This version of the form is not currently in use and is provided for reference only. Download this version of

Form D-403TC

for the current year.

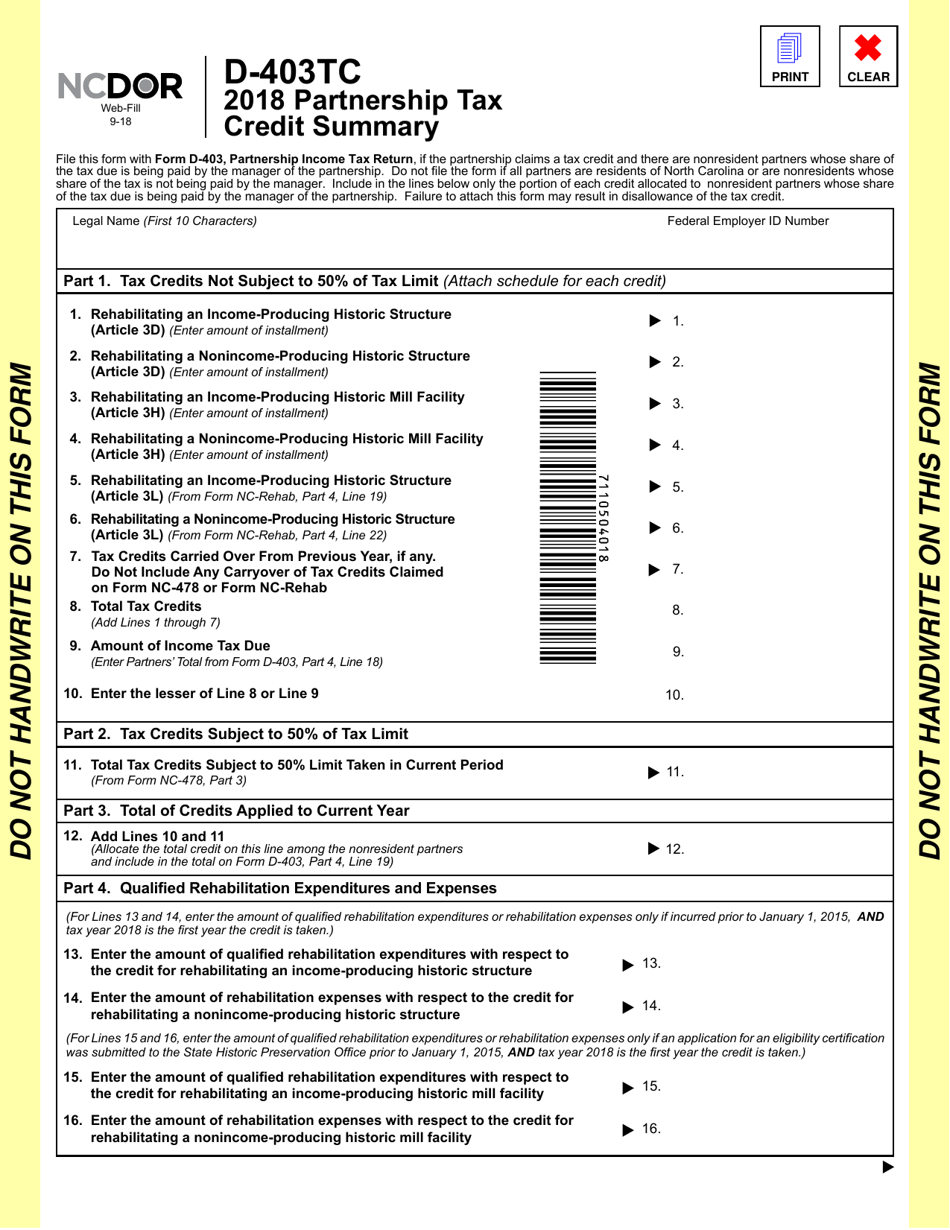

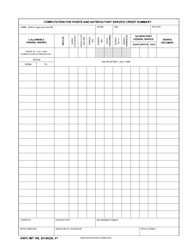

Form D-403TC Partnership Tax Credit Summary - North Carolina

What Is Form D-403TC?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D-403TC?

A: Form D-403TC is the Partnership Tax Credit Summary form used in North Carolina.

Q: What is the purpose of Form D-403TC?

A: The purpose of Form D-403TC is to provide a summary of partnership tax credits in North Carolina.

Q: Who needs to file Form D-403TC?

A: Partnerships in North Carolina with eligible tax credits need to file Form D-403TC.

Q: What information is required on Form D-403TC?

A: Form D-403TC requires information about the partnership and the tax credits claimed.

Q: When is the deadline to file Form D-403TC?

A: Form D-403TC is generally due on or before the due date for filing the partnership tax return.

Q: Are there any specific instructions for completing Form D-403TC?

A: Yes, the North Carolina Department of Revenue provides instructions for completing Form D-403TC.

Q: Can Form D-403TC be filed electronically?

A: Yes, Form D-403TC can be filed electronically through the North Carolina Department of Revenue's eFile system.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

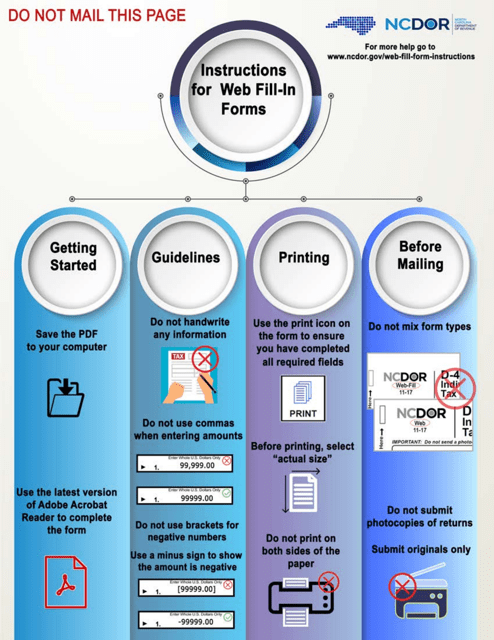

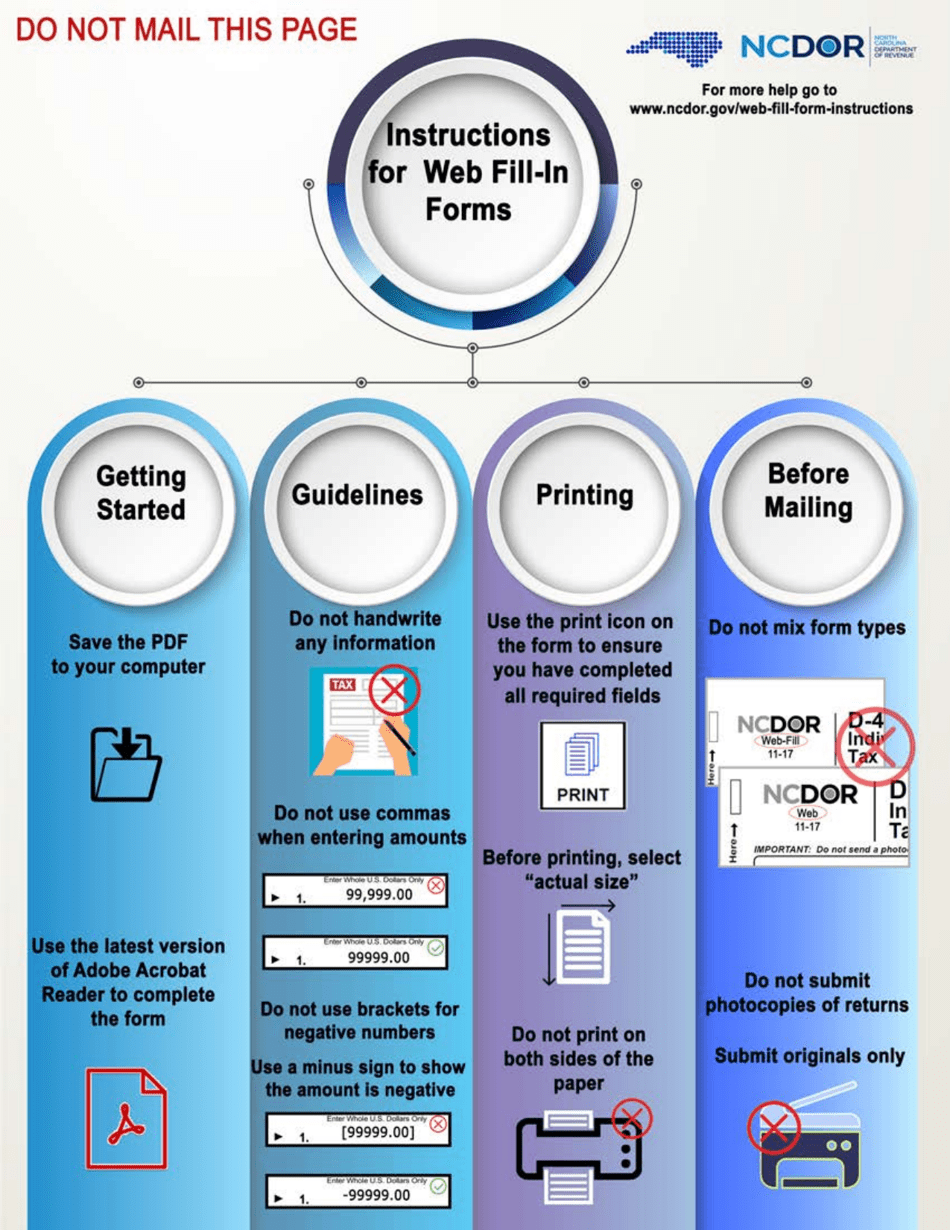

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-403TC by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.