This version of the form is not currently in use and is provided for reference only. Download this version of

Form IB-33

for the current year.

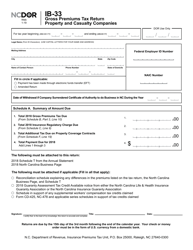

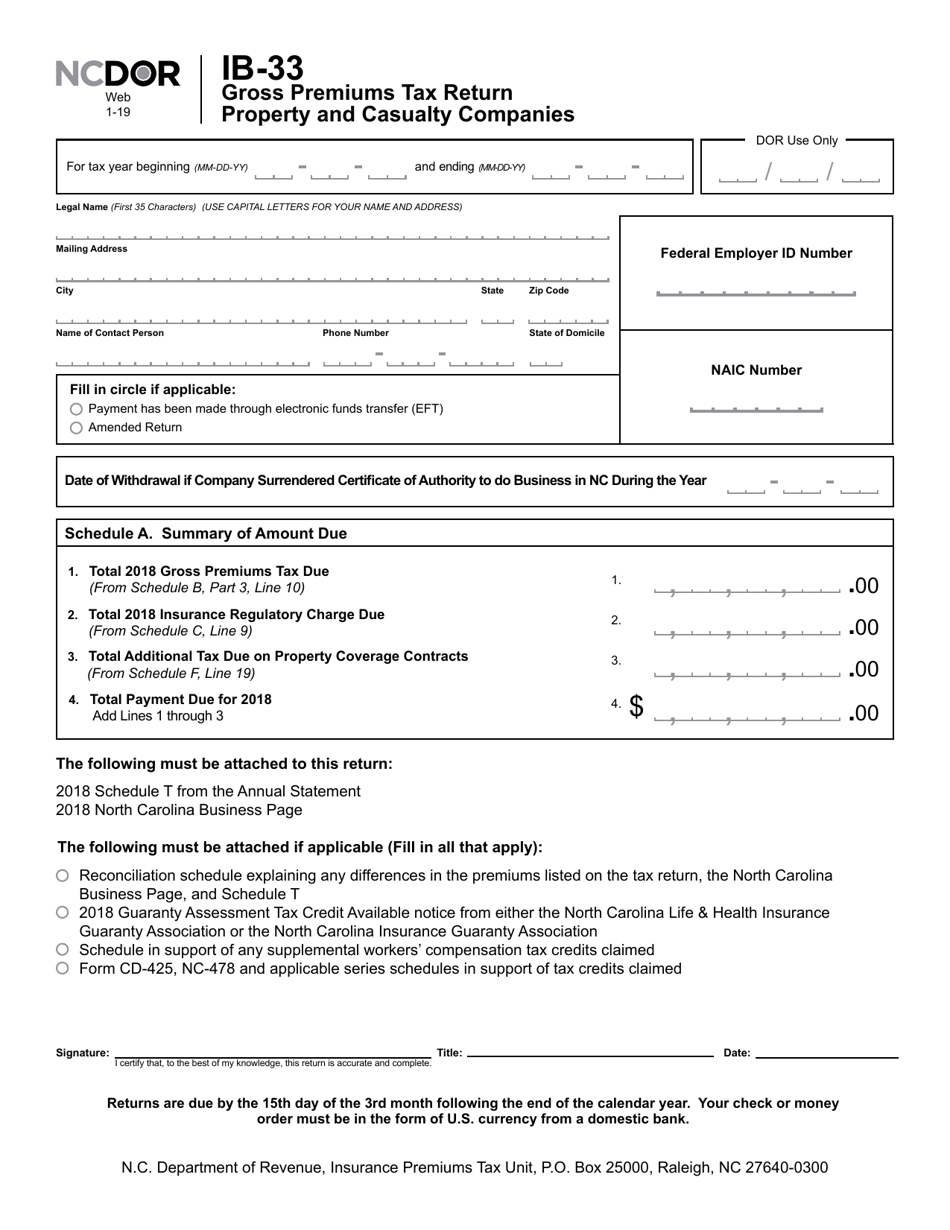

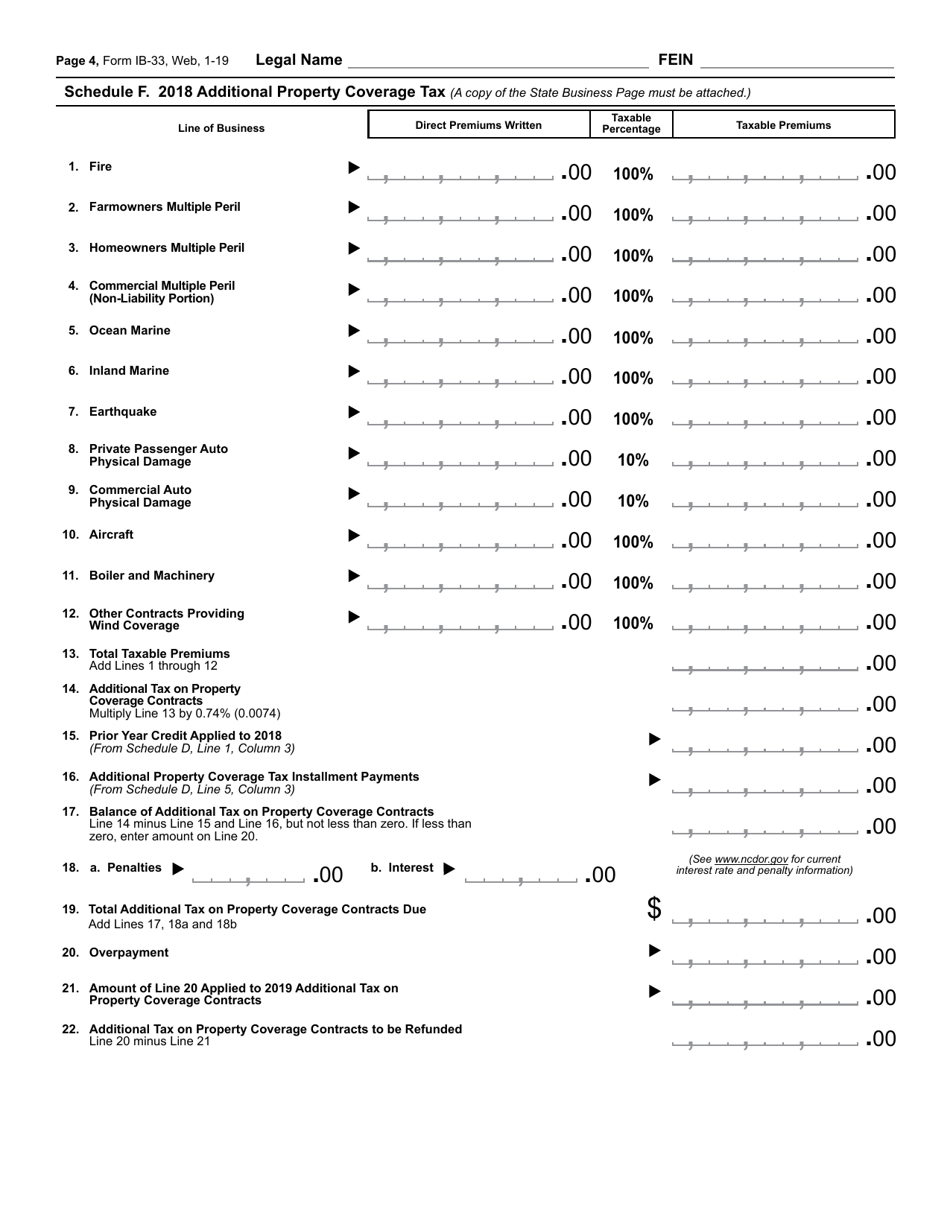

Form IB-33 Gross Premiums Tax Return - Property and Casualty Companies - North Carolina

What Is Form IB-33?

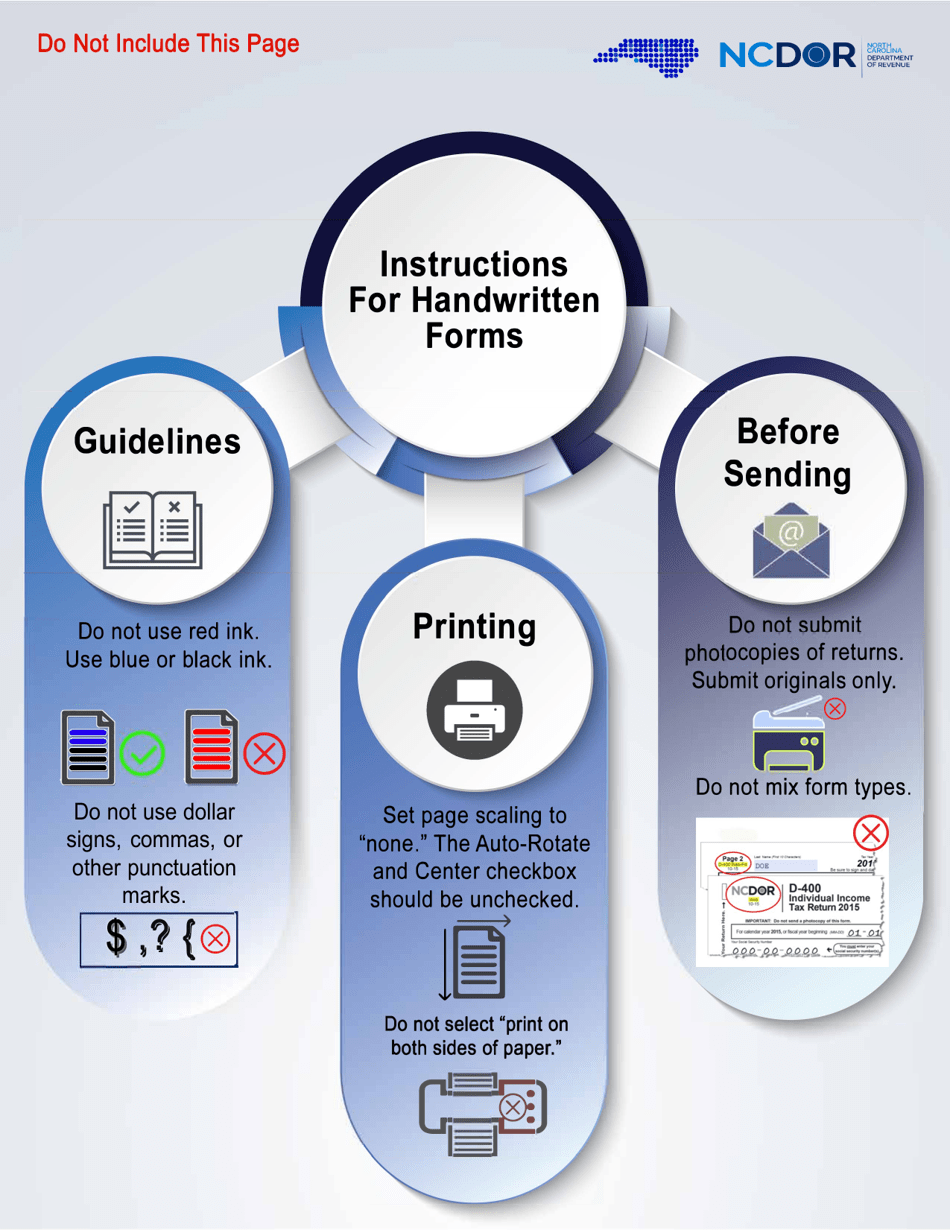

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IB-33?

A: Form IB-33 is the Gross Premiums Tax Return for Property and Casualty Companies in North Carolina.

Q: Who needs to file Form IB-33?

A: Property and Casualty Companies in North Carolina need to file Form IB-33.

Q: What is the purpose of Form IB-33?

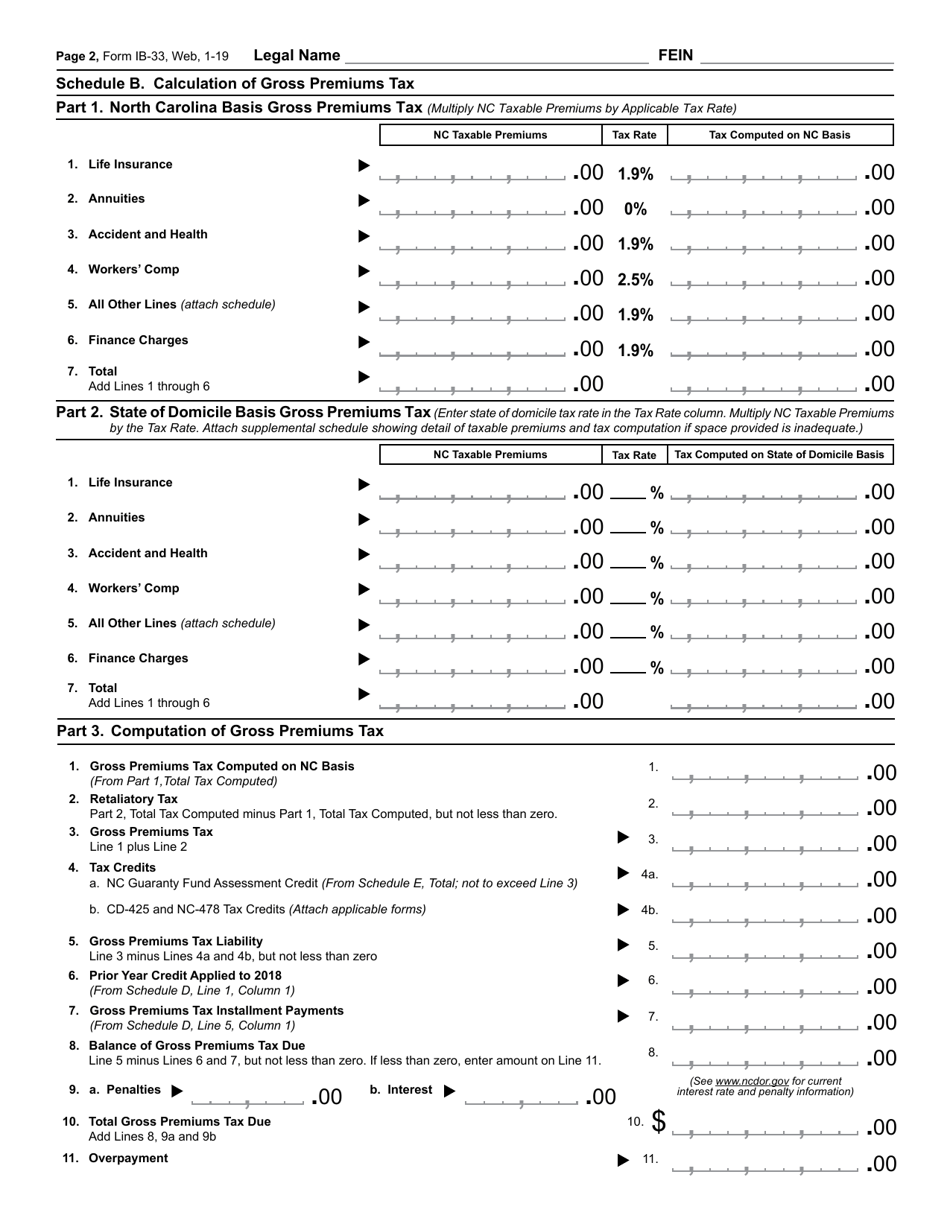

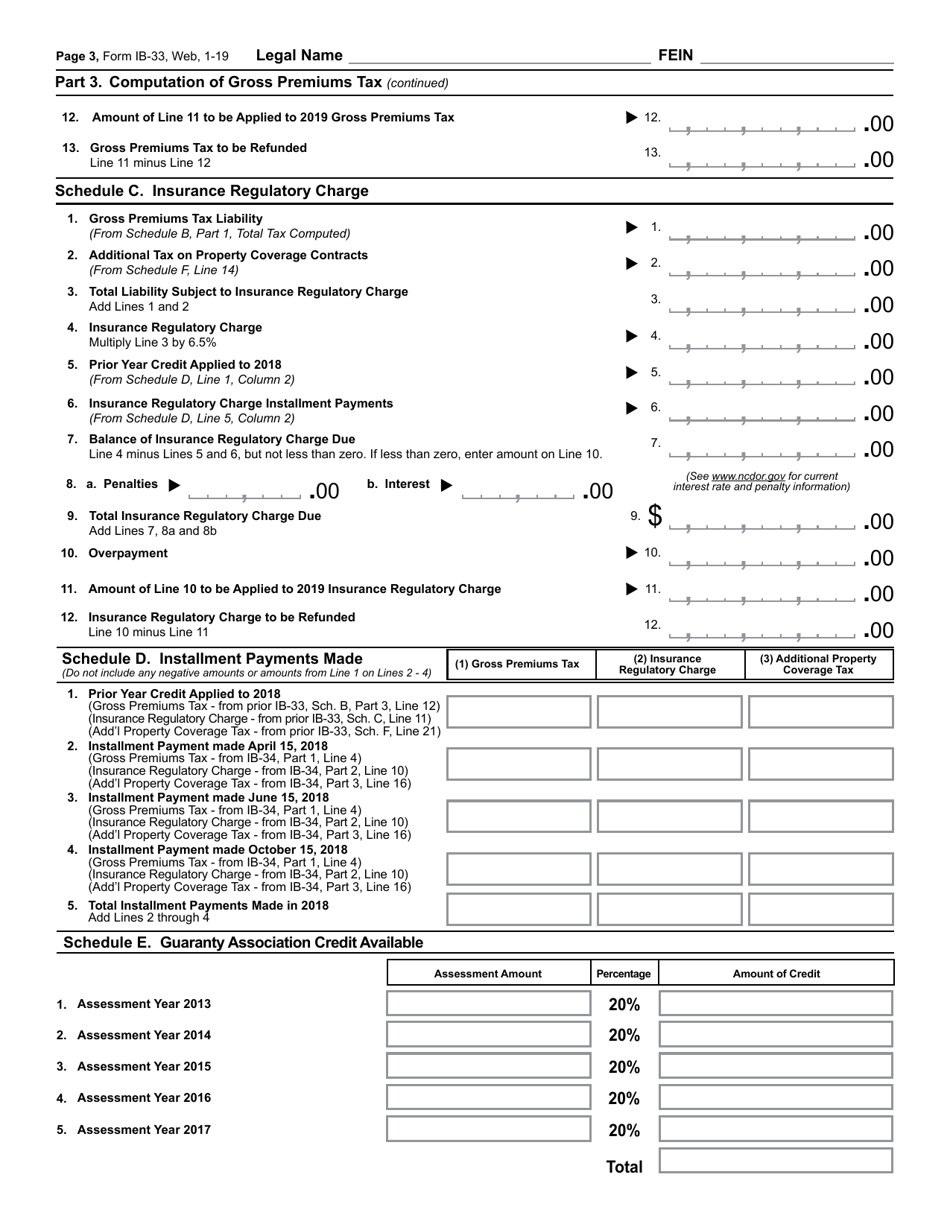

A: Form IB-33 is used to calculate and report the Gross PremiumsTax owed by Property and Casualty Companies in North Carolina.

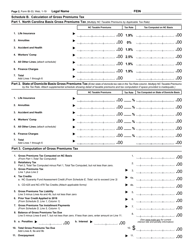

Q: What is the Gross Premiums Tax?

A: The Gross Premiums Tax is a tax on the premiums collected by Property and Casualty Companies in North Carolina.

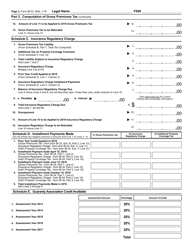

Q: When is Form IB-33 due?

A: Form IB-33 is due on or before March 1st of each year.

Q: Are there any penalties for late filing of Form IB-33?

A: Yes, there are penalties for late filing of Form IB-33, including interest charges on any unpaid tax.

Q: Are there any exemptions or deductions available on Form IB-33?

A: Yes, there are exemptions and deductions available on Form IB-33. It is recommended to consult the instructions or a tax professional for details.

Q: Is Form IB-33 only for North Carolina companies?

A: Yes, Form IB-33 is specifically for Property and Casualty Companies operating in North Carolina.

Q: Can Form IB-33 be filed electronically?

A: Yes, North Carolina allows electronic filing of Form IB-33.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

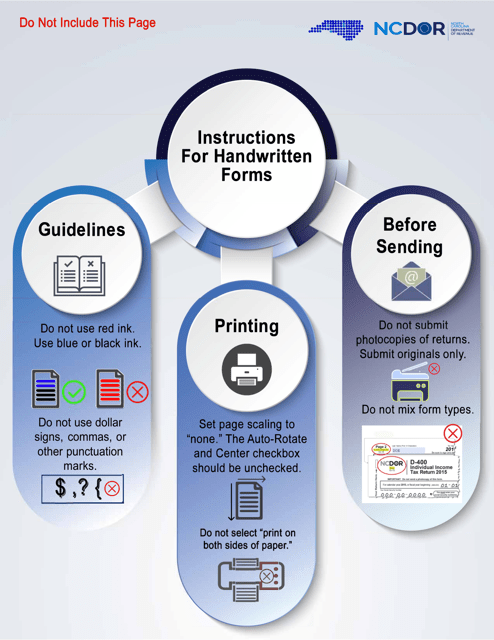

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IB-33 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.