This version of the form is not currently in use and is provided for reference only. Download this version of

Form D-403 NC K-1

for the current year.

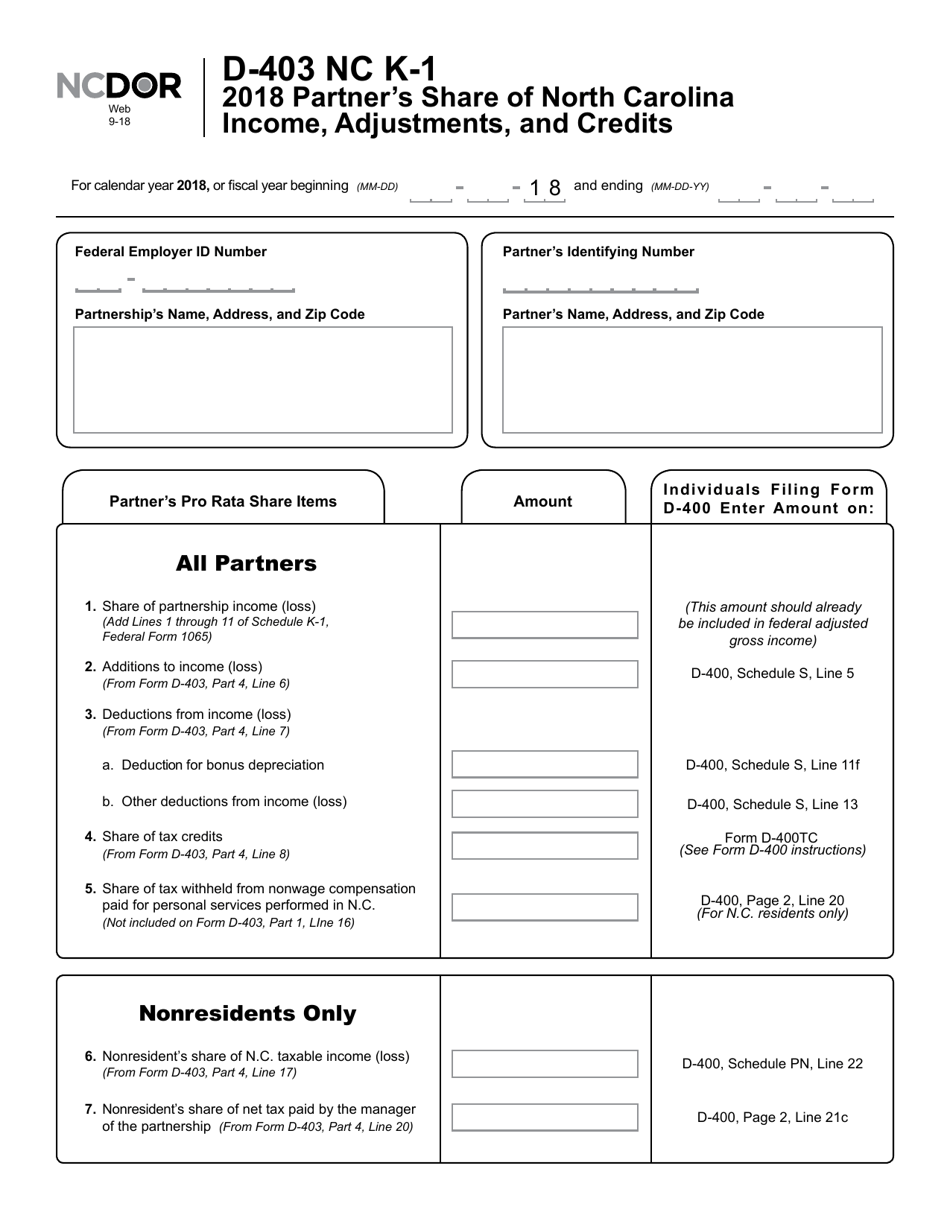

Form D-403 NC K-1 Partner's Share of North Carolina Income, Adjustments, and Credits - North Carolina

What Is Form D-403 NC K-1?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D-403 NC K-1?

A: Form D-403 NC K-1 is a tax form used by partners of North Carolina partnerships to report their share of income, adjustments, and credits.

Q: Who needs to file Form D-403 NC K-1?

A: Partners of North Carolina partnerships need to file Form D-403 NC K-1 to report their share of income, adjustments, and credits.

Q: What information is included on Form D-403 NC K-1?

A: Form D-403 NC K-1 includes information about a partner's share of income, adjustments, and credits from a North Carolina partnership.

Q: How do I fill out Form D-403 NC K-1?

A: To fill out Form D-403 NC K-1, you need to provide information about your share of income, adjustments, and credits from the North Carolina partnership.

Q: When is the deadline to file Form D-403 NC K-1?

A: The deadline to file Form D-403 NC K-1 is usually April 15th, or the same deadline as your federal tax return.

Q: Do I need to include Form D-403 NC K-1 with my federal tax return?

A: No, you do not need to include Form D-403 NC K-1 with your federal tax return. It is only for reporting purposes to the North Carolina Department of Revenue.

Q: What should I do if I have questions about Form D-403 NC K-1?

A: If you have questions about Form D-403 NC K-1, you should contact the North Carolina Department of Revenue or consult a tax professional.

Q: Can I file Form D-403 NC K-1 electronically?

A: Yes, you can file Form D-403 NC K-1 electronically through the North Carolina Department of Revenue's eFile system.

Q: Is Form D-403 NC K-1 the same as my personal tax return?

A: No, Form D-403 NC K-1 is not the same as your personal tax return. It is a separate form for reporting income, adjustments, and credits from a North Carolina partnership.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

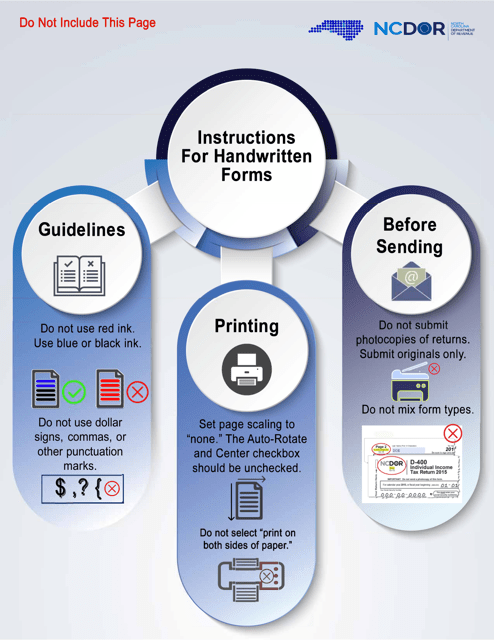

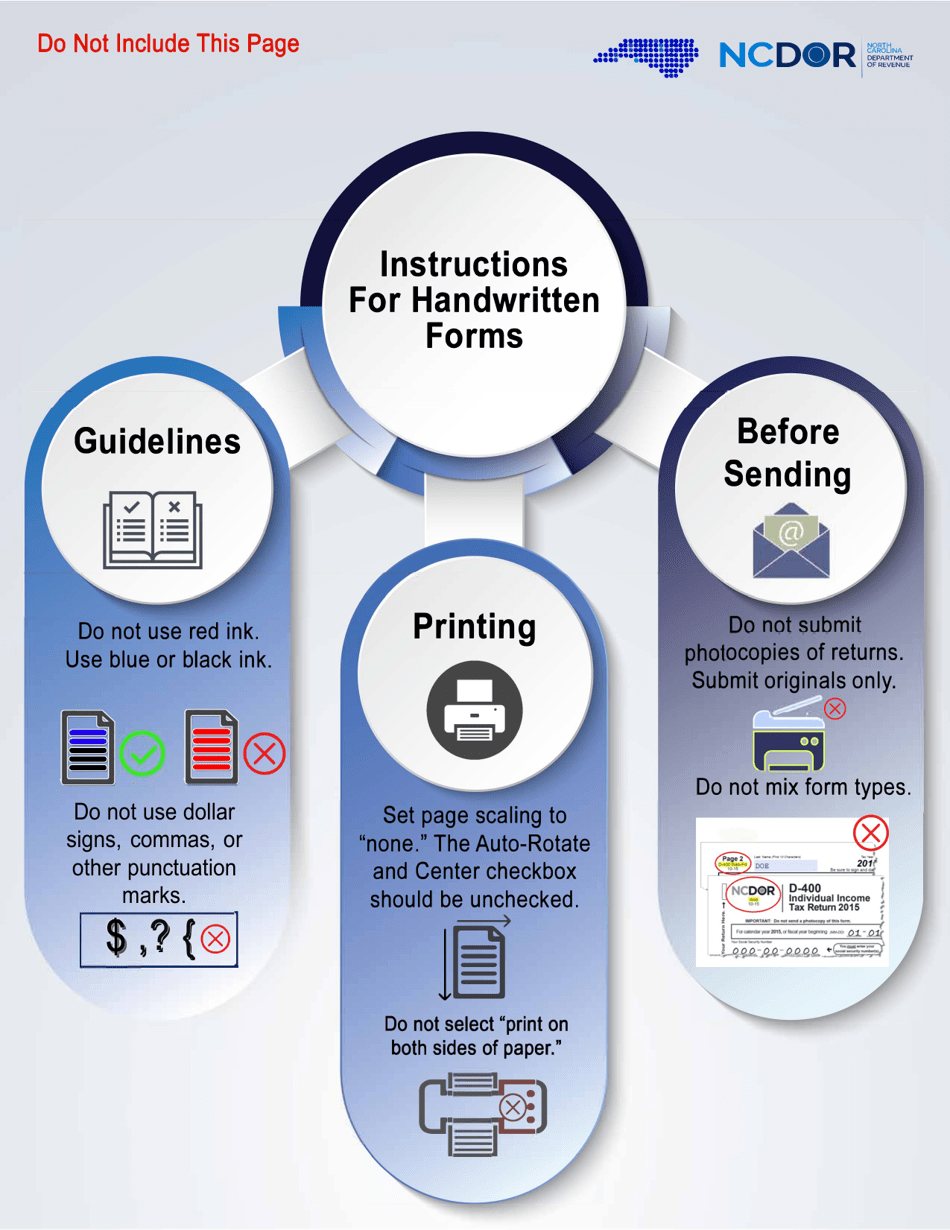

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form D-403 NC K-1 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.