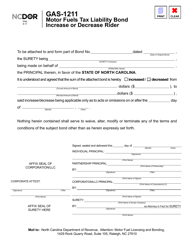

This version of the form is not currently in use and is provided for reference only. Download this version of

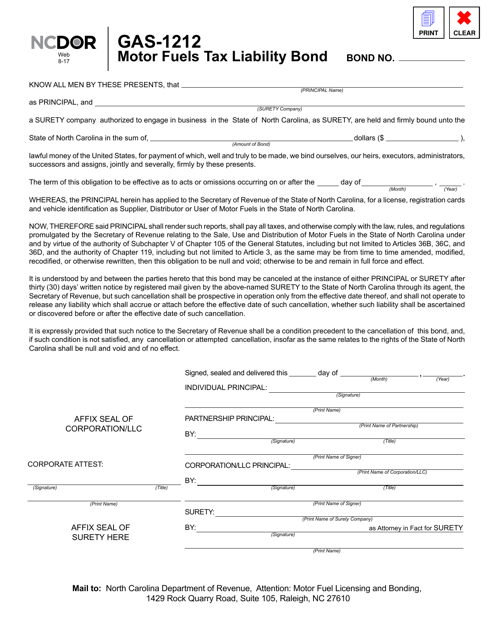

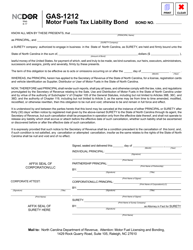

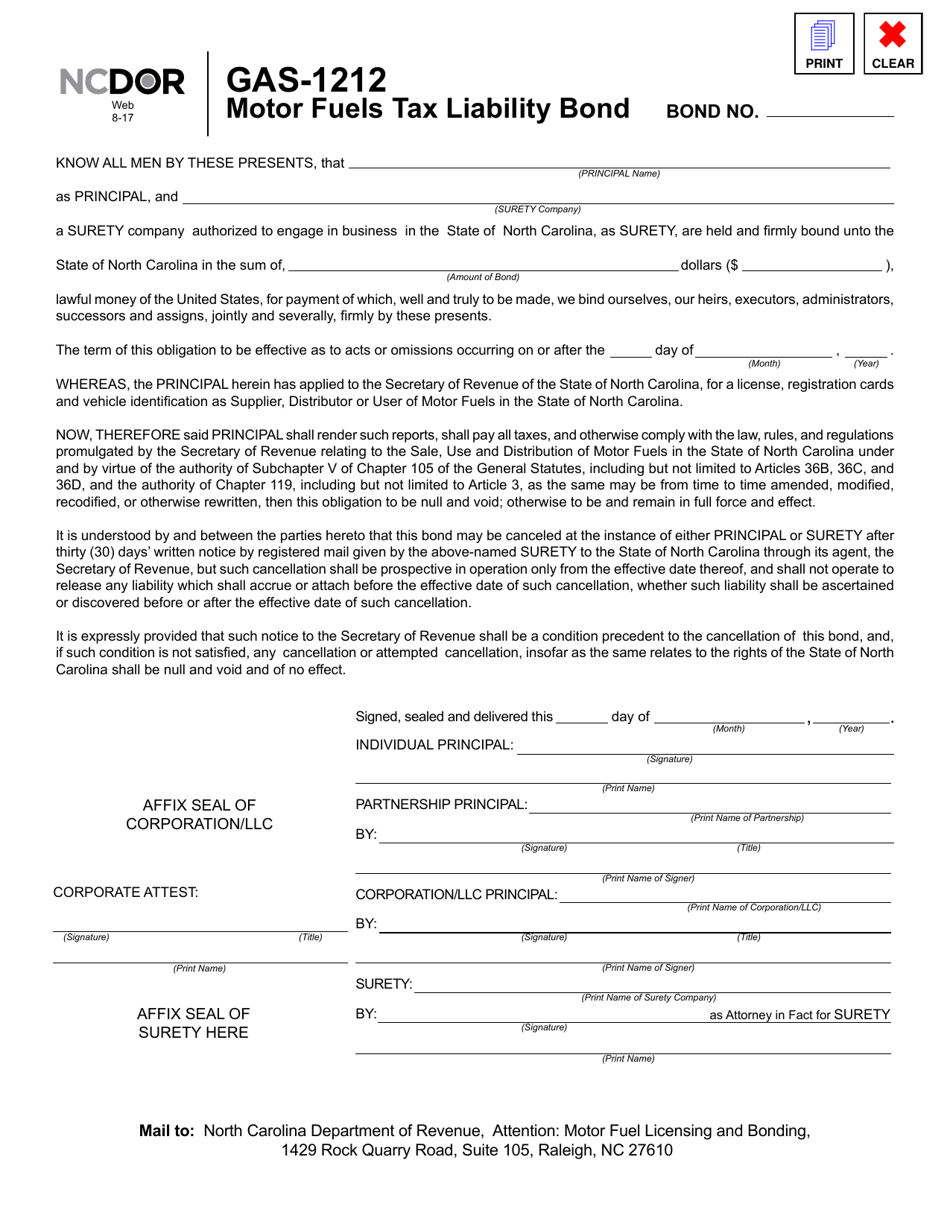

Form GAS-1212

for the current year.

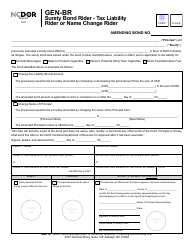

Form GAS-1212 Motor Fuels Tax Liability Bond - North Carolina

What Is Form GAS-1212?

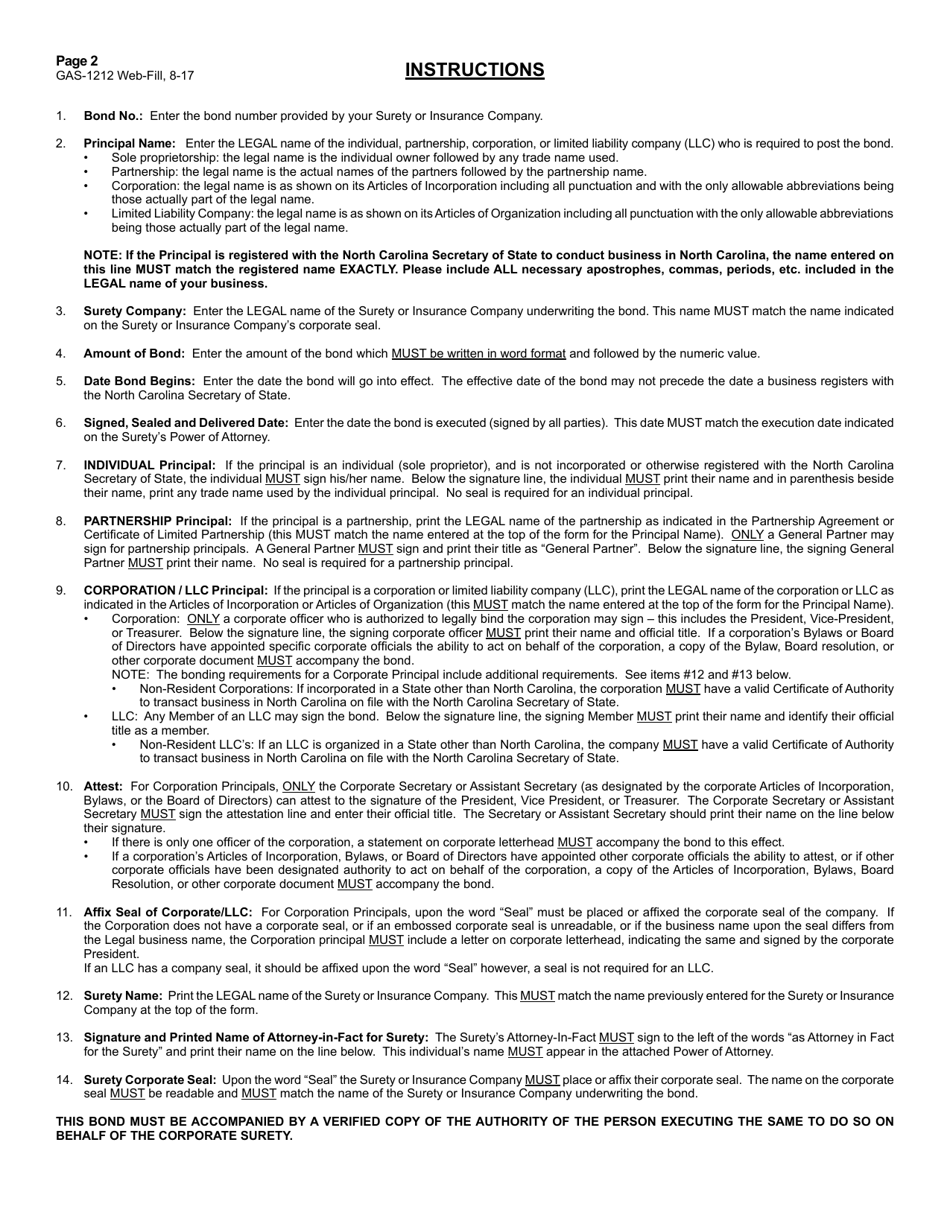

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form GAS-1212?

A: Form GAS-1212 is a Motor Fuels TaxLiability Bond used in North Carolina.

Q: What is a Motor Fuels Tax Liability Bond?

A: A Motor Fuels Tax Liability Bond is a type of bond required by the state of North Carolina for businesses involved in selling or distributing motor fuels.

Q: Who needs to file Form GAS-1212?

A: Businesses involved in selling or distributing motor fuels in North Carolina need to file Form GAS-1212.

Q: What is the purpose of Form GAS-1212?

A: The purpose of Form GAS-1212 is to secure the payment of motor fuels taxes by businesses in North Carolina.

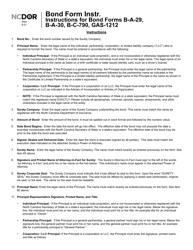

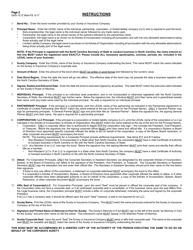

Q: Are there any specific requirements for the Motor Fuels Tax Liability Bond?

A: Yes, there are specific requirements for the Motor Fuels Tax Liability Bond, including the amount of the bond and the approval process.

Q: What happens if I don't file Form GAS-1212?

A: Failure to file Form GAS-1212 or comply with the motor fuels tax requirements in North Carolina may result in penalties or legal consequences.

Q: Can I get assistance in filling out Form GAS-1212?

A: Yes, you can contact the North Carolina Department of Revenue for assistance in filling out Form GAS-1212.

Q: How often do I need to file Form GAS-1212?

A: The filing frequency for Form GAS-1212 depends on the specific requirements set by the North Carolina Department of Revenue.

Q: Is Form GAS-1212 the only form required for motor fuels tax in North Carolina?

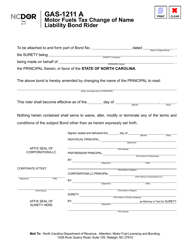

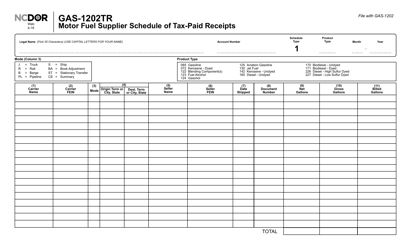

A: No, there may be other forms or requirements for motor fuels tax in North Carolina depending on the nature of your business.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GAS-1212 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.