This version of the form is not currently in use and is provided for reference only. Download this version of

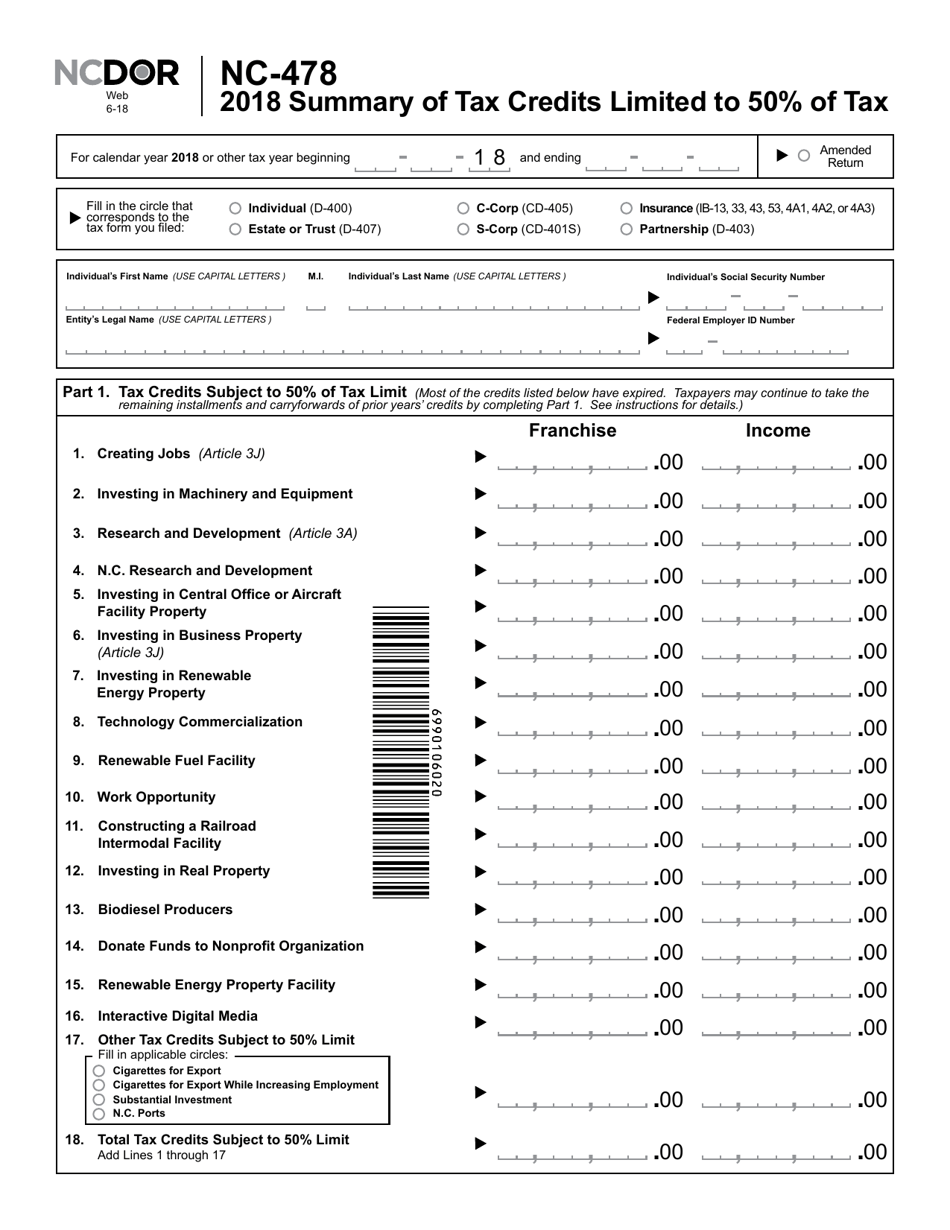

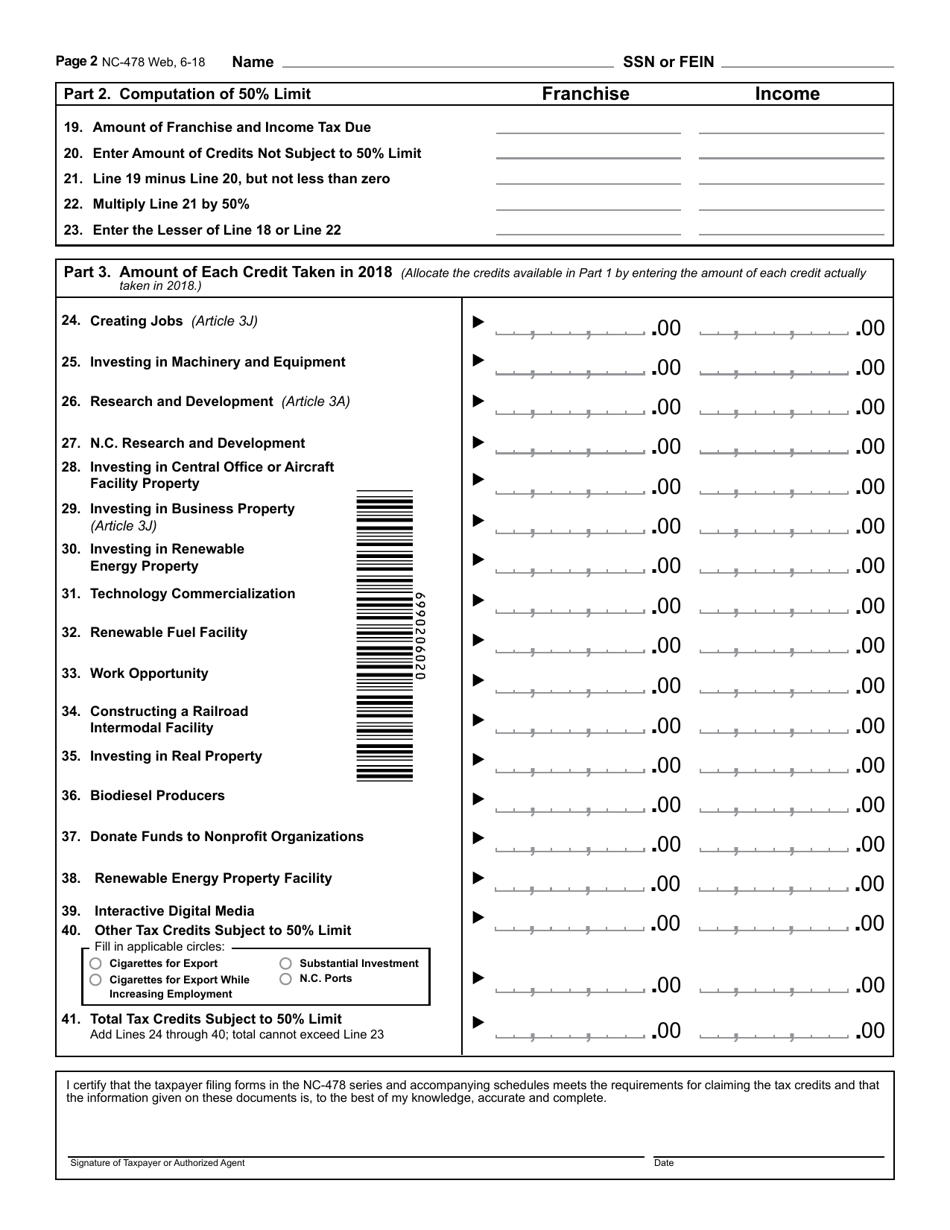

Form NC-478

for the current year.

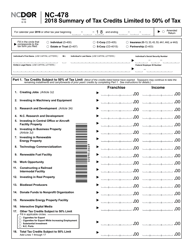

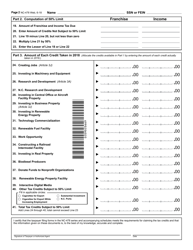

Form NC-478 Summary of Tax Credits Limited to 50% of Tax - North Carolina

What Is Form NC-478?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NC-478?

A: Form NC-478 is a form used by North Carolina taxpayers to calculate and summarize tax credits that are limited to 50% of tax.

Q: What is the purpose of Form NC-478?

A: The purpose of Form NC-478 is to help taxpayers calculate and summarize tax credits that are limited to 50% of their tax liability.

Q: Who needs to file Form NC-478?

A: North Carolina taxpayers who are claiming tax credits that are limited to 50% of their tax liability need to file Form NC-478.

Q: What are tax credits limited to 50% of tax?

A: Tax credits limited to 50% of tax are credits that taxpayers can claim, but the total amount of credits claimed cannot exceed 50% of their tax liability.

Q: How do I complete Form NC-478?

A: To complete Form NC-478, you will need to provide the necessary information and calculate the total amount of tax credits that are limited to 50% of your tax liability.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

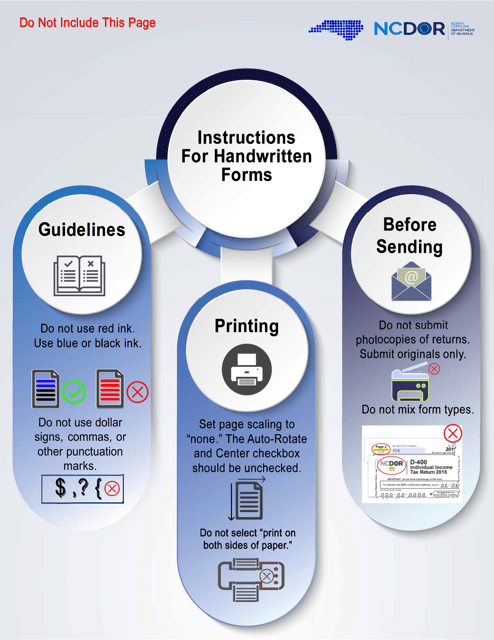

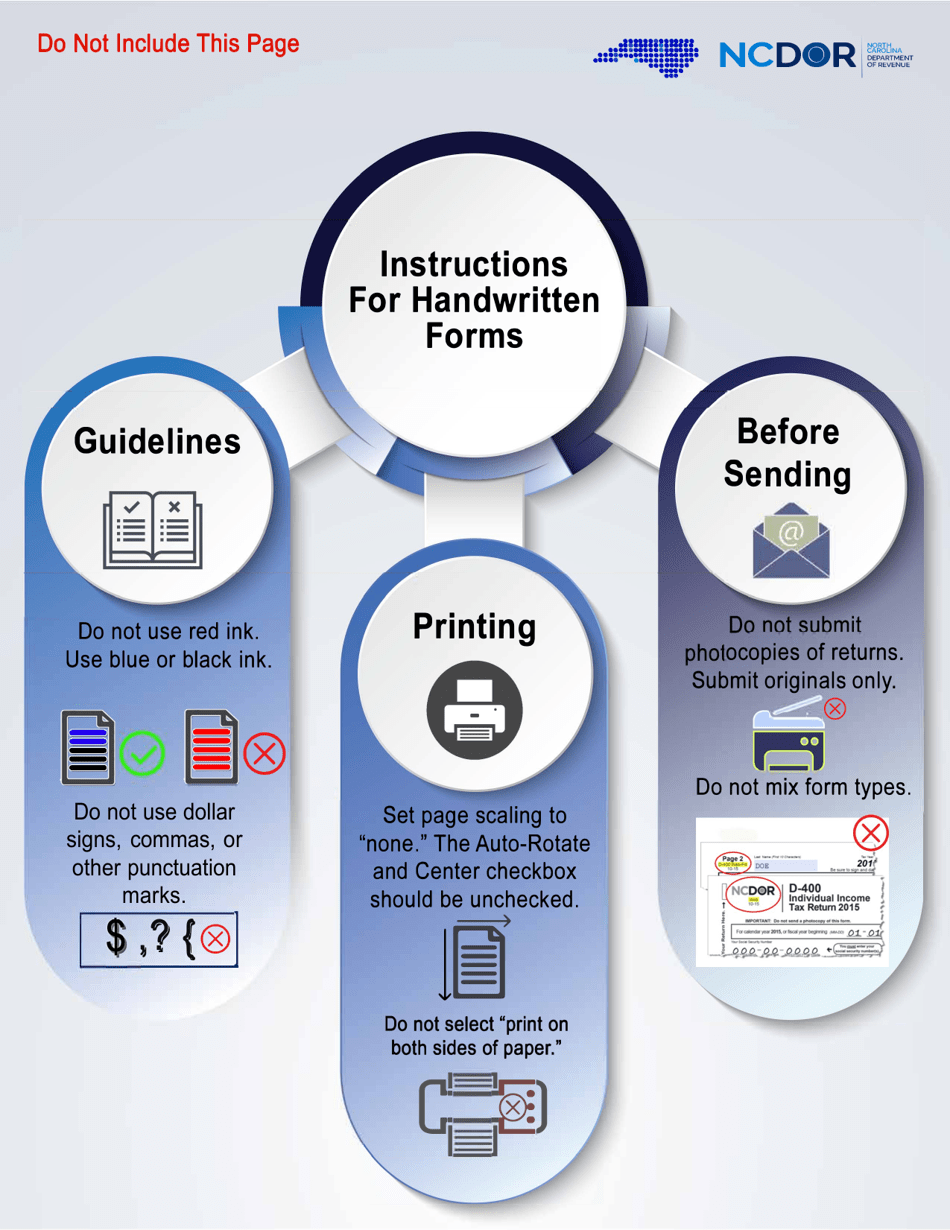

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC-478 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.