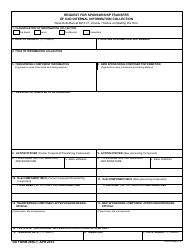

This version of the form is not currently in use and is provided for reference only. Download this version of

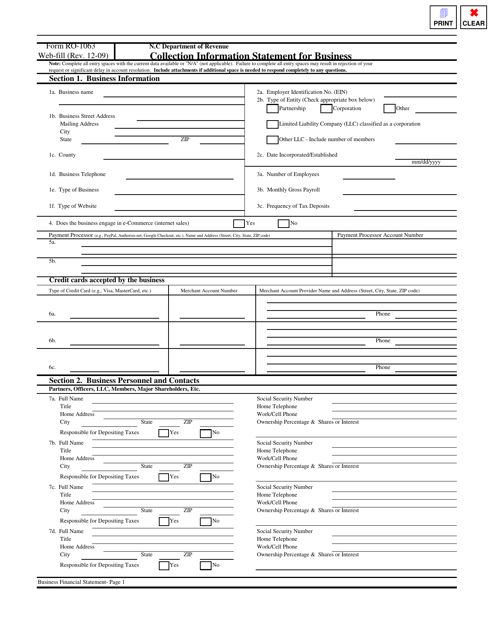

Form RO-1063

for the current year.

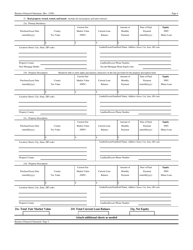

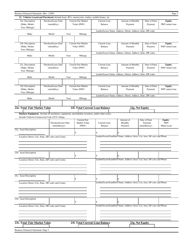

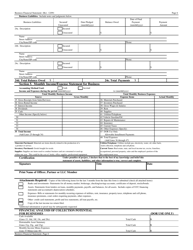

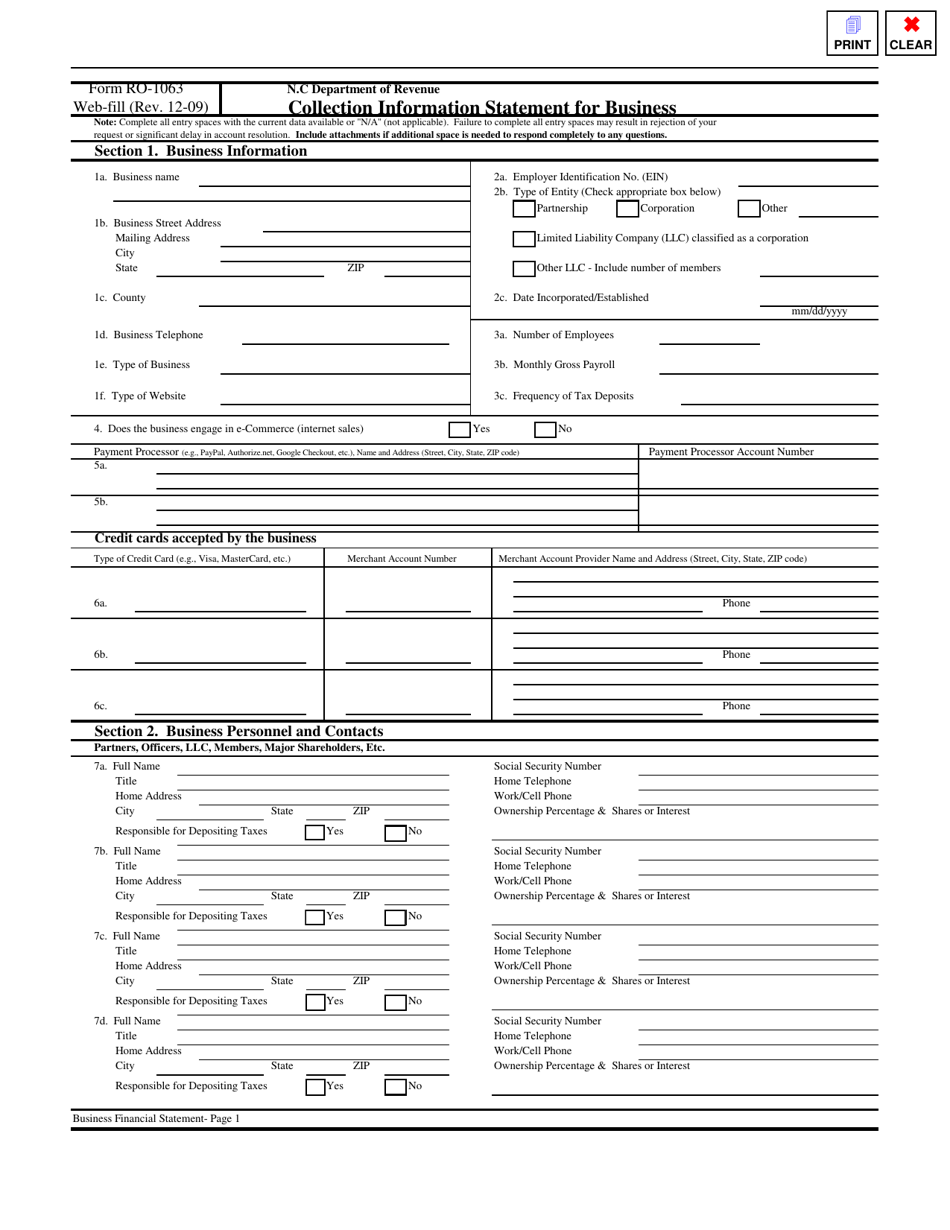

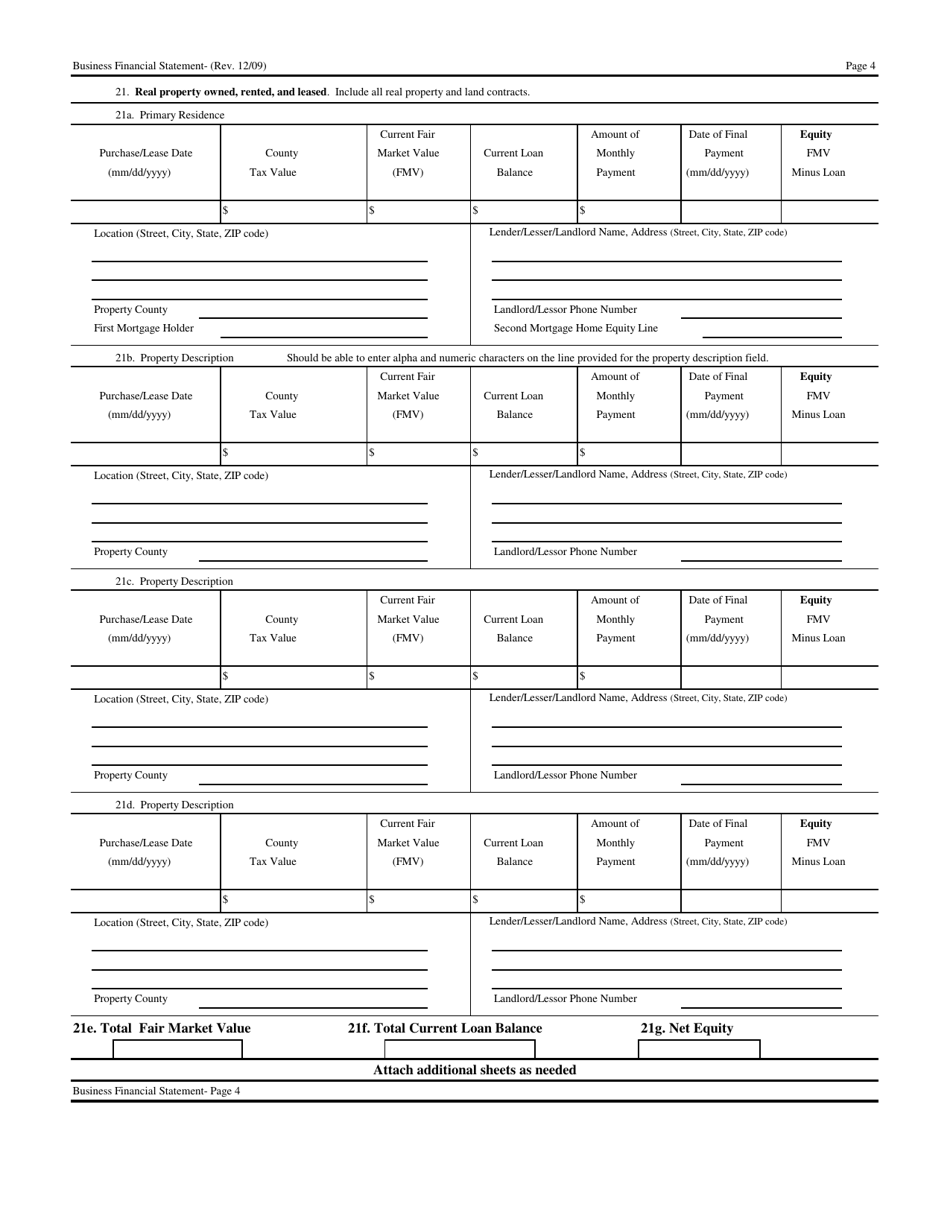

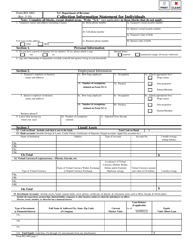

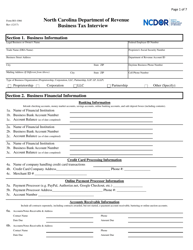

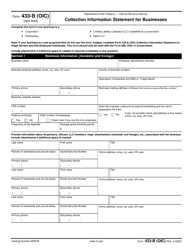

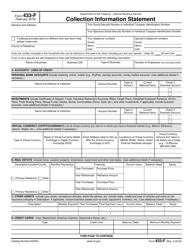

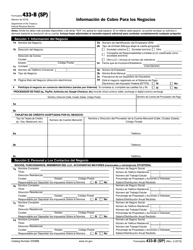

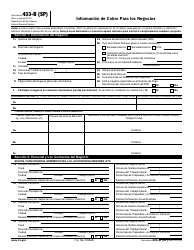

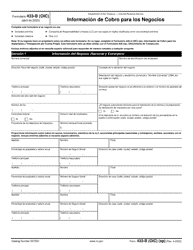

Form RO-1063 Collection Information Statement for Business - North Carolina

What Is Form RO-1063?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form RO-1063?

A: Form RO-1063 is the Collection Information Statement for Business in North Carolina.

Q: Who needs to file form RO-1063?

A: Businesses in North Carolina who owe taxes or have outstanding liabilities may need to file form RO-1063.

Q: What is the purpose of form RO-1063?

A: The purpose of form RO-1063 is to provide detailed financial information about a business to help determine a suitable arrangement for tax payments or debt resolution.

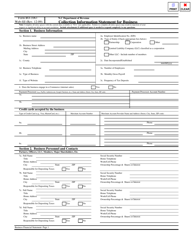

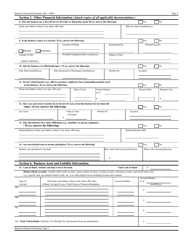

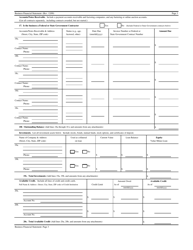

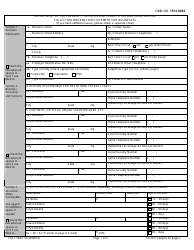

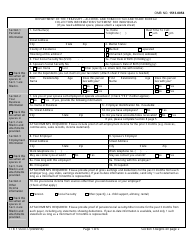

Q: What kind of information is required in form RO-1063?

A: Form RO-1063 requires information about the business's assets, liabilities, income, expenses, and bank accounts.

Q: Are there any penalties for not filing form RO-1063?

A: Yes, failure to file form RO-1063 or providing false information may result in penalties or other legal consequences.

Q: Can I seek professional assistance to fill out form RO-1063?

A: Yes, you can seek professional assistance from a tax professional, accountant, or attorney to help you fill out form RO-1063 correctly.

Q: What should I do after completing form RO-1063?

A: After completing form RO-1063, you should submit it to the North Carolina Department of Revenue according to their instructions.

Form Details:

- Released on December 1, 2009;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RO-1063 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.