This version of the form is not currently in use and is provided for reference only. Download this version of

Form D-400 Schedule PN

for the current year.

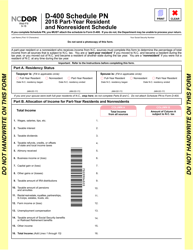

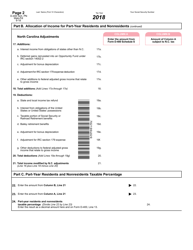

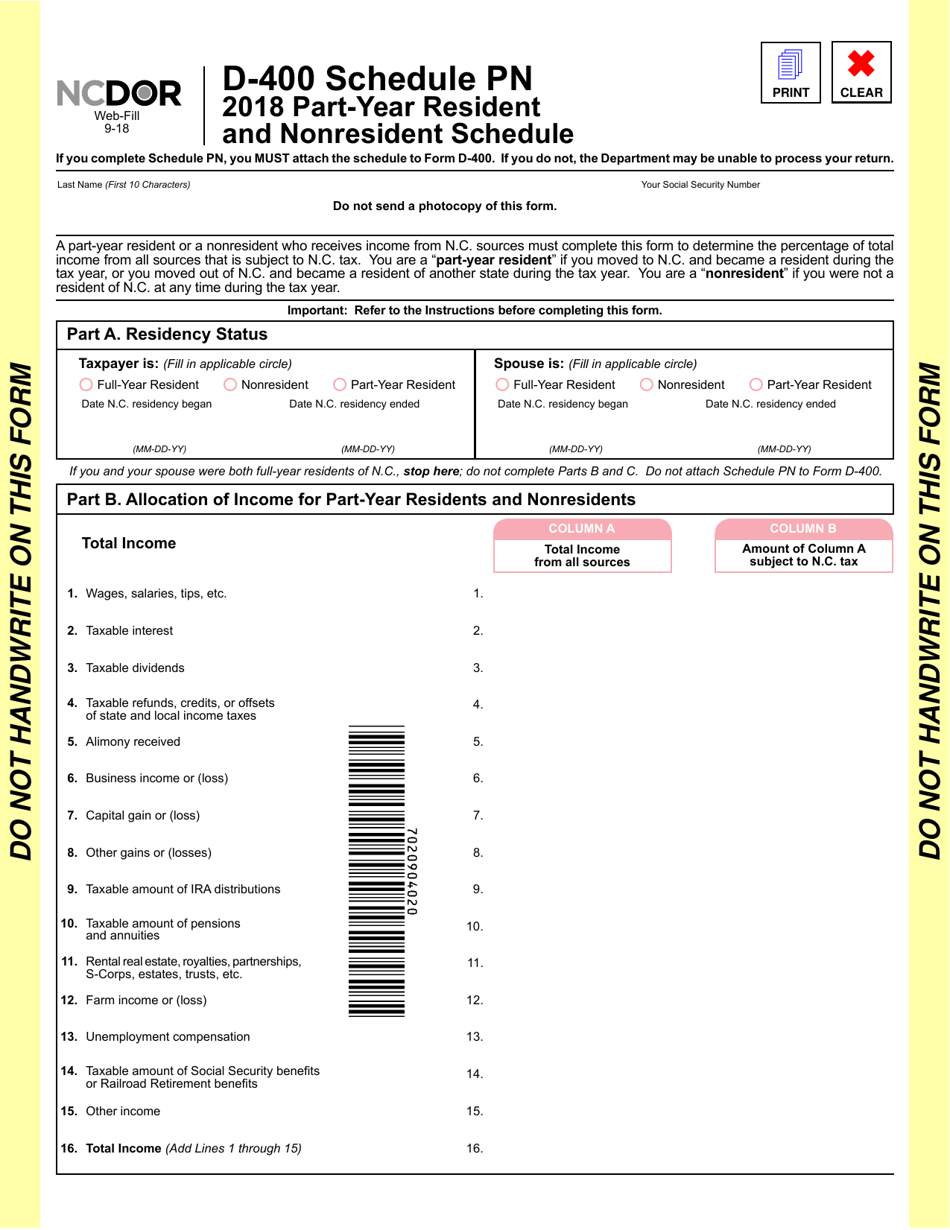

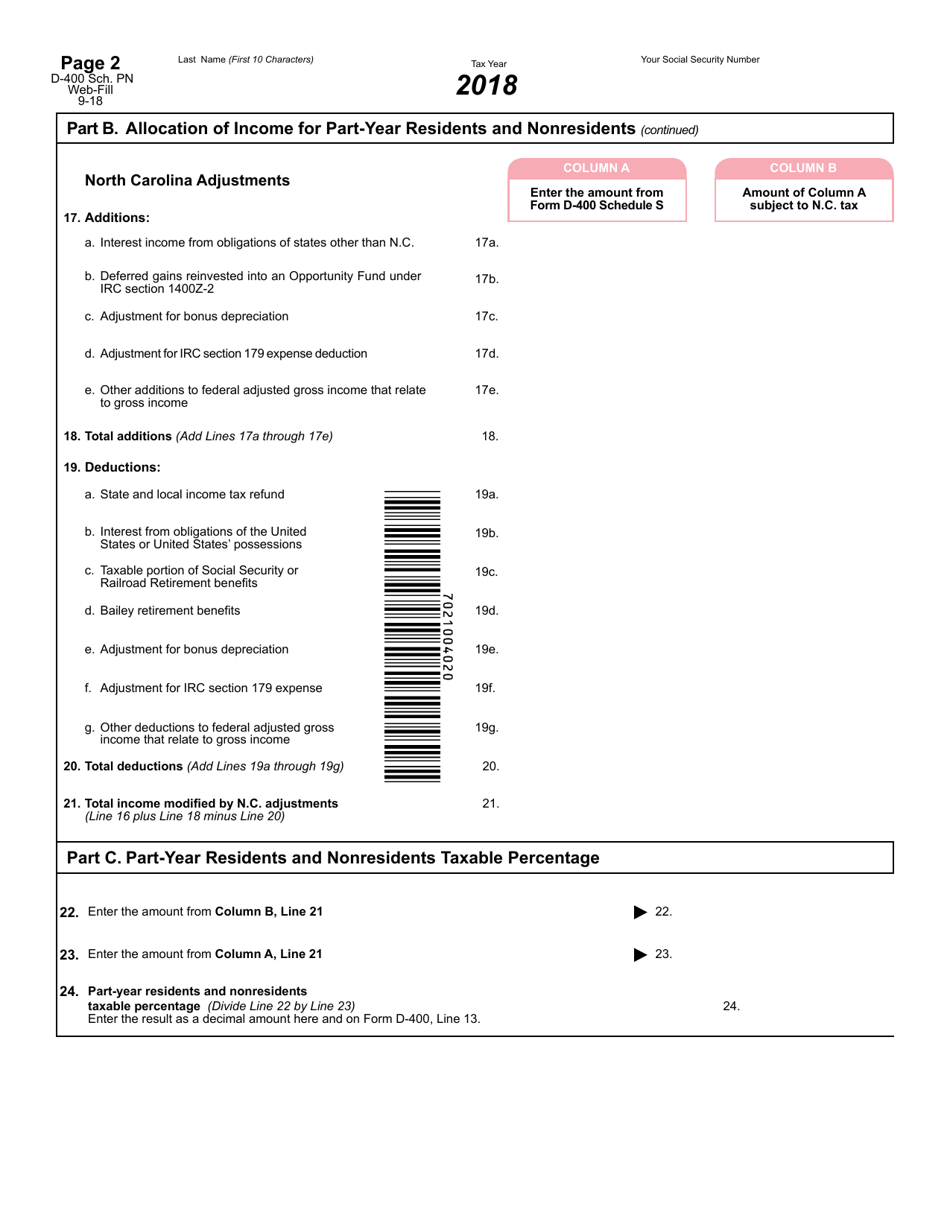

Form D-400 Schedule PN Part-Year Resident and Nonresident Schedule - North Carolina

What Is Form D-400 Schedule PN?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina.The document is a supplement to Form D-400, Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D-400 Schedule PN?

A: Form D-400 Schedule PN is a tax form used by residents of North Carolina who were part-year residents or nonresidents.

Q: Who should use Form D-400 Schedule PN?

A: Form D-400 Schedule PN should be used by individuals who were part-year residents or nonresidents of North Carolina.

Q: What is the purpose of Form D-400 Schedule PN?

A: The purpose of Form D-400 Schedule PN is to report income and deductions for individuals who were part-year residents or nonresidents of North Carolina.

Q: What information is required on Form D-400 Schedule PN?

A: Form D-400 Schedule PN requires information about income earned in North Carolina and deductions for part-year residents and nonresidents.

Q: When is Form D-400 Schedule PN due?

A: Form D-400 Schedule PN is due on the same date as the North Carolina individual income tax return, usually April 15th.

Q: Are there any penalties for late filing of Form D-400 Schedule PN?

A: Yes, there may be penalties for late filing of Form D-400 Schedule PN. It is important to file the form on time to avoid penalties.

Q: Can I file Form D-400 Schedule PN electronically?

A: Yes, Form D-400 Schedule PN can be filed electronically using the North Carolina Department of Revenue's eFile system.

Q: Do I need to file Form D-400 Schedule PN if I had no income in North Carolina?

A: If you had no income in North Carolina as a part-year resident or nonresident, you may not need to file Form D-400 Schedule PN. However, it is recommended to consult a tax professional or the North Carolina Department of Revenue for guidance.

Q: Is Form D-400 Schedule PN the only tax form I need to file for North Carolina?

A: No, Form D-400 Schedule PN is a supplemental form that is filed along with the North Carolina individual income tax return, Form D-400.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

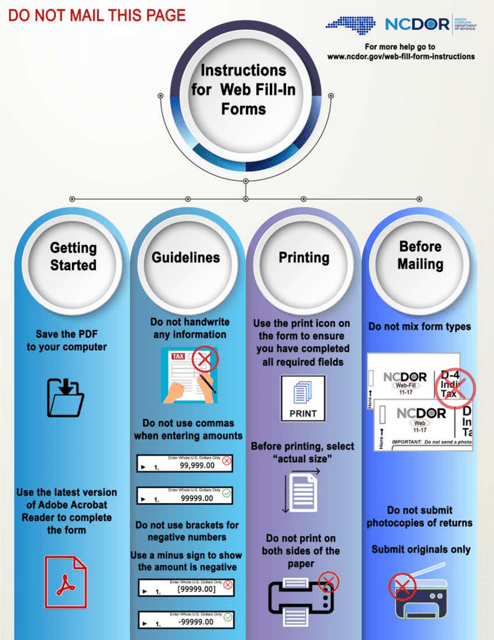

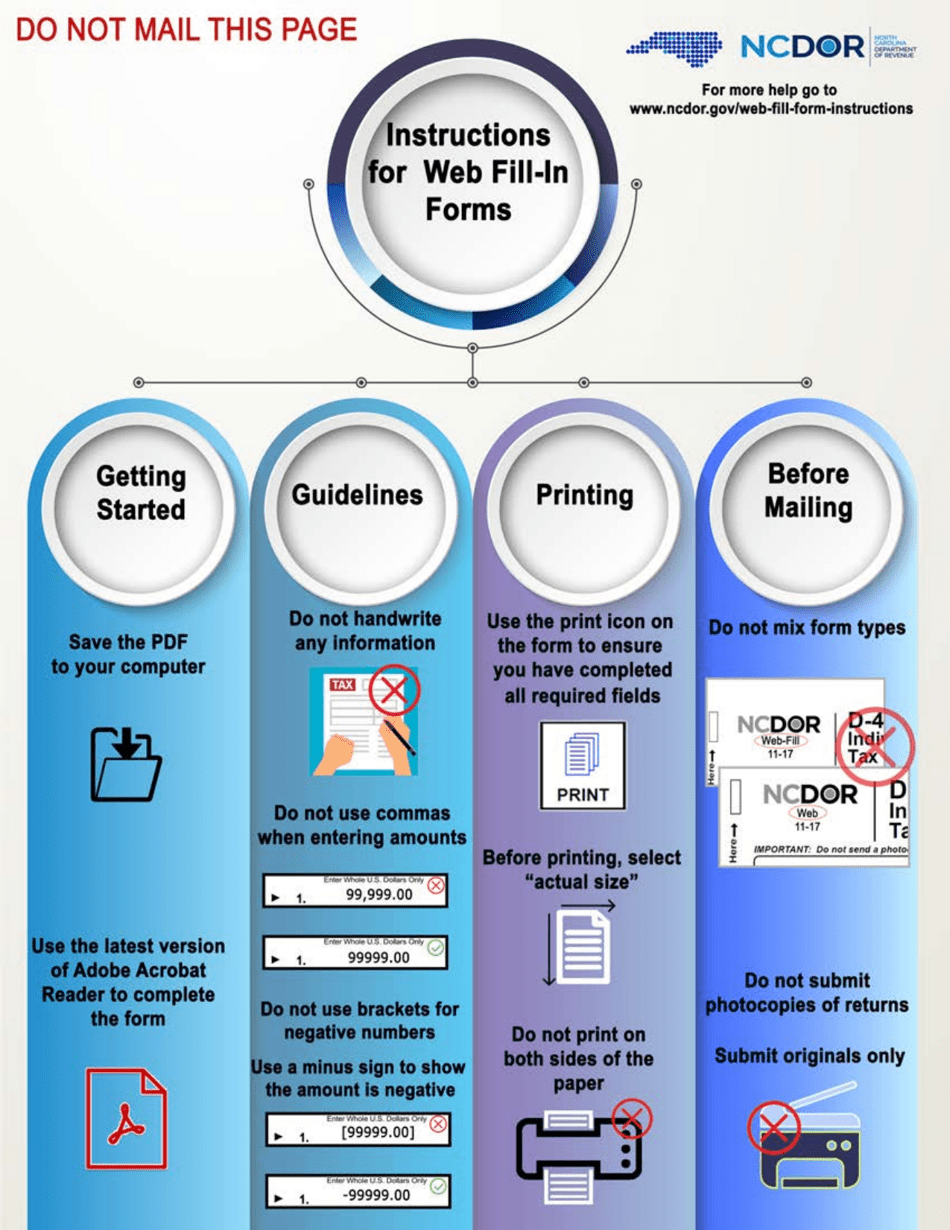

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-400 Schedule PN by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.