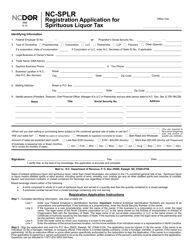

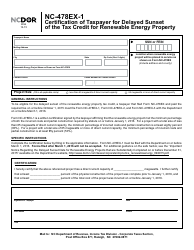

This version of the form is not currently in use and is provided for reference only. Download this version of

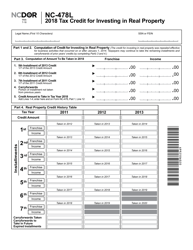

Form NC-478L

for the current year.

Form NC-478L Tax Credit for Investing in Real Property - North Carolina

What Is Form NC-478L?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NC-478L?

A: Form NC-478L is a tax form used in North Carolina for claiming tax credits for investing in real property.

Q: What is the purpose of Form NC-478L?

A: The purpose of Form NC-478L is to claim tax credits for investing in real property in North Carolina.

Q: Who can use Form NC-478L?

A: Form NC-478L can be used by individuals or businesses who have invested in real property in North Carolina and are eligible for the tax credits.

Q: What are the requirements to qualify for the tax credits?

A: To qualify for the tax credits, you must meet certain criteria set by the North Carolina Department of Revenue, including investing in qualifying real property and meeting any specified time requirements.

Q: How much tax credit can be claimed using Form NC-478L?

A: The amount of tax credit that can be claimed using Form NC-478L depends on various factors, including the amount of the investment and the specific tax credit program being utilized.

Q: When is the deadline for filing Form NC-478L?

A: The deadline for filing Form NC-478L may vary depending on the specific tax credit program. It is important to check the instructions provided with the form or consult with the North Carolina Department of Revenue for the applicable deadline.

Q: Are there any supporting documents required with Form NC-478L?

A: Yes, you may be required to submit supporting documents such as investment receipts, property records, or other documentation as specified by the North Carolina Department of Revenue.

Q: Is Form NC-478L specific to North Carolina?

A: Yes, Form NC-478L is specific to North Carolina and cannot be used for tax purposes in any other state.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC-478L by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.