This version of the form is not currently in use and is provided for reference only. Download this version of

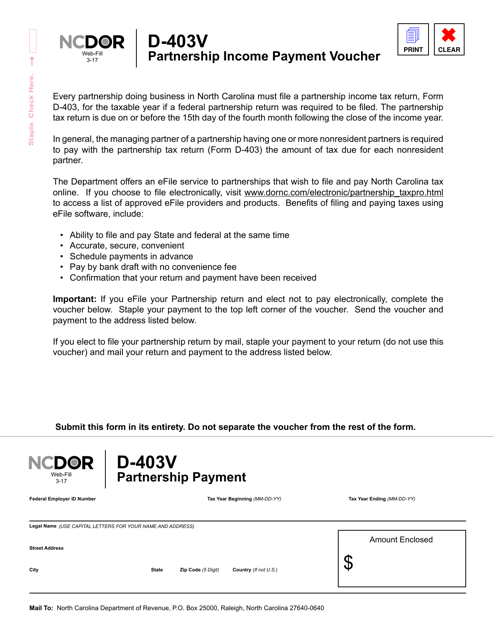

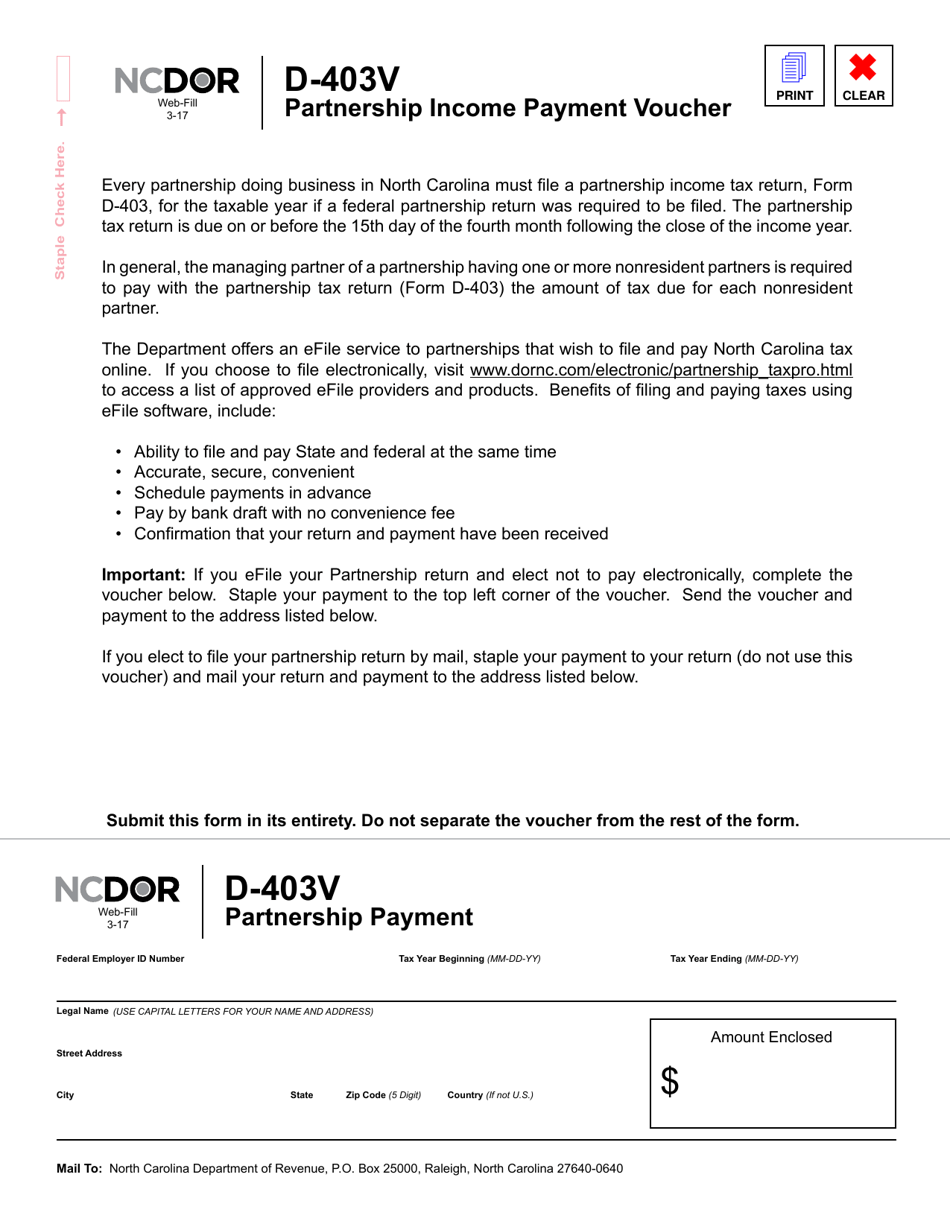

Form D-403V

for the current year.

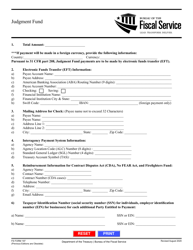

Form D-403V Partnership Income Payment Voucher - North Carolina

What Is Form D-403V?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D-403V?

A: Form D-403V is a payment voucher for partnership income tax in North Carolina.

Q: Who needs to file Form D-403V?

A: Partnerships in North Carolina that need to make a payment for their income tax.

Q: What is the purpose of Form D-403V?

A: The purpose of Form D-403V is to submit a payment for partnership income tax in North Carolina.

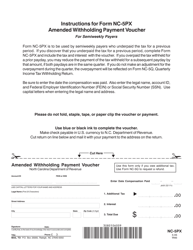

Q: What information is needed to fill out Form D-403V?

A: You will need the partnership's name, address, federal employer identification number (FEIN), and the amount of tax payment.

Q: When is Form D-403V due?

A: Form D-403V is due on or before the 15th day of the fourth month following the close of the partnership's tax year.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the North Carolina Department of Revenue;

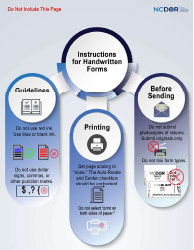

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-403V by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.