This version of the form is not currently in use and is provided for reference only. Download this version of

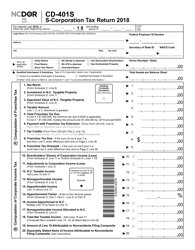

Form CD-401S

for the current year.

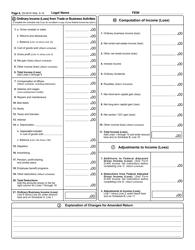

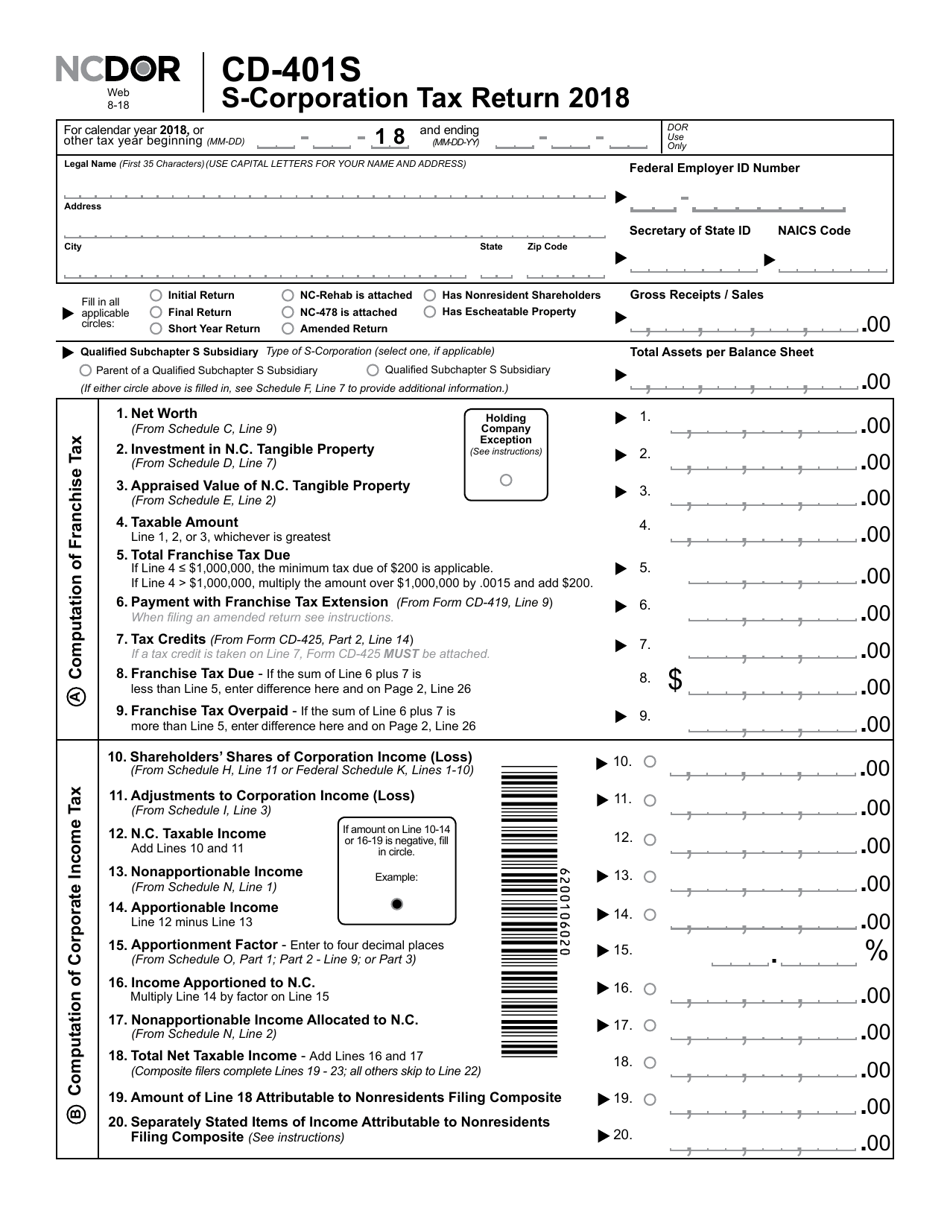

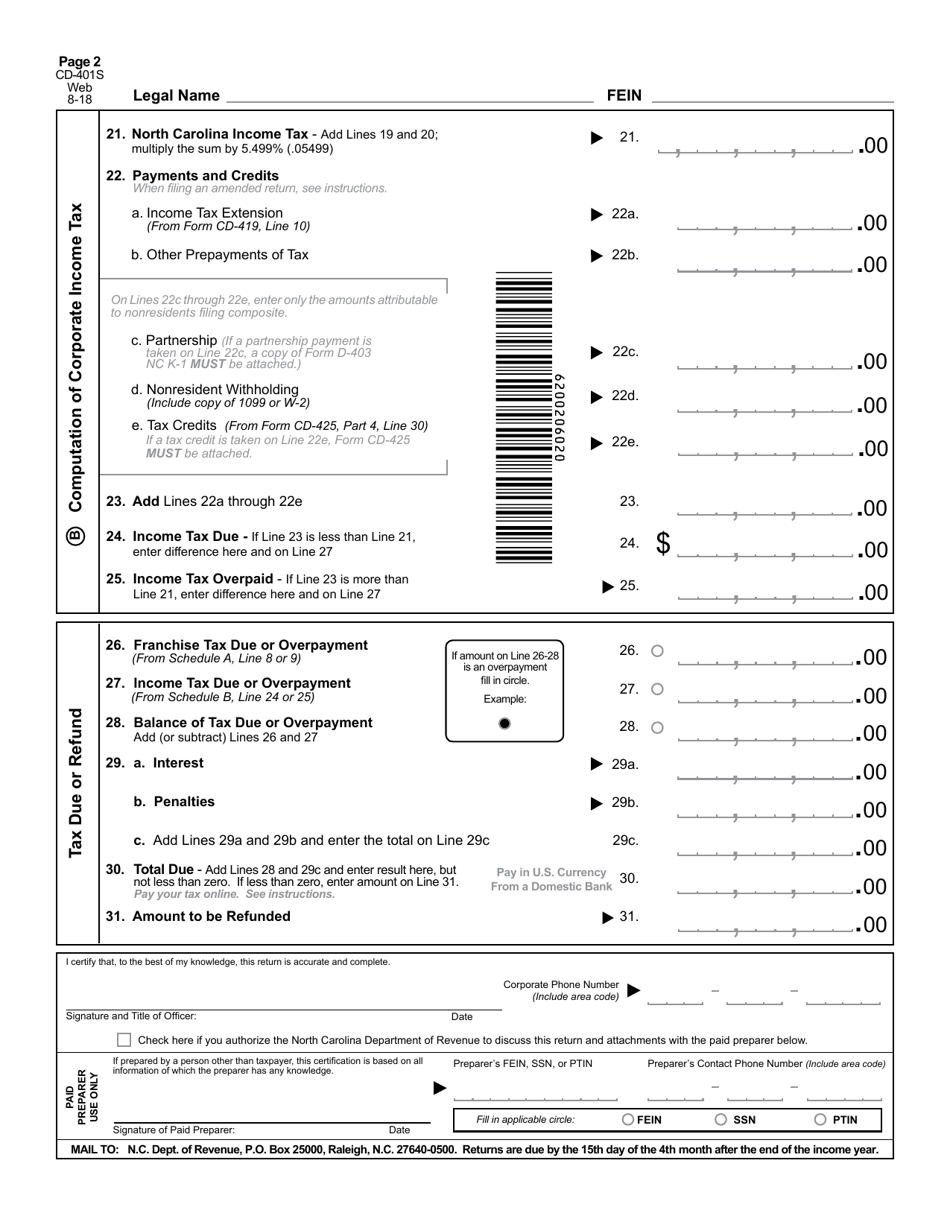

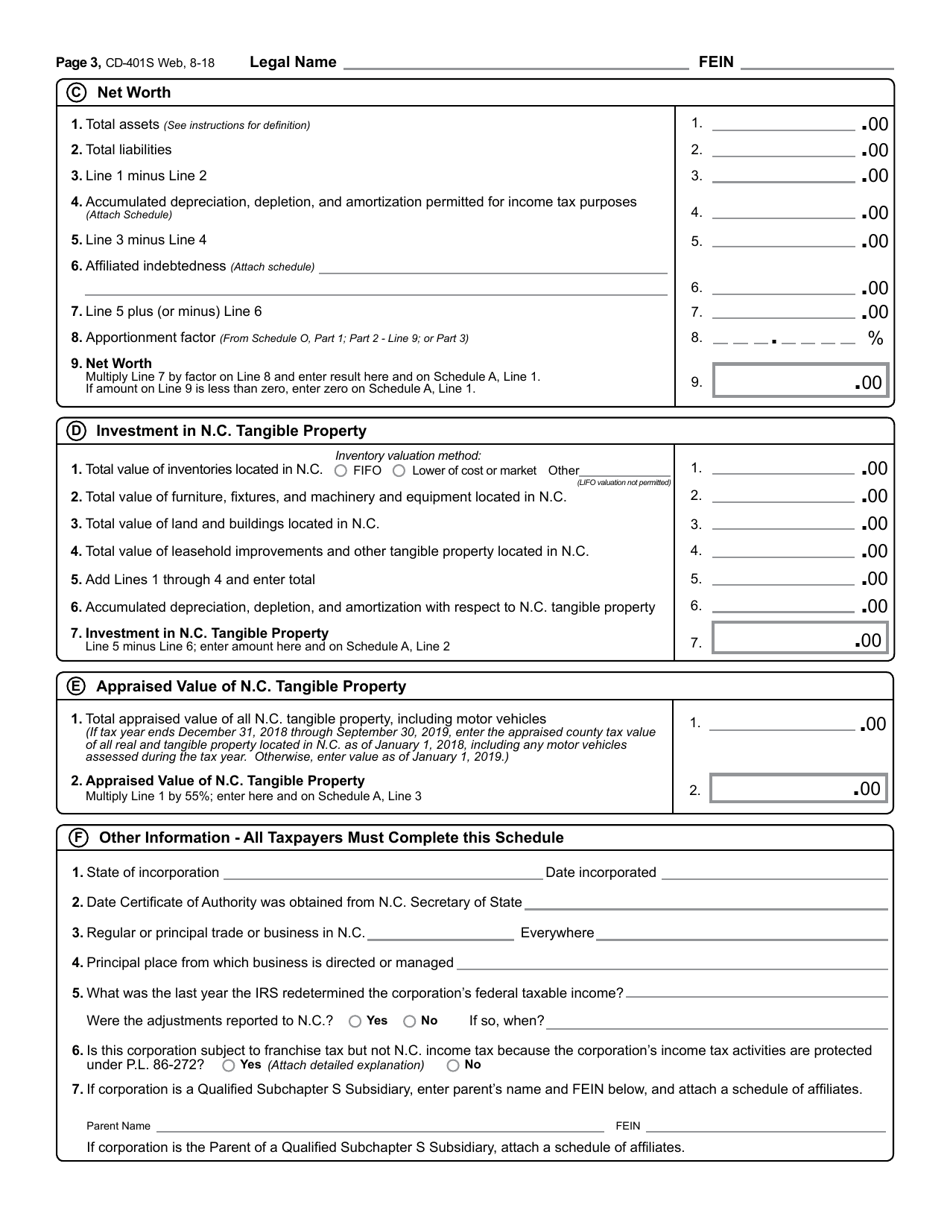

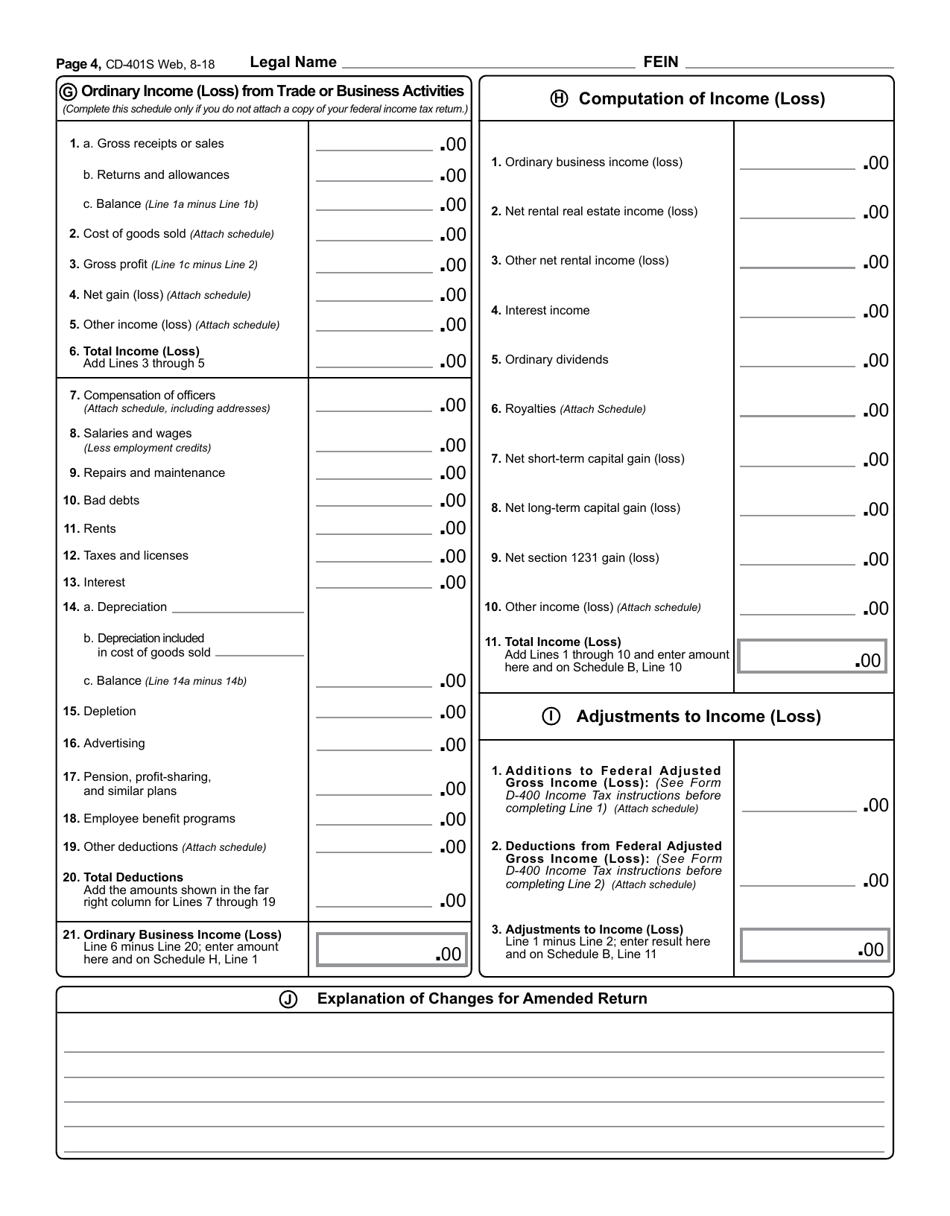

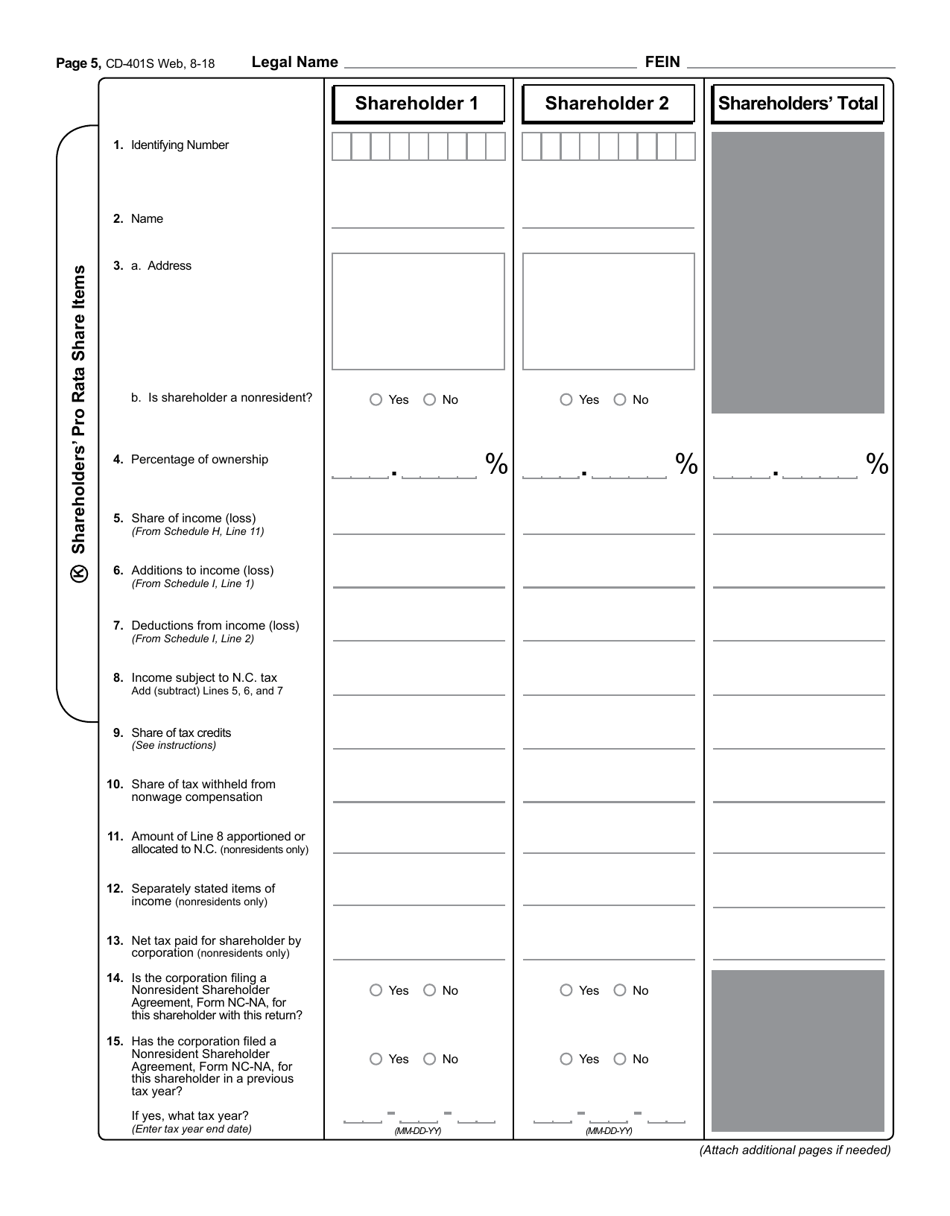

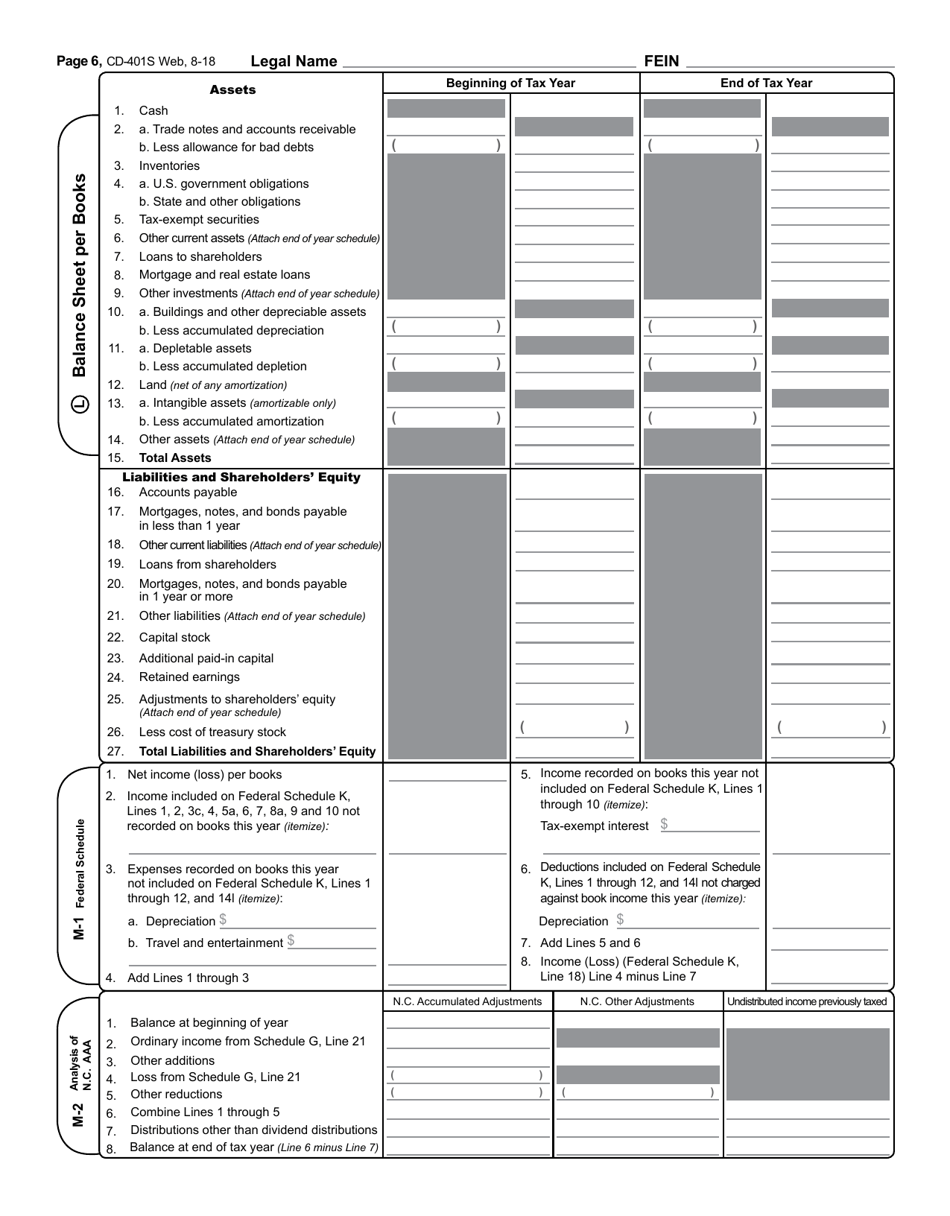

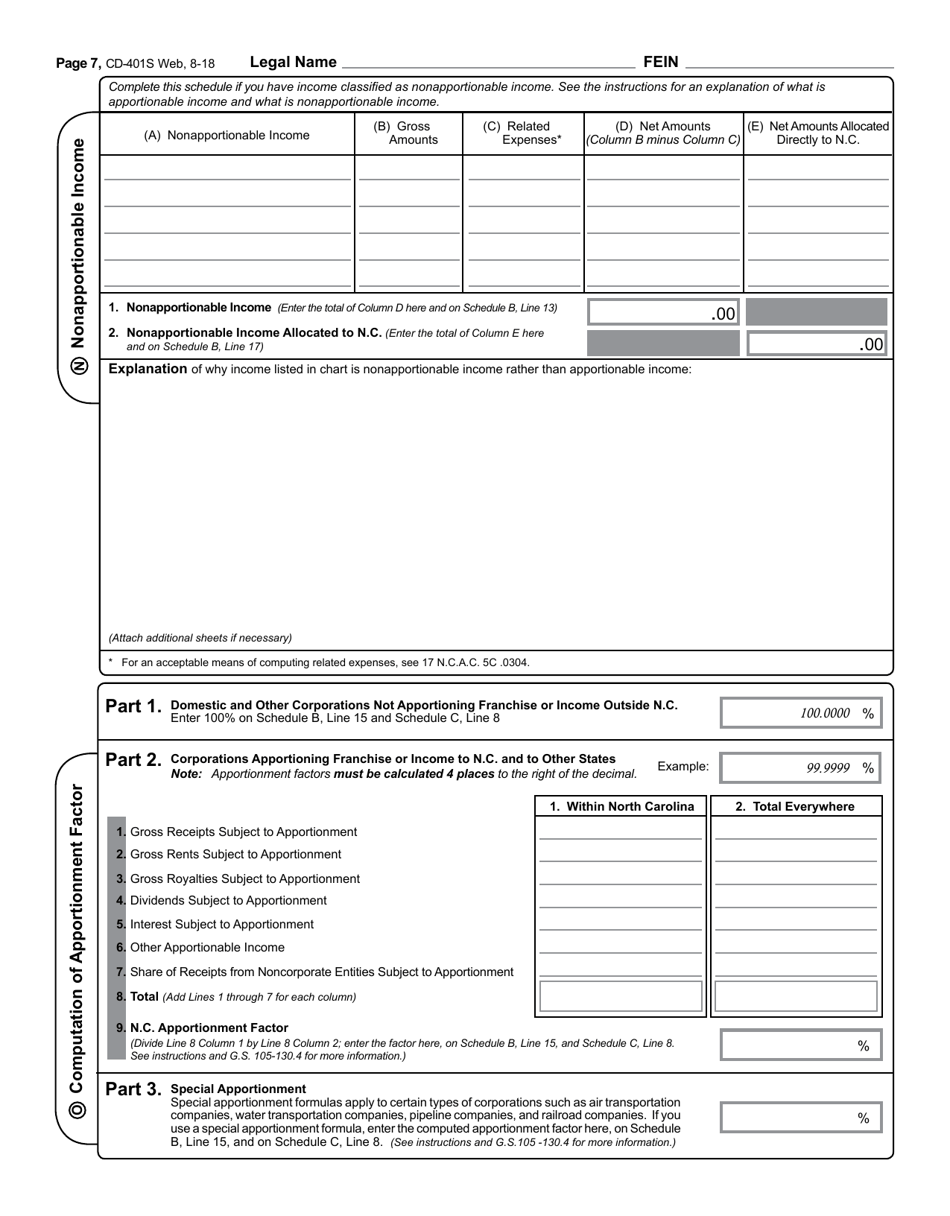

Form CD-401S S-Corporation Tax Return - North Carolina

What Is Form CD-401S?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CD-401S?

A: Form CD-401S is the S-Corporation Tax Return for North Carolina.

Q: Who needs to file Form CD-401S?

A: S-Corporations in North Carolina need to file Form CD-401S.

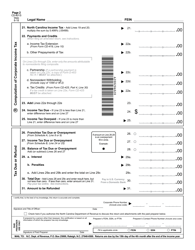

Q: What is the deadline for filing Form CD-401S?

A: The deadline for filing Form CD-401S is the 15th day of the third month after the close of the tax year.

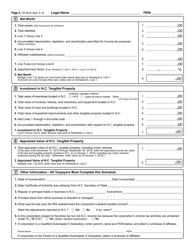

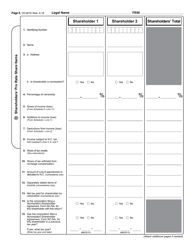

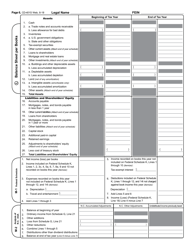

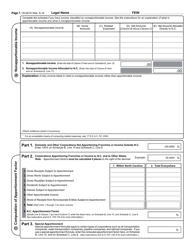

Q: Are there any special requirements for filing Form CD-401S?

A: Yes, S-Corporations may be required to attach additional schedules to Form CD-401S depending on their specific circumstances.

Q: Is there a fee for filing Form CD-401S?

A: No, there is no fee for filing Form CD-401S.

Q: What if I can't file Form CD-401S by the deadline?

A: If you can't file Form CD-401S by the deadline, you can request an extension of time to file.

Q: Can I amend my Form CD-401S if I made a mistake?

A: Yes, you can file an amended Form CD-401S to correct any mistakes or omissions.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

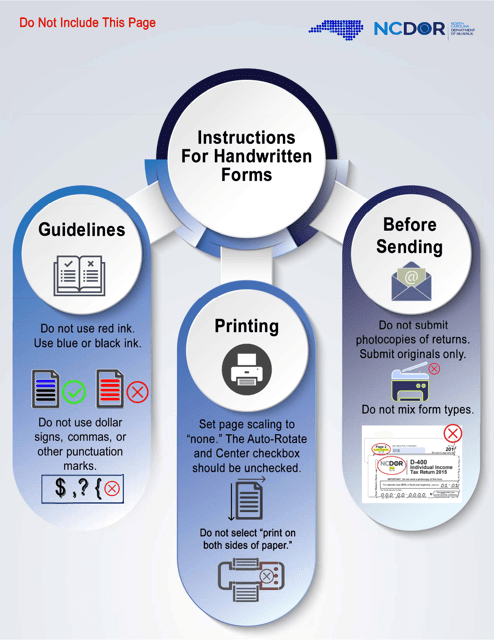

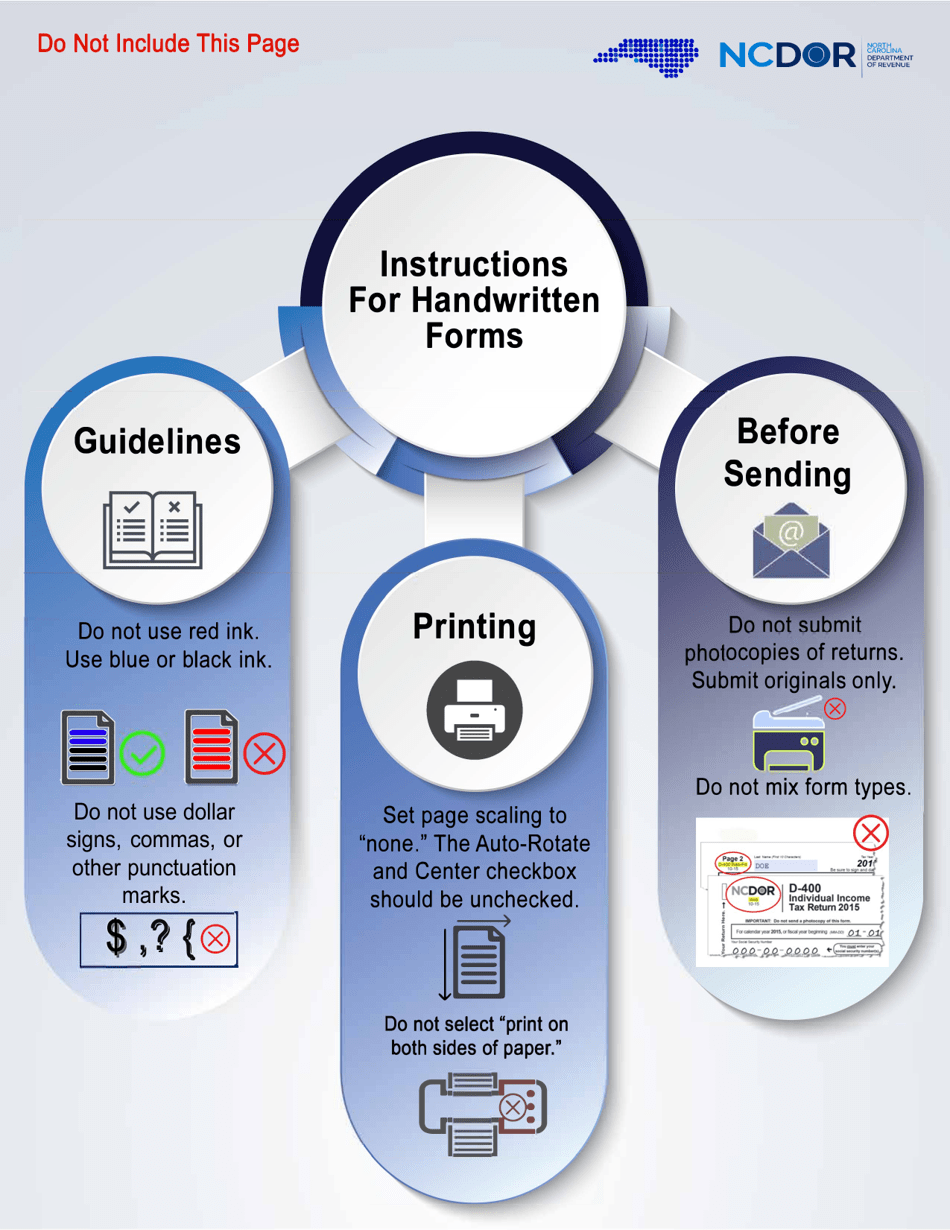

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CD-401S by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.