This version of the form is not currently in use and is provided for reference only. Download this version of

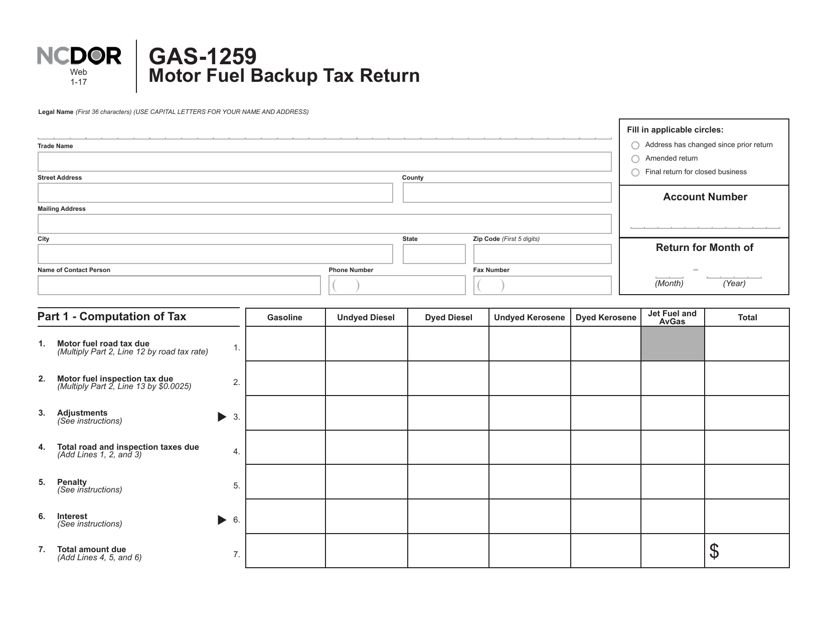

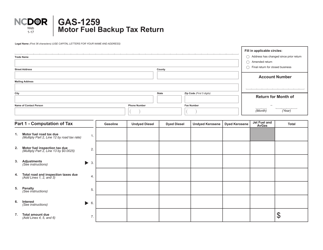

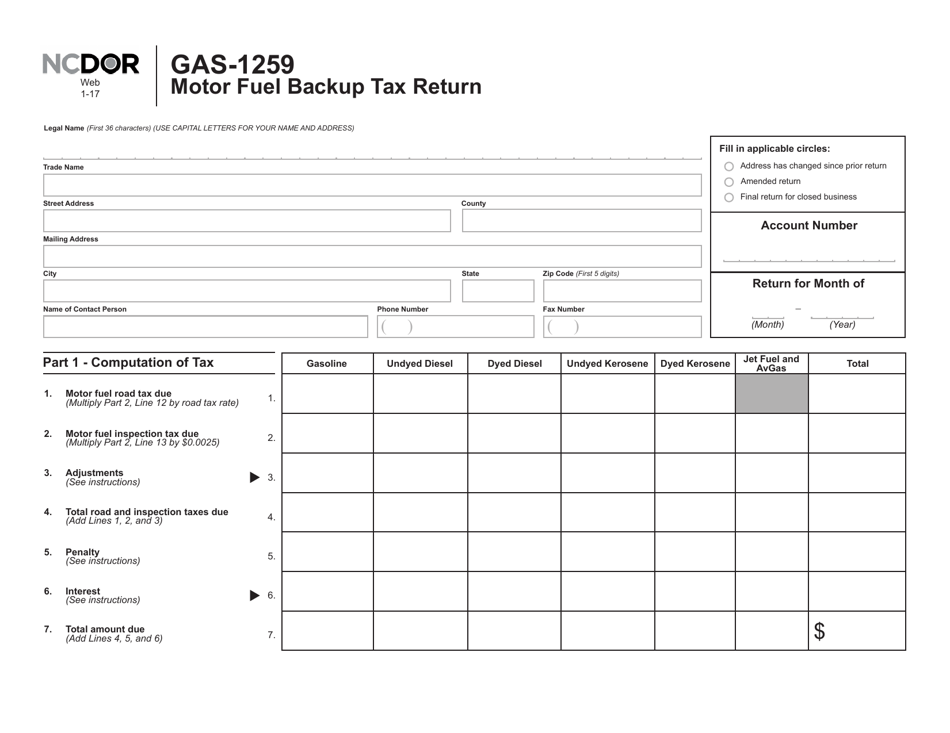

Form GAS-1259

for the current year.

Form GAS-1259 Motor Fuel Backup Tax Return - North Carolina

What Is Form GAS-1259?

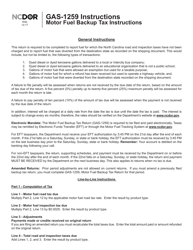

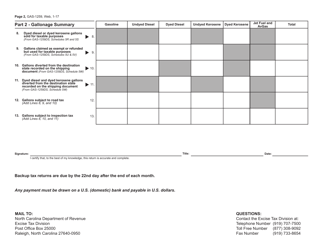

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form GAS-1259?

A: Form GAS-1259 is the Motor Fuel Backup Tax Return for North Carolina.

Q: Who needs to file Form GAS-1259?

A: Any distributor of motor fuel in North Carolina who wants to claim a refund for the backup tax paid on motor fuel can file Form GAS-1259.

Q: What is the purpose of Form GAS-1259?

A: The purpose of Form GAS-1259 is to claim a refund for the backup tax paid on motor fuel.

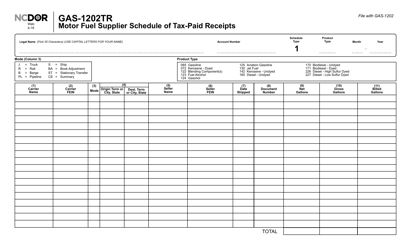

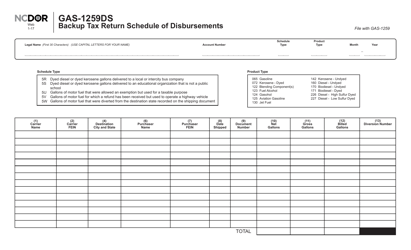

Q: What information is required on Form GAS-1259?

A: Form GAS-1259 requires information such as the distributor's name, address, and business information, as well as details of the backup tax paid on motor fuel.

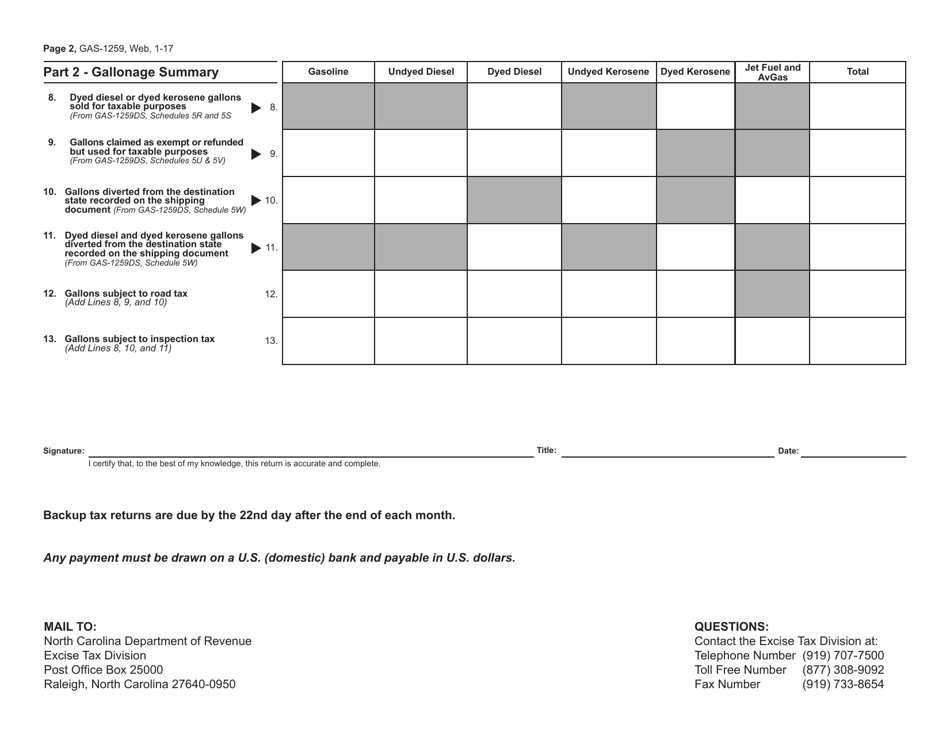

Q: When is Form GAS-1259 due?

A: Form GAS-1259 is due on a monthly basis, and the due date is the 25th day of the following month.

Q: Are there any penalties for late filing of Form GAS-1259?

A: Yes, there are penalties for late filing of Form GAS-1259, including interest charges on the unpaid tax amount.

Q: Can I file Form GAS-1259 for multiple periods together?

A: No, each period requires a separate filing of Form GAS-1259.

Q: Can I claim a refund for backup tax paid on motor fuel by using any other form?

A: No, Form GAS-1259 is specifically for claiming a refund for backup tax paid on motor fuel in North Carolina.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GAS-1259 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.