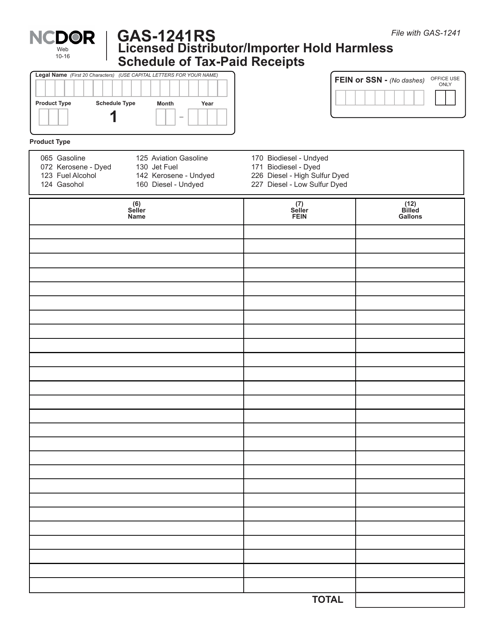

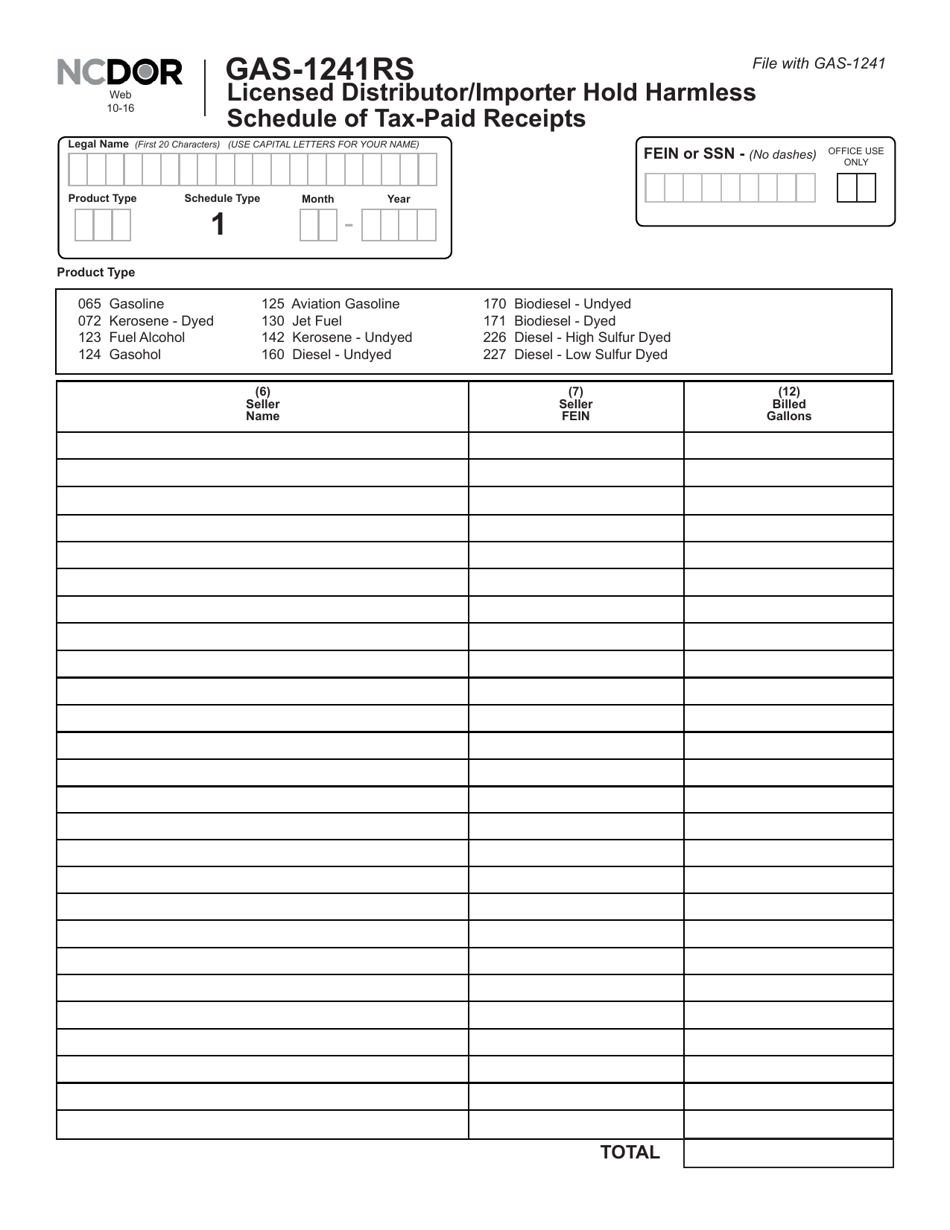

Form GAS-1241RS Licensed Distributor / Importer Hold Harmless Schedule of Tax-Paid Receipts - North Carolina

What Is Form GAS-1241RS?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GAS-1241RS?

A: Form GAS-1241RS is the Licensed Distributor/Importer Hold Harmless Schedule of Tax-Paid Receipts for North Carolina.

Q: Who is required to fill out Form GAS-1241RS?

A: Licensed distributors and importers in North Carolina are required to fill out Form GAS-1241RS.

Q: What is the purpose of Form GAS-1241RS?

A: The purpose of Form GAS-1241RS is to report tax-paid receipts for gasoline sales in North Carolina.

Q: What information is required on Form GAS-1241RS?

A: Form GAS-1241RS requires information such as the distributor/importer's name, address, product information, and tax-paid receipts.

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GAS-1241RS by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.