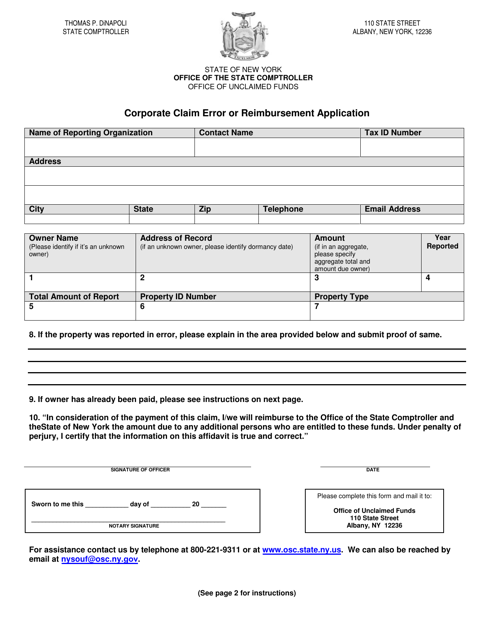

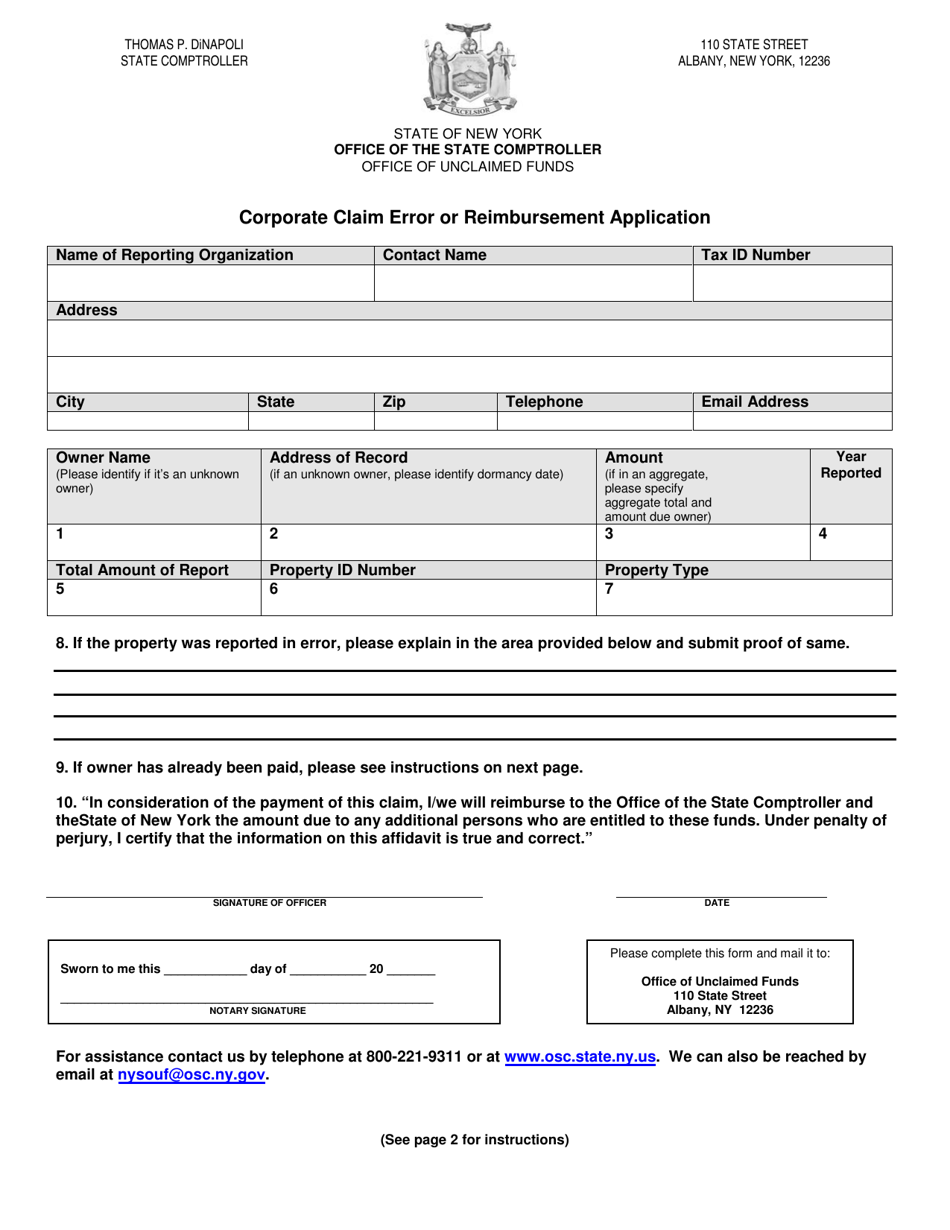

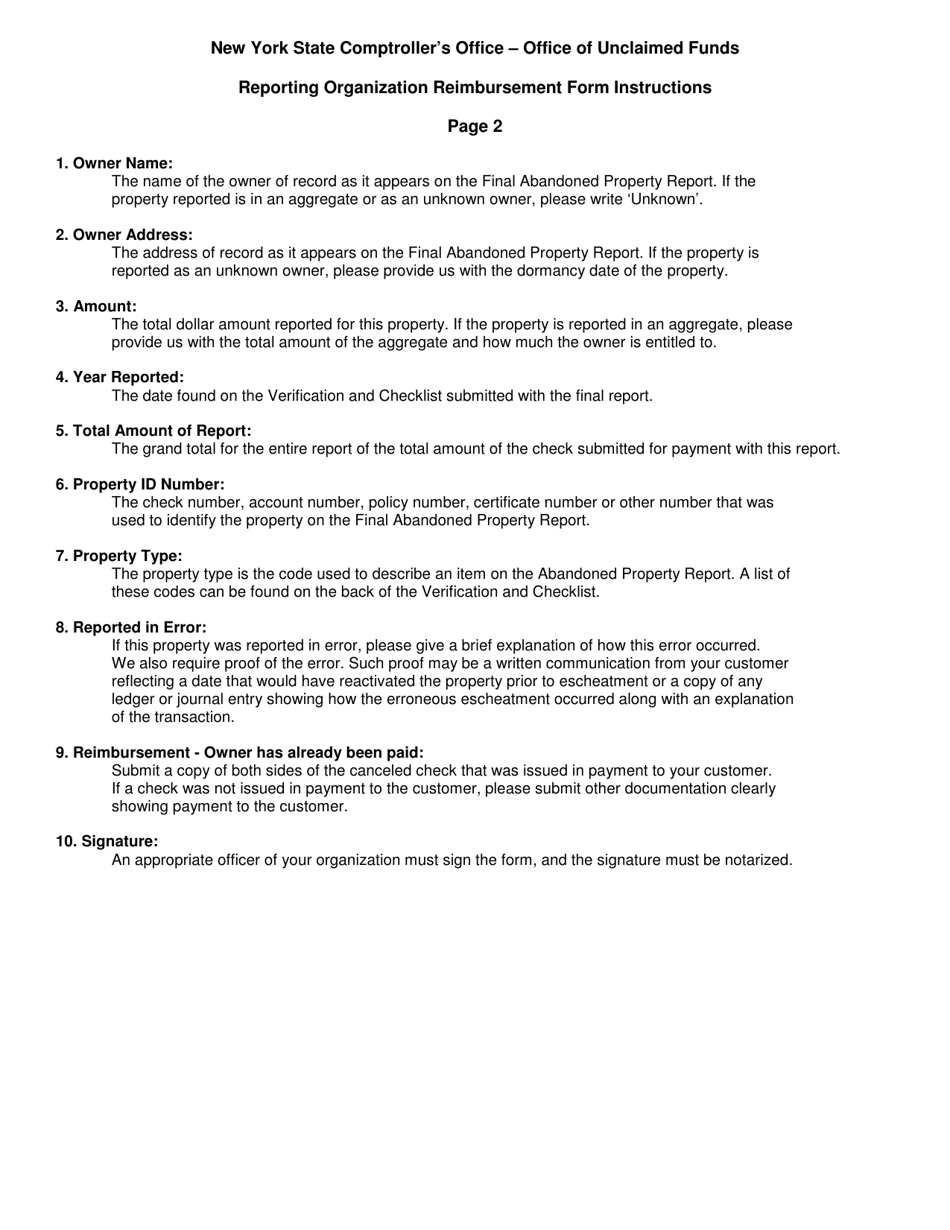

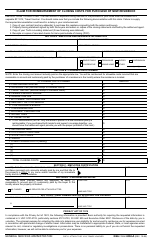

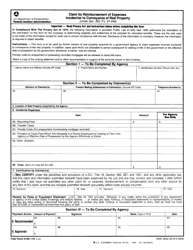

Corporate Claim Error or Reimbursement Application - New York

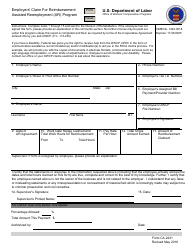

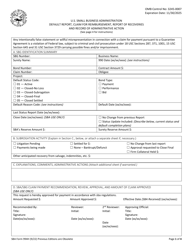

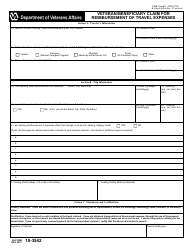

Corporate Claim Error or Reimbursement Application is a legal document that was released by the Office of the New York State Comptroller - a government authority operating within New York.

FAQ

Q: What is a Corporate Claim Error or Reimbursement Application?

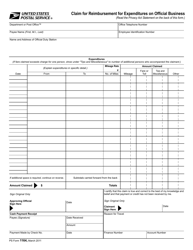

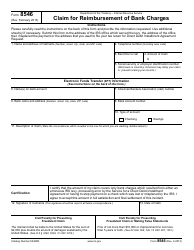

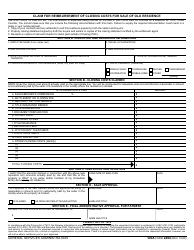

A: It is a form used to apply for reimbursement for expenses incurred on behalf of a company.

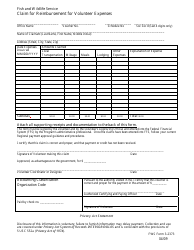

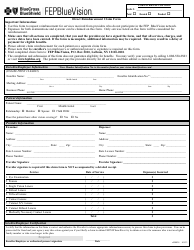

Q: Who can use a Corporate Claim Error or Reimbursement Application?

A: Employees who have paid for business-related expenses out of their own pocket may use it.

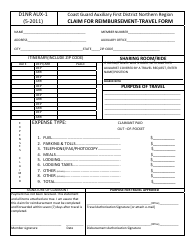

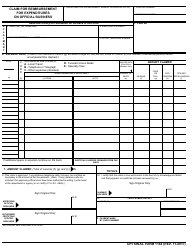

Q: What types of expenses can be claimed through this application?

A: Typically, expenses such as travel costs, meals, and office supplies can be claimed.

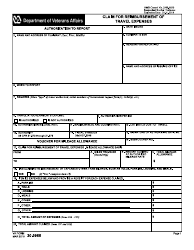

Q: What information is required to complete the application?

A: You will need to provide details of the expenses incurred, including receipts and any relevant supporting documents.

Q: Is there a deadline for submitting the application?

A: Check with your company's policy, as there may be a specific timeframe within which applications must be submitted.

Q: How long does it take to receive reimbursement?

A: The processing time can vary, but it is advisable to inquire about the estimated timeline from your company.

Q: What should I do if my application is denied?

A: If your application is denied, you can seek clarification on the reasons for denial and provide any additional necessary documentation.

Q: Can I claim expenses incurred on personal trips?

A: Typically, only expenses directly related to business purposes are eligible for reimbursement.

Q: Are there any tax implications for claiming expenses?

A: Consult with a tax professional to understand any potential tax implications of claiming expenses through this application.

Form Details:

- The latest edition currently provided by the Office of the New York State Comptroller;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Office of the New York State Comptroller.