This version of the form is not currently in use and is provided for reference only. Download this version of

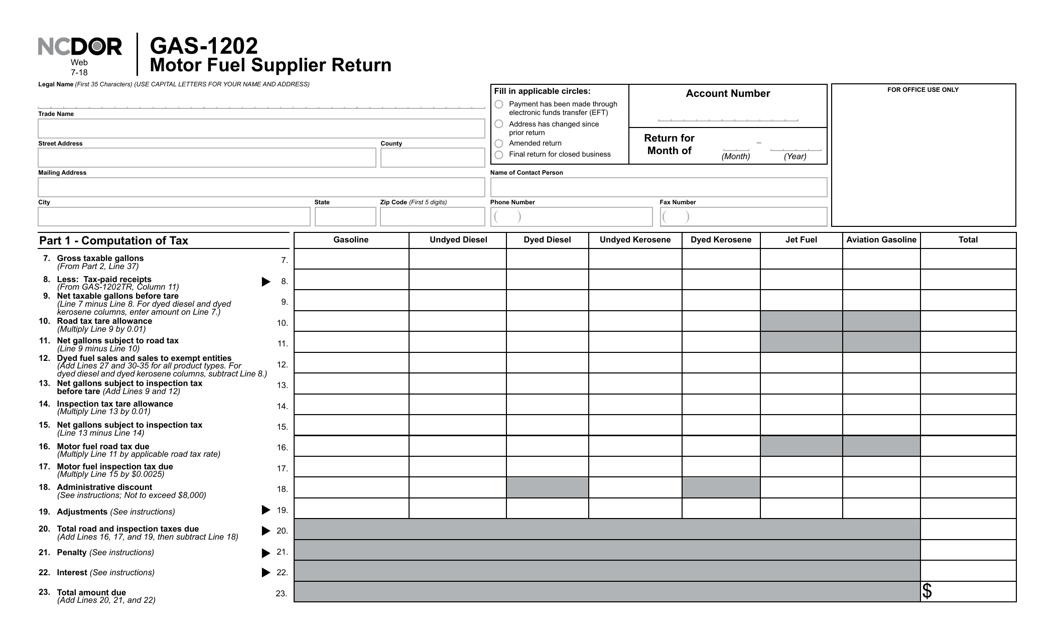

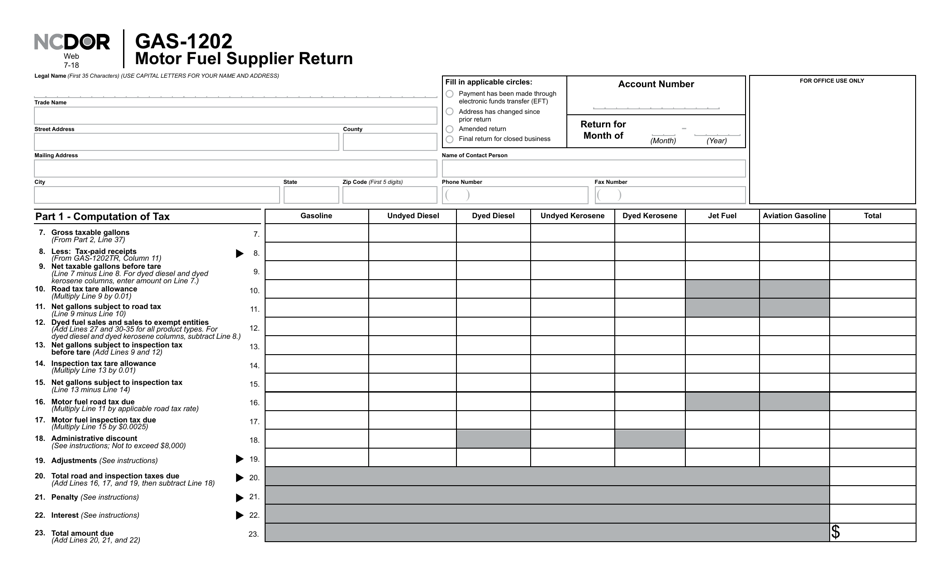

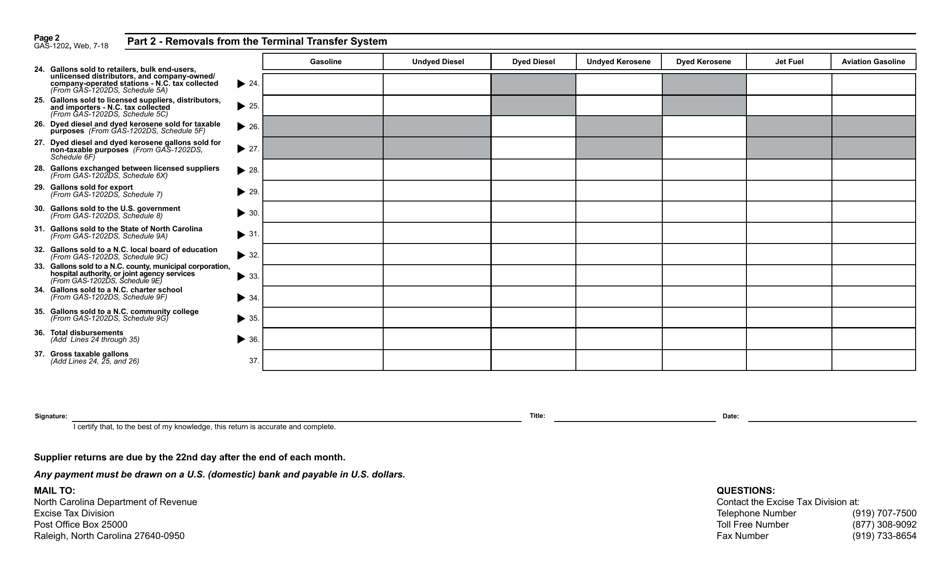

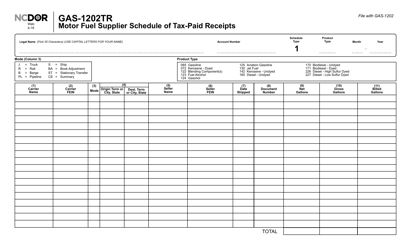

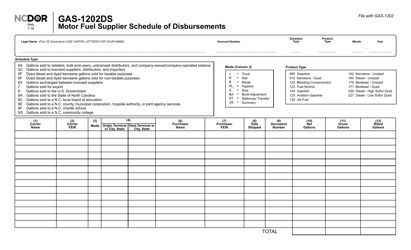

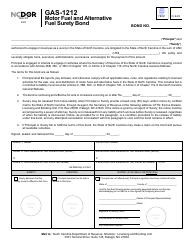

Form GAS-1202

for the current year.

Form GAS-1202 Motor Fuel Supplier Return - North Carolina

What Is Form GAS-1202?

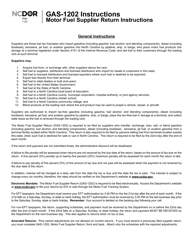

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is GAS-1202?

A: GAS-1202 is a Motor Fuel Supplier Return form in North Carolina.

Q: Who needs to file GAS-1202?

A: Motor fuel suppliers in North Carolina need to file GAS-1202.

Q: What is the purpose of GAS-1202?

A: GAS-1202 is used to report and remit taxes on motor fuel sales in North Carolina.

Q: Are there any filing exemptions?

A: Yes, certain suppliers may be exempt from filing GAS-1202. Contact the North Carolina Department of Revenue for more information.

Q: How often do I need to file GAS-1202?

A: GAS-1202 is filed on a monthly basis.

Q: What are the penalties for late or incorrect filing?

A: Penalties may apply for late or incorrect filing. Contact the North Carolina Department of Revenue for specific details.

Q: Is there any additional documentation required with GAS-1202?

A: Additional documentation may be required. Refer to the GAS-1202 instructions or contact the North Carolina Department of Revenue for more information.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GAS-1202 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.