This version of the form is not currently in use and is provided for reference only. Download this version of

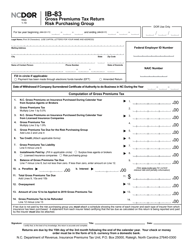

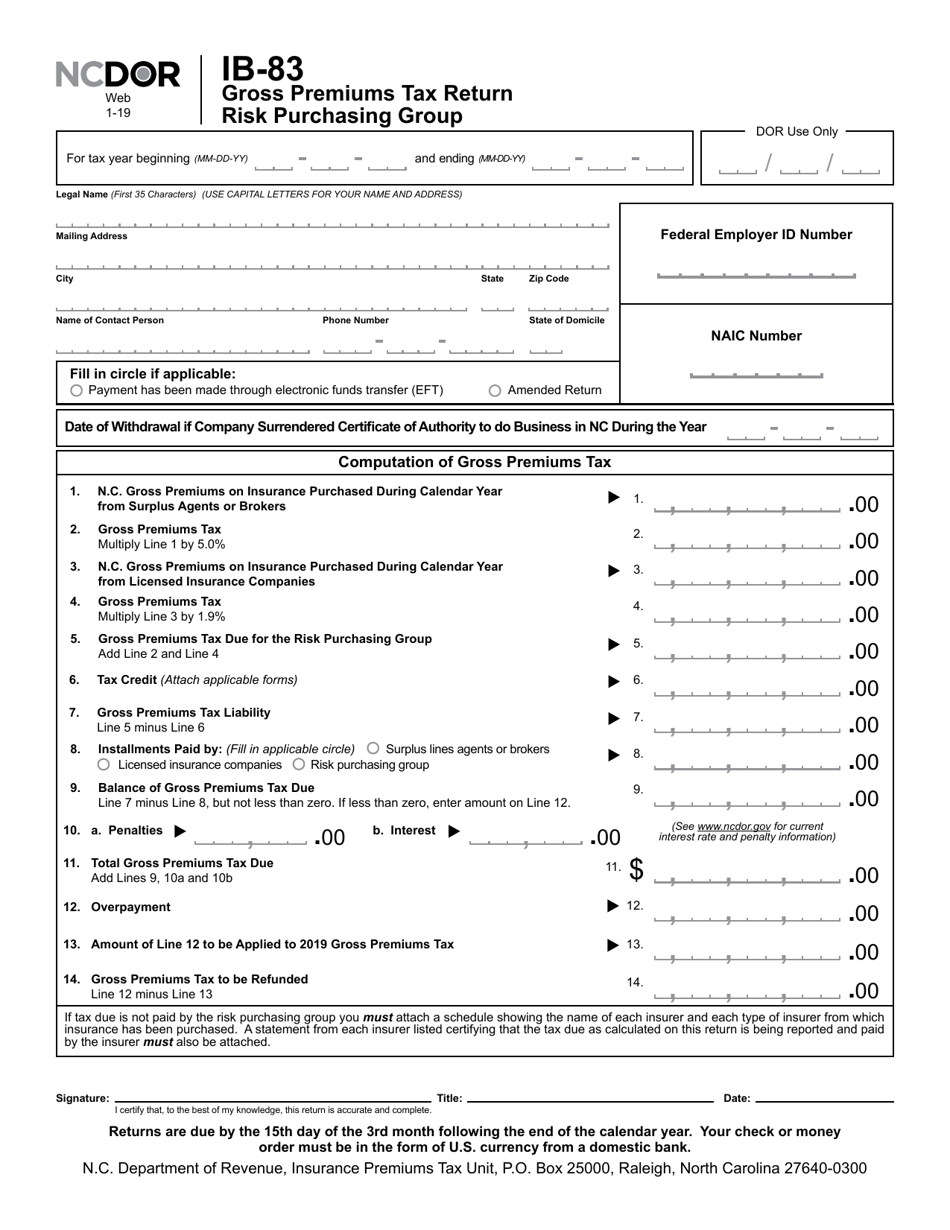

Form IB-83

for the current year.

Form IB-83 Gross Premiums Tax Return - Risk Purchasing Group - North Carolina

What Is Form IB-83?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IB-83?

A: Form IB-83 is the Gross Premiums Tax Return specifically designed for Risk Purchasing Groups (RPGs) in North Carolina.

Q: What is the purpose of Form IB-83?

A: The purpose of Form IB-83 is to report and remit the Gross PremiumsTax owed by Risk Purchasing Groups in North Carolina.

Q: Who is required to file Form IB-83?

A: Risk Purchasing Groups operating in North Carolina are required to file Form IB-83.

Q: What is a Risk Purchasing Group?

A: A Risk Purchasing Group is an entity that purchases liability insurance coverage on behalf of its members, who are typically individuals or businesses sharing similar risks.

Q: What information does Form IB-83 require?

A: Form IB-83 requires the RPG to provide details of the gross premiums received by the group for insurance policies covering risks located in North Carolina.

Q: When is Form IB-83 due?

A: Form IB-83 is due on or before the 1st of May following the tax year.

Q: Is there a penalty for late filing?

A: Yes, there is a penalty for late filing of Form IB-83. The penalty is 5% of the gross premiums tax due, with an additional 5% for each month the return remains unfiled, up to a maximum penalty of 25%.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

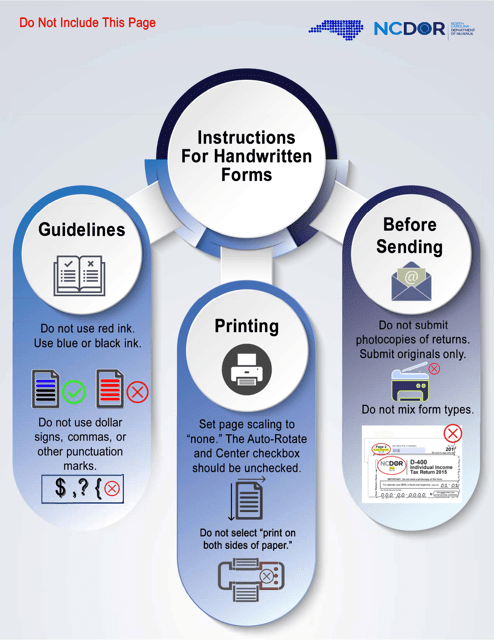

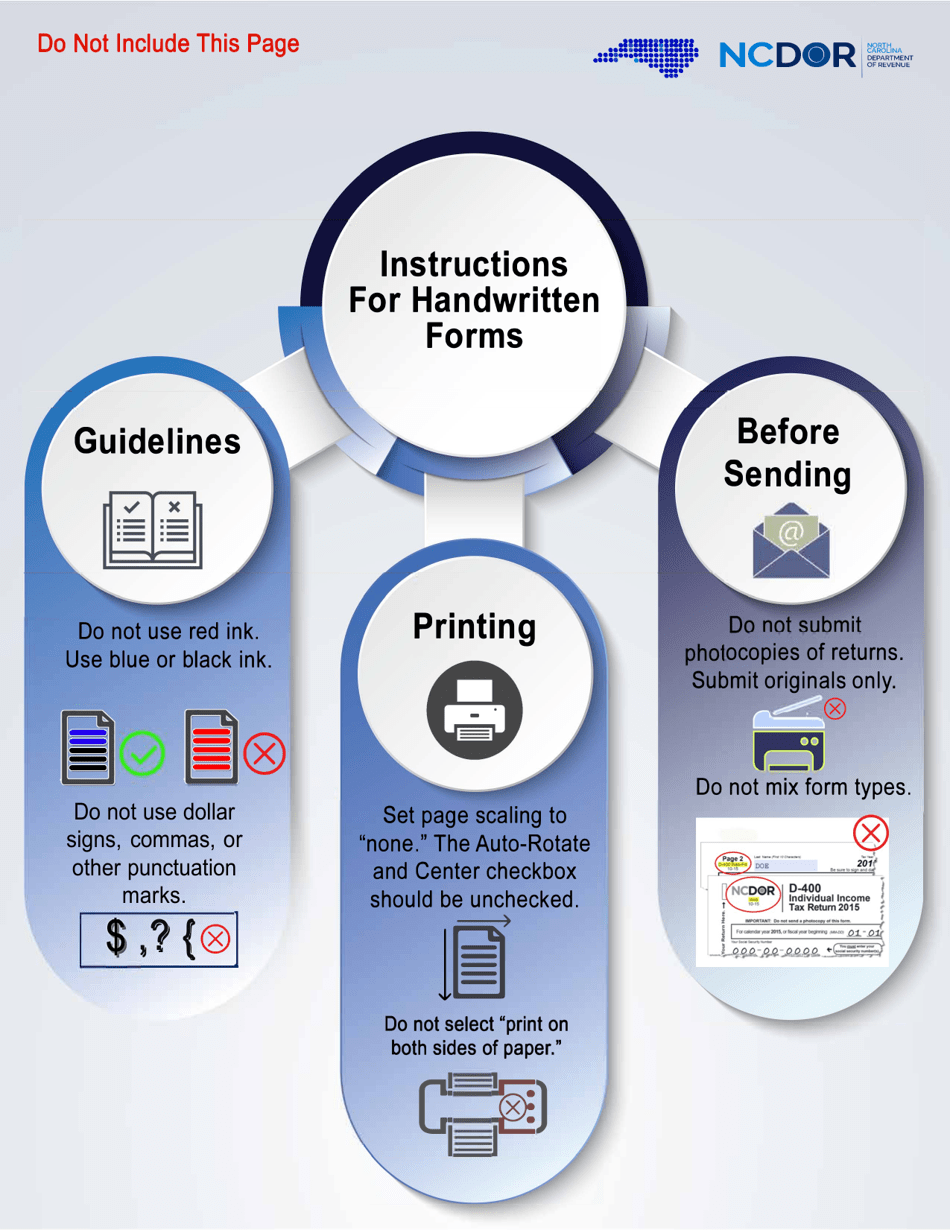

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IB-83 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.