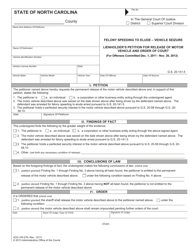

This version of the form is not currently in use and is provided for reference only. Download this version of

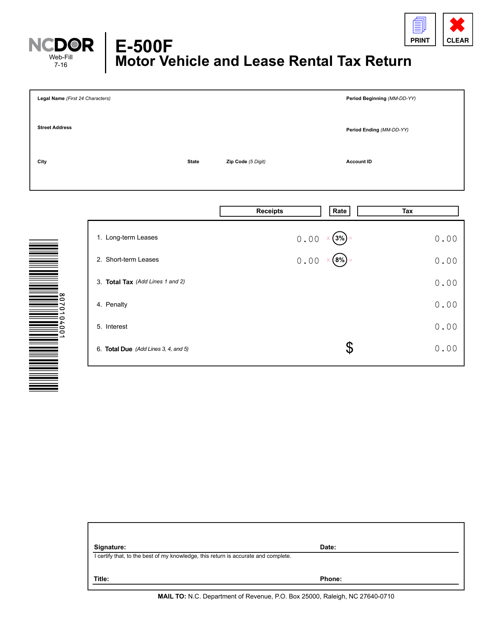

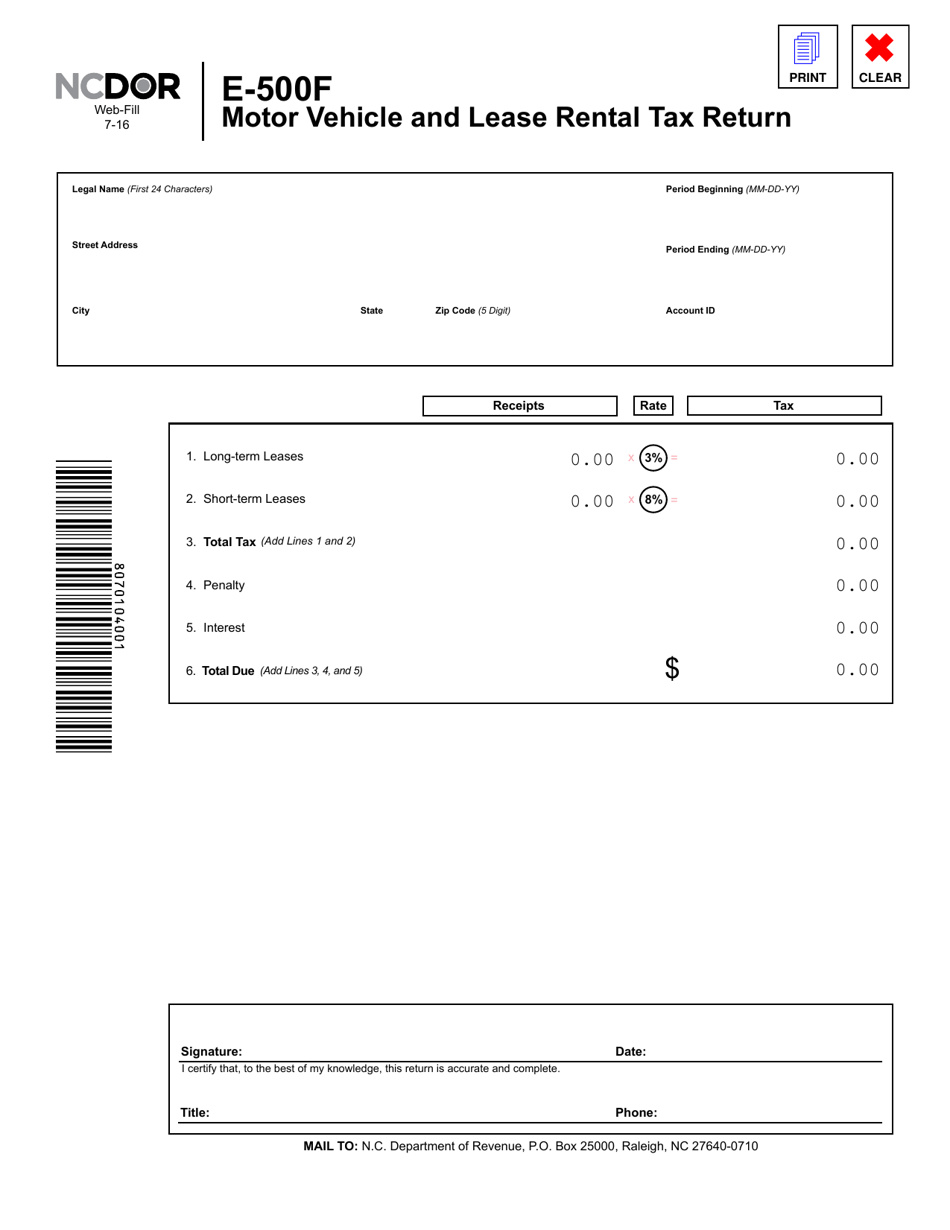

Form E-500F

for the current year.

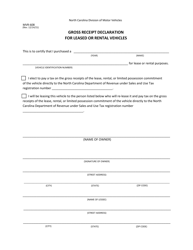

Form E-500F Motor Vehicle and Lease Rental Tax Return - North Carolina

What Is Form E-500F?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form E-500F?

A: Form E-500F is the Motor Vehicle and Lease Rental Tax Return used in North Carolina.

Q: Who needs to file Form E-500F?

A: Any person or business in North Carolina engaged in the business of leasing or renting motor vehicles must file Form E-500F.

Q: What is the purpose of Form E-500F?

A: The purpose of Form E-500F is to report and pay the motor vehicle and lease rental tax owed to the state of North Carolina.

Q: When is Form E-500F due?

A: Form E-500F is due on the 20th day of the month following the end of the reporting period.

Q: What information is required on Form E-500F?

A: Form E-500F requires information such as gross receipts from rental or lease of motor vehicles, tax due, and any adjustments or credits.

Q: Are there any penalties for late filing of Form E-500F?

A: Yes, there are penalties for late filing of Form E-500F, including interest charges and potential penalties.

Q: Is Form E-500F only for businesses?

A: No, individuals who lease or rent motor vehicles for personal use in North Carolina are also required to file Form E-500F.

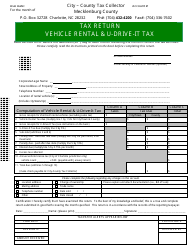

Q: What other taxes are related to motor vehicles in North Carolina?

A: In addition to the motor vehicle and lease rental tax, North Carolina also imposes highway use tax and registration fees on motor vehicles.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E-500F by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.