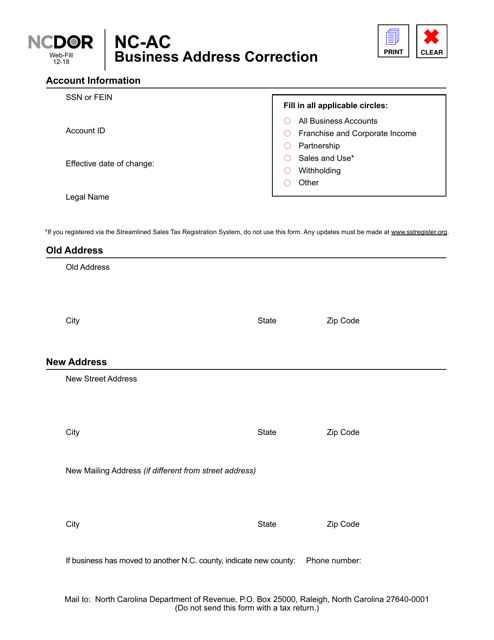

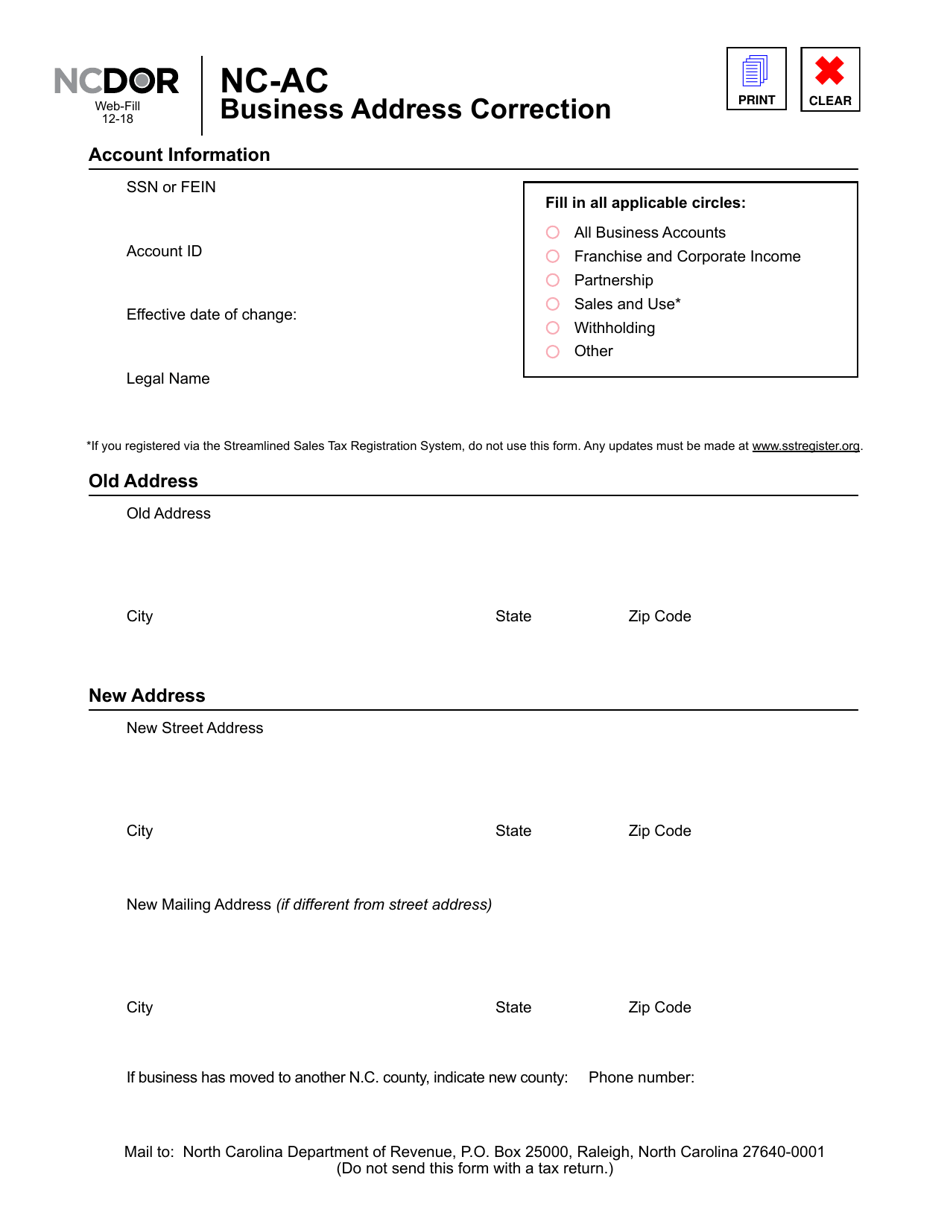

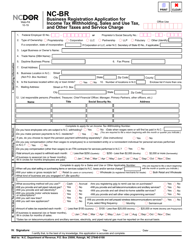

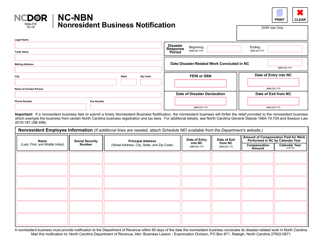

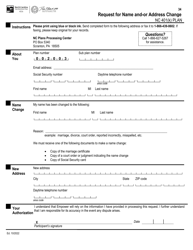

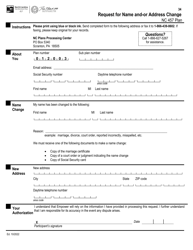

Form NC-AC Business Address Correction - North Carolina

What Is Form NC-AC?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form NC-AC?

A: Form NC-AC is a form for business address correction in North Carolina.

Q: Why would I need to use Form NC-AC?

A: You would need to use Form NC-AC if the address of your business in North Carolina has changed and you need to update it.

Q: How do I use Form NC-AC?

A: To use Form NC-AC, you need to fill out the form with your updated business address information and submit it according to the instructions provided.

Q: Is there a fee for submitting Form NC-AC?

A: Yes, there is a filing fee associated with submitting Form NC-AC. The fee amount may vary, so it's best to check the instructions or contact the Secretary of State office for the current fee.

Q: Are there any deadlines for submitting Form NC-AC?

A: There are no specific deadlines mentioned for submitting Form NC-AC. However, it is recommended to update your business address as soon as possible to avoid any potential issues.

Q: What happens after I submit Form NC-AC?

A: After you submit Form NC-AC, your business address will be updated in the official records maintained by the North Carolina Secretary of State.

Q: Can I make other changes to my business information using Form NC-AC?

A: No, Form NC-AC is specifically for business address corrections. If you need to make other changes, you may need to use a different form or contact the Secretary of State office for guidance.

Q: Is Form NC-AC applicable only to businesses in North Carolina?

A: Yes, Form NC-AC is applicable only to businesses registered in North Carolina and need to update their address information.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NC-AC by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.