This version of the form is not currently in use and is provided for reference only. Download this version of

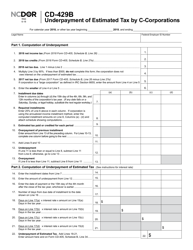

Form CD-429B

for the current year.

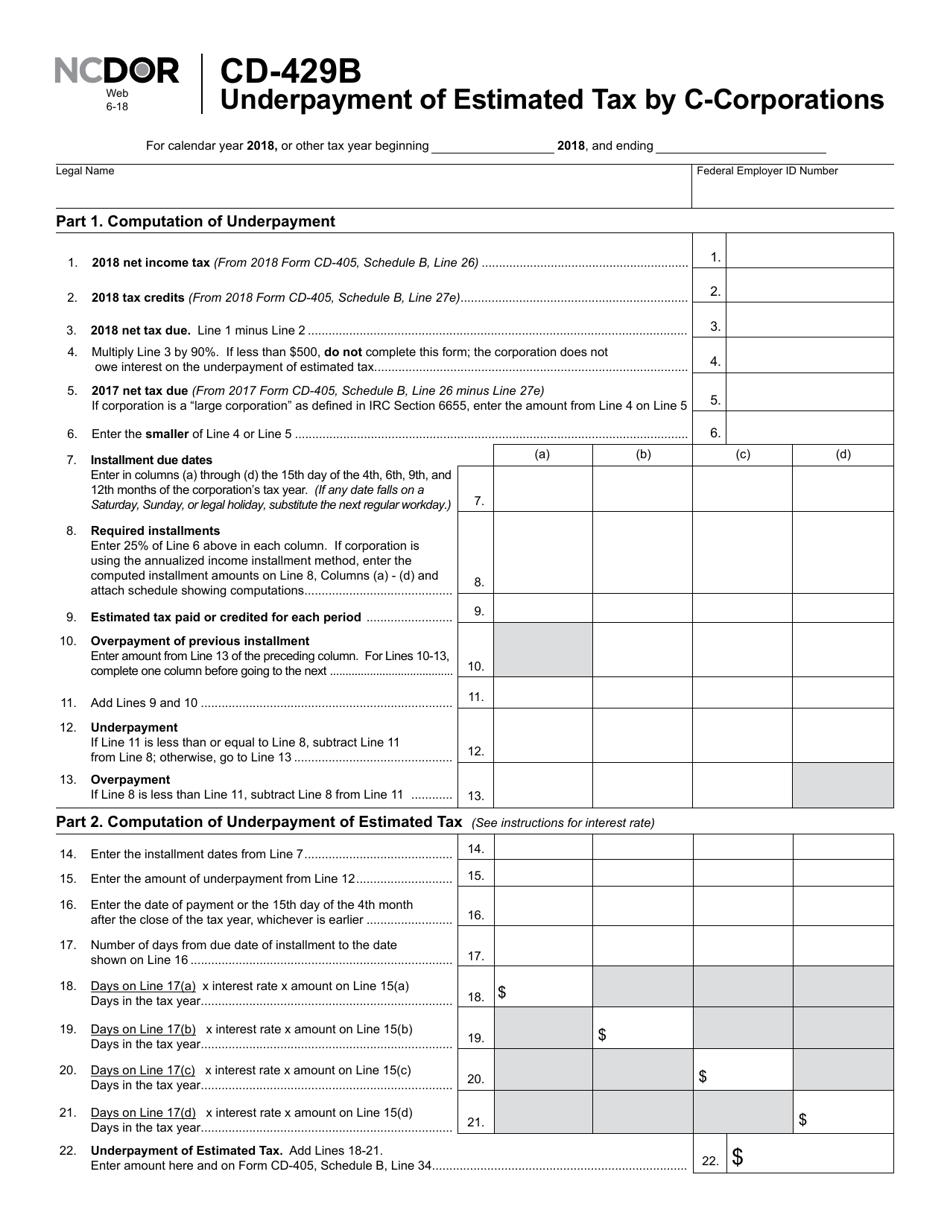

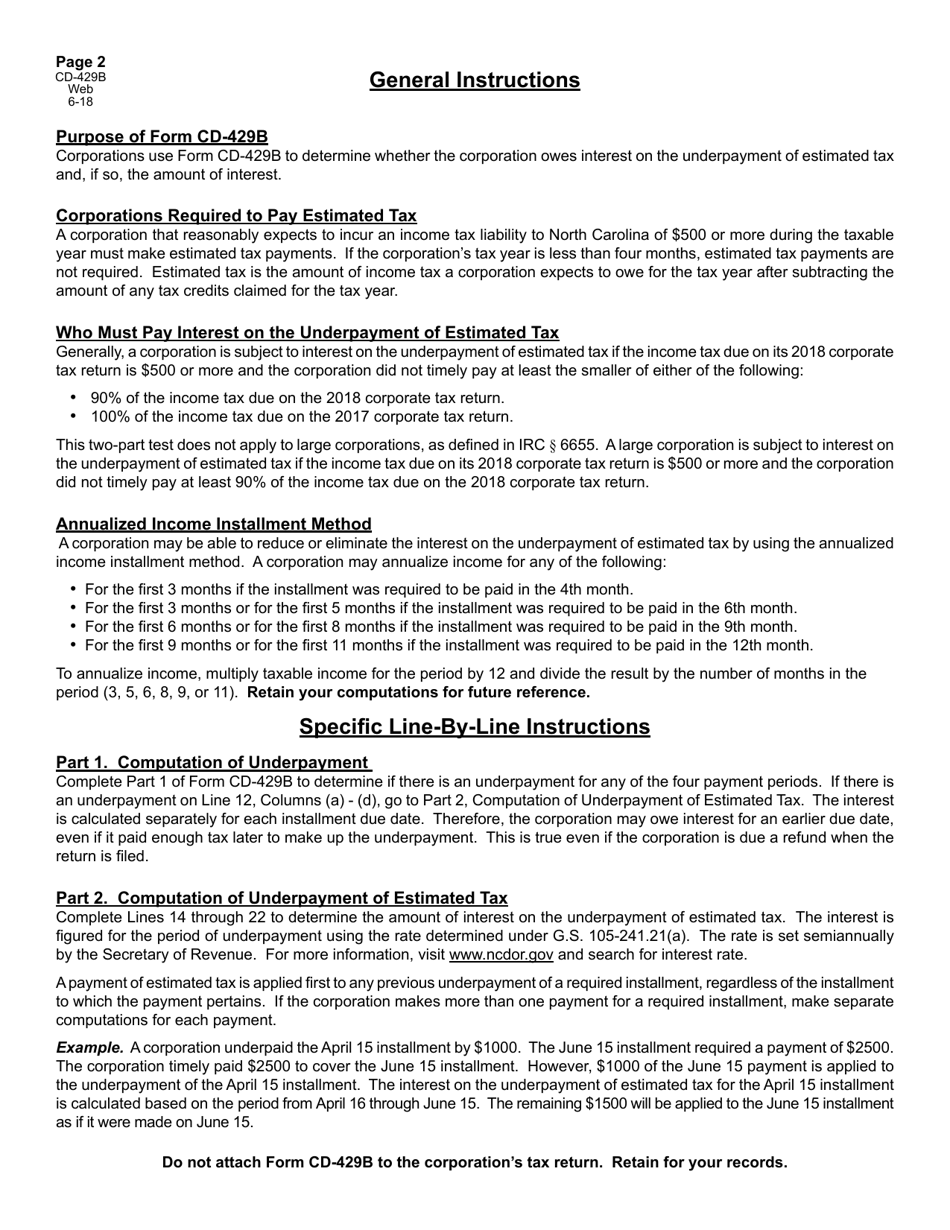

Form CD-429B Underpayment of Estimated Tax by C-Corporations - North Carolina

What Is Form CD-429B?

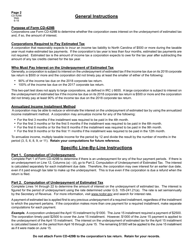

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CD-429B?

A: Form CD-429B is a form used by C-Corporations to report underpayment of estimated tax in North Carolina.

Q: When should Form CD-429B be filed?

A: Form CD-429B should be filed if a C-Corporation has underpaid their estimated tax in North Carolina.

Q: Are all C-Corporations required to file Form CD-429B?

A: No, Form CD-429B is only required to be filed if a C-Corporation has underpaid their estimated tax in North Carolina.

Q: What information is needed to complete Form CD-429B?

A: To complete Form CD-429B, you will need information about your estimated tax payments and the amount of underpayment.

Q: What are the consequences of not filing Form CD-429B?

A: Failure to file Form CD-429B may result in penalties and interest on the underpaid amount.

Q: Is there a deadline for filing Form CD-429B?

A: Yes, Form CD-429B must be filed by the due date of the C-Corporation's North Carolina corporate income tax return.

Q: Can I amend Form CD-429B if I made an error?

A: Yes, you can amend Form CD-429B if you made an error. Use Form CD-429B-X to amend the underpayment information.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

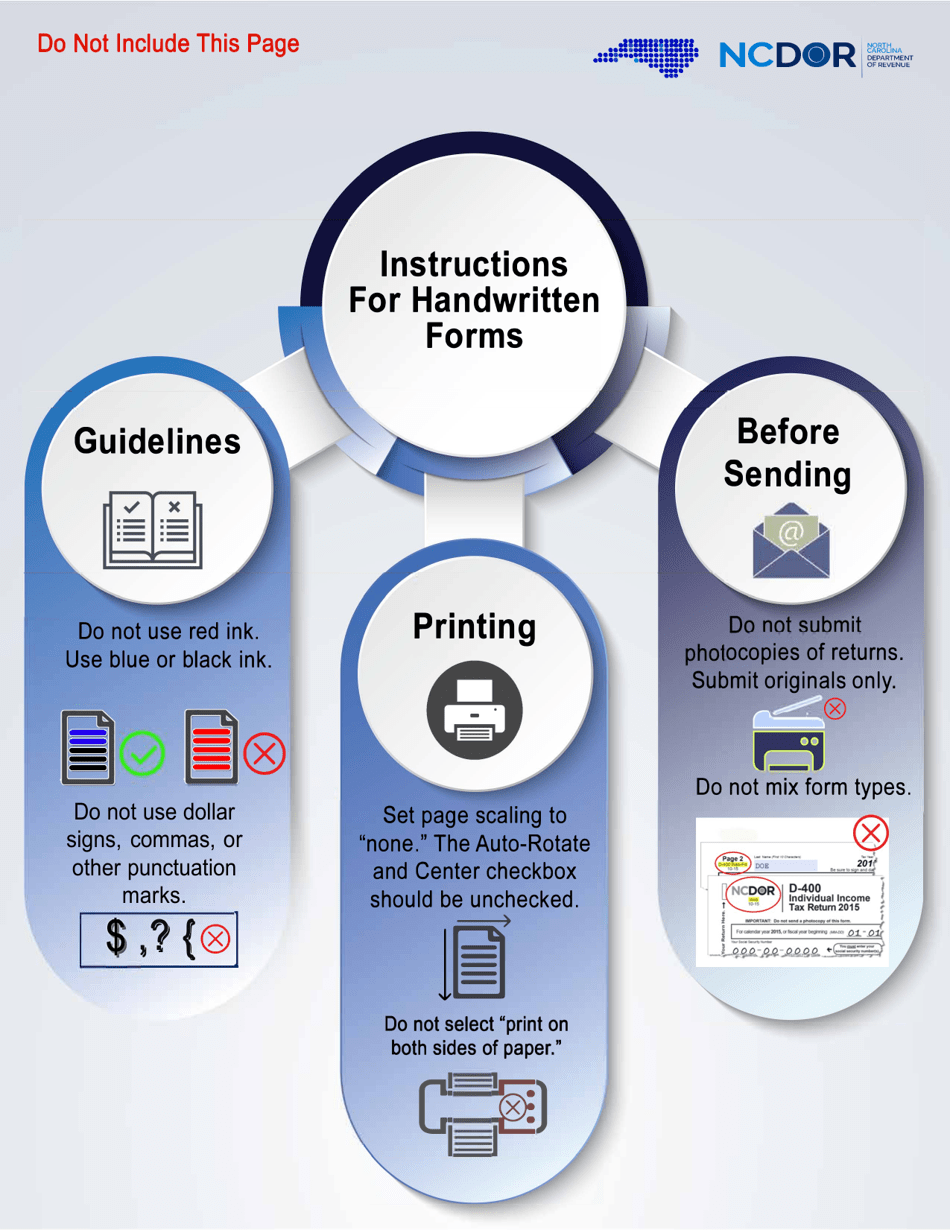

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CD-429B by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.