This version of the form is not currently in use and is provided for reference only. Download this version of

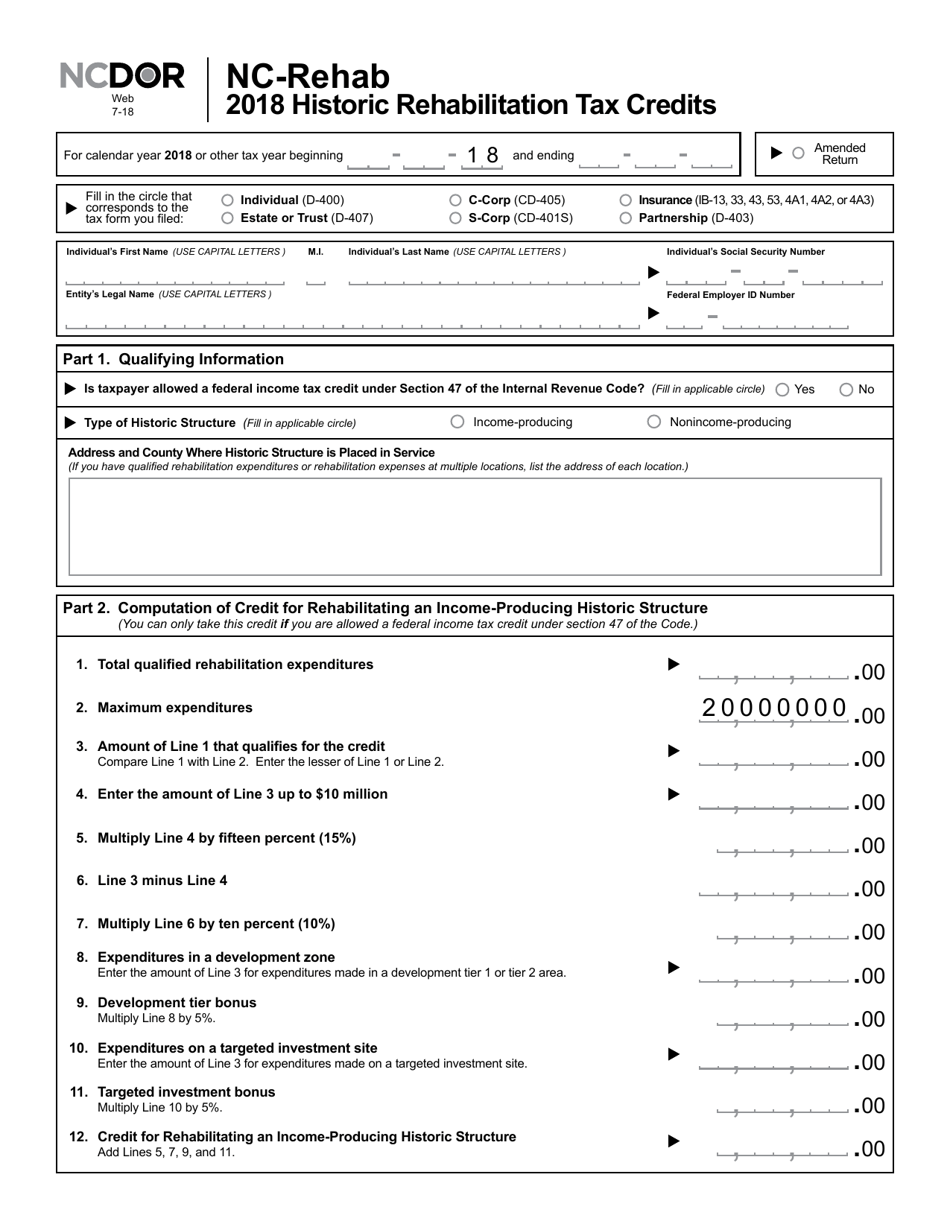

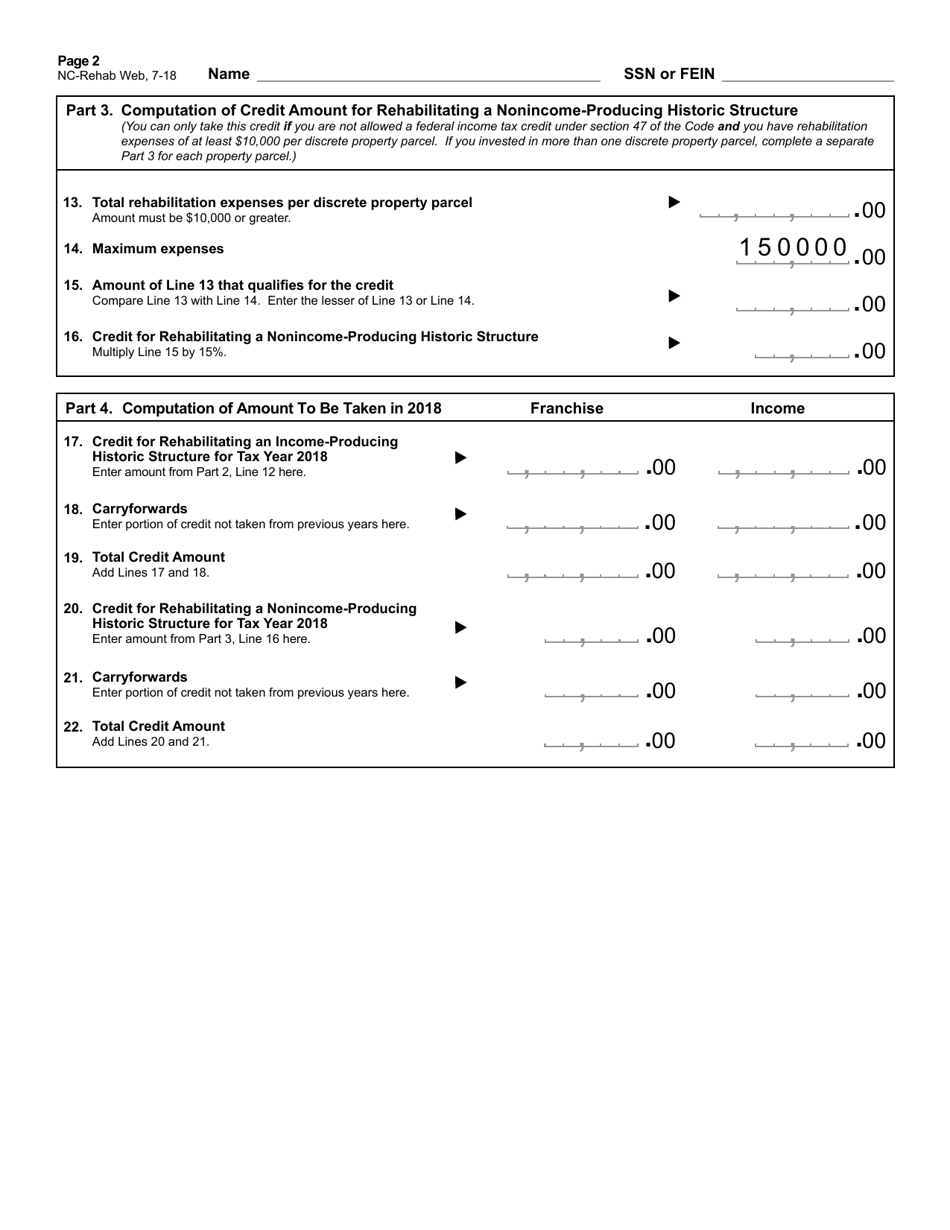

Form NC-REHAB

for the current year.

Form NC-REHAB Historic Rehabilitation Tax Credits - North Carolina

What Is Form NC-REHAB?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NC-REHAB?

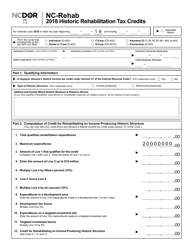

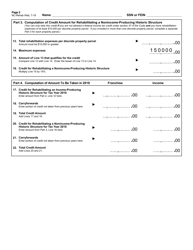

A: Form NC-REHAB is a tax form used in North Carolina to claim Historic Rehabilitation Tax Credits.

Q: What are Historic Rehabilitation Tax Credits?

A: Historic Rehabilitation Tax Credits are credits offered by the state of North Carolina to incentivize the preservation and restoration of historic properties.

Q: Who is eligible to claim Historic Rehabilitation Tax Credits in North Carolina?

A: Property owners who have restored or rehabilitated a certified historic property in North Carolina may be eligible to claim Historic Rehabilitation Tax Credits.

Q: How do I claim Historic Rehabilitation Tax Credits in North Carolina?

A: To claim Historic Rehabilitation Tax Credits in North Carolina, you need to complete and submit Form NC-REHAB along with the required documentation.

Q: What is the purpose of Form NC-REHAB?

A: Form NC-REHAB is used to calculate and claim the amount of Historic Rehabilitation Tax Credits you are eligible for in North Carolina.

Q: Are there any deadlines for filing Form NC-REHAB?

A: Yes, there are specific deadlines for filing Form NC-REHAB. It is recommended to refer to the instructions provided with the form or consult with the North Carolina Department of Revenue for the current deadlines.

Q: What documentation do I need to submit with Form NC-REHAB?

A: Along with Form NC-REHAB, you will need to submit documentation such as photographs, detailed project plans, expense receipts, and any other supporting documents related to the historic rehabilitation project.

Q: How long does it take to process a Historic Rehabilitation Tax Credit claim in North Carolina?

A: The processing time for a Historic Rehabilitation Tax Credit claim in North Carolina can vary. It is recommended to check with the North Carolina Department of Revenue for an estimate of the processing time.

Q: Can I claim both federal and state Historic Rehabilitation Tax Credits?

A: Yes, it is possible to claim both federal and state Historic Rehabilitation Tax Credits, as long as you meet the eligibility criteria and requirements set by both programs.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

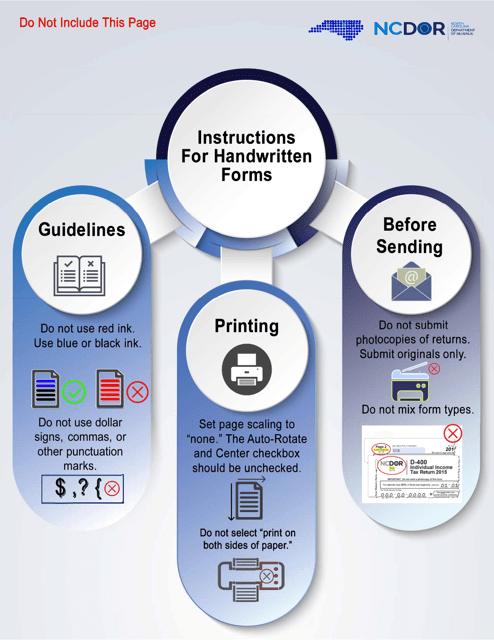

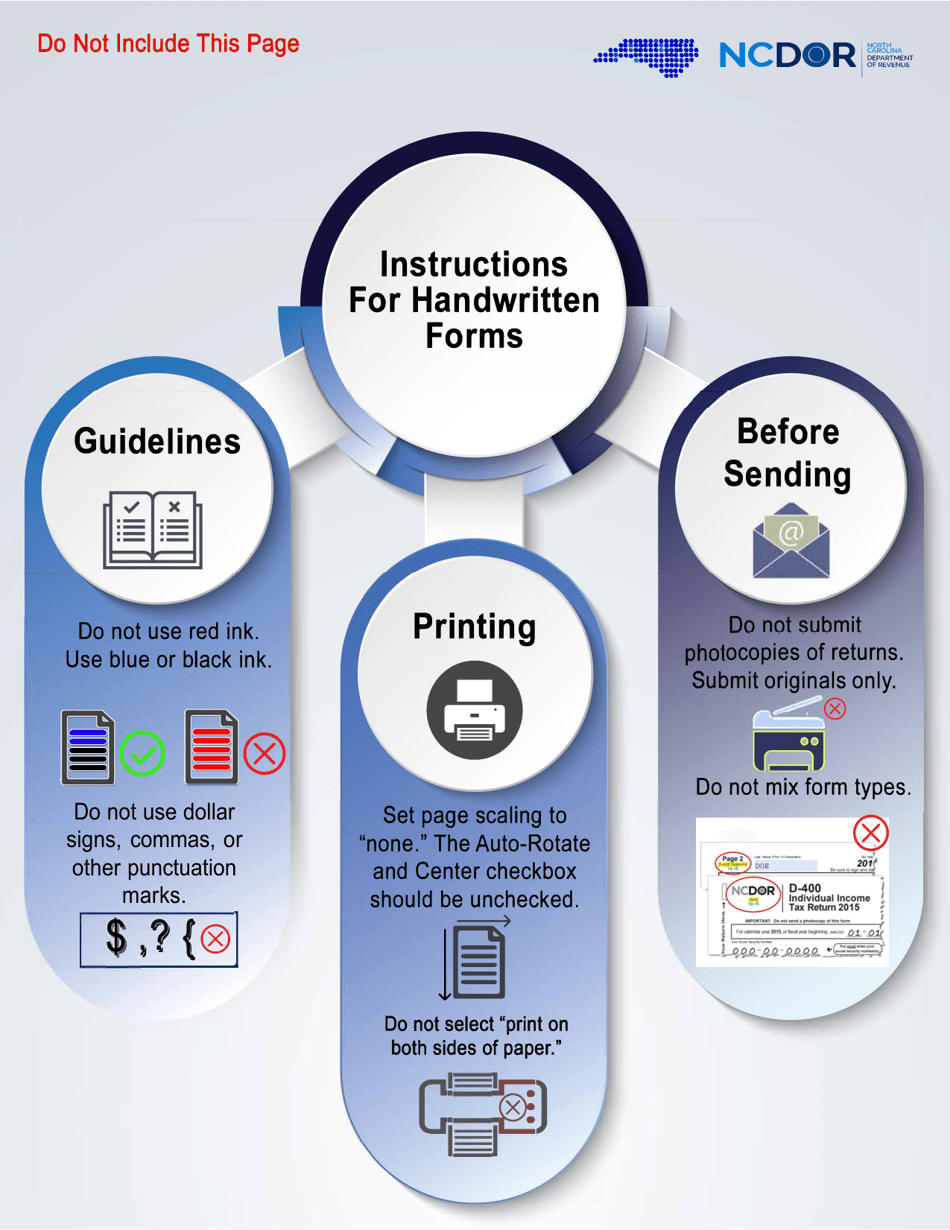

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC-REHAB by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.