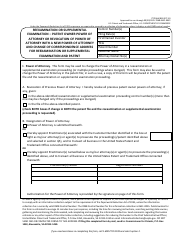

This version of the form is not currently in use and is provided for reference only. Download this version of

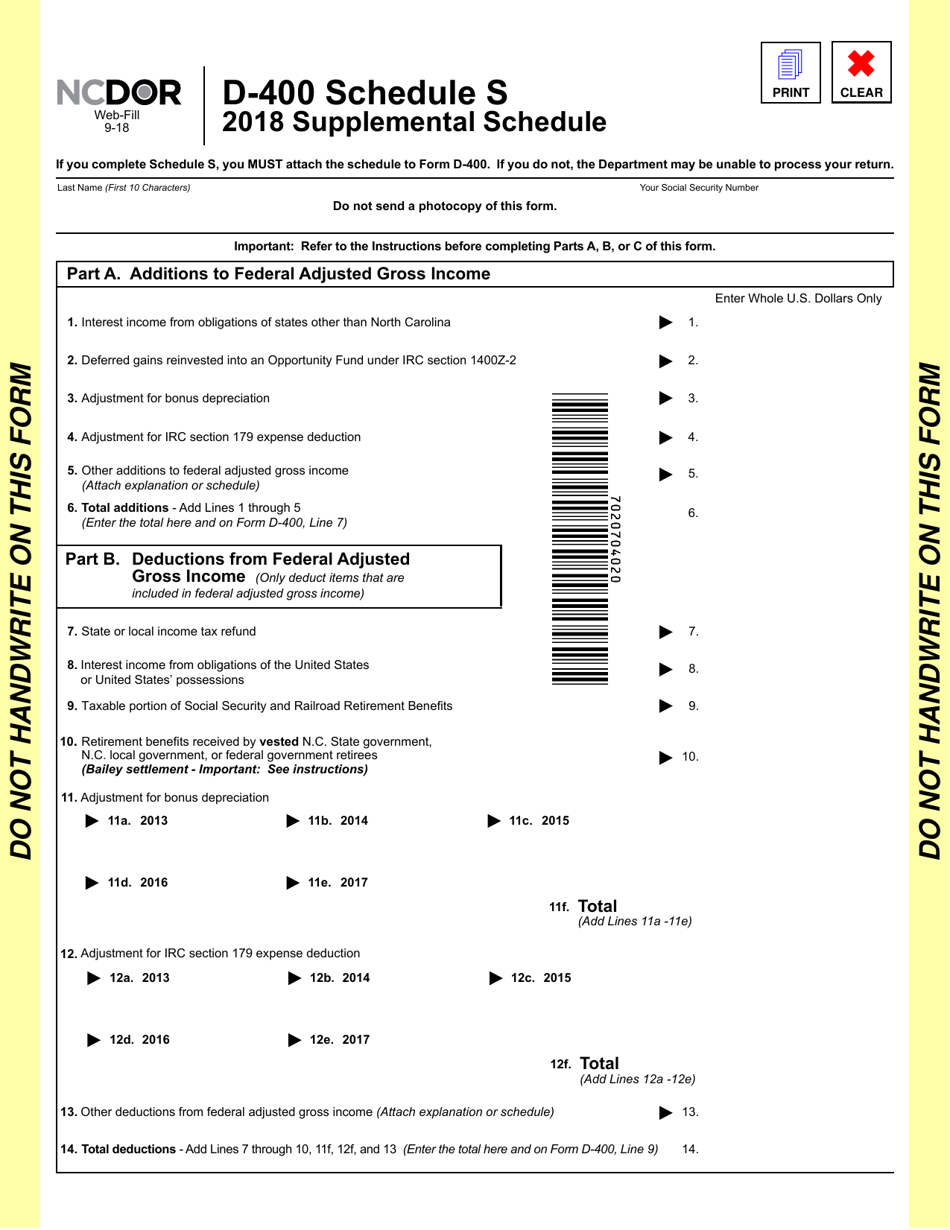

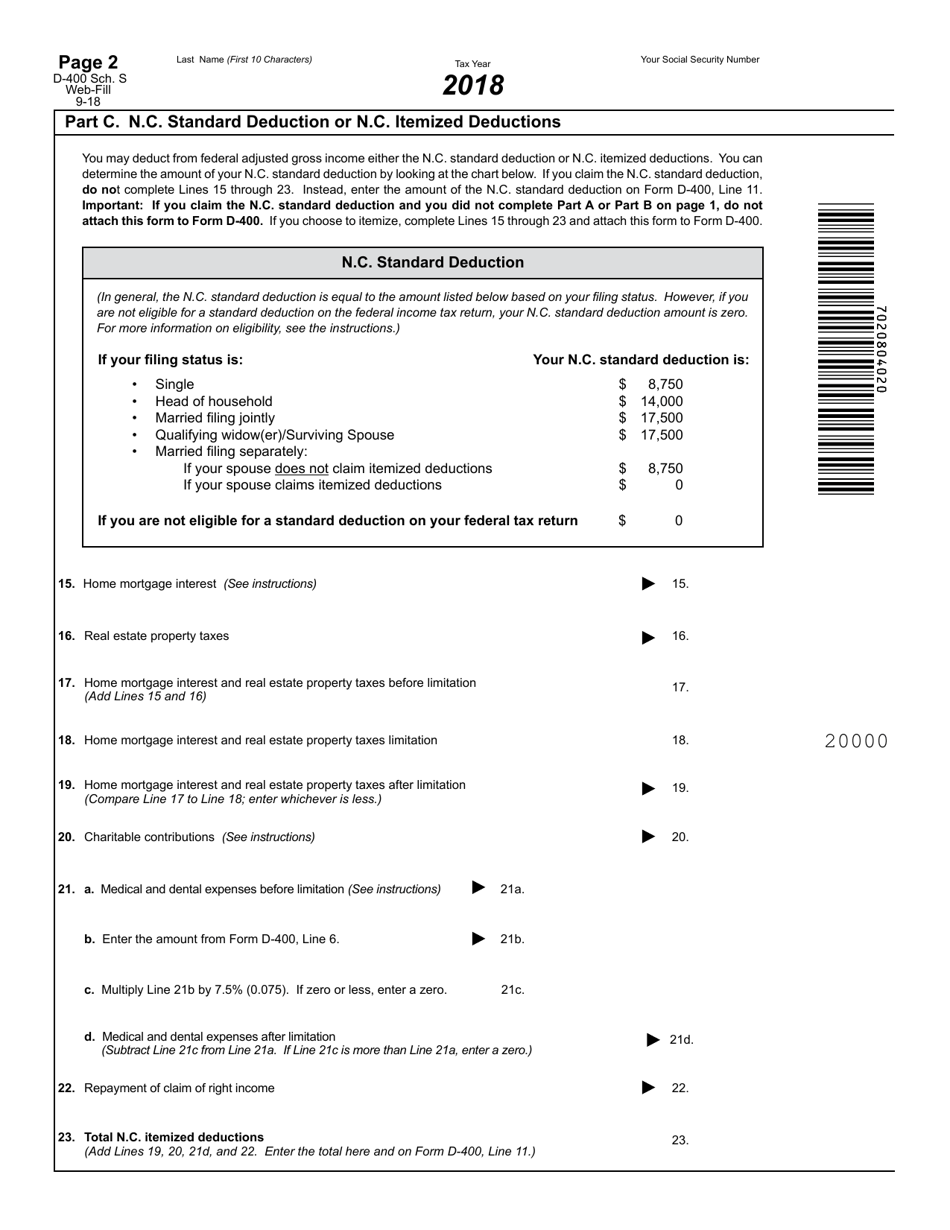

Form D-400 Schedule S

for the current year.

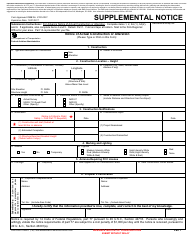

Form D-400 Schedule S Supplemental Schedule - North Carolina

What Is Form D-400 Schedule S?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina.The document is a supplement to Form D-400, Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D-400 Schedule S?

A: Form D-400 Schedule S is a supplemental schedule for residents of North Carolina to report additional income, deductions, credits, and adjustments to their state tax return.

Q: Who needs to file Form D-400 Schedule S?

A: Residents of North Carolina who have additional income, deductions, credits, or adjustments not already accounted for in their regular tax return must file Form D-400 Schedule S.

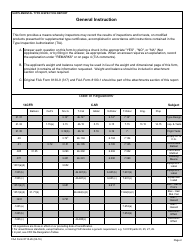

Q: What information is required on Form D-400 Schedule S?

A: Form D-400 Schedule S requires taxpayers to provide details of the additional income, deductions, credits, and adjustments they are reporting.

Q: When is the deadline to file Form D-400 Schedule S?

A: The deadline to file Form D-400 Schedule S is usually the same as the deadline to file the state tax return, which is April 15th.

Q: Can Form D-400 Schedule S be filed electronically?

A: Yes, Form D-400 Schedule S can be filed electronically if you are also filing your state tax return electronically.

Q: What should I do if I need help filling out Form D-400 Schedule S?

A: If you need help filling out Form D-400 Schedule S, you can consult the instructions provided with the form or seek assistance from a tax professional or the North Carolina Department of Revenue.

Q: Are there any penalties for not filing Form D-400 Schedule S?

A: If you are required to file Form D-400 Schedule S and fail to do so, you may be subject to penalties and interest on any tax owed.

Q: Can I claim a refund if I overpaid my taxes on Form D-400 Schedule S?

A: Yes, if you overpaid your taxes, you can claim a refund on Form D-400 Schedule S and receive the excess amount back.

Q: Can I amend my Form D-400 Schedule S if I made a mistake?

A: Yes, you can amend your Form D-400 Schedule S if you made a mistake or need to make changes. You will need to file an amended return using Form D-400X.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

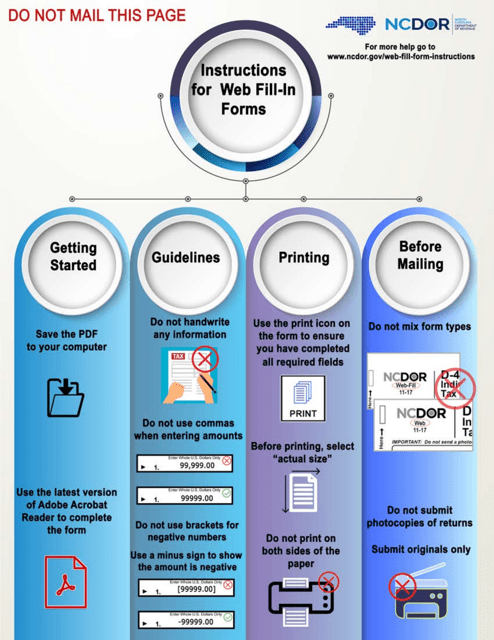

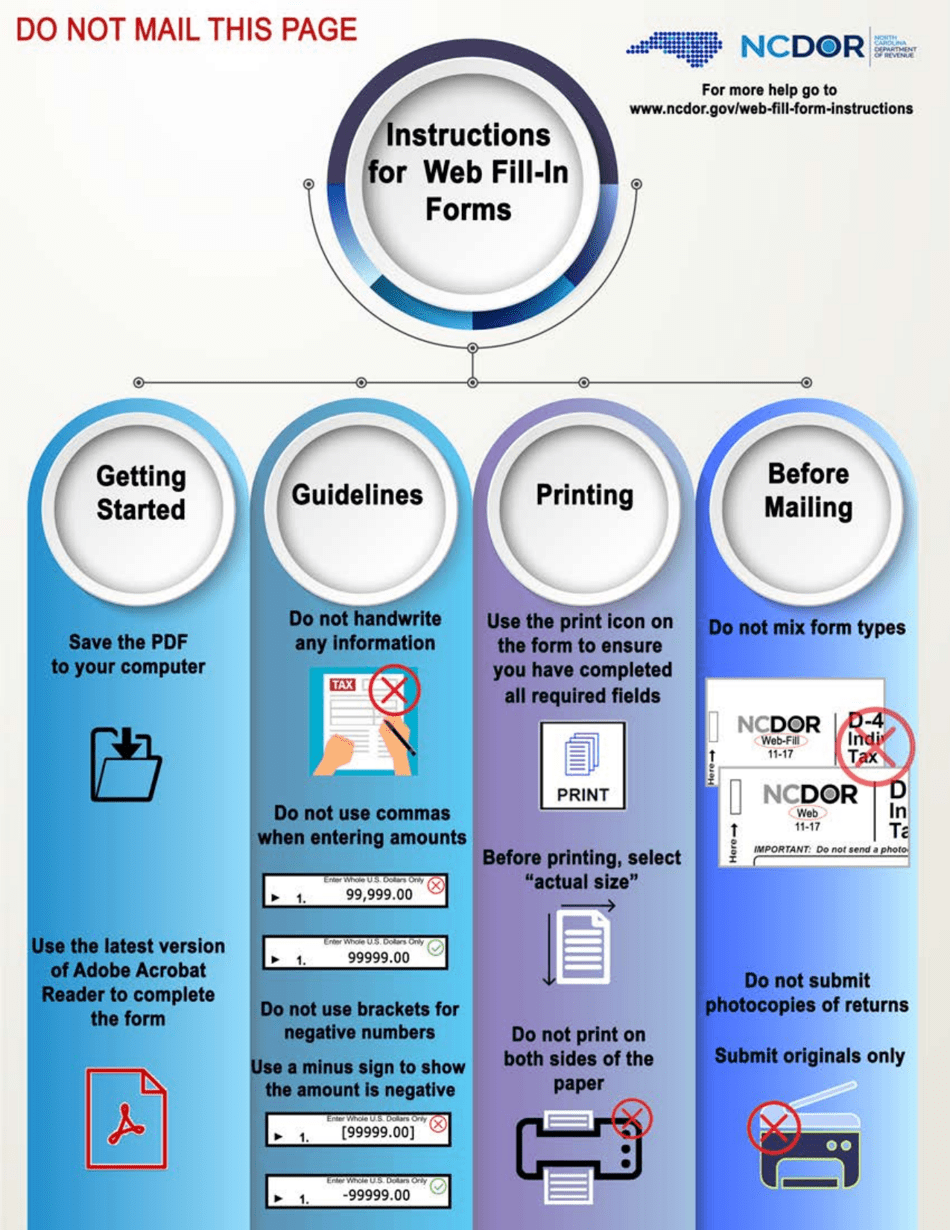

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-400 Schedule S by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.