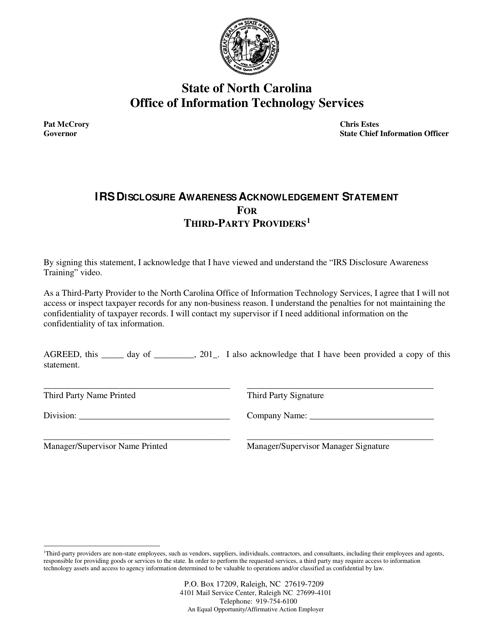

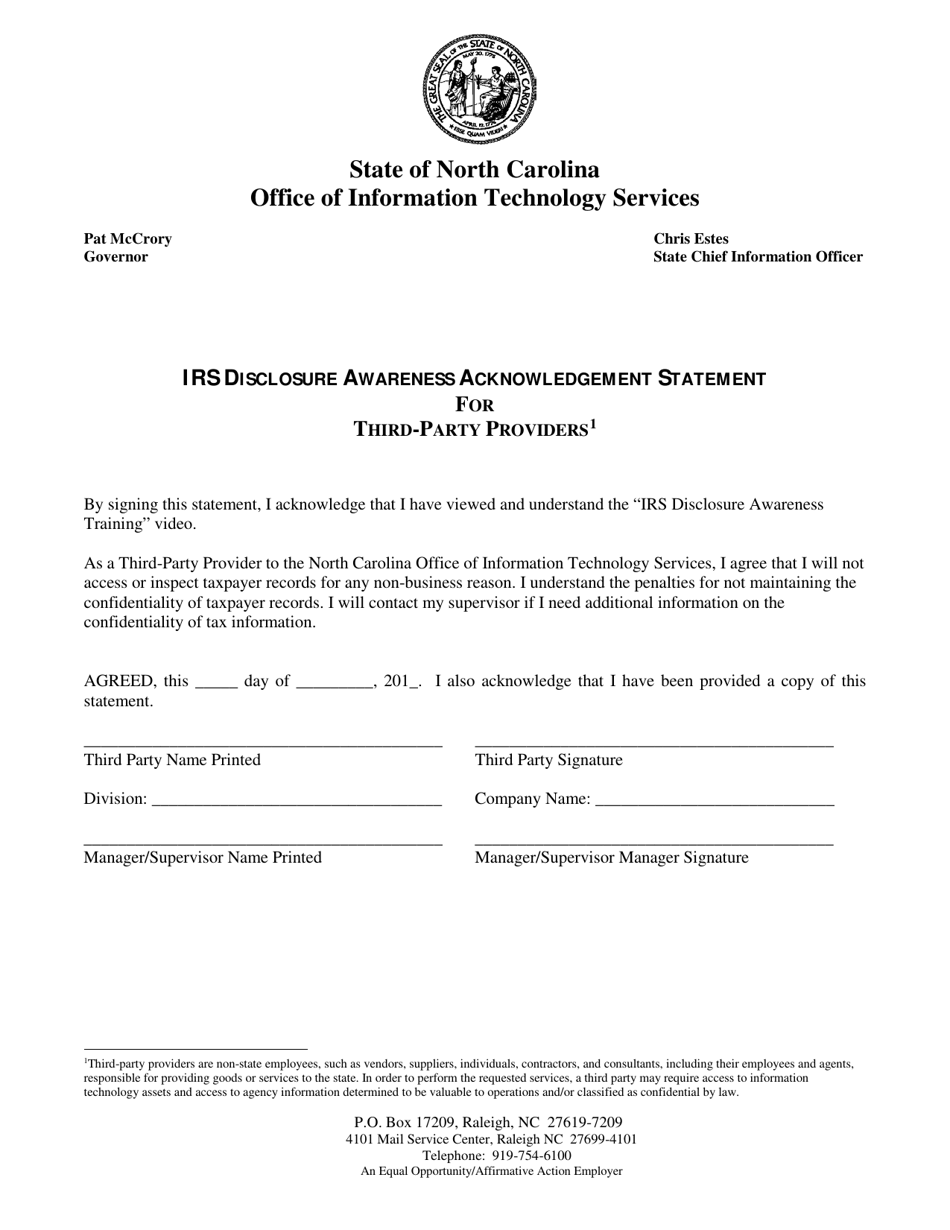

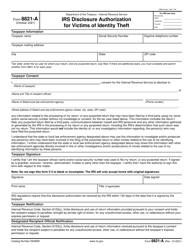

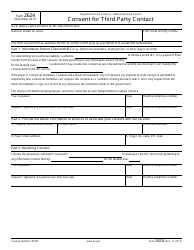

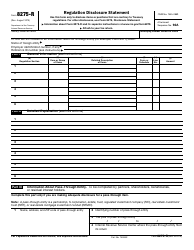

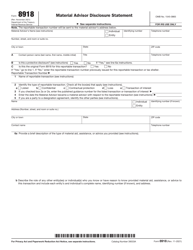

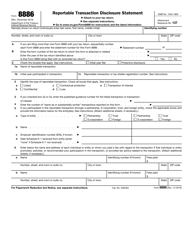

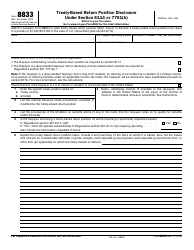

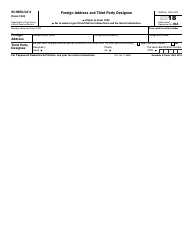

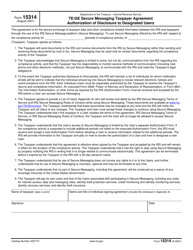

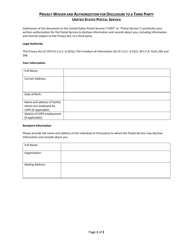

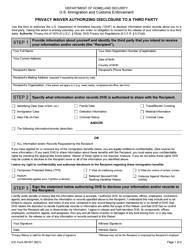

IRS Disclosure Awareness Acknowledgement Statement for Third-Party Providers - North Carolina

IRS Disclosure Awareness Acknowledgement Statement for Third-Party Providers is a legal document that was released by the North Carolina Department of Information Technology - a government authority operating within North Carolina.

FAQ

Q: What is the IRS Disclosure Awareness Acknowledgement Statement?

A: The IRS Disclosure Awareness Acknowledgement Statement is a document that acknowledges the awareness of certain IRS regulations.

Q: Who needs to complete the IRS Disclosure Awareness Acknowledgement Statement?

A: Third-party providers in North Carolina who have access to taxpayer information need to complete this statement.

Q: What does the IRS Disclosure Awareness Acknowledgement Statement confirm?

A: The statement confirms that the third-party provider understands and will comply with IRS regulations regarding the disclosure and protection of taxpayer information.

Q: How do I complete the IRS Disclosure Awareness Acknowledgement Statement?

A: You need to review the statement, sign and date it, and submit it to the appropriate authority as specified in the instructions.

Q: Why is the IRS Disclosure Awareness Acknowledgement Statement important?

A: It ensures that third-party providers handling taxpayer information are aware of their responsibilities and obligations to safeguard sensitive data.

Form Details:

- The latest edition currently provided by the North Carolina Department of Information Technology;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the North Carolina Department of Information Technology.