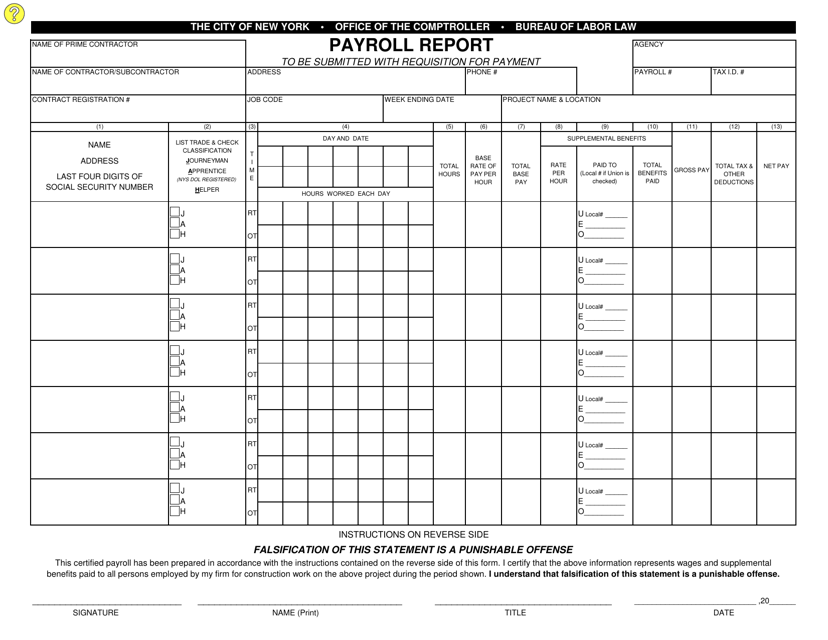

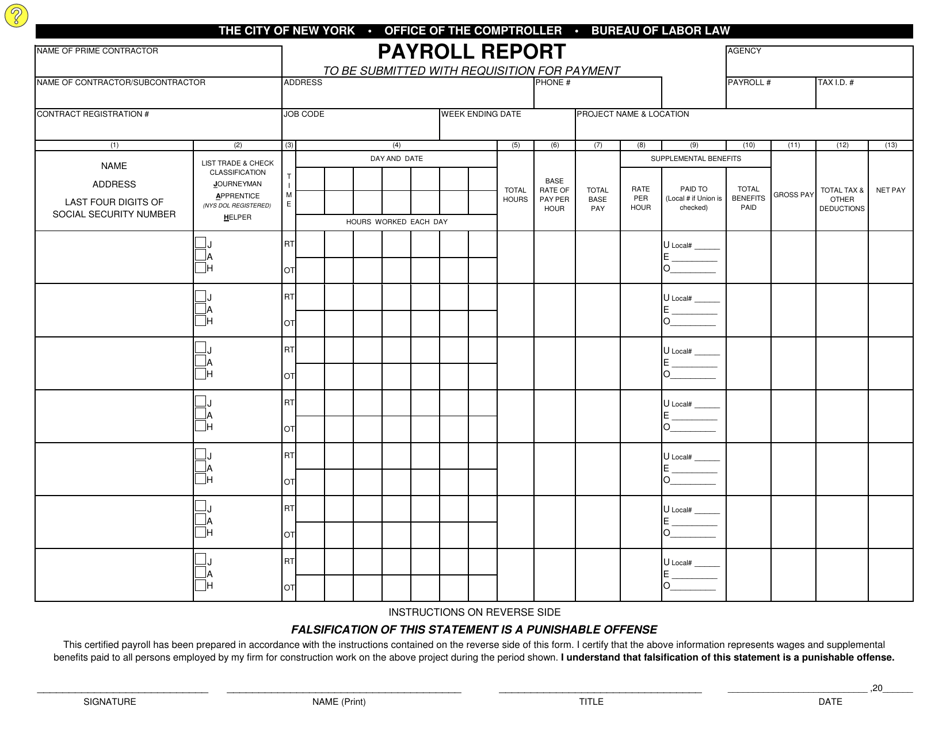

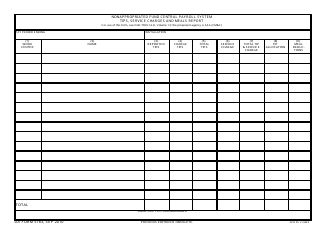

Payroll Report Form - New York City

Payroll Report Form is a legal document that was released by the Office of the New York City Comptroller - a government authority operating within New York City.

FAQ

Q: What is a Payroll Report Form?

A: A Payroll Report Form is a document used to report employee payroll information.

Q: Why is a Payroll Report Form required?

A: A Payroll Report Form is required to ensure accurate reporting and compliance with labor laws.

Q: Who needs to file a Payroll Report Form?

A: Businesses in New York City with employees need to file a Payroll Report Form.

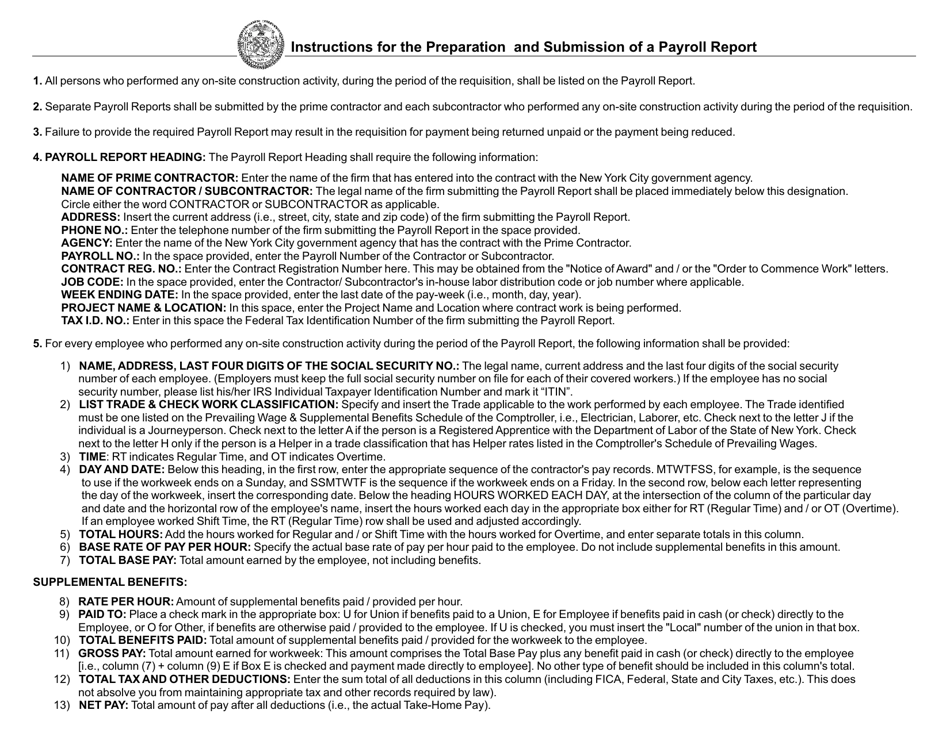

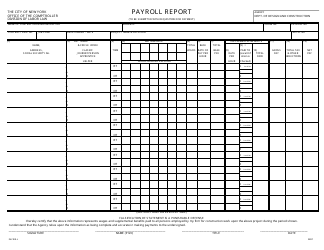

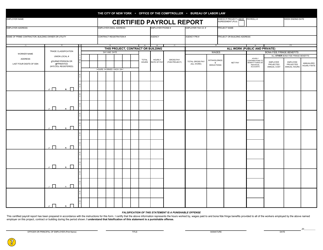

Q: What information is required in a Payroll Report Form?

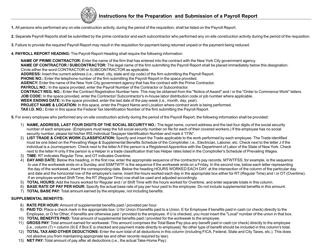

A: A Payroll Report Form typically requires details such as employee names, wages, and hours worked.

Q: When is the deadline for filing a Payroll Report Form?

A: The deadline for filing a Payroll Report Form may vary, so it's important to check with the relevant authorities.

Q: Are there any penalties for not filing a Payroll Report Form?

A: Yes, there may be penalties for not filing a Payroll Report Form, including fines and potential legal consequences.

Q: Do I need any supporting documents with a Payroll Report Form?

A: Depending on the specific requirements, you may need to attach supporting documents such as wage records or tax information.

Q: What should I do if I have questions about filling out a Payroll Report Form?

A: If you have questions, it is advisable to contact the relevant government agency for guidance.

Form Details:

- The latest edition currently provided by the Office of the New York City Comptroller;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Office of the New York City Comptroller.