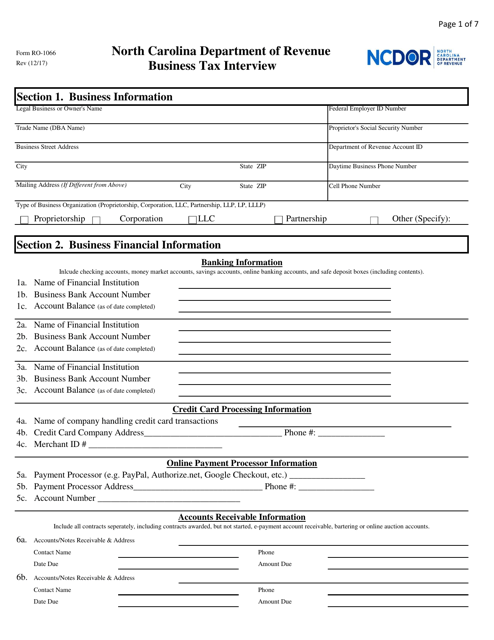

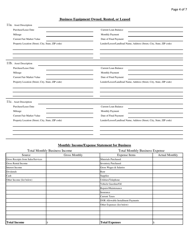

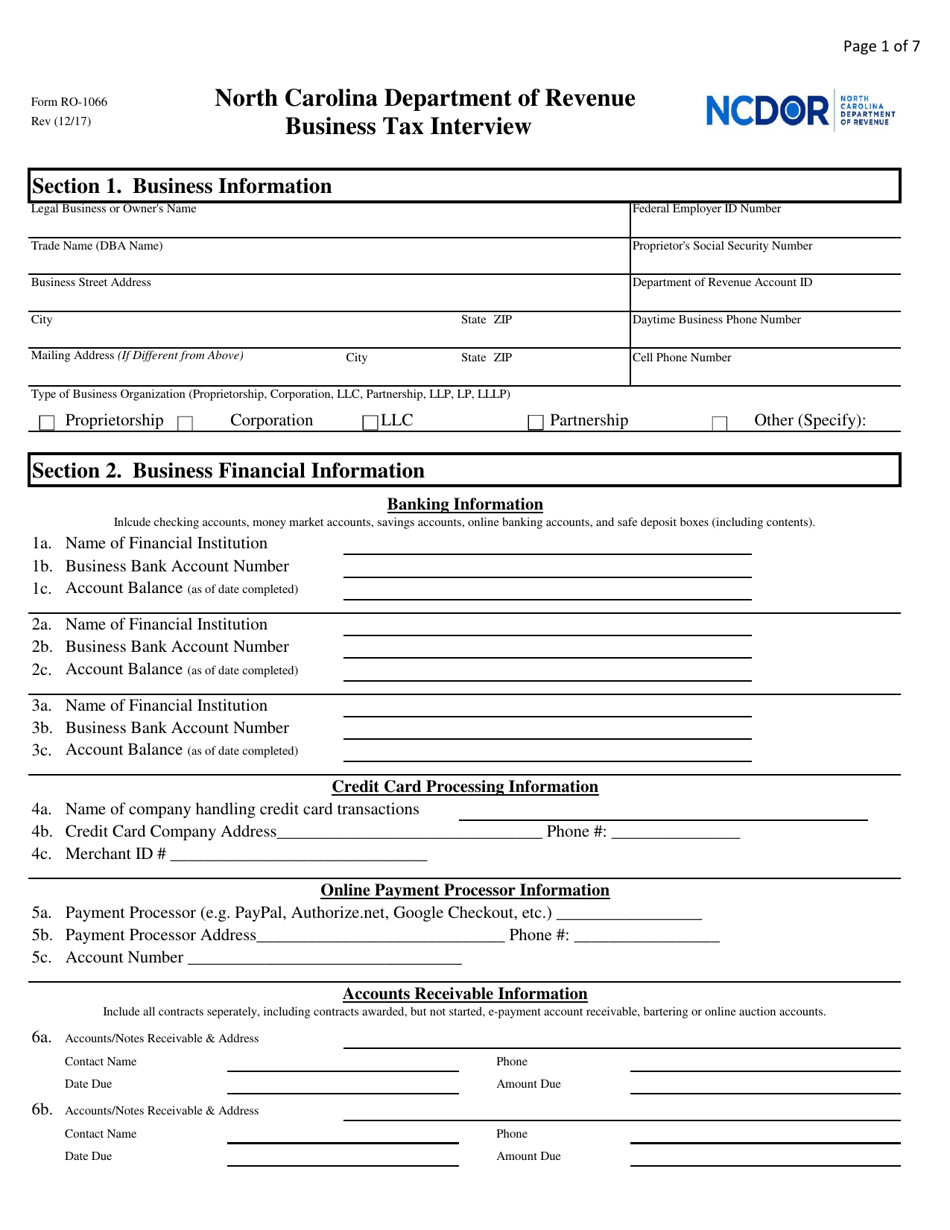

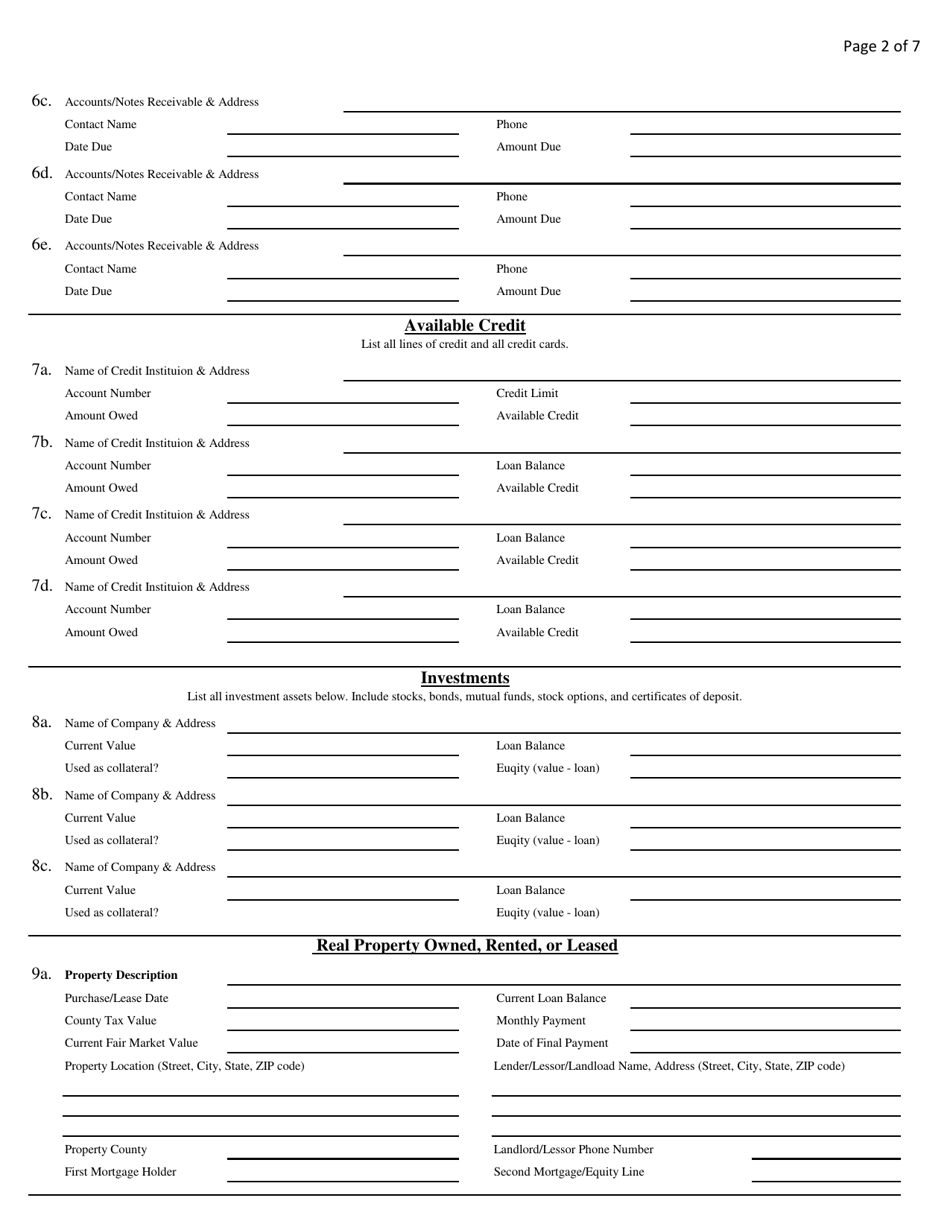

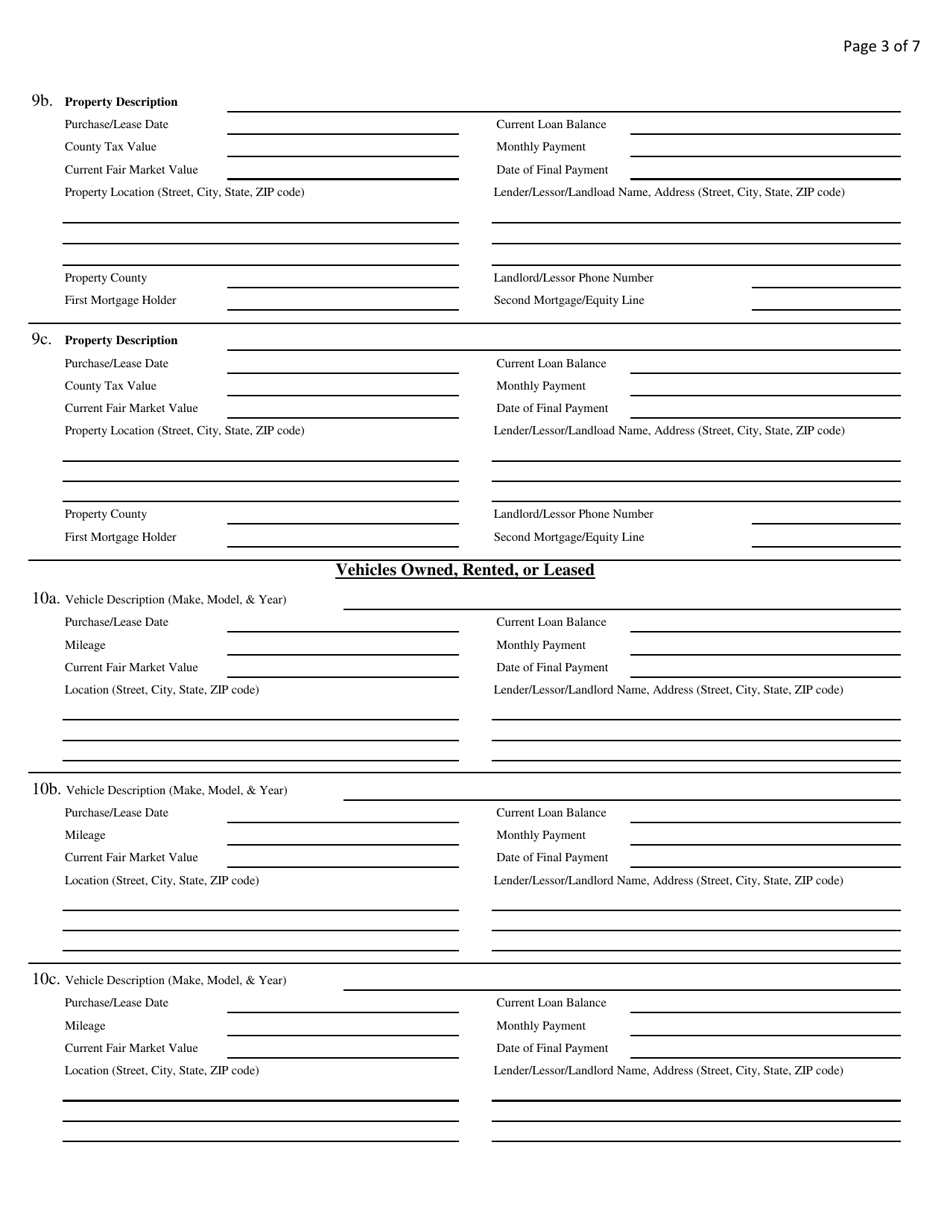

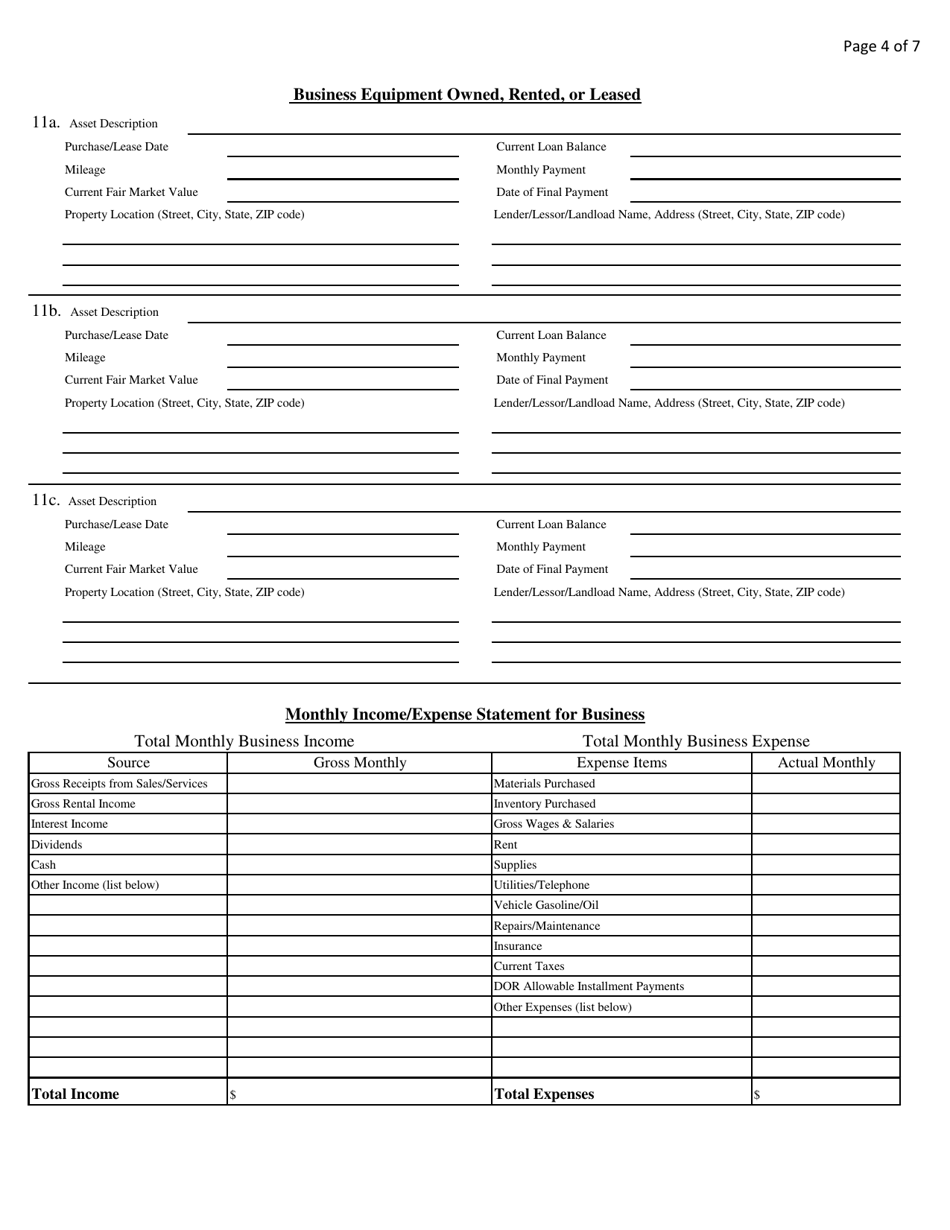

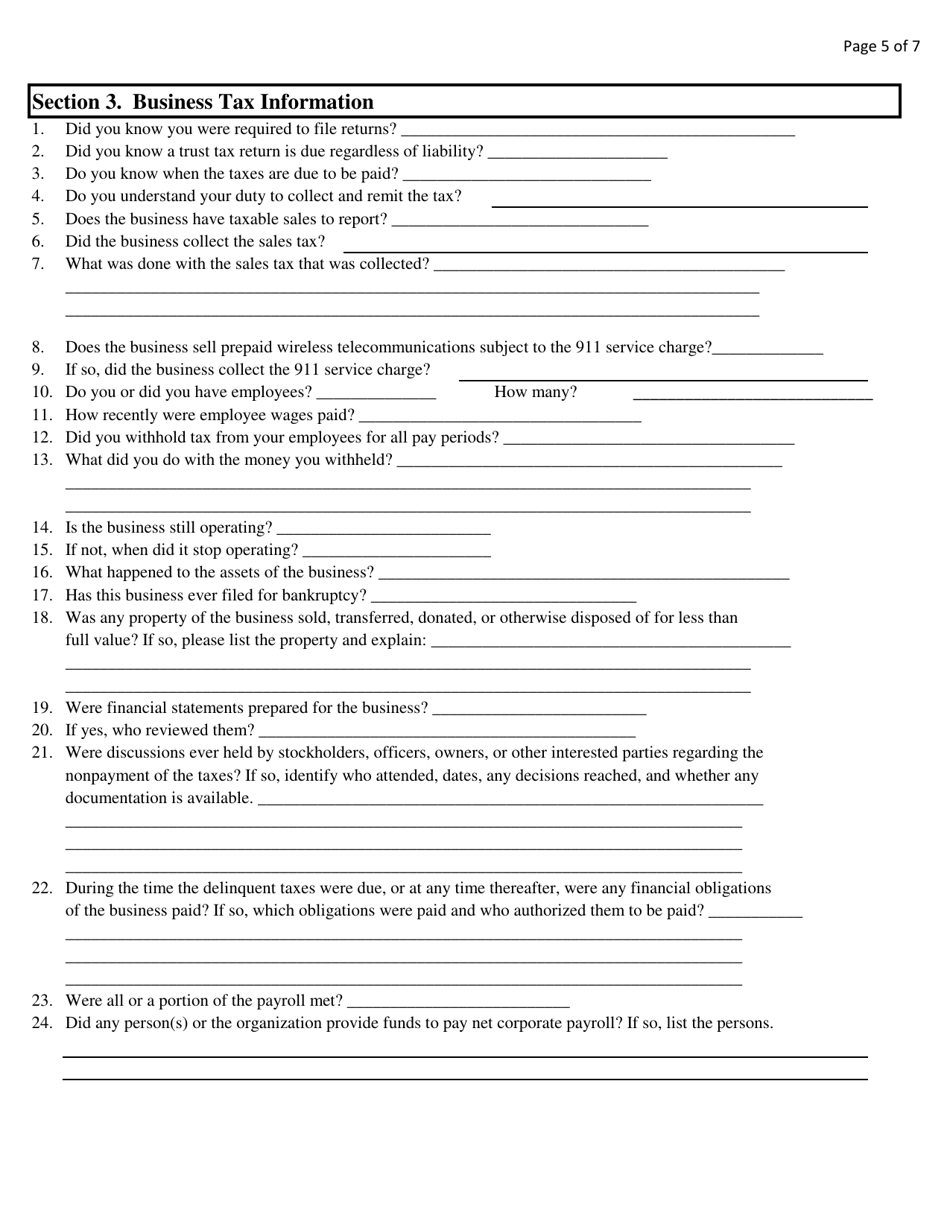

Form RO-1066 Business Tax Interview - North Carolina

What Is Form RO-1066?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form RO-1066?

A: The Form RO-1066 is the Business Tax Interview form in North Carolina.

Q: Who needs to fill out the Form RO-1066?

A: Business entities operating in North Carolina need to fill out the Form RO-1066.

Q: What is the purpose of the Form RO-1066?

A: The Form RO-1066 is used to gather information about the business for tax purposes.

Q: Are there any filing fees associated with the Form RO-1066?

A: No, there are no filing fees for the Form RO-1066.

Q: When is the deadline for filing the Form RO-1066?

A: The deadline for filing the Form RO-1066 is generally on or before the 15th day of the fourth month following the close of the business tax year.

Q: What happens if I don't file the Form RO-1066?

A: Failure to file the Form RO-1066 may result in penalties or interest charges.

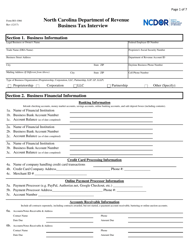

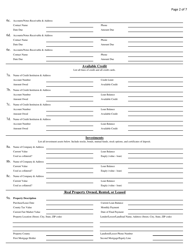

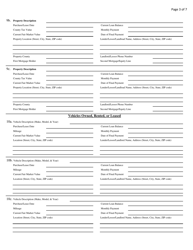

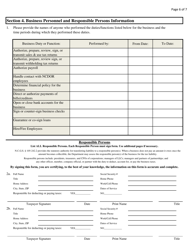

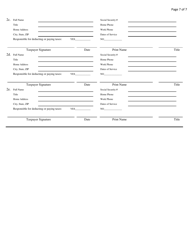

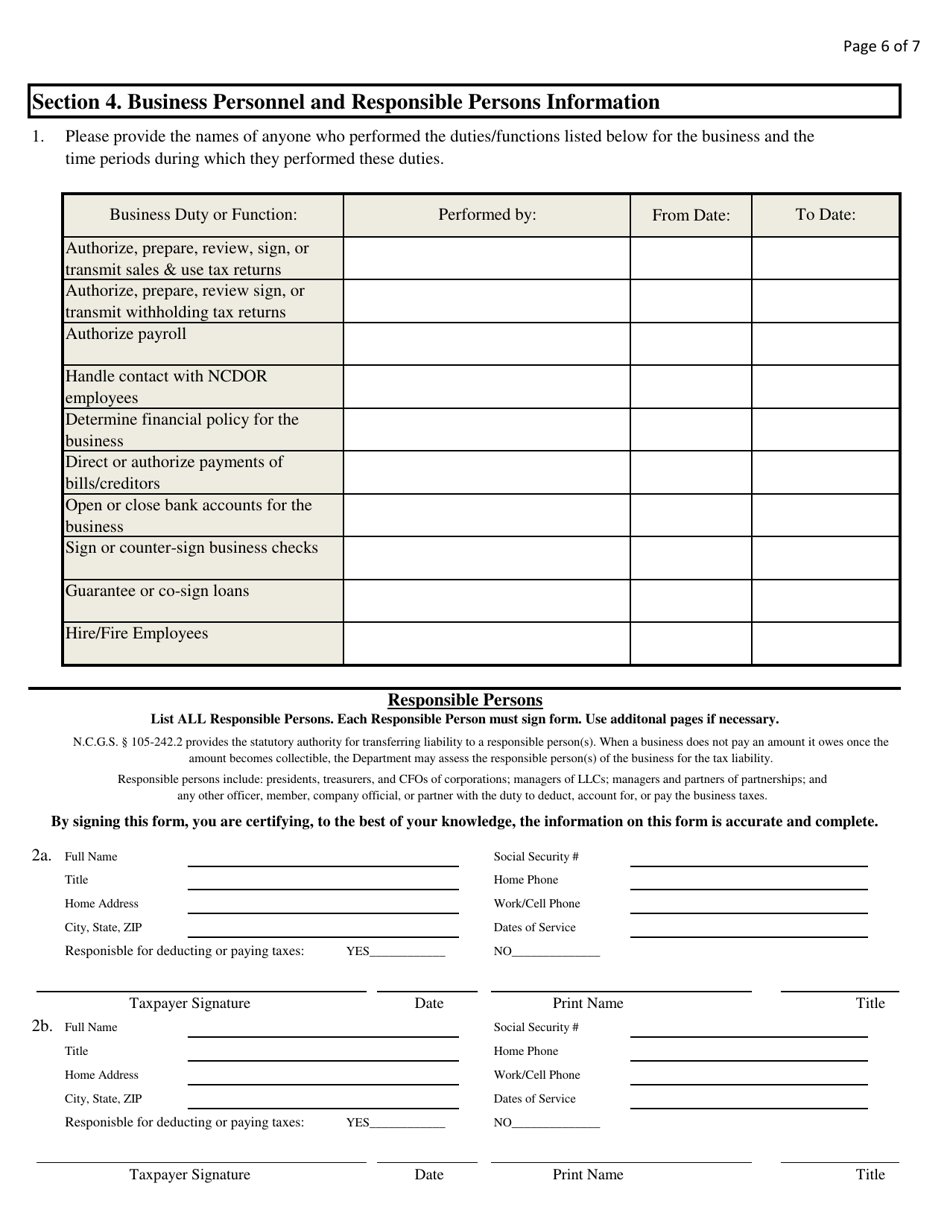

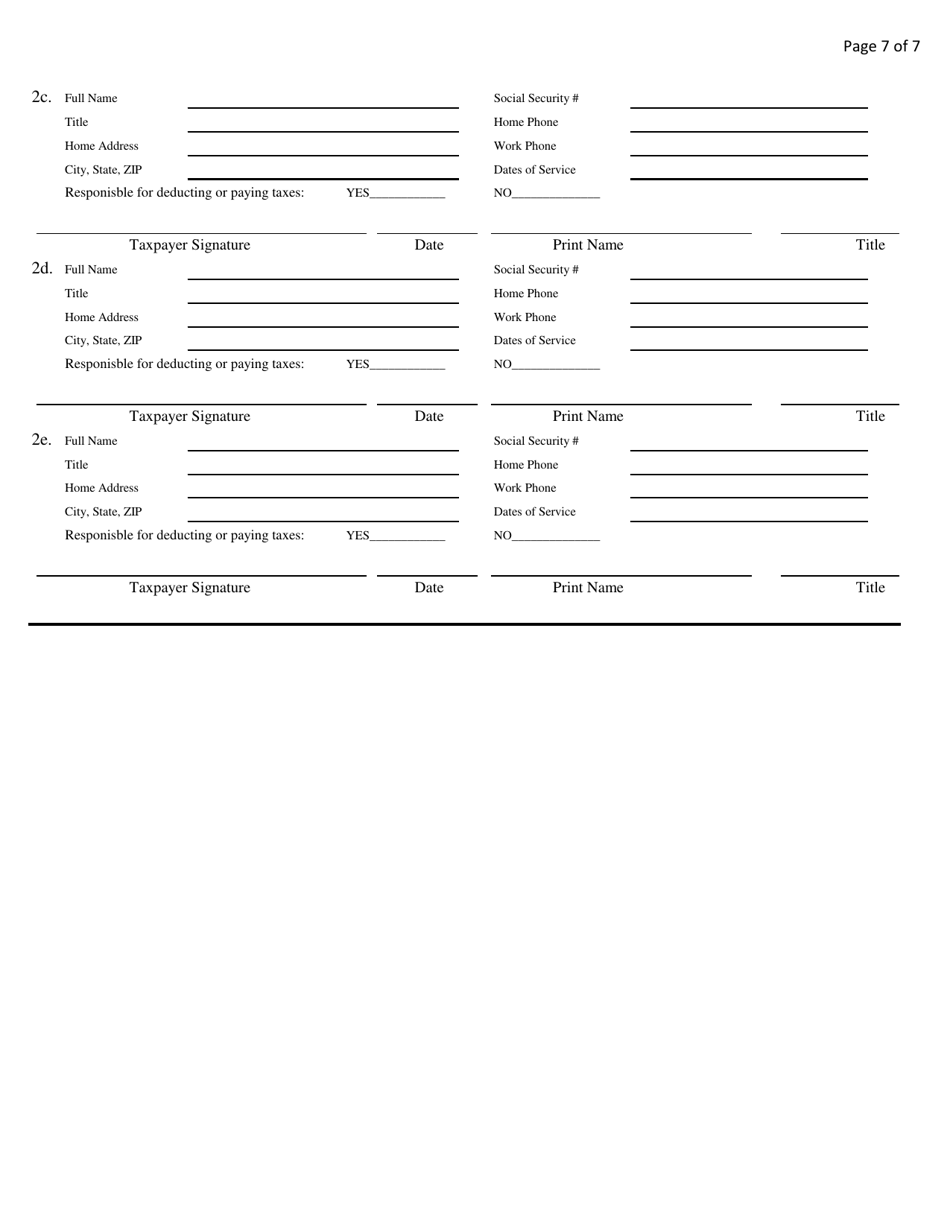

Q: What information do I need to provide on the Form RO-1066?

A: You will need to provide information about your business, such as its name, address, federal employer identification number, and gross receipts.

Q: Are there any specific instructions for filling out the Form RO-1066?

A: Yes, the Form RO-1066 comes with detailed instructions that should be followed to accurately complete the form.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RO-1066 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.