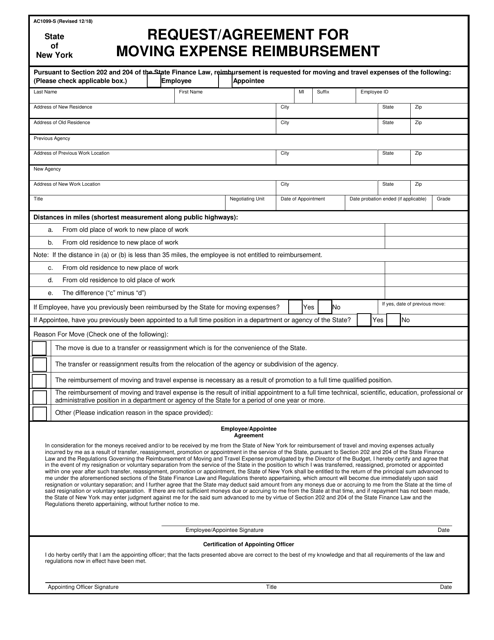

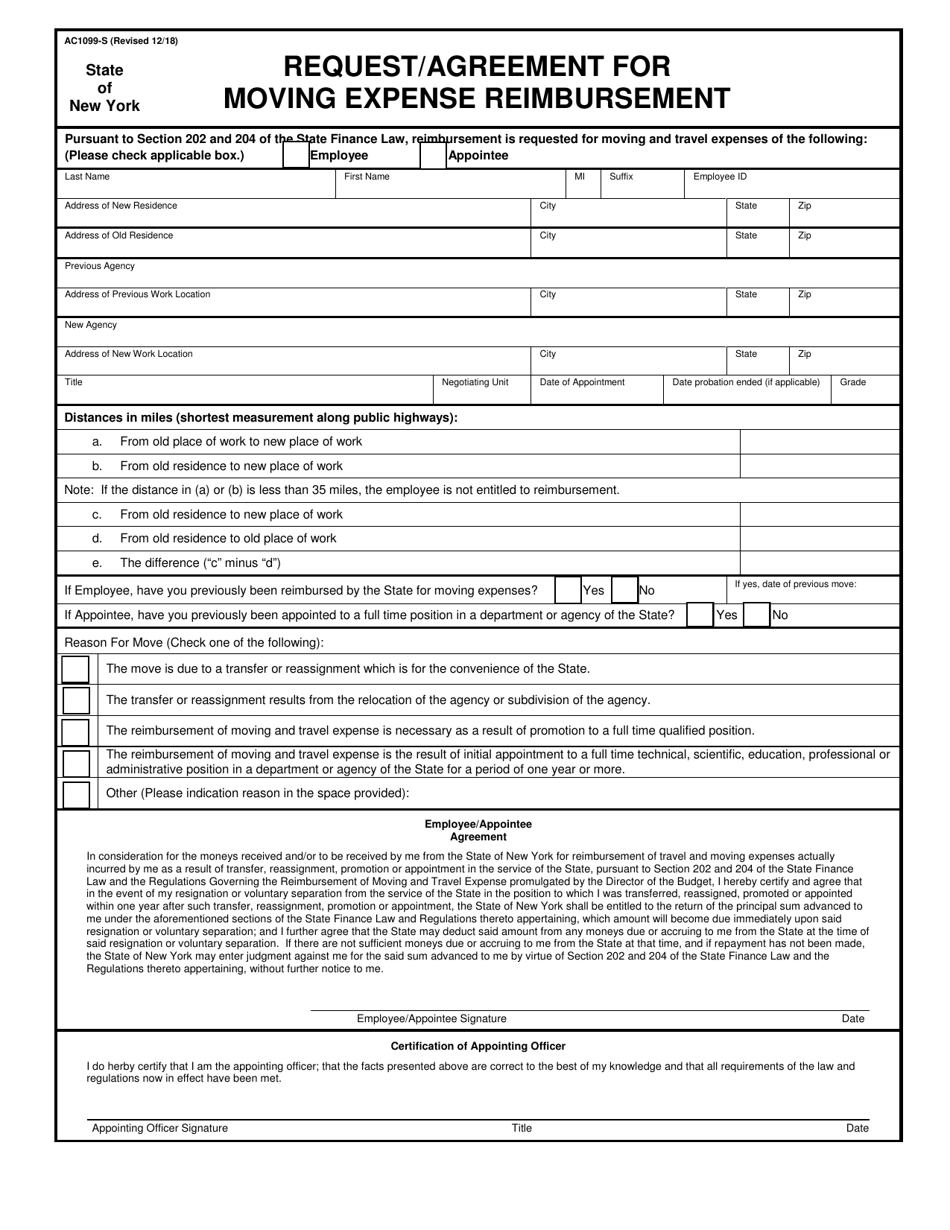

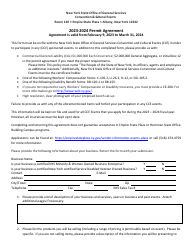

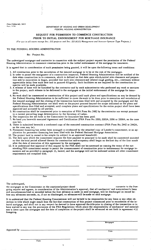

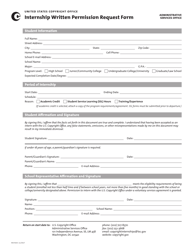

Form AC1099-S Request / Agreement for Moving Expense Reimbursement - New York

What Is Form AC1099-S?

This is a legal form that was released by the Office of the New York State Comptroller - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AC1099-S?

A: Form AC1099-S is a request/agreement for moving expense reimbursement in the state of New York.

Q: Who should use Form AC1099-S?

A: Form AC1099-S should be used by individuals who have incurred eligible moving expenses and are seeking reimbursement from their employer.

Q: What is the purpose of Form AC1099-S?

A: The purpose of Form AC1099-S is to request reimbursement for moving expenses incurred by the employee.

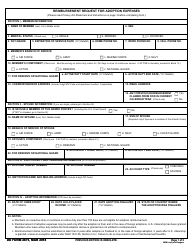

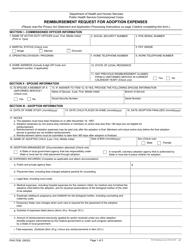

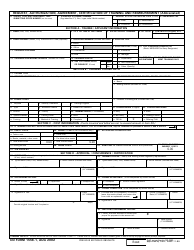

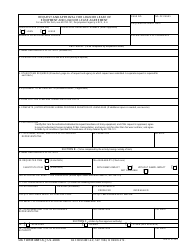

Q: What information is required on Form AC1099-S?

A: Form AC1099-S requires the employee's personal information, details of the moving expenses, and the employer's information.

Q: Are all moving expenses eligible for reimbursement?

A: No, only eligible moving expenses as defined by the Internal Revenue Service (IRS) are eligible for reimbursement.

Q: Is there a deadline to submit Form AC1099-S?

A: Yes, Form AC1099-S should be submitted within a certain time period specified by the employer.

Q: Are there any tax implications of receiving moving expense reimbursement?

A: Yes, moving expense reimbursement may be subject to federal and state taxes. It is recommended to consult a tax professional for specific tax advice.

Q: Can I submit Form AC1099-S electronically?

A: The submission method for Form AC1099-S may vary depending on the employer's policies. Some employers may accept electronic submissions, while others may require a paper copy.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Office of the New York State Comptroller;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AC1099-S by clicking the link below or browse more documents and templates provided by the Office of the New York State Comptroller.