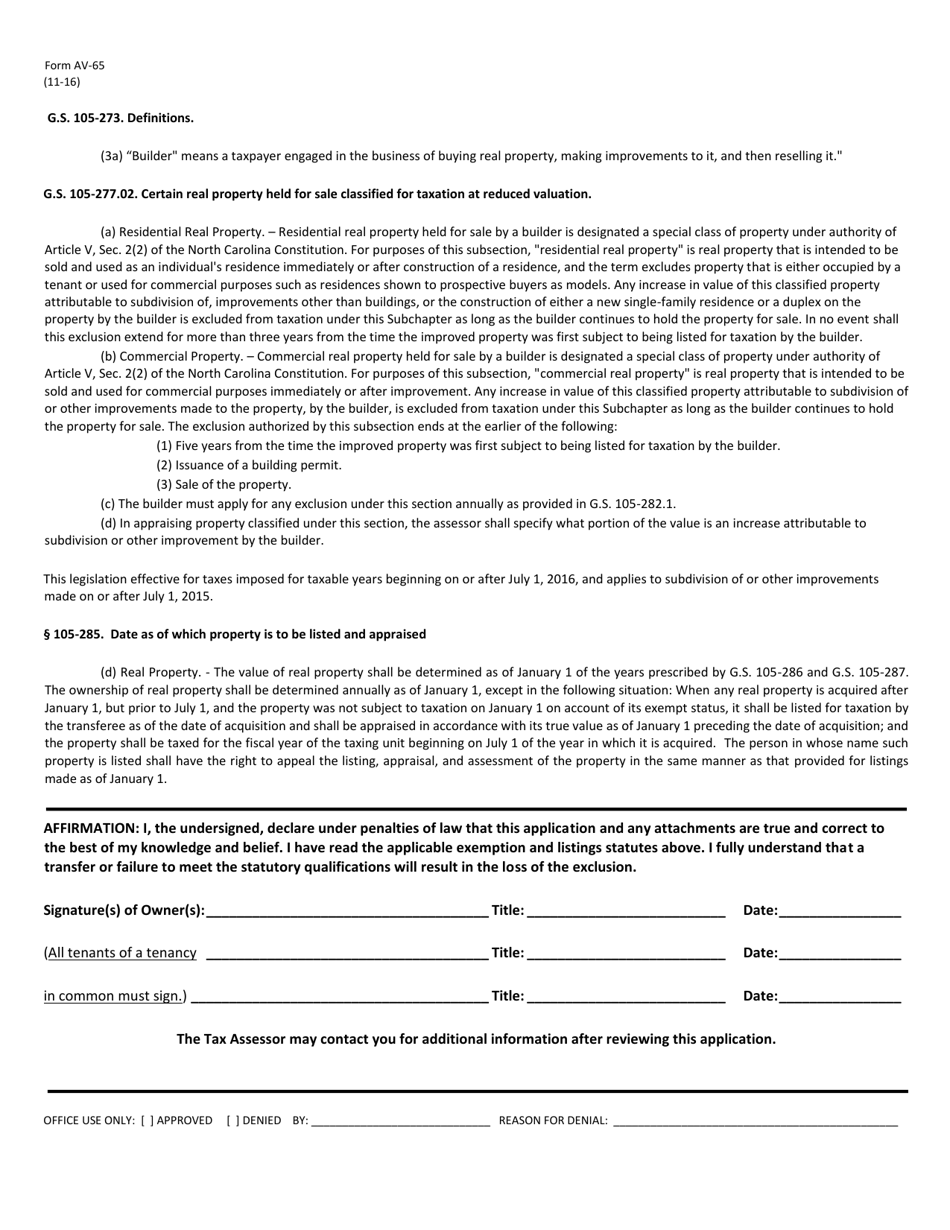

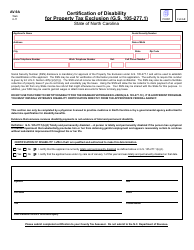

Form AV-65

for the current year.

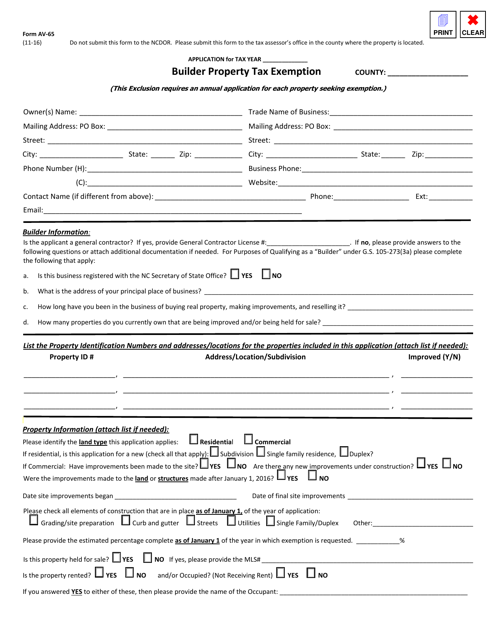

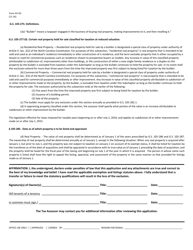

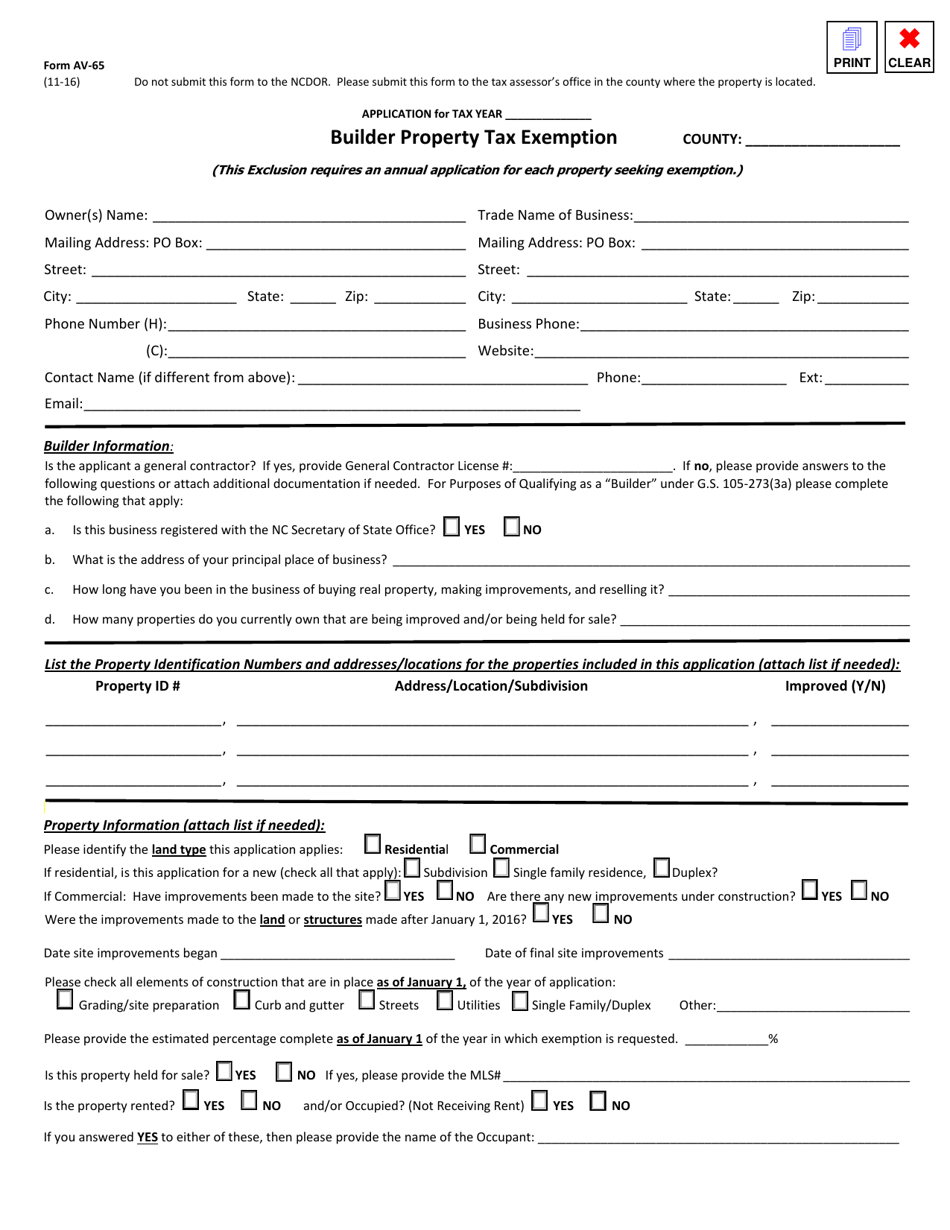

Form AV-65 Builder Property Tax Exemption - North Carolina

What Is Form AV-65?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AV-65?

A: Form AV-65 is a tax exemption form for builder properties in North Carolina.

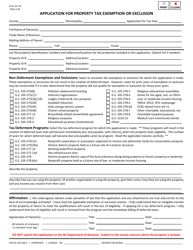

Q: Who is eligible for the Builder Property Tax Exemption?

A: Builders who meet certain criteria specified by the North Carolina Department of Revenue are eligible for the Builder Property Tax Exemption.

Q: What is the purpose of the Builder Property Tax Exemption?

A: The purpose of the exemption is to provide temporary relief from property tax assessments on properties held for sale by builders.

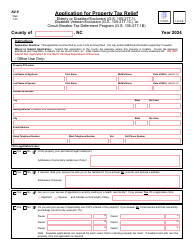

Q: What information do I need to provide on Form AV-65?

A: You will need to provide information about the property and the builder, including the builder's name and address.

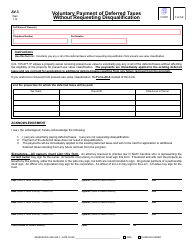

Q: When should I file Form AV-65?

A: Form AV-65 should be filed with the local tax office within 30 days of the date the builder acquires the property.

Q: How long does the exemption last?

A: The exemption lasts for a period of one year from the date the builder acquires the property.

Q: Is there a fee to file Form AV-65?

A: No, there is no fee to file Form AV-65.

Q: What happens if I sell the property before the exemption expires?

A: If the property is sold before the expiration of the exemption, the exemption is terminated and the builder may be subject to property taxes for the remaining portion of the year.

Q: Are there any penalties for not filing Form AV-65?

A: Failure to file Form AV-65 may result in the assessment of property taxes on the builder property.

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AV-65 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.