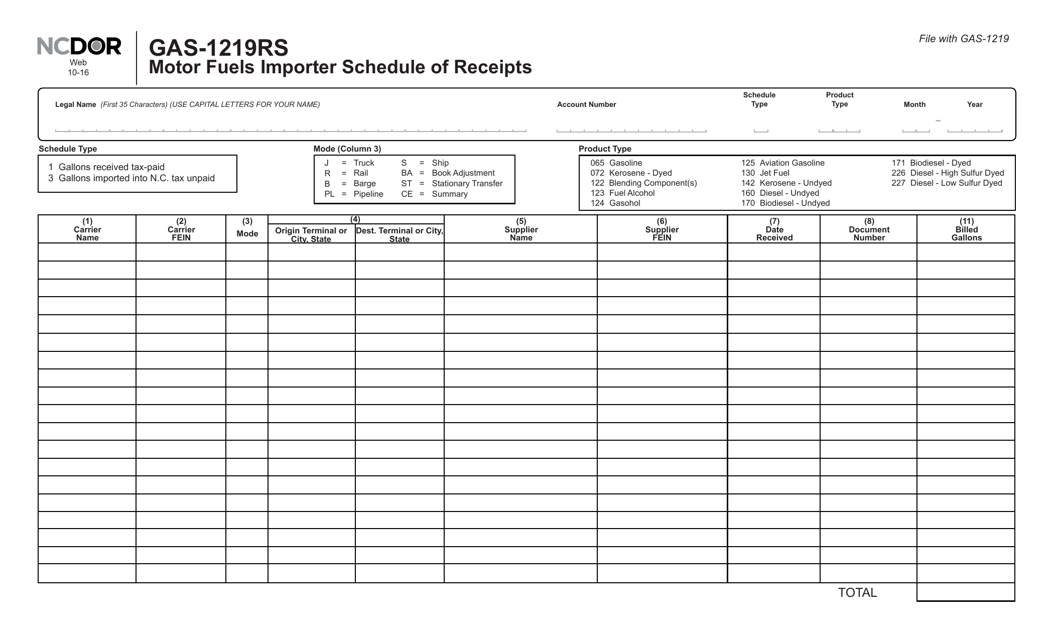

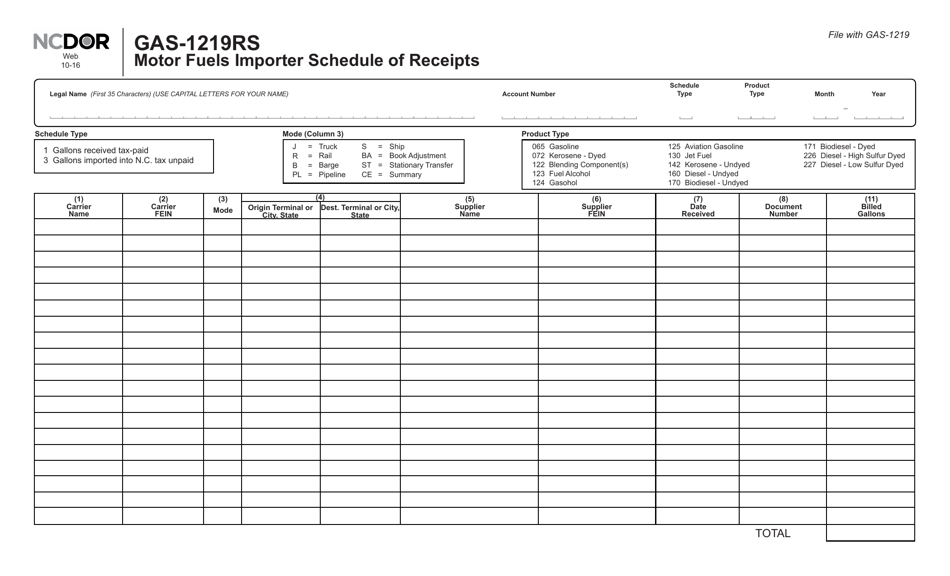

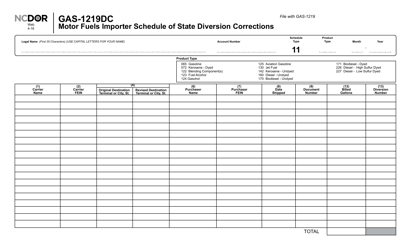

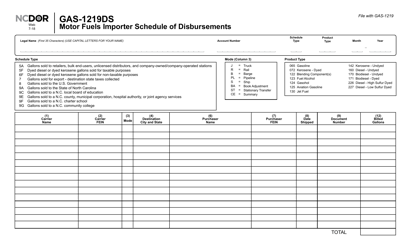

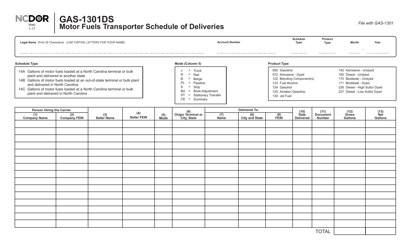

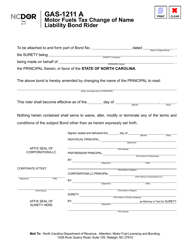

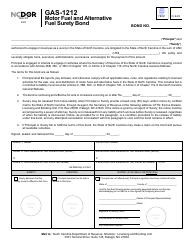

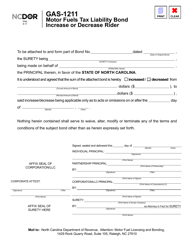

Form GAS-1219RS Motor Fuels Importer Schedule of Receipts - North Carolina

What Is Form GAS-1219RS?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GAS-1219RS?

A: GAS-1219RS is a motor fuelsimporter schedule of receipts form.

Q: What is the purpose of GAS-1219RS?

A: The purpose of GAS-1219RS is to report receipts of motor fuels by importers in North Carolina.

Q: Who needs to fill out GAS-1219RS?

A: Motor fuels importers in North Carolina need to fill out GAS-1219RS.

Q: What information is required on GAS-1219RS?

A: GAS-1219RS requires information about the type and quantity of motor fuels received by the importer.

Q: Is there a deadline for submitting GAS-1219RS?

A: Yes, GAS-1219RS must be submitted by the 20th day of the month following the month in which the receipts were made.

Q: Are there any penalties for late submission of GAS-1219RS?

A: Yes, there may be penalties for late submission of GAS-1219RS.

Q: Are there any fees associated with GAS-1219RS?

A: There are no fees associated with submitting GAS-1219RS.

Q: Is there a paper version of GAS-1219RS?

A: Yes, a paper version of GAS-1219RS is available for those who prefer to submit it by mail.

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GAS-1219RS by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.