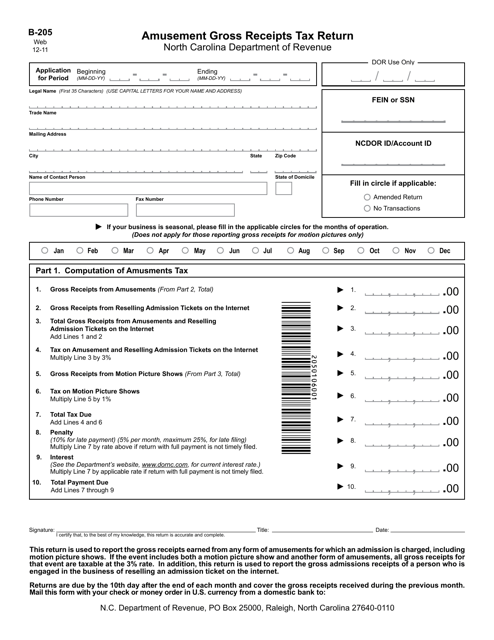

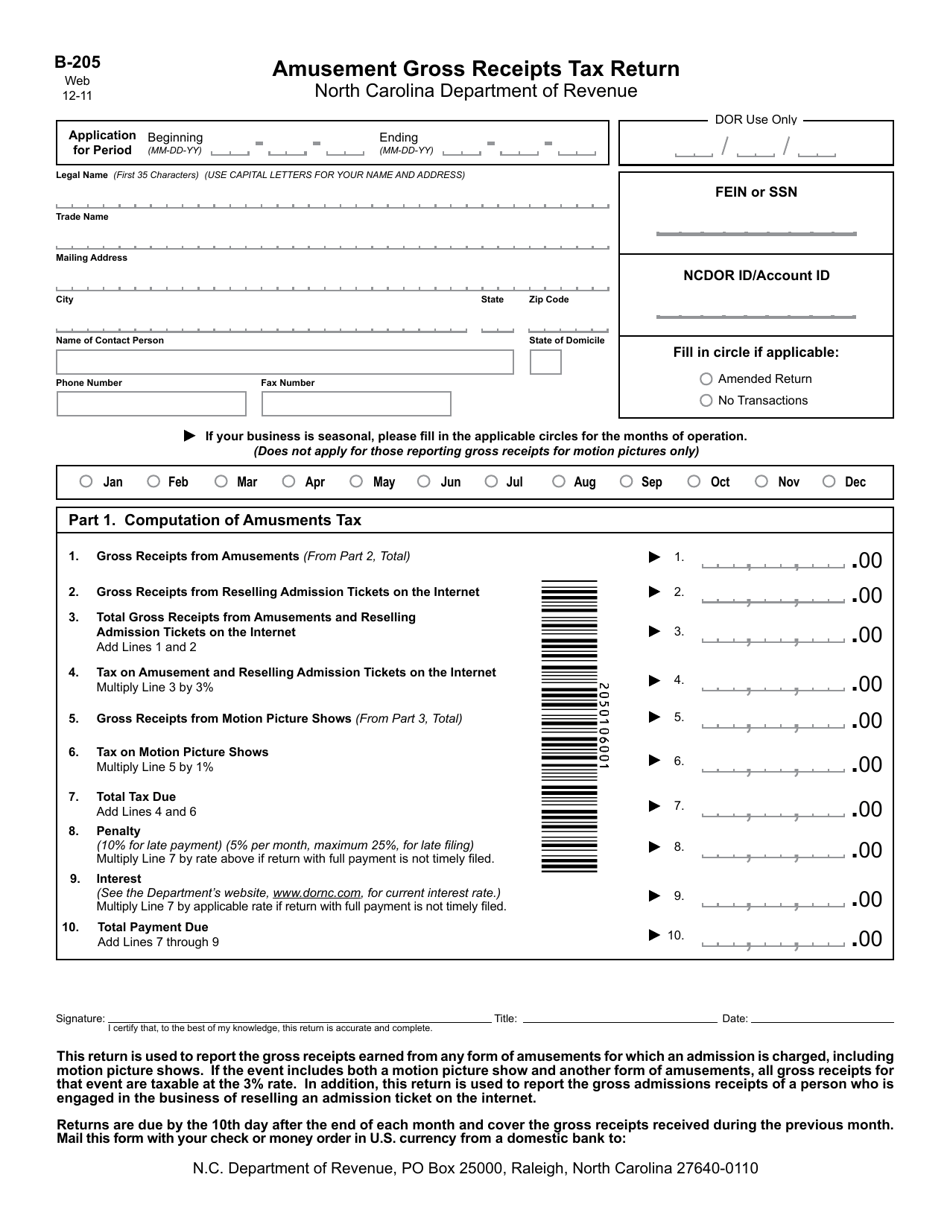

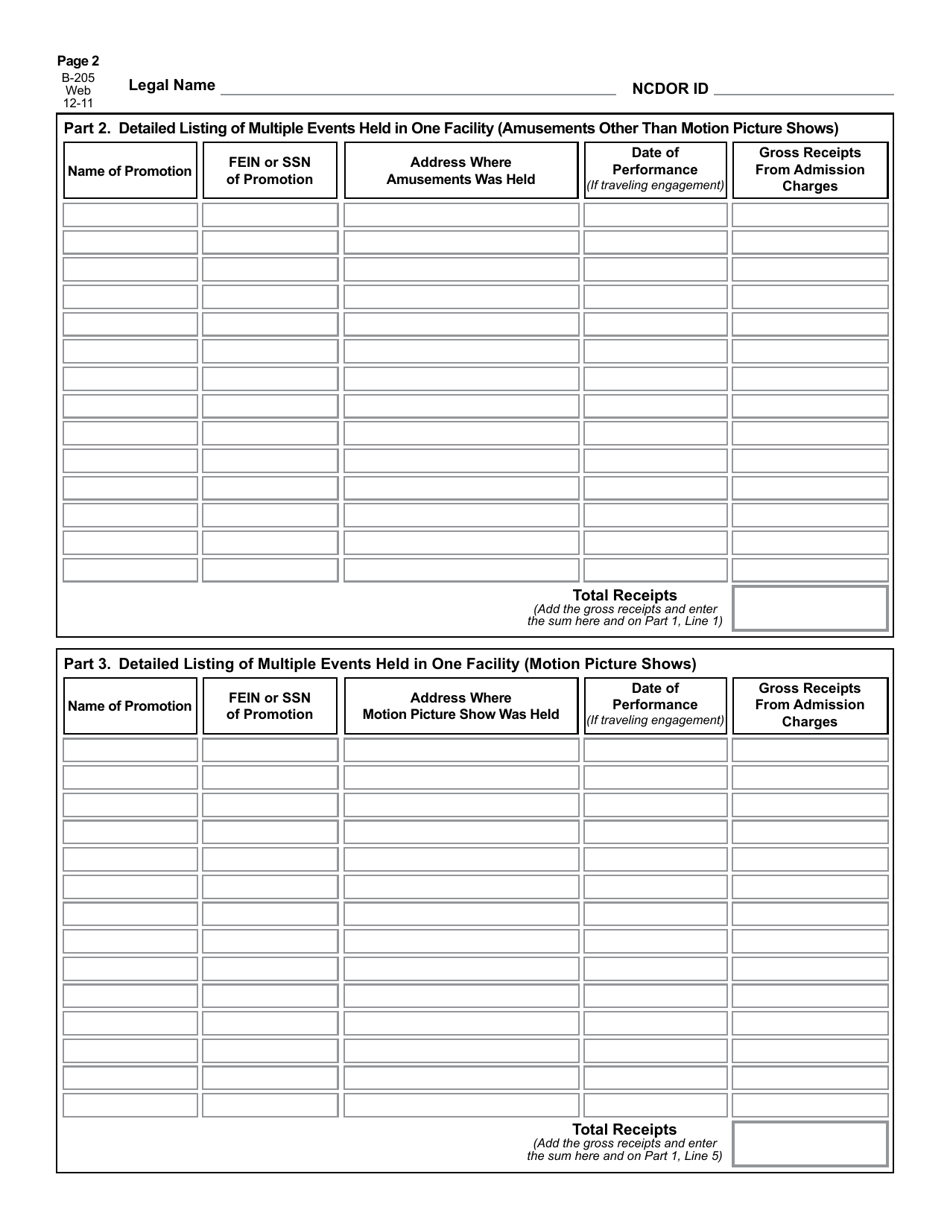

Form B-205 Amusement Gross Receipts Tax Return - North Carolina

What Is Form B-205?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form B-205?

A: Form B-205 is the Amusement Gross Receipts Tax Return used in North Carolina.

Q: Who needs to file Form B-205?

A: Anyone that operates an amusement business in North Carolina and receives gross receipts of $10,000 or more in a year needs to file Form B-205.

Q: What is the purpose of Form B-205?

A: The purpose of Form B-205 is to report and pay the Amusement Gross Receipts Tax to the North Carolina Department of Revenue.

Q: What is Amusement Gross Receipts Tax?

A: Amusement Gross Receipts Tax is a tax imposed on the gross receipts from amusement activities in North Carolina.

Q: When is Form B-205 due?

A: Form B-205 is due on or before the 20th day of the month following the end of the reporting period.

Q: What happens if I don't file Form B-205?

A: Failure to file Form B-205 or pay the Amusement Gross Receipts Tax can result in penalties and interest.

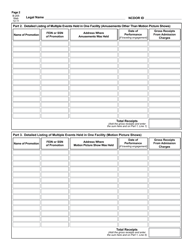

Q: What information do I need to complete Form B-205?

A: You will need to provide information about your amusement business, including gross receipts and any exemptions or deductions.

Q: Are there any exemptions or deductions available for Form B-205?

A: Yes, there are exemptions and deductions available for certain amusement activities, such as sales to nonprofits or receipts from certain events.

Form Details:

- Released on December 1, 2011;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form B-205 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.