This version of the form is not currently in use and is provided for reference only. Download this version of

Form GAS-1288

for the current year.

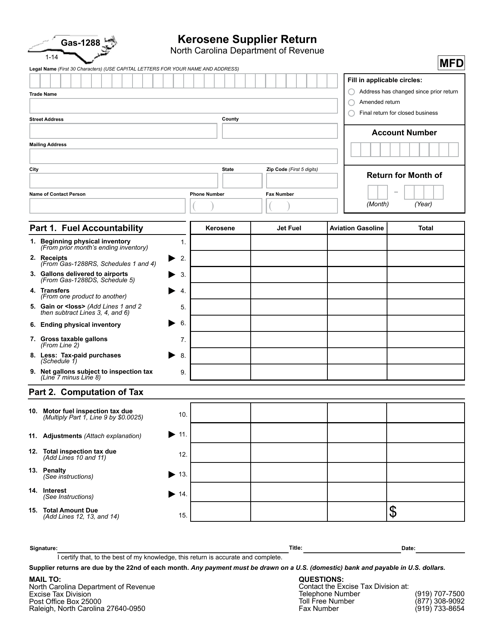

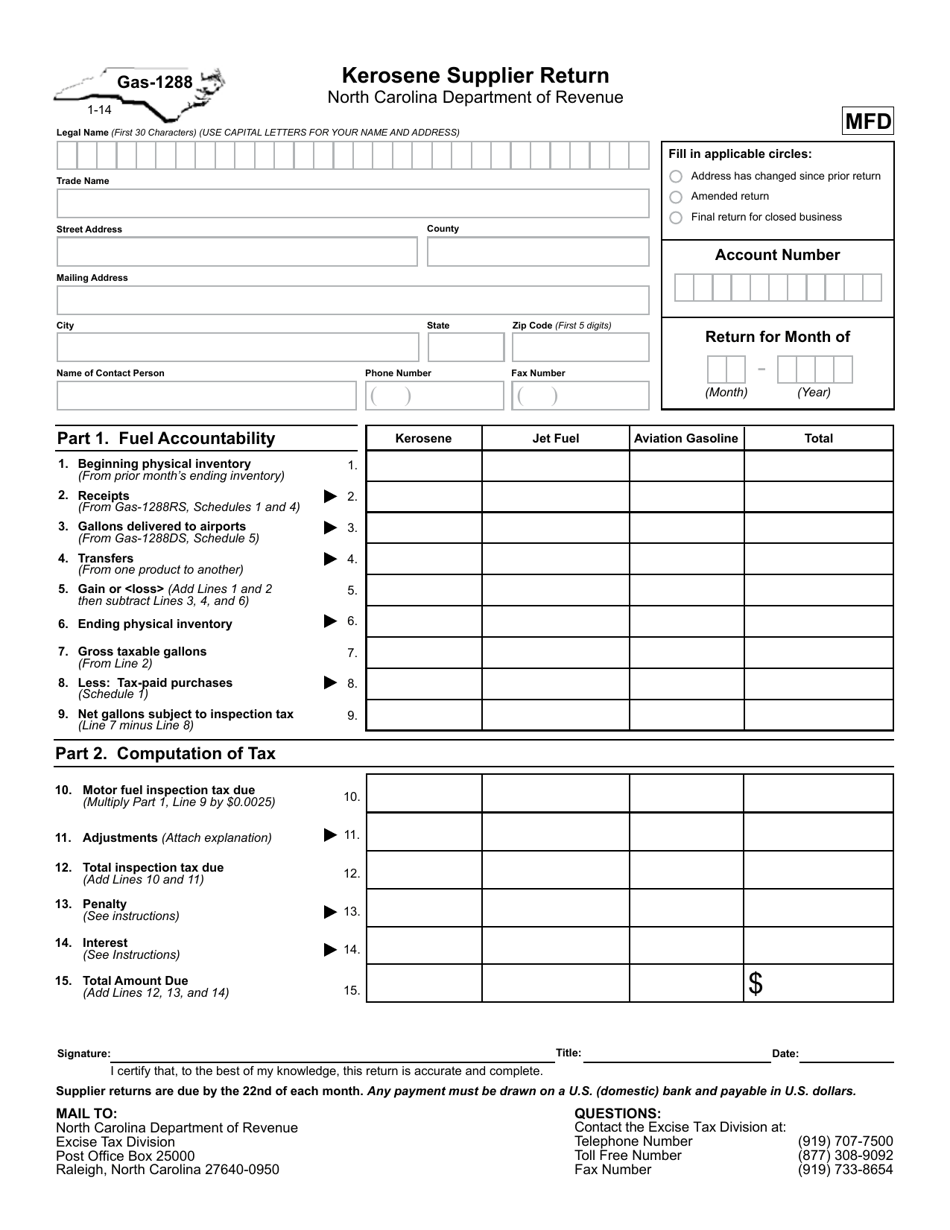

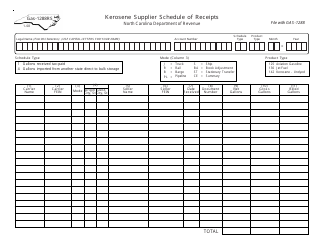

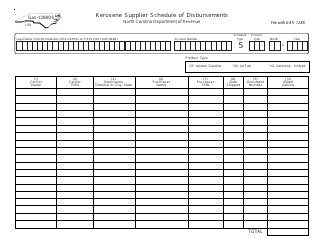

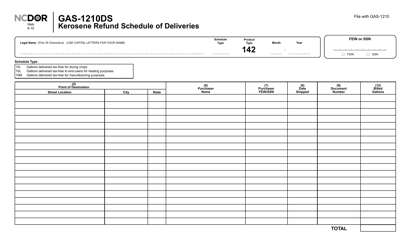

Form GAS-1288 Kerosene Supplier Return - North Carolina

What Is Form GAS-1288?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form GAS-1288?

A: Form GAS-1288 is the Kerosene Supplier Return.

Q: What is the purpose of Form GAS-1288?

A: The purpose of Form GAS-1288 is to report the sales and use tax on kerosene in the state of North Carolina.

Q: Who needs to file Form GAS-1288?

A: Kerosene suppliers in North Carolina need to file Form GAS-1288.

Q: How often do you need to file Form GAS-1288?

A: Form GAS-1288 needs to be filed on a monthly basis.

Q: What information do I need to complete Form GAS-1288?

A: You will need to provide information regarding your kerosene sales, purchases, and usage during the reporting period.

Q: Are there any penalties for not filing Form GAS-1288?

A: Yes, there are penalties for failure to file or late filing of Form GAS-1288, including interest charges on unpaid tax amounts.

Q: Is there a deadline for filing Form GAS-1288?

A: Yes, Form GAS-1288 must be filed by the 20th day of the month following the end of the reporting period.

Form Details:

- Released on January 1, 2014;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GAS-1288 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.