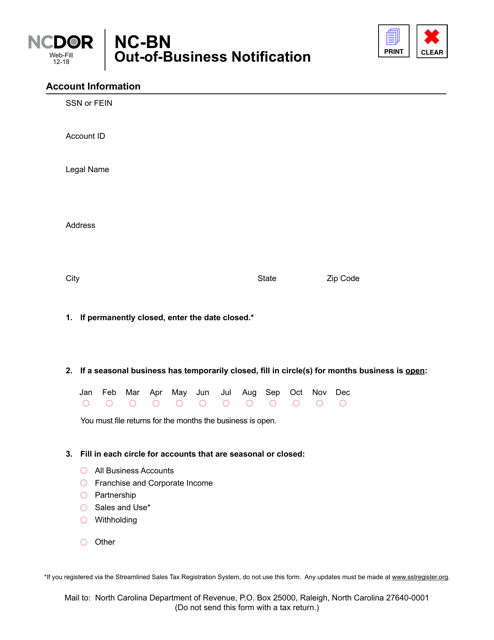

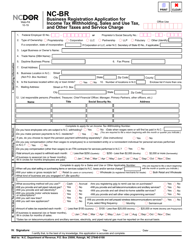

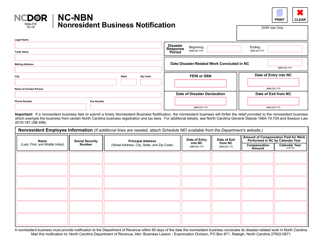

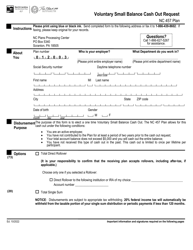

Form NC-BN Out-Of-Business Notification - North Carolina

What Is Form NC-BN?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NC-BN?

A: Form NC-BN is an Out-Of-Business Notification form for businesses in North Carolina.

Q: When should businesses use Form NC-BN?

A: Businesses should use Form NC-BN to notify the North Carolina Department of Revenue when they are going out of business or ceasing operations in the state.

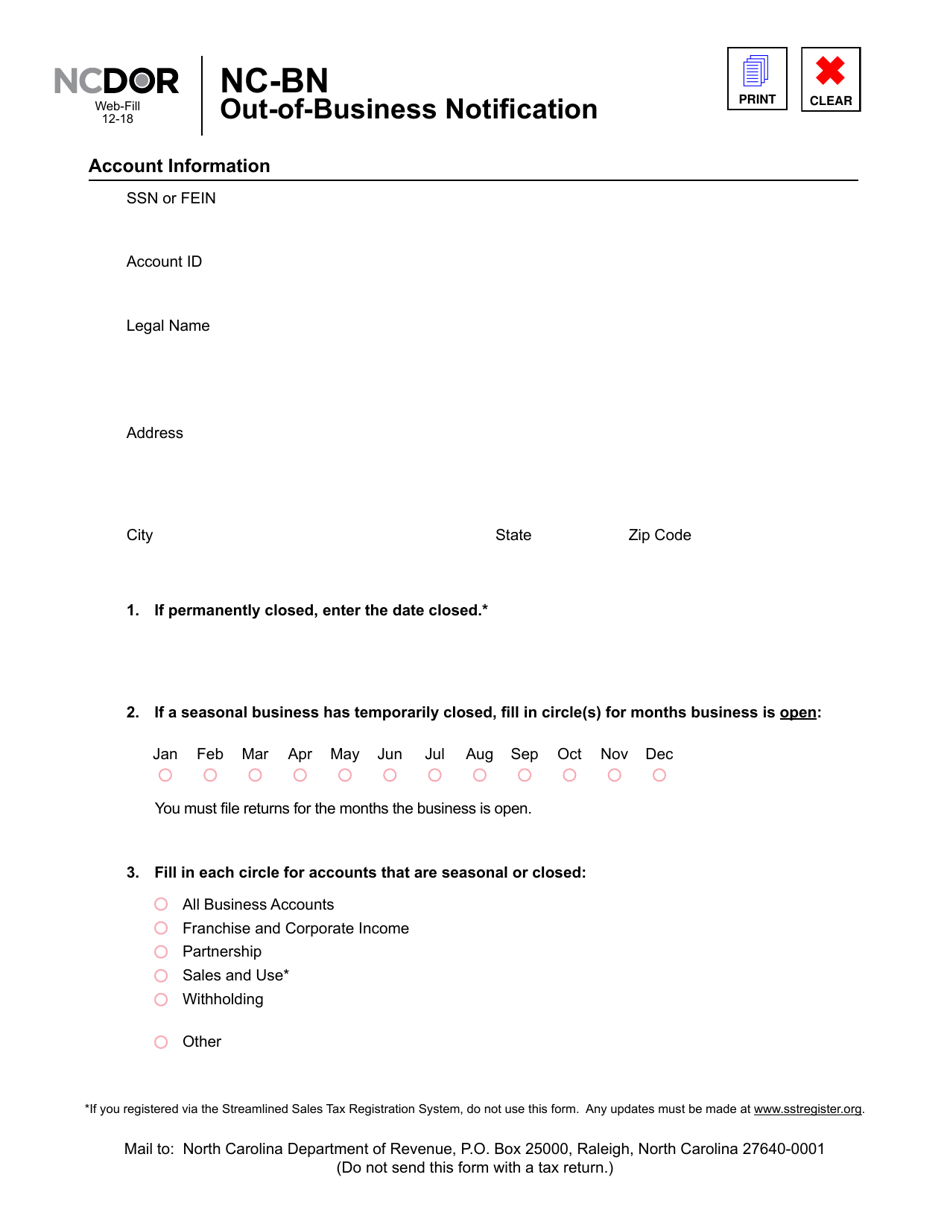

Q: What information is required on Form NC-BN?

A: Form NC-BN requires businesses to provide their name, address, contact information, Employer Identification Number (EIN), date of final business activity, and other relevant details.

Q: What is the purpose of submitting Form NC-BN?

A: Submitting Form NC-BN helps the North Carolina Department of Revenue update their records and ensures that businesses are no longer responsible for state tax obligations.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NC-BN by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.