This version of the form is not currently in use and is provided for reference only. Download this version of

Form CD-429

for the current year.

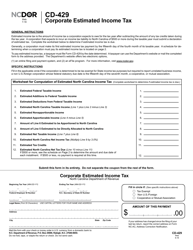

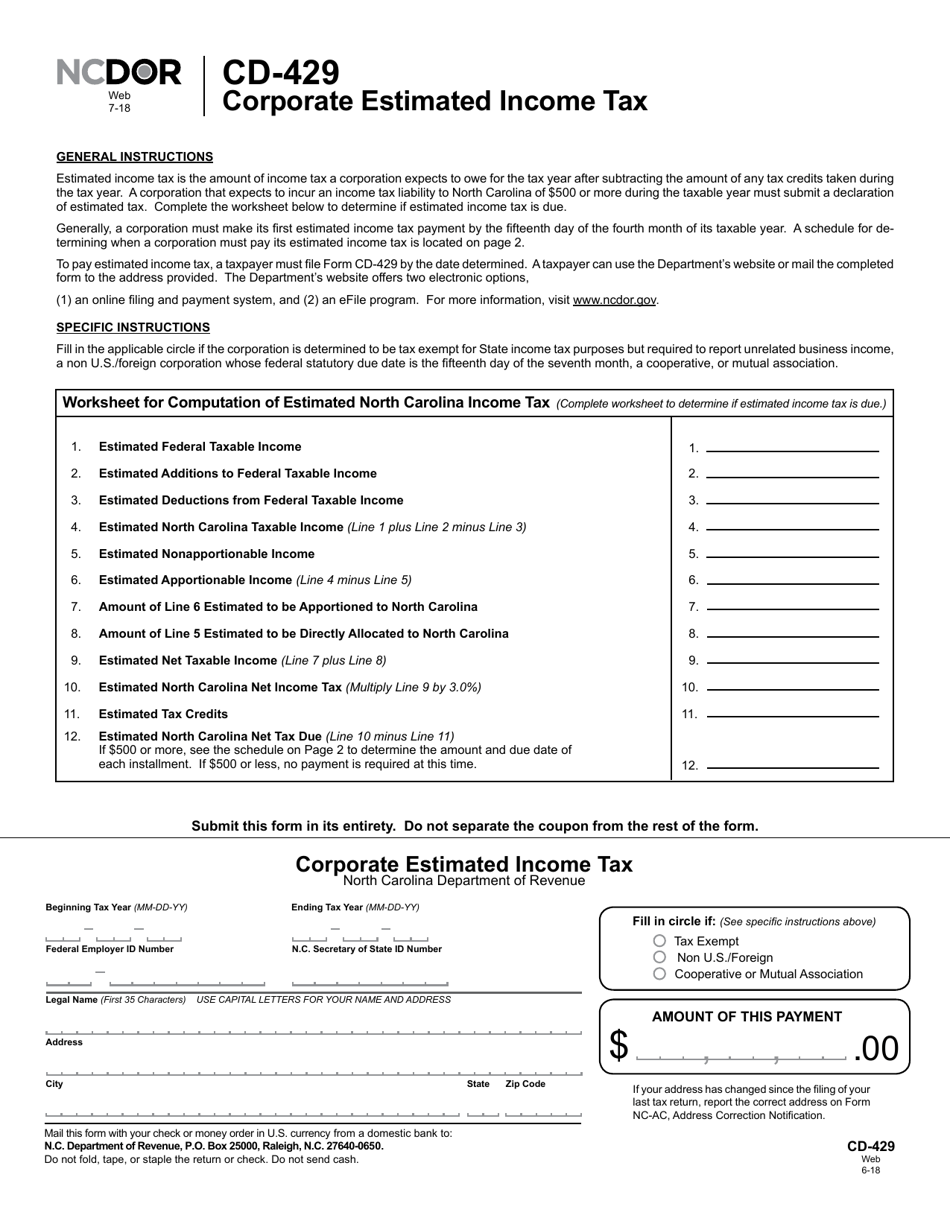

Form CD-429 Corporate Estimated Income Tax - North Carolina

What Is Form CD-429?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CD-429?

A: Form CD-429 is the Corporate Estimated Income Tax form for North Carolina.

Q: Who needs to file Form CD-429?

A: Corporations that have estimated income tax liability in North Carolina need to file Form CD-429.

Q: What is the purpose of Form CD-429?

A: Form CD-429 is used to calculate and pay estimated income tax for corporations in North Carolina.

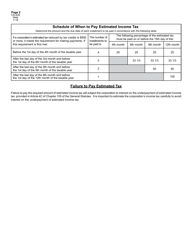

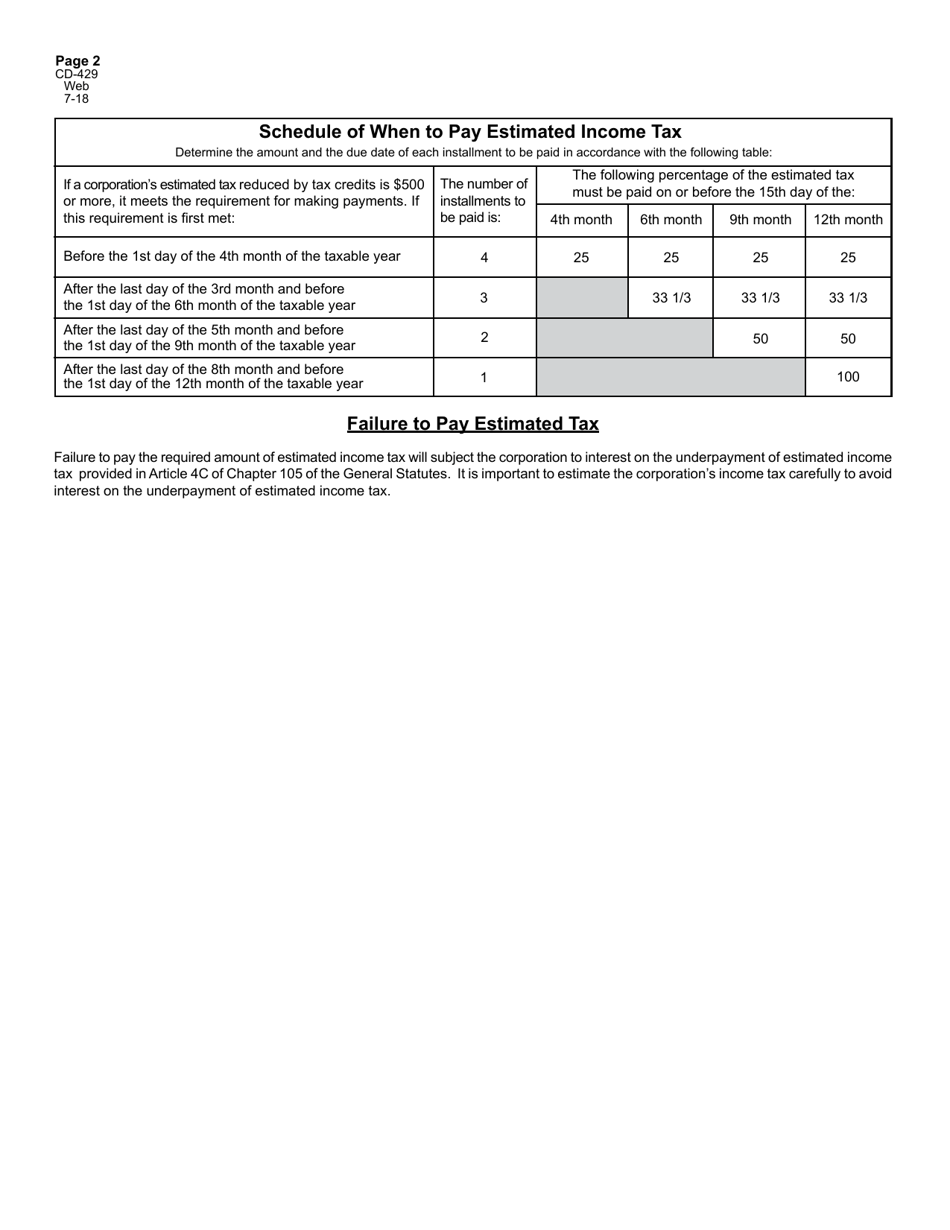

Q: When is Form CD-429 due?

A: Form CD-429 is due on the 15th day of the 4th, 6th, 9th, and 12th months of the corporation's tax year.

Q: What information is required on Form CD-429?

A: Form CD-429 requires the corporation to provide information on its estimated income tax liability and make the necessary payment.

Q: Are there any penalties for not filing Form CD-429?

A: Yes, there are penalties for not filing Form CD-429 or for underpaying estimated tax. It is important to file and pay on time to avoid these penalties.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

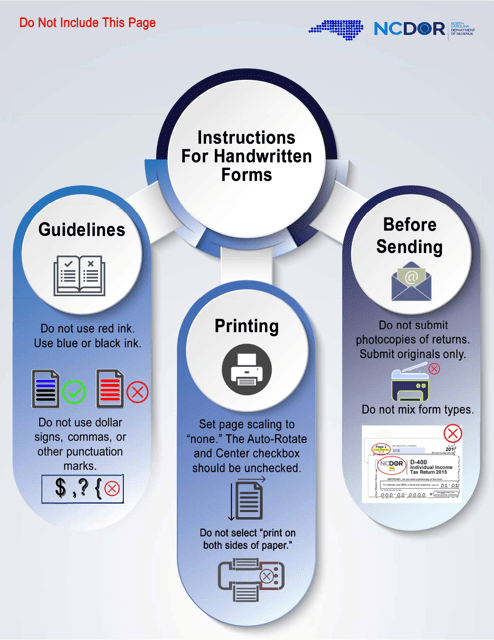

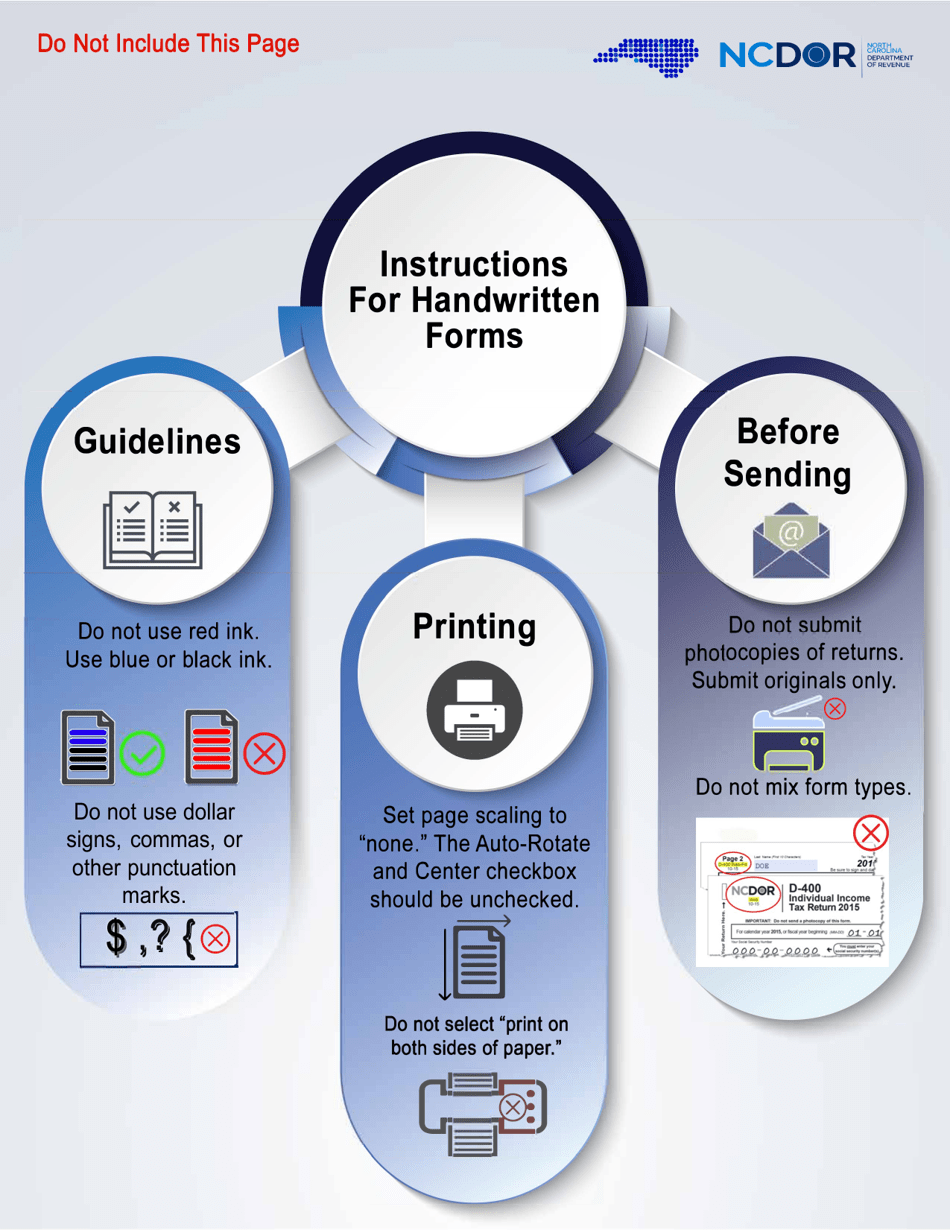

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CD-429 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.