This version of the form is not currently in use and is provided for reference only. Download this version of

Form IB-13

for the current year.

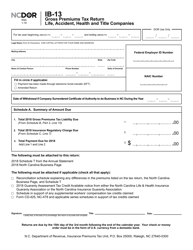

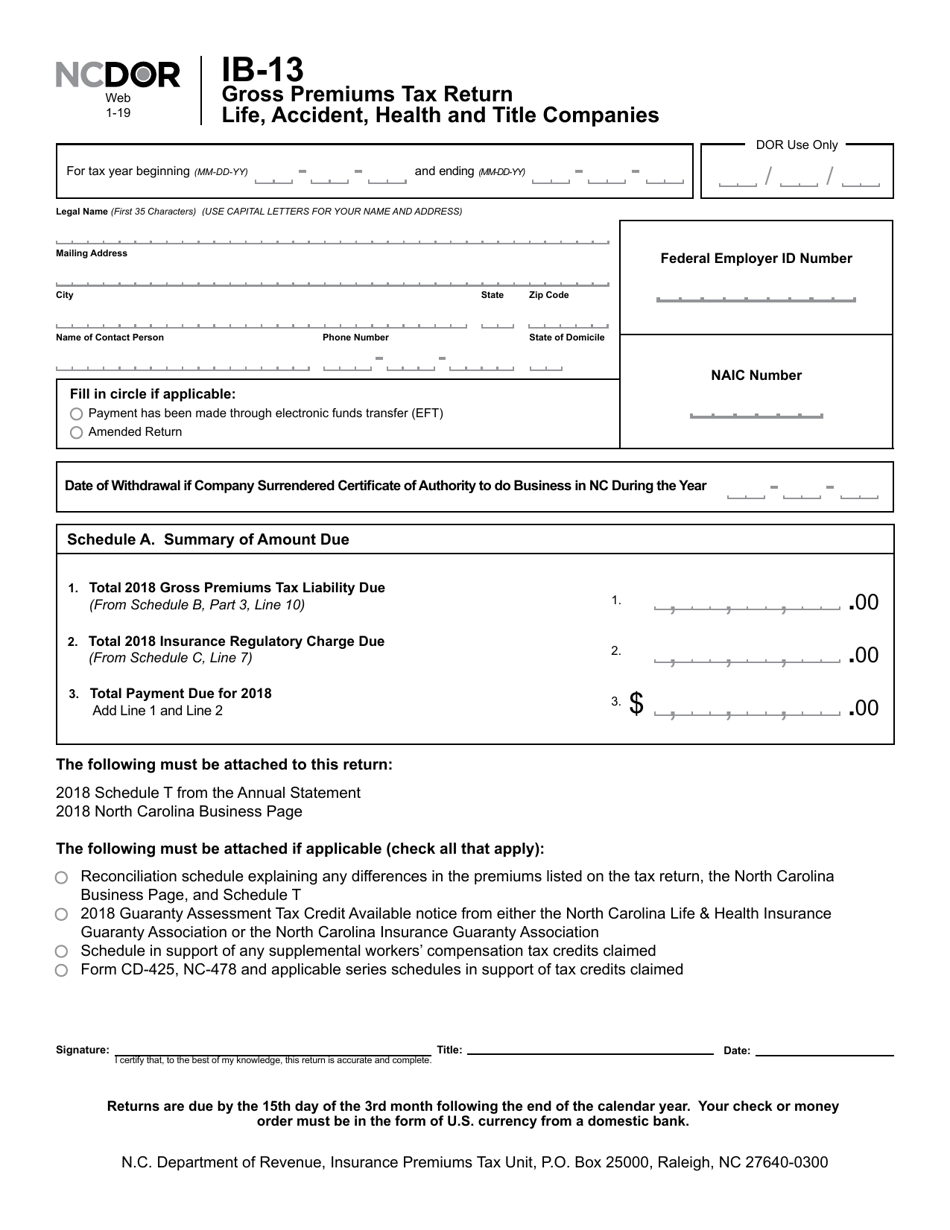

Form IB-13 Gross Premiums Tax Return - Life, Accident, Health and Title Companies - North Carolina

What Is Form IB-13?

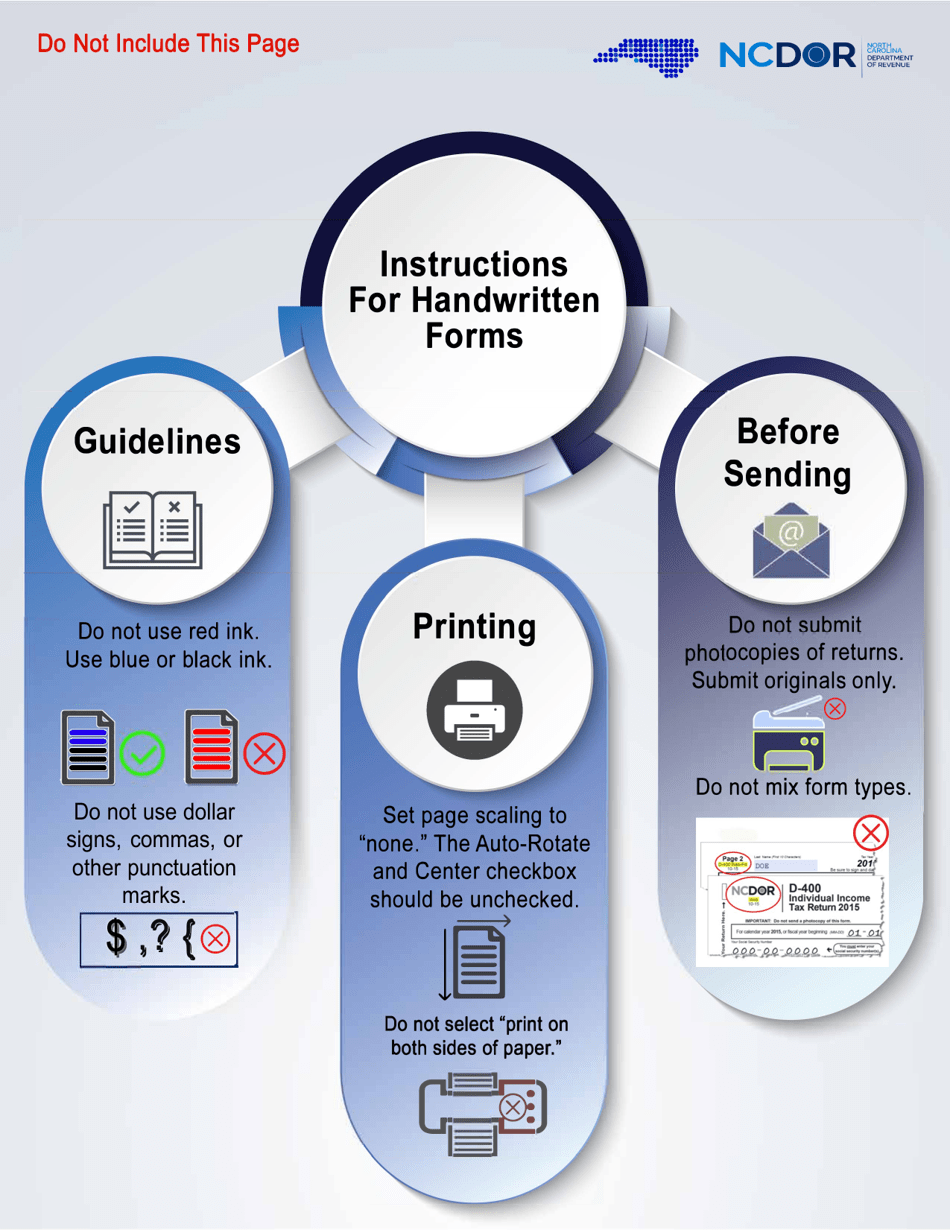

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IB-13?

A: Form IB-13 is the Gross Premiums Tax Return specifically for Life, Accident, Health, and Title Companies in North Carolina.

Q: Who needs to file Form IB-13?

A: Life, Accident, Health, and Title Companies operating in North Carolina are required to file Form IB-13.

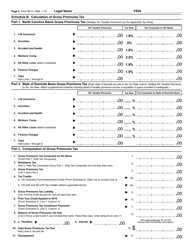

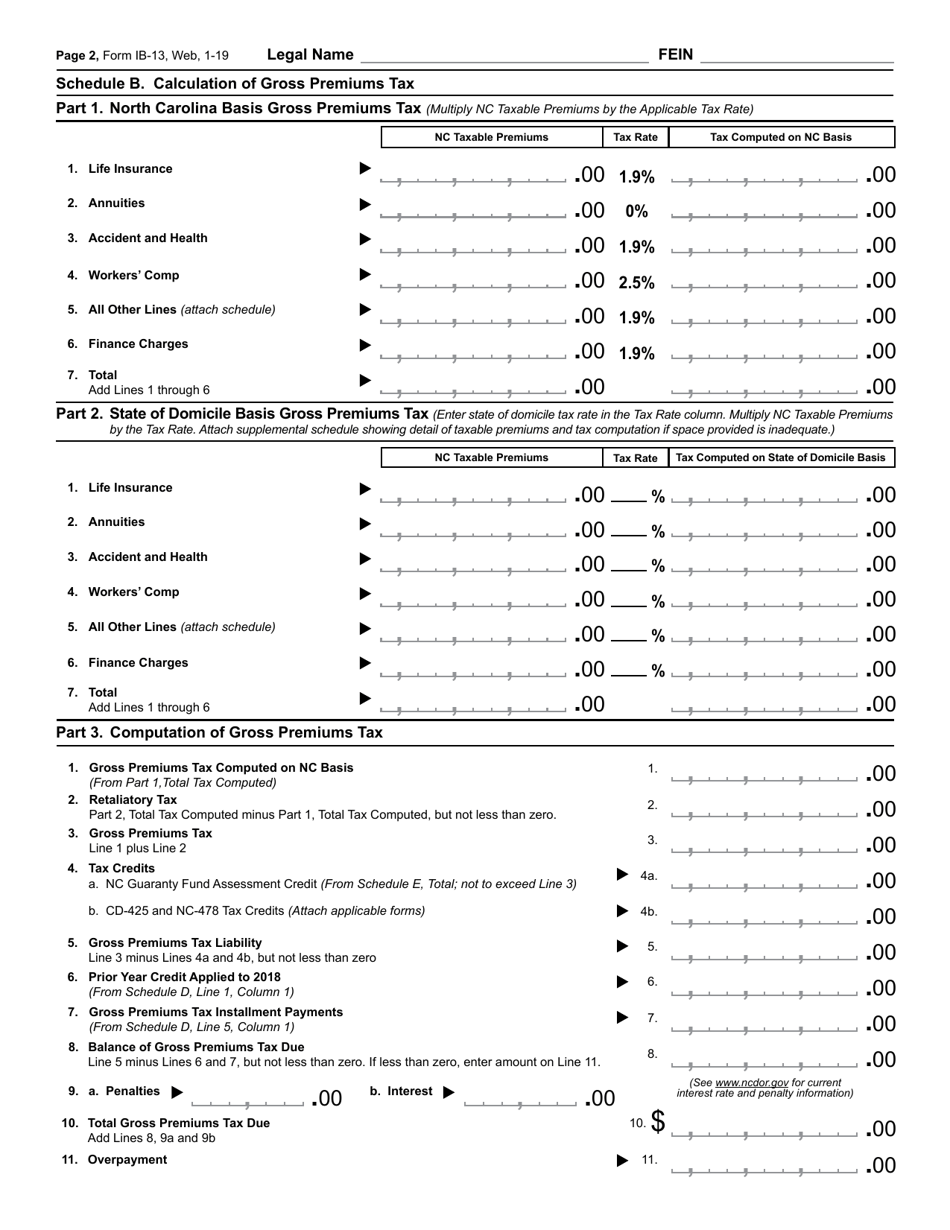

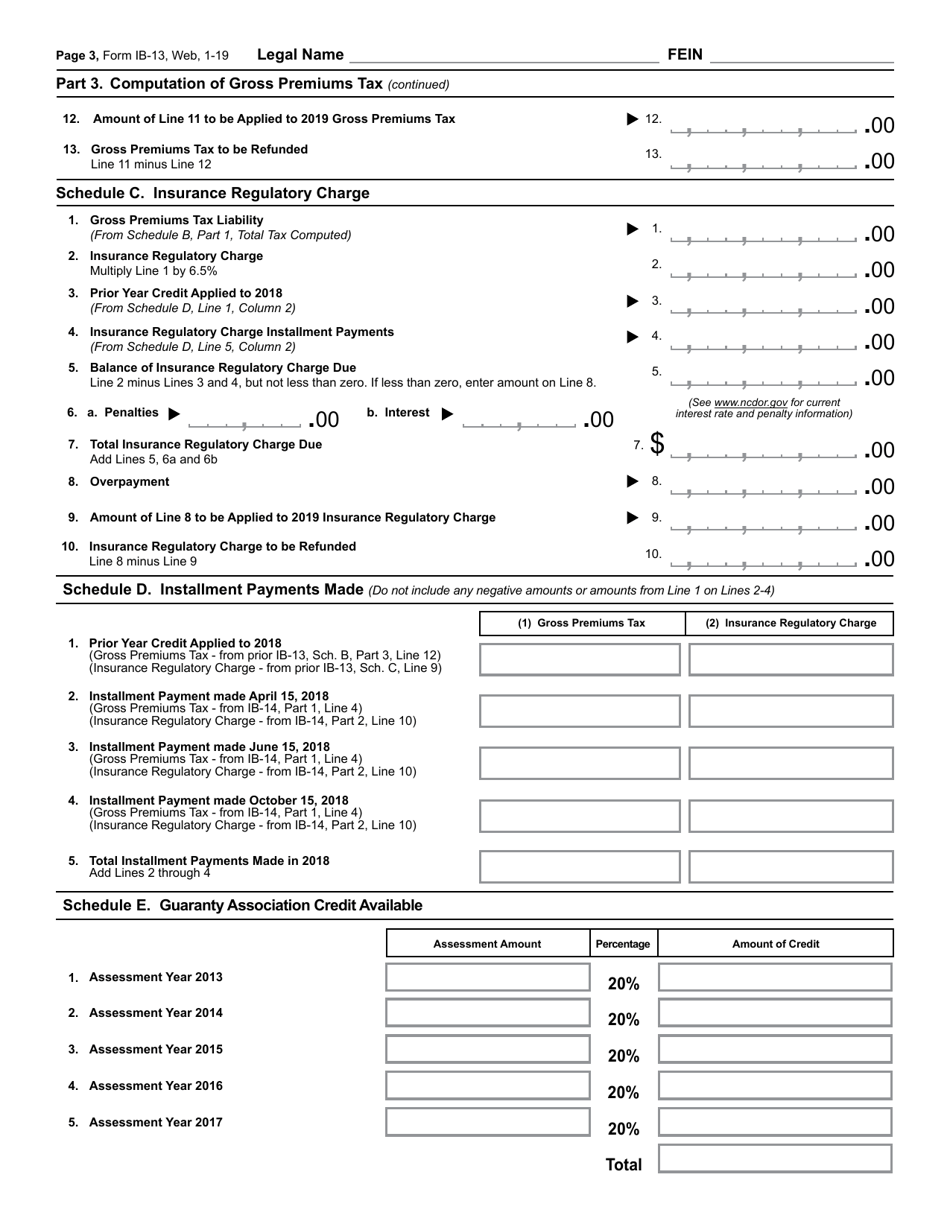

Q: What does the Gross Premiums Tax Return cover?

A: The Gross Premiums Tax Return covers the reporting and payment of taxes on the gross premiums received by Life, Accident, Health, and Title Companies.

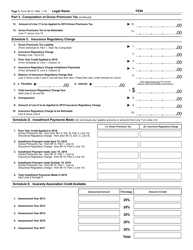

Q: When is Form IB-13 due?

A: Form IB-13 is due on or before March 1st of each year.

Q: Are there any penalties for late filing of Form IB-13?

A: Yes, there are penalties for late filing of Form IB-13. The penalty is 5% of the amount due per month, up to a maximum of 25%.

Q: Is Form IB-13 specific to North Carolina?

A: Yes, Form IB-13 is specific to Life, Accident, Health, and Title Companies operating in North Carolina.

Q: What is the purpose of the Gross Premiums Tax?

A: The purpose of the Gross Premiums Tax is to generate revenue for the state by taxing the gross premiums received by Life, Accident, Health, and Title Companies in North Carolina.

Q: Are there any exemptions or deductions available for companies filing Form IB-13?

A: Yes, there are exemptions and deductions available for companies filing Form IB-13. However, specific eligibility requirements apply, and it is recommended to consult the instructions or a tax professional for more information.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

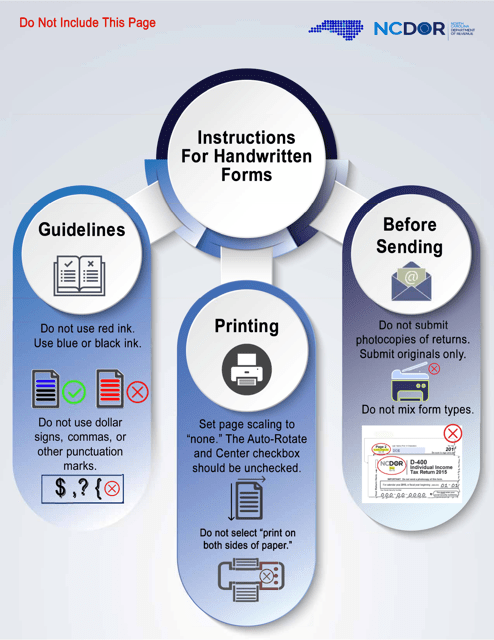

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IB-13 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.