This version of the form is not currently in use and is provided for reference only. Download this version of

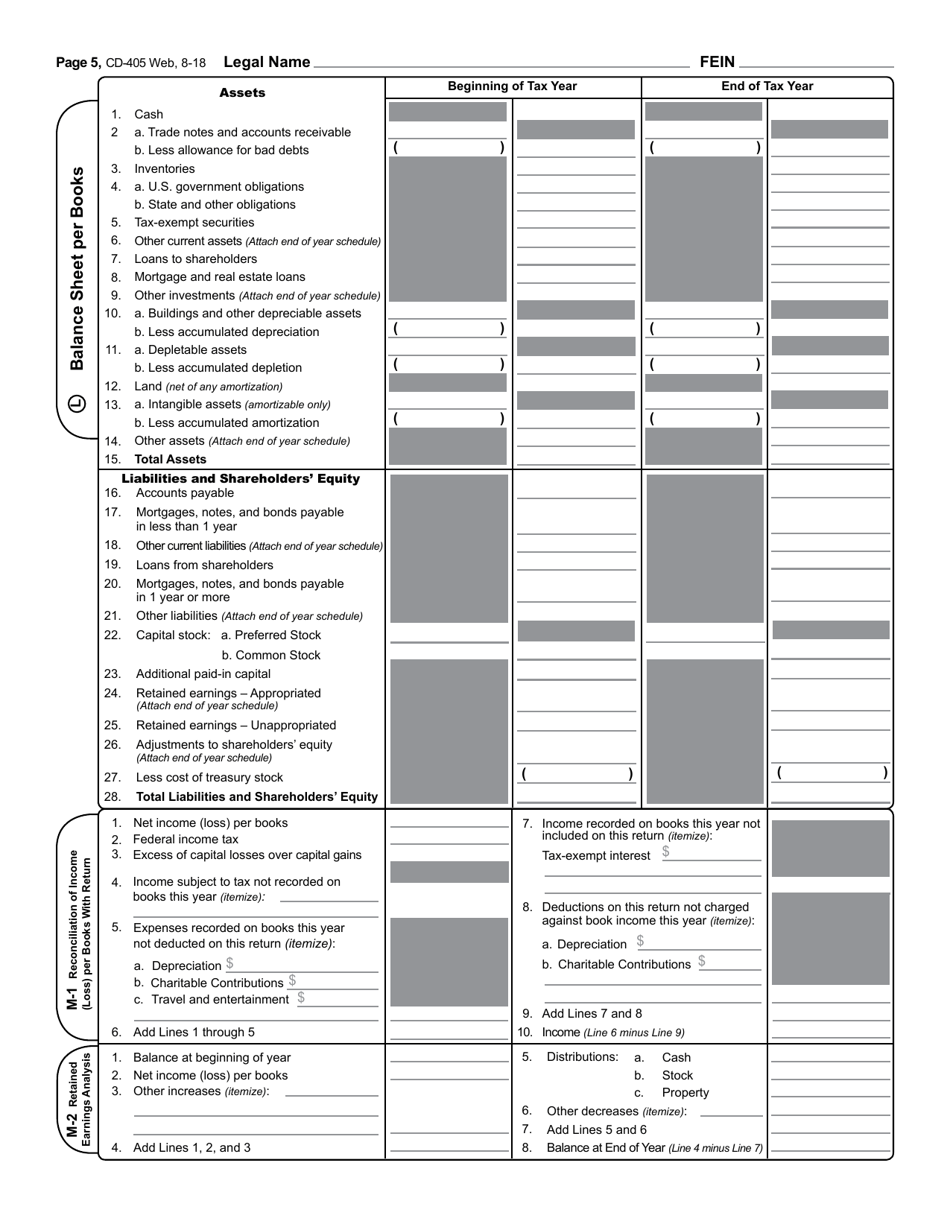

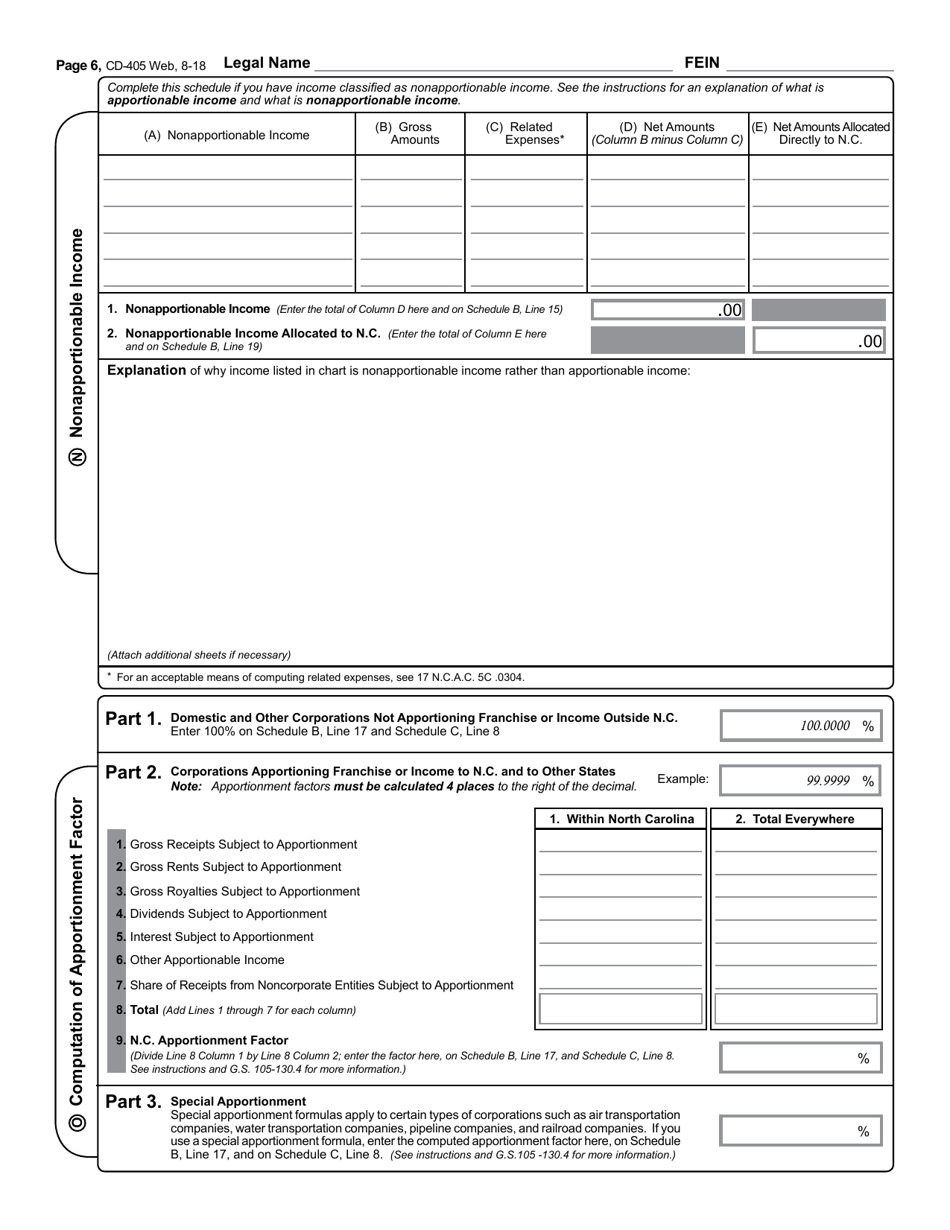

Form CD-405

for the current year.

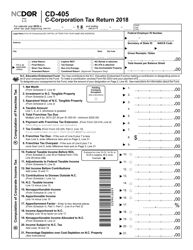

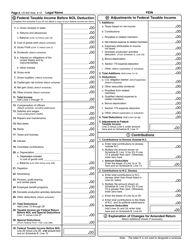

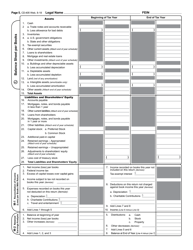

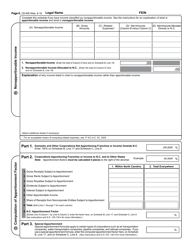

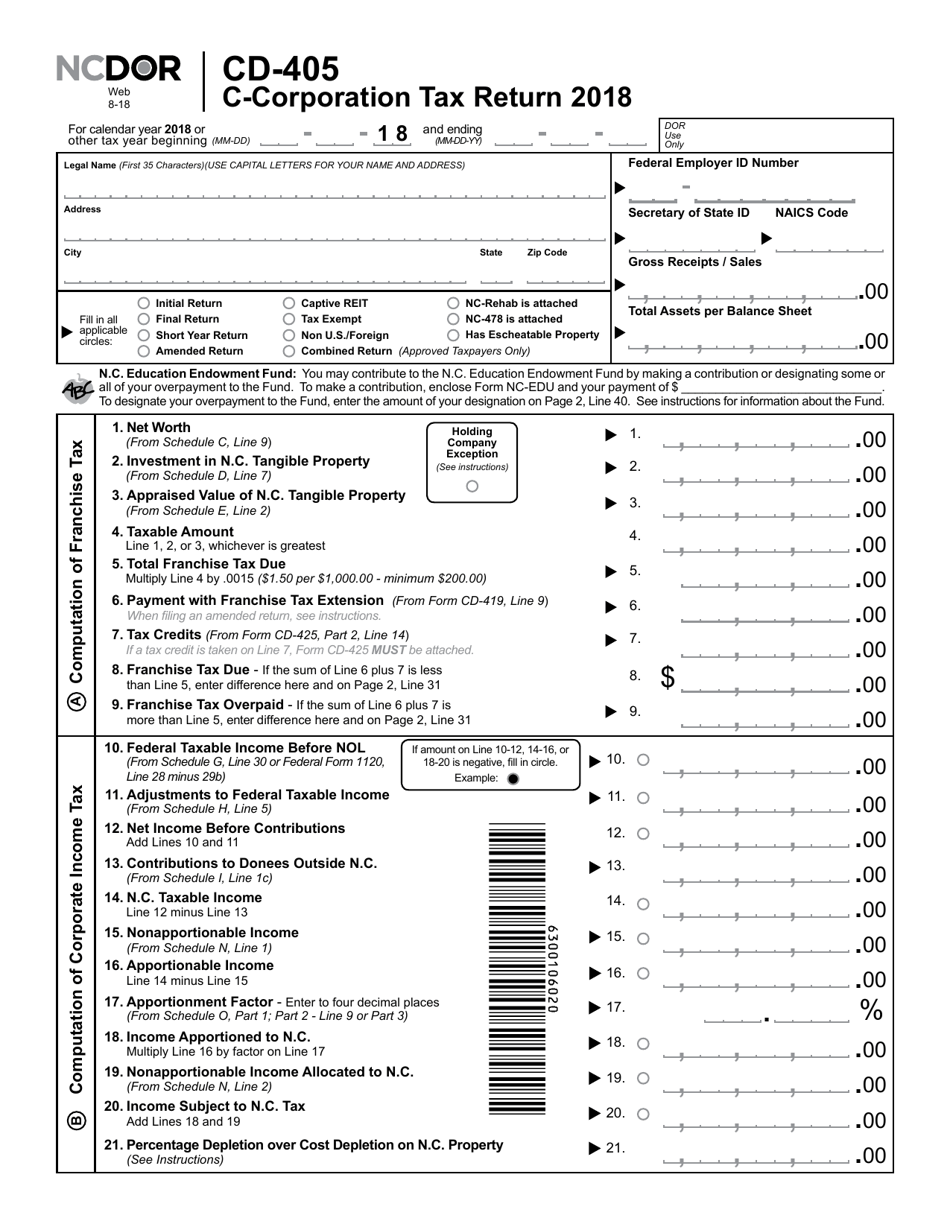

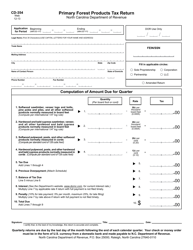

Form CD-405 C-Corporation Tax Return - North Carolina

What Is Form CD-405?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CD-405?

A: Form CD-405 is the C-Corporation Tax Return for North Carolina.

Q: Who needs to file Form CD-405?

A: C-Corporations in North Carolina need to file Form CD-405.

Q: What is the purpose of Form CD-405?

A: Form CD-405 is used to report and pay the state income tax for C-Corporations in North Carolina.

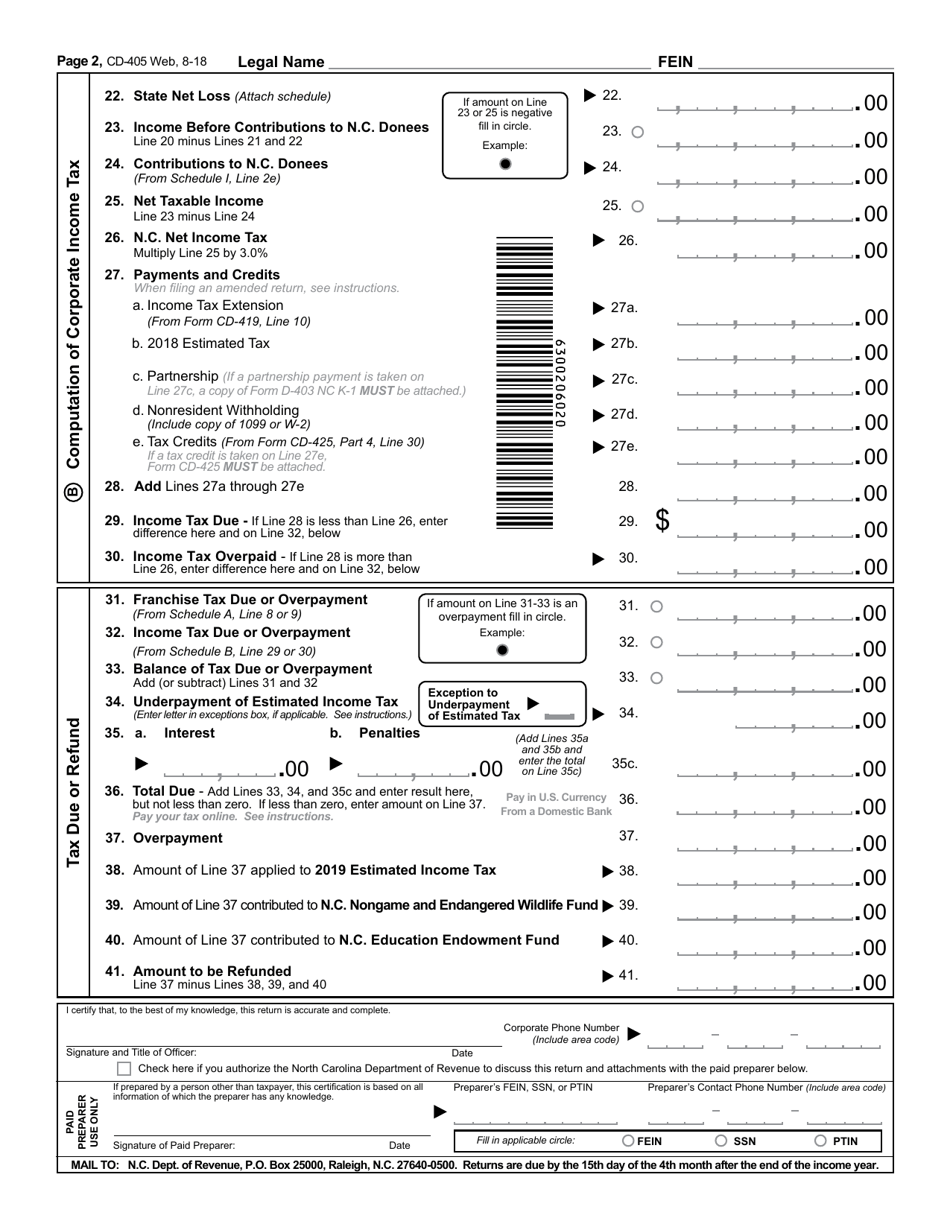

Q: When is the deadline for filing Form CD-405?

A: The deadline for filing Form CD-405 is on or before the 15th day of the fourth month following the close of the corporation's taxable year.

Q: Are there any payment requirements with Form CD-405?

A: Yes, any tax due must be paid along with the filing of Form CD-405.

Q: Are there any penalties for late filing of Form CD-405?

A: Yes, there are penalties for late filing of Form CD-405, including interest on any unpaid tax.

Q: Can Form CD-405 be filed electronically?

A: Yes, Form CD-405 can be filed electronically through the North Carolina Department of Revenue's eFile system.

Q: Can I request an extension to file Form CD-405?

A: Yes, you can request an extension to file Form CD-405, but any tax owed must still be paid by the original due date.

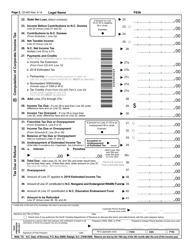

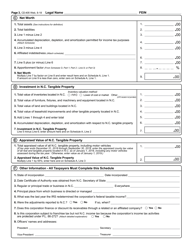

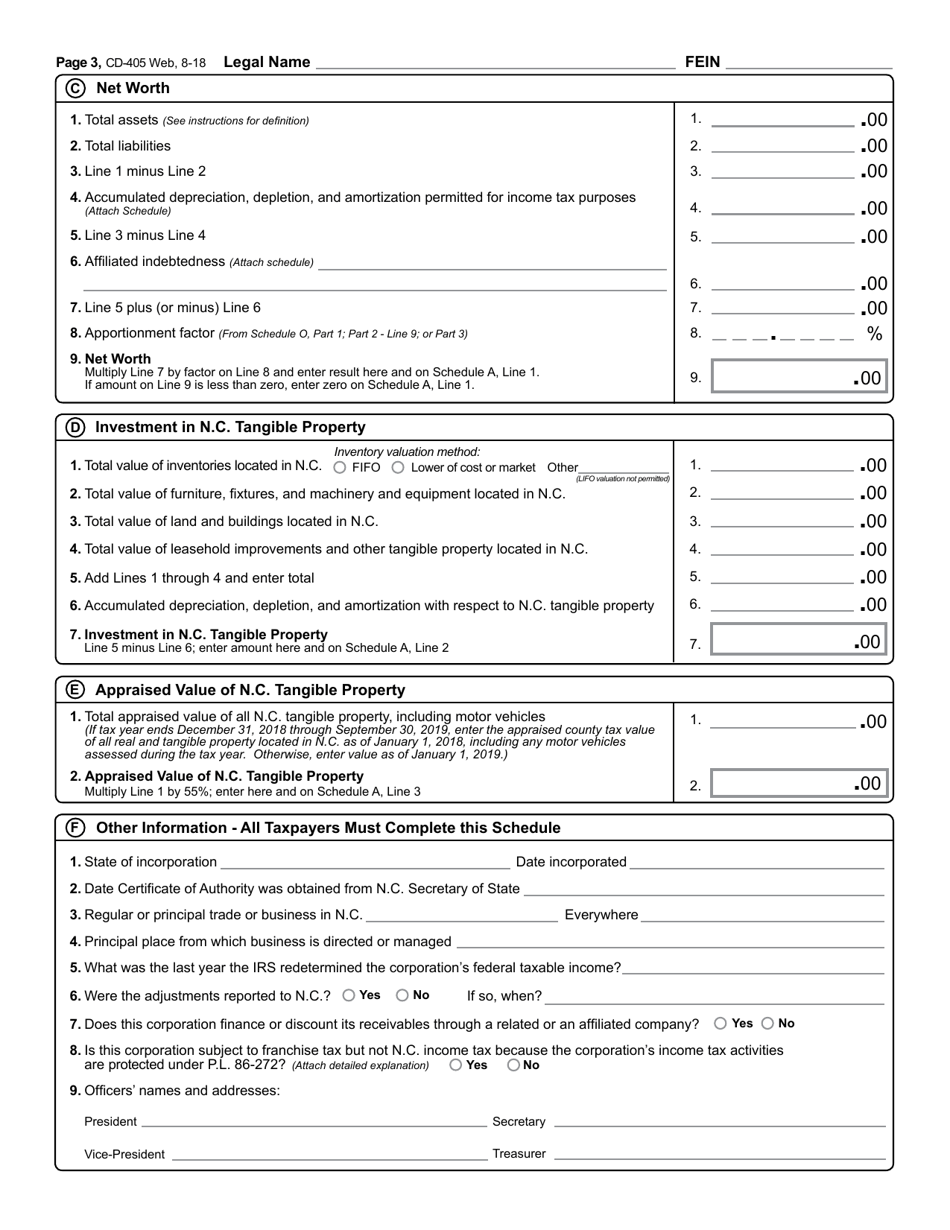

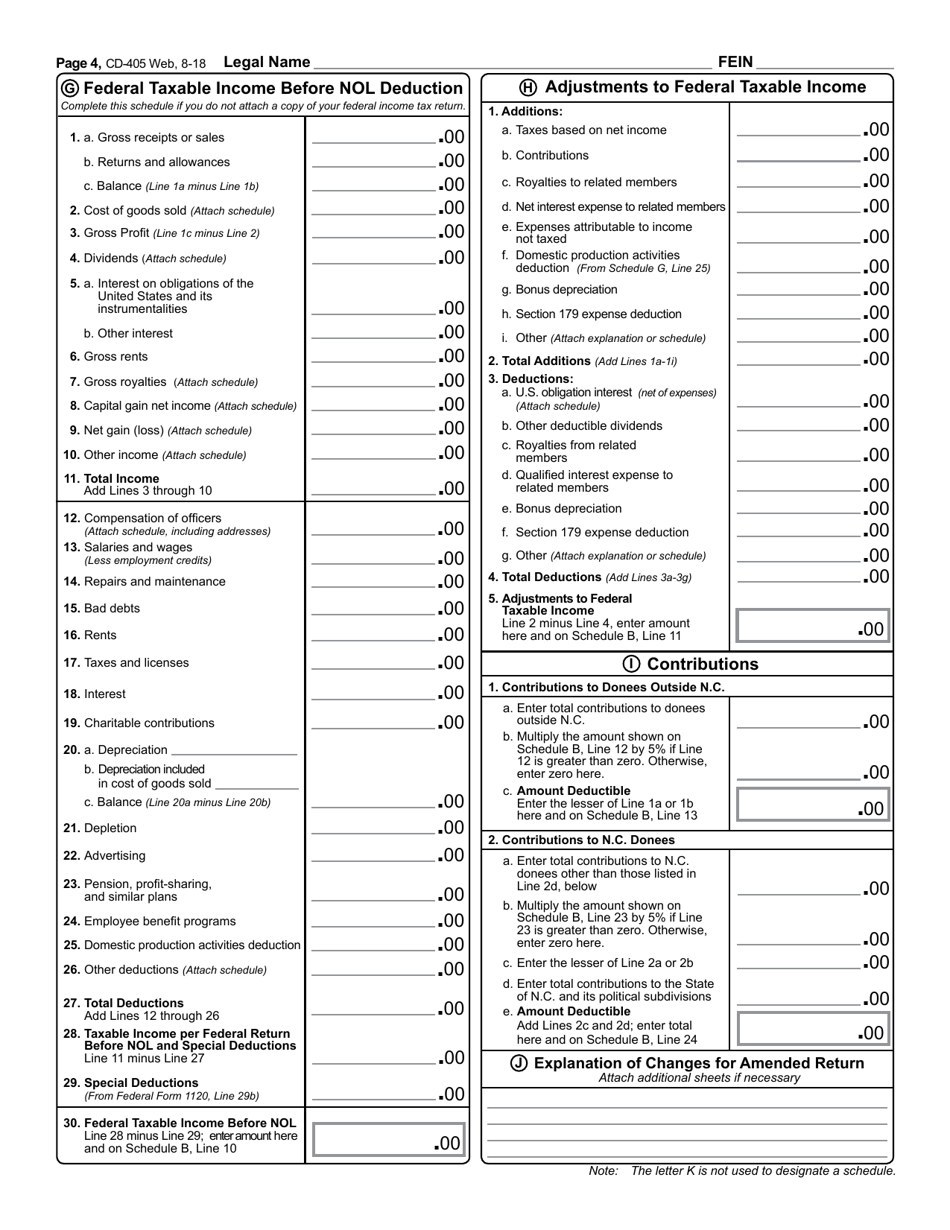

Q: Are there any other forms or schedules that may need to be filed with Form CD-405?

A: Yes, depending on the specific circumstances of the C-Corporation, additional forms or schedules may need to be filed with Form CD-405.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

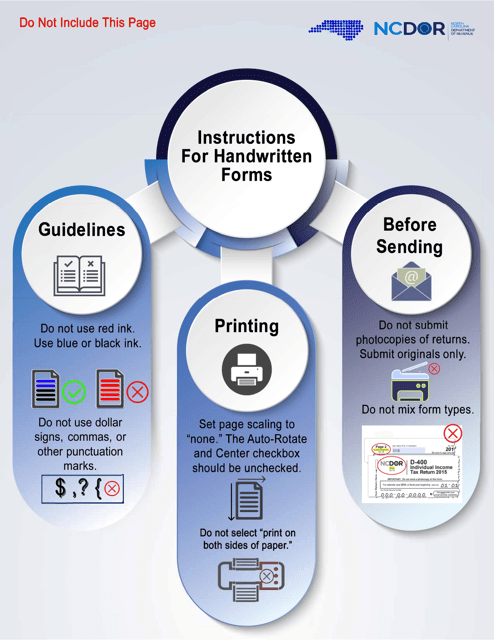

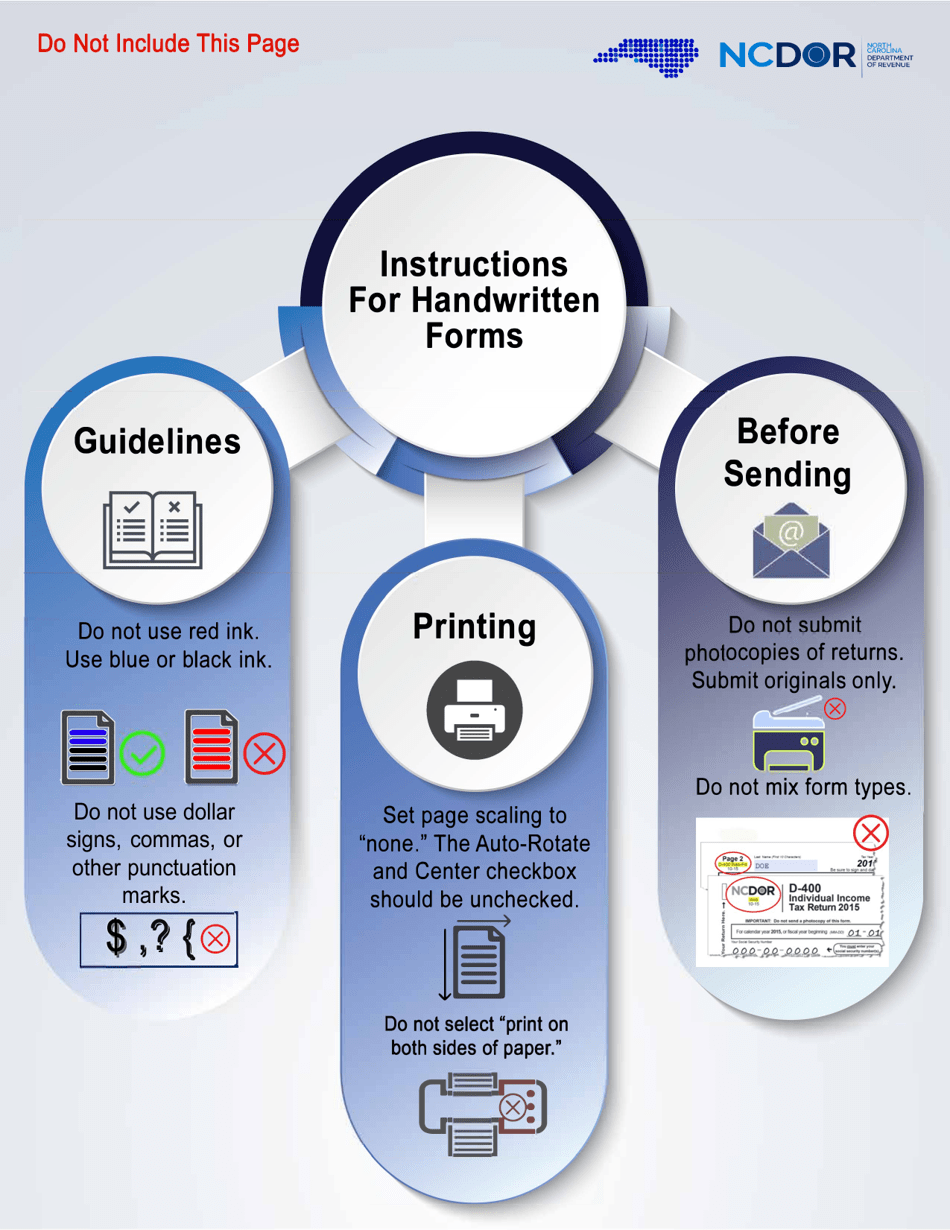

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CD-405 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.